We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Unenforceability & Template Letters

Comments

-

I've never come across a bag of very cunning weasels but I can imagine that, of all the rodents, a weasel is one of the more cunning; so yesCunning as a bag of very cunning weasels eh ?

t :rotfl: Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0

:rotfl: Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

-

I think he's referring to MBNA's attempts to collect from me before I realise they don't have a valid CCA! :money:never-in-doubt wrote: »Confused

:rotfl::rotfl:Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

If it appears that my capital one agreement is enforceable for the copy they produced on a cca request. Would they have to produce a copy of the actual signed document if it was to go to court to prove enforceability?

Should I ask them for a signed copy????0 -

If they don't send a signed one initially, your best bet for access to one is to SAR them. This costs a tenner. See page one of this thread.If it appears that my capital one agreement is enforceable for the copy they produced on a cca request. Would they have to produce a copy of the actual signed document if it was to go to court to prove enforceability?

Should I ask them for a signed copy????

If they still don't provide it - which I think they should do - the next step is court.

If you get to this stage and they keep refusing to provide it I think it's safe to assume they don't have one OR know it's not going to be enforceable.

- I've just calculated that it's been 17 days since I sent my CCA requests and 16 days since the creditors recieved them according to Royal Mail. I shall be sending out the second letters tomorrow afternoon if I don't get the CCAs in tomorrow's post.

:mad::jHi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

Hi N-I-D......

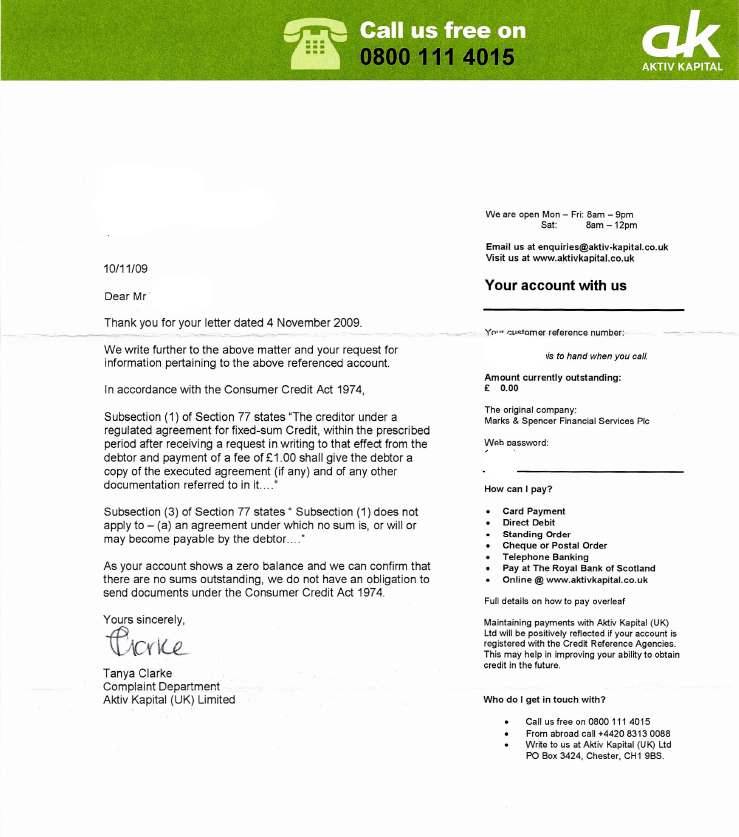

Reply to the letter to Aktiv Kapital.....Post #461.

http://forums.moneysavingexpert.com/showthread.html?t=1868507&page=24

Hmmm - a total KOP OUT! They havent even acknowledged the questions...So as there is NO balance, they dont have to give anything? Is it time to get a solicitor involved?

BTW this is the second time they answered this request in exactly the same format..(same letter)..

Here are some snips of the actions....

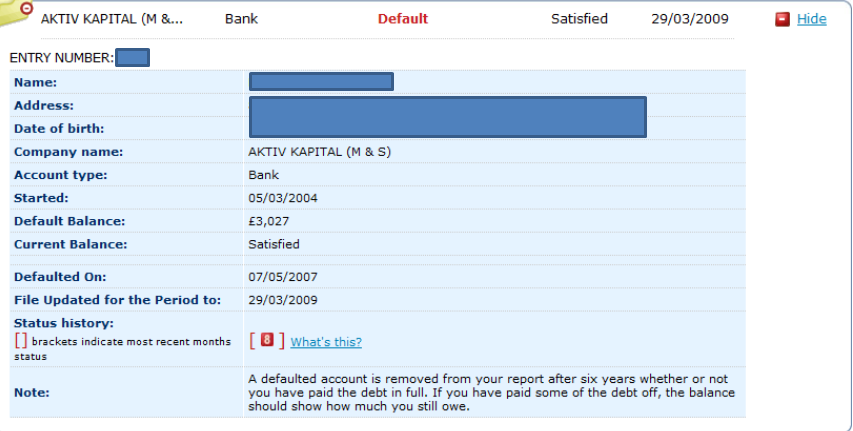

Experian..

Equifax....

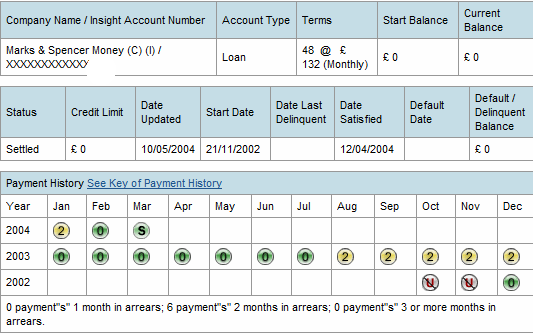

M&S Info...

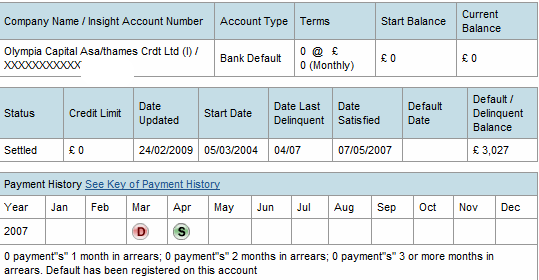

AK Info........

Next Steps?

Best

GGT

0 -

Hi N-I-D

I hope you don't mind me addressing this to you (I know there are lots of people giving their time and expertise here!)?

I have a couple of questions I hope you can help with:

I've sent off initial CCA request letters as per the template and had a couple of responses.

1.Frederickson Int Ltd (for Egg) simply return the payment and say it needs to be requested from Egg themselves, as do Debitas (for Capital One). That's fine - I can repeat the process for Egg/Cap One but does this mean I can ask the two DCAs to stop contacting me on the understanding that they either deal with the account or not - instead of picking which bits to comply with? If so, any suggestions as to how to word this? And shouldn't they have got the docs from the original owners anyway??

2. Debt Managers (for Barclaycard) say they have closed the file (guess they didn't have a copy of the CCA...) and 'returned it to Barclaycard' - does this mean I start the process again, or wait until B'card get in touch?

3. Redcats (for La Redoute) sent a 'copy of the standard credit agreement issued when the account was opened [pursuant to section 78(1) of the Consumer Credit Act 1974 and Regulation 3 of the COnsumer Credit (Cancellation Notices and Copies of Documents) Regulations 1983]' which does not contain any peronal details at all nor any signature. Should I reply with the standard 12+2 failure to supply letter?

Sorry for the long-winded post, but I know your advice is so often dependent on getting the right info in the first place! Hope you can help

:beer:0 -

Hi N-I-D and everyone,

I think my situation is similar to scott9c's query, however can you point me in the right direction?

I have sent my first 2 letters to various DCA's. Today Moorcroft have replied with:-

"...we regret that despite their best efforts our client is unable to produce a copy of your document and to this end we therefore return the £1 payment you submitted with your original request, if applicable.

Notwithstanding this our clients believe the above account remains due and payable and we therefore require immediate payment of the sum or alternatively your realistic proposal for repayment of the same. The Information Commissioner's Office has confirmed whereas a debtor is not obliged to repay the account due to the provisions of the CCA, this does not mean that there was no enforceable agreement.

In addition our client will continue to report the conduct of your account to the various Credit Reference Agencies to whom they subscribe. Should you wish you can file a Notice of Correction with the respective CRA which will offer you the opportunity to explain the circumstances surrounding this registration however you will need to speak with them direct to do so.

We look forward to hearing from you within the next 14 days with your proposal for discharging this liability."

Can you tell me the best thing to do next?

Also, although I have sent CCA letters to Capquest (which they have acknowledged) they continue to harass me on the phone. Is there anything I can do to insist on the phone calls stopping??

Many thanks

x0 -

Courtesy of NID, you need to send these sods the following letter :ricardovich wrote: »Can you tell me the best thing to do next? Alternative Follow-Up Letter after failed CCA

Alternative Follow-Up Letter after failed CCA

Dear Sirs,

Account No:

I do not acknowledge any debt to your company.

I wrote to you and sent the letter by Recorded Delivery on XX/XX/2009 asking for a true copy of the Consumer Credit Agreement together with any relevant information under Sections 77-79 of the Consumer Credit Act 1974, enclosing a £1.00 cheque / postal order as the fee payable. This letter was delivered and signed for on XX/XX/2009 and my cheque was cashed XX/XX/2009.

The Consumer Credit Act allows 12 working days for this request to be carried out before you enter into a default situation. As you have replied to me confirming you have no CCA then the account must remain in dispute which refers s.10 CCA (cease & desist processing data)

As you are unable to comply with my request for the agreement, as required by s.78 of the Consumer Credit Act 1974, nor any other information relating to the account and as such, this account has become unenforceable by law. As you are no doubt aware ss.6 of the CCA states:"If the creditor under an agreement fails to comply with ss.1 (CCA.1974) then (a) He is not entitled, while the default continues, to enforce the agreement"As the 12 working days have now expired, from your receipt of the request for the agreement and supporting documents until now, the account is now formally in dispute and whilst it remains in dispute, the agreement is unenforceable.

Whilst it is unenforceable, no interest can be added to the account and no action can be taken against me such as defaults or adverse data registered at any of the credit reference agencies. As you have already added a default against me, I hereby give you 30 days in which to remove the default or supply me with the Consumer Credit Agreement to enforce the default.

There is no debt as there is no agreement and therefore the default that you registered against me is unlawful and will be defended by demanding enforcement of removal via the county courts, if necessary. We both know without a true copy of a CCA then the chances success are slim, to say the least.

Furthermore, under the Data Protection Act (s.10), you are also denied the authority to pass on any of my personal data. To do so in the circumstances is I understand a breach of the Data Protection Act 1998, and also the OFT guidelines, and should you ignore my request it would again result in you being further reported to the relevant authorities.

I also require that you remove all my data from your files within the next 7 days and look forward to receiving a letter from you within 30 days confirming that you have complied with this request.

Yours faithfully

Sign digitally

The debt you have with them is unenforceable if they cannot produce a CCA. They're trying to scare you in to paying up by saying that the debt still stands. It absolutely doesn't. Don't pay them a penny.

Send the above letter by recorded delivery.Hi, we’ve had to remove your signature. If you’re not sure why please read the forum rules or email the forum team if you’re still unsure - MSE ForumTeam0 -

Hi N-I-D......

Reply to the letter to Aktiv Kapital.....Post #461.

http://forums.moneysavingexpert.com/showthread.html?t=1868507&page=24

Hmmm - a total KOP OUT! They havent even acknowledged the questions...So as there is NO balance, they dont have to give anything? Is it time to get a solicitor involved?

BTW this is the second time they answered this request in exactly the same format..(same letter)....

They do not have to send a CCA when there is no debt. However they should be speaking to you and dealing with your basic request. I'd look to report this to the FOS - pointless getting a solicitor at this stage - do you really want to go to court?

Its a bummer, I know, but the process doesn't force lenders/DCA's to follow processes - it can only guide them then we (the consumer) must pursue it. :mad: 2010 - year of the troll

2010 - year of the troll

Niddy - Over & Out :wave:

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards