We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

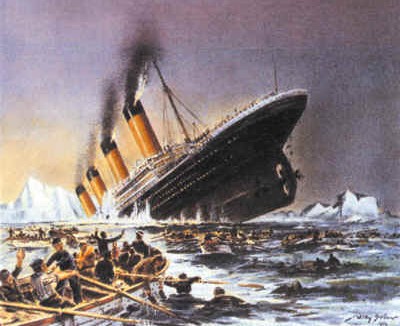

Missed the boat.

Comments

-

Anyway, it`s all a load of rubbish. House prices went out of control. How can you expect the market to function when prices were going up, what, 25% a year? Based on cheap ( ? ) and dodgy lending, low wage inflation, it just goes on. Based on the old rules, a couple earning between them £30k a year could have bought, even in the South East, very easily, a nice home. In fact less than than that.

Now multiply that by 200% and there`s where we see the difference. I find it even more disgusting because that Brown fellow did promise he wouldn`t let the housing market get out of control again.0 -

I'd stick with The Spiral Of Doom, somebody's bound to ask "where's this Siren you guaranteed".Really I should have worked on it a bit more. After all a tsunami would stuff that boat that all the bulls are clinging onto, and would send it crashign into the Northern rocks. A single lifebelt made out of printed notes will not keep them safe for long, and the Sirens are calling their names on the wind - ccchhhuucckky, bbbllluuueeeyyy they call, and the poor sailors are powerless to resist.0 -

You need to look at the bigger picture Graham, interest rates, mortgage term, mortgage product etc. It would be very naive to only consider the ball point purchase figure.

he has the doctors certifcate for this don't worry... he's been excused...the_ash_and_the_oak wrote: »of course. I just thinking decreasing affordability is the main driver for future price falls - ie the reason prices will fall is because the money to buy them will become more difficult, and more expensive, to borrow

what many people have been saying for a long time... mortgages will not be this cheap for a long time, for those who can borrow.

if prices drop it will be cancelled out by the savings in mortgage repayments (minus rent). if they increase from now, it's all good...Graham_Devon wrote: »To work all that out you must have been sat there desperately trying to convince yourself you've made the right decision.

Did it work?

no, you need to remind yourself that you only own 50% of your house... this is way over your head... :rolleyes:0 -

The availability of cheap debt is over. Which got me thinking.

How much more would my mortgage cost if I took it out post crash.

Looking at tracker mortgages, they're about two percent more expensive than when I took mine out.

The term of the mortgage is 25 years. And for arguments sakewe will call the 'average' outstanding balance half the house value.

Using crude maths 2% extra * 25years * 1/2 = 25%

It would cost me approximately a quarter more of my house to take out a mortgage now.

Wow, I am glad I didn't miss the boat.

The MSE financial guru, Dithering Dad, was discussing this several months ago. He stated that the days of free credit were over and that interest rates would return to a normal level of around 8%:Dithering_Dad wrote: »Becuase we have had such low interest rates for the duration of Labour's tenure (and 5% is historically low), people seemed to have been lulled into thinking that this the norm. They forget that for 10 years we have had a financial system awash with cheap credit that allowed interest rates to be so low, we currently have a financial system awash with cheap credit care of the government's QE policy. Once we start seeing a recovery and the QE taps are turned off, where is the cheap credit going to come from? Certainly not the banks - I do believe they've learned their lesson (well, at least for a few years anyway).

I see a return to the 'norm' where interest rates are at 8%, and that alone will cause misery to a huge swathe of people. It will, however help to further normalize house prices, though at a huge cost to some people.

He's such a loss to this site, we should start a petition to try and attract him back. We're the poorer without his no-nonsense financial advice."I can hear you whisperin', children, so I know you're down there. I can feel myself gettin' awful mad. I'm out of patience, children. I'm coming to find you now." - Harry Powell, Night of the Hunter, 1955.0 -

he has the doctors certifcate for this don't worry... he's been excused...

what many people have been saying for a long time... mortgages will not be this cheap for a long time, for those who can borrow.

if prices drop it will be cancelled out by the savings in mortgage repayments (minus rent). if they increase from now, it's all good...

kinda agree w this to an extent. it may well make sense to buy (for some), even though future increases in the cost of credit will have a negative impact on house prices. might be worth going for that dream home now. the 2 bed apt you plan to live in for 5 years before selling to trade up? not so muchPrefer girls to money0 -

Harry_Powell wrote: »The MSE financial guru, Dithering Dad, was discussing this several months ago. He stated that the days of free credit were over and that interest rates would return to a normal level of around 8%:

He's such a loss to this site, we should start a petition to try and attract him back. We're the poorer without his no-nonsense financial advice.

I actually thought that was a very good, well thought out post from DD...and (push me over with a feather!), I agreed with some of his points.

His examples were very clear to understand and he stated his arguement extremely well.We made it! All three boys have graduated, it's been hard work but it shows there is a possibility of a chance of normal (ish) life after a diagnosis (or two) of ASD. It's not been the easiest route but I am so glad I ignored everything and everyone and did my own therapies with them.

Eldests' EDS diagnosis 4.5.10, mine 13.1.11 eekk - now having fun and games as a wheelchair user.0 -

DD certainly had a point in that post. However imagine what 8% would do to a lot of people. Lovely for me and other savers. The interest would be very welcome but at what price?

I suspect we are in a rut. Even if inflation takes off I suspect they will do anything to avoid rate rises.0 -

You need to look at the bigger picture Graham, interest rates, mortgage term, mortgage product etc. It would be very naive to only consider the ball point purchase figure.

Did you purchase a new pen then?Get to 119lbs! 1/2/09: 135.6lbs 1/5/11: 145.8lbs 30/3/13 150lbs 22/2/14 137lbs 2/6/14 128lbs 29/8/14 124lbs 2/6/17 126lbs

Save £180,000 by 31 Dec 2020! 2011: £54,342 * 2012: £62,200 * 2013: £74,127 * 2014: £84,839 * 2015: £95,207 * 2016: £109,122 * 2017: £121,733 * 2018: £136,565 * 2019: £161,957 * 2020: £197,685

eBay sales - £4,559.89 Cashback - £2,309.730 -

The availability of cheap debt is over. Which got me thinking.

How much more would my mortgage cost if I took it out post crash.

Looking at tracker mortgages, they're about two percent more expensive than when I took mine out.

The term of the mortgage is 25 years. And for arguments sakewe will call the 'average' outstanding balance half the house value.

Using crude maths 2% extra * 25years * 1/2 = 25%

It would cost me approximately a quarter more of my house to take out a mortgage now.

Wow, I am glad I didn't miss the boat.

Here's some Maths....

The base rate is 0.5% yet the lowest FTB mortgage is around 6% unless you have at least a 25% deposit -which is extremely unlikey. I make that interest rate 12 times the base rate. Cheap credit? Missed boat?

I think I'll just rent our somewhere that costs much less than to buy, save my money and have a beer. cheers:beer:"For those who understand, no explanation is necessary. Those who don't understand, dont matter."0 -

Help I've missed the boat!!!!

"For those who understand, no explanation is necessary. Those who don't understand, dont matter."0

"For those who understand, no explanation is necessary. Those who don't understand, dont matter."0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards