We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

MSE news: Nationwide reports largest house price rise for over two years

Comments

-

Statistics are only ever useful on a like for like basis, the situation at the moment is far from normal, therefore the statistics we see are meaningless.

I would disagree on that point as you could the same for the last 2 years.

All statistics carry some meaning. But they may not fit in with some ones view of a market.0 -

But the last two years have been so fluid, i.e. the introduction of quantitative easing, bank rescues and the ensuing recession, statistical comparison even month by month during that period is pointless surly?I would disagree on that point as you could the same for the last 2 years.

All statistics carry some meaning. But they may not fit in with some ones view of a market.0 -

But the last two years have been so fluid, i.e. the introduction of quantitative easing, bank rescues and the ensuing recession, statistical comparison even month by month during that period is pointless surly?

What about the collapse of lending and the effect of that?

Would that not make falls irelevent as they were not based on a normal market?

Thus causing historical market lows?

if you are going to blame lows and a changed market you have to look at both directions not one.0 -

Im just trying to work out who chrishoar was before he/she joined yesterday?

Someone who embarrassed himself/herself with a ridiculous prediction I assume?

I reckon he's Dithering Dad, returned from the grave!"I can hear you whisperin', children, so I know you're down there. I can feel myself gettin' awful mad. I'm out of patience, children. I'm coming to find you now." - Harry Powell, Night of the Hunter, 1955.0 -

Welcome to the forum chris.

Hope you can stick around and join in the debates."The problem with quotes on the internet is that you never know whether they are genuine or not" -

Albert Einstein0 -

Why is there so much wishful thinking on this forum?

I have no idea, but it happens a lot. All those people thinking house prices can have big further falls, when the overall shortage, lack of supply, and corresponding rising prices, are so well documented.;)

It fascinates me how people take statistics, even meaningless ones (as these are with such a low level of transactional activity) and convince themselves that everything is now rosy for those hoping for rises.

No statistics are meaningless. Mortgage approvals should be around 60K this month. Total sales were 75K last month.

Is this so low as to be "meaningless"?

Hardly.

Prior to the last boom, mortgage approvals were at 80K. Given the circumstances this time around, with so many being in NE, and so many choosing to stick with their existing deals, it's hardly surprising the volume of approvals is only three quarters of that level, but that's still plenty to be meaningful.

Peak transaction volumes are not needed for prices to recover.

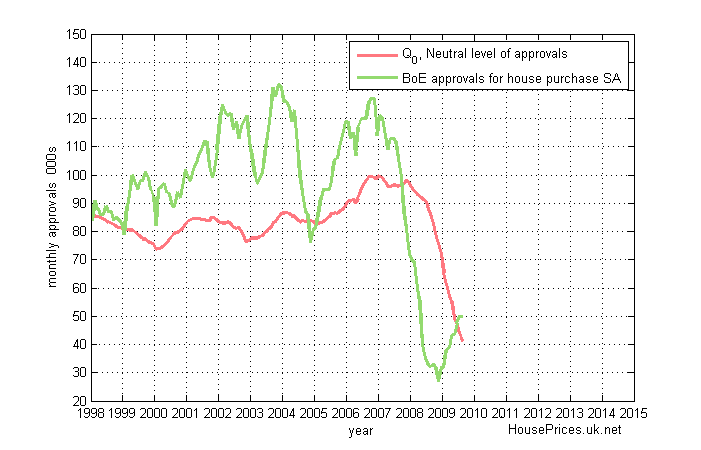

Spline has done some excellent work on mortgage approvals and price neutrality. This graph is from his website, and clearly shows the level of approvals required for pricing neutrality has already been exceeded.

I’d be really interested to understand some of your personal circumstances to try to fit it into a context. For me it doesn’t matter if house prices rise or fall.

I own property, two houses to be exact, one of which is completely mortgage free, the other is mortgaged at a low income multiple. I live in one, an aging relative lives in the other rent free.

Like most owners of an asset, I don't wish my asset to lose value, so from that perspective I have a vested interest.

In general terms though, I believe the benefits of a crash to a small group of people, are far outweighed by the negatives of a crash to the majority, therefore corrective action to minimise price falls is good for society.

And I like debating with people who think otherwise.:D“The great enemy of the truth is very often not the lie – deliberate, contrived, and dishonest – but the myth, persistent, persuasive, and unrealistic.

Belief in myths allows the comfort of opinion without the discomfort of thought.”

-- President John F. Kennedy”0 -

Im not sure I understand your point, if you mean will the collapse in lending eventually result in historical lows, then in my oppinion, over several years, yes in relative terms.What about the collapse of lending and the effect of that?

Would that not make falls irelevent as they were not based on a normal market?

Thus causing historical market lows?

if you are going to blame lows and a changed market you have to look at both directions not one.0 -

HAMISH_MCTAVISH wrote: »[/SIZE][/FONT]

In general terms though, I believe the benefits of a boom to a small group of people, are far outweighed by the negatives of a boom to the majority, therefore corrective action to minimise price rises is good for society.

.

Nice one McTittish.

I think I agree with you for once.

(I love it when my post is at the top of a page)"The problem with quotes on the internet is that you never know whether they are genuine or not" -

Albert Einstein0 -

Of course the big unknown is the lasting effect of quantitative easing, this will in time place inflationary pressures on the economy and lead to higher interest rates. The irony is when the economy does start to emerge from recession the downward pressure on house prices will then fully materialise. In order to keep inflation under control, interest rates will have to go up. Secondly there is no cheep money anymore, how can a commodity that is inflated in price due to the influx of money sustain that price or even grow when that money has gone?0

-

Im not sure I understand your point, if you mean will the collapse in lending eventually result in historical lows, then in my oppinion, over several years, yes in relative terms.

Collapse of lending causing house price falls, and lowest ever volumes of sales.

I am saying if you are saying data is meaning less because of the sample size you would have to apply it to the whole of the credit crunch.

Not just because prices have now started to go up.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards