We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Greatest Depression Under Way

Asheron

Posts: 1,229 Forumite

"The Greatest Depression" that The Trends Research Institute forecast, well before Wall Street or Washington would acknowledge recession, is upon us.

The global financial markets are collapsing.

All the pundit's cautious predictions and business media's hopeful expectations at the New Year for an economic turn around and imminent market bottom were dead wrong. There will be no turn around in the second quarter of 2009 or 2010 or 2011 America and much of the world has entered "The Greatest Depression."

The global financial system, built on endless supplies of cheap money, rampant speculation, fraud, greed, and delusion is terminally ill and will not be coaxed into remission by stimulus packages nor restored to health by government buyouts and bailouts.

Today, the MSCI World Index of stocks in 23 developed nations fell 4.9 percent to 713.75, the lowest closing level since March 2003, and its Emerging Markets Index slid 5 percent. The Dow followed, plunging 300 points, closing below 7,000 for the first time since 1997.

There is no stock market bottom in sight. The only figure that can be forecast with confidence is that the Dow won't reach zero!

As the crisis worsens, governments will take draconian measures to prevent total economic collapse and public panic. We have cautioned the likelihood of such measures before. But the rapidity and severity of the economic unraveling now demands immediate attention.

Expect massive bank failures, runs on banks, and bank holidays. Even if deposits are FDIC insured, quick access to money is by no means assured. At minimum, have reserves on hand for emergencies.

Trendpost: When the ship is sinking there are very few options: Life boats, life rafts, life preservers and for the late to act, possibly a few pieces of floating debris to cling to.

The Trends Research Institute

The global financial markets are collapsing.

All the pundit's cautious predictions and business media's hopeful expectations at the New Year for an economic turn around and imminent market bottom were dead wrong. There will be no turn around in the second quarter of 2009 or 2010 or 2011 America and much of the world has entered "The Greatest Depression."

The global financial system, built on endless supplies of cheap money, rampant speculation, fraud, greed, and delusion is terminally ill and will not be coaxed into remission by stimulus packages nor restored to health by government buyouts and bailouts.

Today, the MSCI World Index of stocks in 23 developed nations fell 4.9 percent to 713.75, the lowest closing level since March 2003, and its Emerging Markets Index slid 5 percent. The Dow followed, plunging 300 points, closing below 7,000 for the first time since 1997.

There is no stock market bottom in sight. The only figure that can be forecast with confidence is that the Dow won't reach zero!

As the crisis worsens, governments will take draconian measures to prevent total economic collapse and public panic. We have cautioned the likelihood of such measures before. But the rapidity and severity of the economic unraveling now demands immediate attention.

Expect massive bank failures, runs on banks, and bank holidays. Even if deposits are FDIC insured, quick access to money is by no means assured. At minimum, have reserves on hand for emergencies.

Trendpost: When the ship is sinking there are very few options: Life boats, life rafts, life preservers and for the late to act, possibly a few pieces of floating debris to cling to.

The Trends Research Institute

As an investor, you know that any kind of investment opportunity has its risks, and investing in Stocks or Precious Metals is highly speculative. All of the content I post is for informational purposes only.

0

Comments

-

Plagiarizing other people's articles really isn't on.“I could see that, if not actually disgruntled, he was far from being gruntled.” - P.G. Wodehouse0

-

Plagiarizing or Sharing ?As an investor, you know that any kind of investment opportunity has its risks, and investing in Stocks or Precious Metals is highly speculative. All of the content I post is for informational purposes only.0

-

-

-

Because I have no life life experience whatsoever, am naive and ill-informed.........

Ok if you say soAs an investor, you know that any kind of investment opportunity has its risks, and investing in Stocks or Precious Metals is highly speculative. All of the content I post is for informational purposes only.0 -

Forgive my ignorance but why should we give a t0ss if stock markets lose value? People who own shares accept that they could lose the value of their investment. And if my house plummets in value so will everyone else's, so it doesn't matter. And if currencies become unviable I'll be paying for goods in chocolate, whisky and cigarettes

My Debt Free Diary I owe:

My Debt Free Diary I owe:

July 16 £19700 Nov 16 £18002

Aug 16 £19519 Dec 16 £17708

Sep 16 £18780 Jan 17 £17082

Oct 16 £178730 -

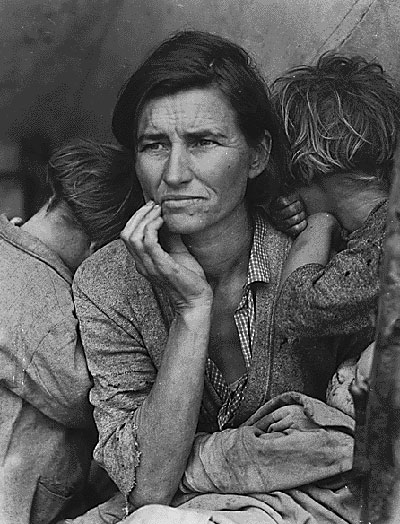

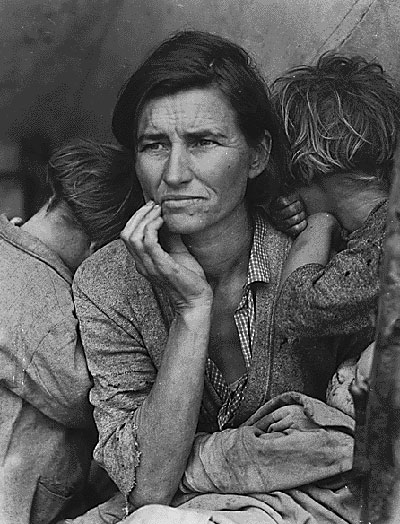

Is it only me, or do other people think that the woman in the picture has an air of nobility about her?No reliance should be placed on the above! Absolutely none, do you hear?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards