We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

inflation likely to go up in 2H

Comments

-

EalingSaver wrote: »The one thing we are not headed for in the next 12 months is 'traditional' inflation i.e. price rises as a symptom of an overheating economy.

That's right - we are headed for 'traditional' inflation as a result of sterling falling against other currencies.

This is already happening as retailers restock following the Christmas and January sales"How could I have been so mistaken as to trust the experts" - John F Kennedy 19620 -

So are you saying that someone saving in Zimbabwe are unaffected by hyperinflation as their interest rate goes up in proportion to it?

Not really - their interest rate is 10,000% but their current rate of inflation is 231 million % (as I read it this morning anyway). The rate of inflation is far outstripping the interest rates so the money is still worthless.0 -

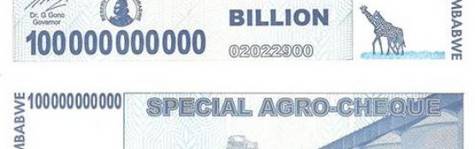

So many zeros on the new note. I think it reads 100,000 million.

It's only six months ago they took ten zeros off. I think the depicted note is from last month. The new note has another three zeros but I could be wrong.

http://www.thestandard.com.hk/breaking_news_detail.asp?id=11920&icid=4&d_str=200901160 -

LOL, ok perhaps you just have never bothered to look up the definition of hyperinflation, well, it's basically inflation out of control. The "out of control" bit is the important bit, if you could just crank up you interest rates so your currency appreciated with it, then it wouldn't really be out of control now would it.So are you saying that someone saving in Zimbabwe are unaffected by hyperinflation as their interest rate goes up in proportion to it?

I see the, loose, relationship between the BOE's move on interest rates over inflation at 'normal' levels, although that's a whole different debate as to whether it's more economics than purely tackling inflation, but always wondered just exactly what happens under hyperinflation circumstances.

Perhaps an analogy is in order, possibly not the best, but gives some idea. Imagine you withdraw all your money from the bank, every last penny, and on the first of every month you split it in half and burnt one half, that'd be something like hyperinflation, except you'd be able to keep warm while it burnt.Hope for the best.....Plan for the worst!

"Never in the history of the world has there been a situation so bad that the government can't make it worse." Unknown0 -

The more I see of the ECB, the gladder I am we kept Sterling.0

-

travellingbum wrote: »

"The Reserve Bank of Zimbabwe is introducing three other notes in trillion-dollar denominations of 10, 20 and 50, the government mouthpiece Herald newspaper said.

Just last week, the bank had introduced billion-dollar bills in denominations of 10, 20 and 50 with the same goal."

That is insane. And it must be far higher than 231,000,000% year on year by now. I think the only people doing well out of this must be the firms that actually print the money! And I doubt they take payment in Zimbabwe dollars either.0 -

-

I don't know why............... The Euro has far more underlying strength than the £.Degenerate wrote: »The more I see of the ECB, the gladder I am we kept Sterling.

The problems of the Euro will be for each country and the 'one-shoe-fits-all' issue, i.e. some eurozone countries will be in recession some not (or not so bad) and reducing interest rates / financial easing will be good for some but not the others.Personal Responsibility - Sad but True

Sometimes.... I am like a dog with a bone0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.3K Banking & Borrowing

- 253.2K Reduce Debt & Boost Income

- 453.7K Spending & Discounts

- 244.2K Work, Benefits & Business

- 599.4K Mortgages, Homes & Bills

- 177.1K Life & Family

- 257.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards