We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Mortgage Reduction Beginner to Novice - The Show Begins

Comments

-

Monthly update and I’m afraid I’m here to brag and share some graph !!!!!!…

Accepted to a new energy supplier; £110 cashback and an estimated annual saving of £43 per year.

Ebay selling; £84 net profit

Mystery shopping; £30 profit, one day gym pass, three free dinners (one by myself, one shared with a friend so a nice evening out and one I had to cook one myself), one free lunch and a bottle of sha-a-ammmmmpoo!

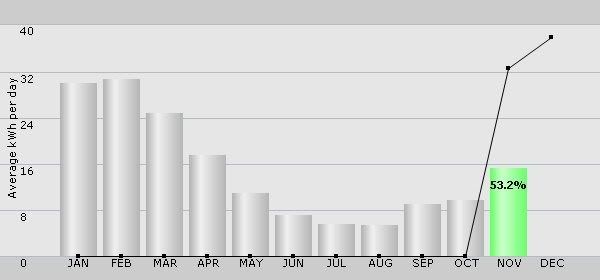

The official data are in for the first full month with the new boiler compared to the same month last year with the old boiler. Also, I'm not working from home anymore so using less gas/electricity during the week. Brace yourselves… its impressive!

Black line - last years consumption (we moved in November 2008)

Grey/green bars - this years consumption

New boiler intalled early October

% consumption this year of last year

Gas:

Electricity:

100th post on my thread coming up... whoever posts it... you better make it a goodun!MFW: Nov 2008 £156k, Jun 2015 £129k, Jun 2017 £114k.0 -

-

December’s energy consumption was as good as Novembers although I was away for 8 days during the month so that will have helped keep usage low. Unfortunately I can’t provide any graphical proof as the transition from E.On to Scottish Power has been initiated, E.On are sulking and withholding graphs from me. I have made a note of December’s readings in my own spreadsheet though. Hopefully the transition is smooth, E.On return the £150 odd credit, Quidco process the £110 cashback and bills are cheaper (guestimated £50 per year cheaper).

In other MRN Financial News:

Still no further along with Barclay’s ISA transfer to First Direct. Thankfully the bulk of ISA money is already with First Direct, only a few hundred with Barclay’s at the moment.

4th of the month and still no money has left my account since the early payday before Christmas, in fact there’s been a £30 increase due to MS money and a reimbursement for work-related spends.

Done two MSs already this year, another two confirmed and one applied for but pending confirmation that it’s mine. Must chase the company that hasn’t paid me for any assignments since October!!!

I’m ready for cashing in points with Toluna, just need to decide if I want Debenhams, Amazon of HMV £15 voucher. I have £40 of Arcadia vouchers accumulated in my purse too but nothing that I like enough to spend them on.

Next (.co.uk) are messing me about though. I bought some curtains (using engagement present vouchers) but they were faulty. Next arranged a courier to collect them from a neighbours’ house and sent a replacement pair of curtains. The faulty ones didn’t get refunded, I’ve been charged again but when I called they told me not to pay it, it’d come right when the faulty ones were refunded. I got back after the Christmas break to find a letter saying I’d been charged a fee for late payment on my account. I called them again yesterday but it’s at stalemate as my neighbour was never given a collection receipt and wasn’t asked to sign anything and Next say they don’t have the faulty curtains. I don’t really know what to do now, other than pay what they claim I owe to avoid further ‘late’ fees.MFW: Nov 2008 £156k, Jun 2015 £129k, Jun 2017 £114k.0 -

I do my own graphs in excel since moving house in Feb 07 and waiting to change supplier I monitor my energy use each month and put the units used in excel

1=Jan 12=Dec cant get months in bottom to show 0

0 -

Savemoney, yeah I will get round to making graphs of the numbers I have in excel spreadsheet... it was just that while E.On were doing it for me, I thought "why bother?"

Also I'd probably represent them as monthly usage whereas E.On liked average daily usage that month. I'll have a play one evening and see what I come up with.MFW: Nov 2008 £156k, Jun 2015 £129k, Jun 2017 £114k.0 -

I find it quite fun to do, and useful to see if usage is down/up obviously better if it goes down

its hard work at time sthough whne kids have habit of not turnng things off and having everything in there bedroom on like tv, pc, pvr 0

its hard work at time sthough whne kids have habit of not turnng things off and having everything in there bedroom on like tv, pc, pvr 0 -

MRN that is sooooo annoying re Next:mad:. Very disappointing. Hope it sorts itself out.0

-

MRN I think you should write a letter to NEXT explaining the full situation. I normally find the Chief Executive is a good place to start.0

-

I'm fuming! First Direct called to say Barclay’s had written to them saying they had no record of my ISA. I called Barclays and they told me that they have my old address – I opened the ISA 7 months after moving to my new address so how they managed that I don’t know! This is on top of them telling me I had my date of birth and mother’s maiden name wrong last time I called them. And to add insult to injury it could take up to 8 weeks to resolve. Not 8 weeks to resolve the transfer from Barclays to First Direct, but 8 weeks to resolve the wrong address issue, at which point First Direct will have to re-request the transfer!!! This has been ongoing since October with excuse after excuse from Barclay’s.

Maybe I should write to Next while my blood is boiling, otherwise I’ll be too nice!MFW: Nov 2008 £156k, Jun 2015 £129k, Jun 2017 £114k.0 -

Barclays that

....... I feel your frustration :mad: 0

....... I feel your frustration :mad: 0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards