We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

At what figure do YOU think the average house price will hit rock bottom ?

Comments

-

Most people have no interest in multiple properties.

Pension provisions.

Most pensions now are not worth the paper they are written on so many are choosing to opt out of pensions and into something far more rewarding.

Over the long term, property is always going to be a good investment. I can buy a house now for £150k and in 25yrs time it will probably be worth £500k. I sell the house, bank the £500k and live off the interest generated, or contine to let the house out and use that as an income.

40yrs to my retirement, that could be another 2 x 20 yr mortgages as investments for me for when i retire so on my 65th birthday, i have my own house plus 2 others.

Beats a pension, that's for sure 0

0 -

Cheer up, spring bounces happen, er every spring, this one was particularly crap due to the state the country is in, but I bet you the shirt on my back prices will be lower at Christmas than now.

But would you put any money on it 'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0

'Just think for a moment what a prospect that is. A single market without barriers visible or invisible giving you direct and unhindered access to the purchasing power of over 300 million of the worlds wealthiest and most prosperous people' Margaret Thatcher0 -

Cheer up, spring bounces happen, er every spring, this one was particularly crap due to the state the country is in, but I bet you the shirt on my back prices will be lower at Christmas than now.

are you currently sunbathing topless?;)Please take the time to have a look around my Daughter's website www.daisypalmertrust.co.uk

(MSE Andrea says ok!)0 -

IveSeenTheLight wrote: »Why use the median wage, when the LR reports Mean average house prices?

To compare adequately, Mean Average wages need to be compared

from http://www.statistics.gov.uk/downloads/theme_labour/ASHE_2008/tab1_7a.xls

Full Time Male Mean Average = £35,122

Full Time Female Mean Average = £25,304

Part Time Male Mean Average = £12,586

Part Time Female Mean Average = £9,911

Roughly on average, I make this an average household income of £45,033 (Not sexist but 1 full time male and 1 part time female)

Use your 3.5 multiplier and thats £157,615.50

Don't forget to add on the minimum 10% deposit = £173,377.05

Not everyone can afford to buy, you have to live to suit your means, not that everything has to adjust to suit your means

Agree with all that. A typical average family with a male in FT work and female in PT work should easily be bringing in £40k+

If they are not, then they are not average and if you are not average you should not be able to purchase that average priced home. If they earn less and are under average then they should buy an under average priced home.

Simple.0 -

http://www.statistics.gov.uk/downloads/theme_labour/ASHE_2008/tab7_7a.xls

Aberdeen - £29,813

Edinburgh - £28,827

Manchester - £28,282

Birmingham - £25,458

Leeds - £25,107

They all support the average salary of £26k without interference from London and account for many millions of people as major cities in the UK

These averages miss the point though. Taking Leeds as an example. If the full time working higher earners in Leeds earn an average £40k a year and they represent 10% of the full time work force. Then the remaining 90% would earn an average £23,300.

If you then took the next 15% who earn say £30k to £40k. The average for the remaining 75% would diminish further.

There is no such thing as an average national salary as there isnt an average house either.0 -

Over the long term, property is always going to be a good investment. I can buy a house now for £150k and in 25yrs time it will probably be worth £500k. I sell the house, bank the £500k and live off the interest generated, or contine to let the house out and use that as an income.

I'll give you that mitchaa, you're pretty confident, thats over a 300% increase over that time, I would suspect that is overdoing it a bit, thats over 13% HPI a year, and with salaries not increasing anywhere near like they have done in the 70's and 80's, I just can't see it.

Just out of interest does anyone know what the average wage was in 2000, just before the boom started, it would be interesting to see how much it increased in that time compared to HPI, it would also give an idea of how much people have overstretched themselves over that period.0 -

Pension provisions.

Most pensions now are not worth the paper they are written on so many are choosing to opt out of pensions and into something far more rewarding.

Over the long term, property is always going to be a good investment. I can buy a house now for £150k and in 25yrs time it will probably be worth £500k. I sell the house, bank the £500k and live off the interest generated, or contine to let the house out and use that as an income.

40yrs to my retirement, that could be another 2 x 20 yr mortgages as investments for me for when i retire so on my 65th birthday, i have my own house plus 2 others.

Beats a pension, that's for sure

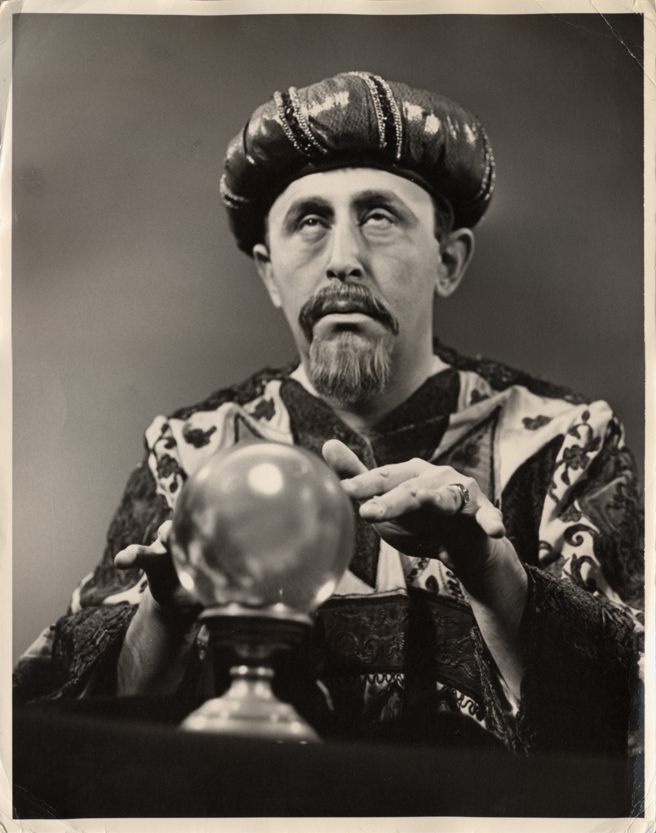

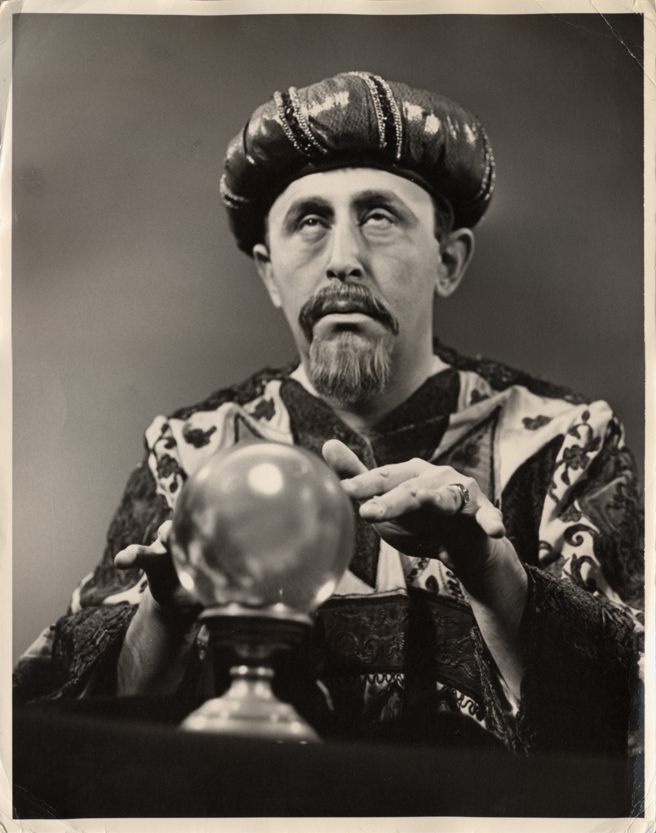

here is a pic of Mitchaa Please take the time to have a look around my Daughter's website www.daisypalmertrust.co.uk

Please take the time to have a look around my Daughter's website www.daisypalmertrust.co.uk

(MSE Andrea says ok!)0 -

inspector_monkfish wrote: »here is a pic of Mitchaa

Yes, Yes......... I see it now, my property portfolio is my pension.;)0 -

I'll give you that mitchaa, you're pretty confident, thats over a 300% increase over that time, I would suspect that is overdoing it a bit, thats over 13% HPI a year, and with salaries not increasing anywhere near like they have done in the 70's and 80's, I just can't see it.

Just out of interest does anyone know what the average wage was in 2000, just before the boom started, it would be interesting to see how much it increased in that time compared to HPI, it would also give an idea of how much people have overstretched themselves over that period.

I think your math's is wrong.

13% HPI per year starting at £150k is £3,184.5k after 25 years

for the property to be worth £500k after 25 years from a £150k base point, its roughly 4.95% per year:wall:

What we've got here is....... failure to communicate.

Some men you just can't reach.

:wall:0 -

We have done this argument to death Graham;)

A singular average salary should not be buying a typical 3bed SD average home. 2 x average salaries should, or at least average household income.

Absolute and utter rubbish....though I can see why you would want this when you look a your sig

We have been buying houses on one wage for donkeys years.

You are eliminating most families from buying a house in your scenario, where one parent is at home to look after the children....as it should be.

No one can have babies, or lose their jobs in your scenario.0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards