We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Mortgage Free in Three - Take 2 challenge (MFiT-T2)

Comments

-

Thank goodness for that. I have to say that it is worrying me rather a lot and i can rest about it for another month at least. More motivation to do what i can this month. More ebaying i think.

0

0 -

£300 OP this month. Would like to try and increase the OPs as much as possible from next month as I am also worried about interest rates going up! Well done to everyone on the challenge so far, let's keep it up!Challenge: To be mortgage free by Dec 2012

Mortgage 12/12/09 = £21,500, 12/03/10 = £19,700, 12/06/10 = £17,800, 12/09/10= £15,985, 12/12/10=£14,550, 12/03/11 = 0 Mortgage Free :j

MFi3#T2 No. 103

"Opportunity is missed by most people because it is dressed in overalls and looks like work." Thomas A Edison0 -

We are embarking on a major plan of home improvements so no overpayments for a while. Excited and slightly scared at the same time:D. We are dipping into savings........:o

I have managed to put £1,800 into an ISA for this year. The first challenge will be to make sure that this stays in the ISA. After this, I hope we can add to the ISA as we have extended the term on our mortgage. The reason for this is that the interest rate is just 0.77% but we can get 3.2% on the ISA. :money:

I must be disciplined and ensure that the £280 reduction in mortgage payment is matched by a £280 increase in ISA deposits.:T:TThat way I am building up a cash fund again which could be used to make a lump sum mortgage payment when the need arises.MFiT - T2 # 64start date: 1.7.09 MFW end date: 31.10.17

Start balance: £205,746.51 :eek: Month 18/100..paid 13.50%

Current balance: £177,977.07 (updated 18.12.10)

Target 12.12.12: From £194,000 to £140,000:p

MFI-3 reductions: £16,023/£54,000 achieved (29.67%):j0 -

lets hope the interest rate stays low for the tracker people and hope that fixed rates start to go down so the benefit is passed on.

Its weird as every month i worry the rate will go up but at the same time I have based our overpayments on the rate staying the same (which it wont) so i may come a bit unstuck on this challenge when they do go up, guess u have to see every month it stays low as a bonus, rather than counting your chickens!

not long til next chart now Mortgage November 2003 was £135k, but thanks to this website on 28/08/12 we became MORTGAGE FREE!

Mortgage November 2003 was £135k, but thanks to this website on 28/08/12 we became MORTGAGE FREE!

Now just over 2 years we have taken on the challenge again! )(starting £237k Nov 2014) Current mortgage £232,399.82, current overpayment total £1550, years remaining= 170 -

Morning Folks,

Another landmark hit this morning - officially 200 days to go now until the mortgage is gone. We're hopefully over what was quite a tight month in April and, unless the pound plummets any further against the dollar, the holiday spending money is safely ringfenced. Pinching myself that just a couple of weeks after getting under the £20k mark, we're only a couple of weeks away from the £15k barrier.

Cheers,

Billy (#85)Mortgage Free: 28/10/2010Time / Interest Saved: 18.5 years / £61,866.500 -

I did my self assesment form this week and i'm due a small refund. Question is do i overpay the whole lot or just a little bit??MF aim 10th December 2020 :j:eek:MFW 2012 no86 OP 0/2000

0

0 -

UPDATE warning

Received statement today. 31 March 2010 expected balance to be £70,500 actual balance £69,500.

Still far too much to pay out for competing with OP and MF target but never mind will get there.No longer half of Optimisticpair

0 -

Well done optimistic pair. I really wish mine would lose a £1000 without me noticing. :rotfl:0

-

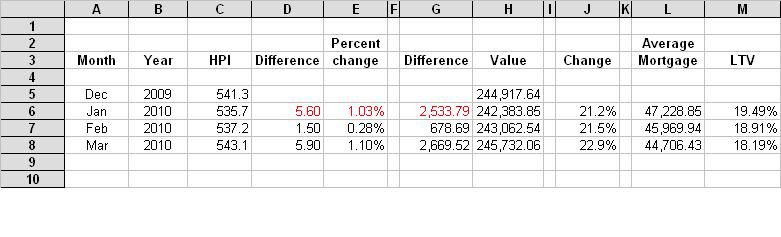

financialbliss wrote: »HPI.

Hi FB :wave:

Right I'm trying, really I am! But... I just can't get my spreadsheet to look like yours lol!

My Column E (% change) looks waaay out to yours- it's def wrong on mine!) and the right hand side of mine looks wrong too but one thing at a time or my head'll explode I think :rotfl:

Feel like a bit of a spreadsheet dunce how on earth do you do this in such a whizzy fashion?! You must be an IT genius!

how on earth do you do this in such a whizzy fashion?! You must be an IT genius!

DD:)0 -

Daisy_Duck wrote: »Hi FB :wave:

Right I'm trying, really I am! But... I just can't get my spreadsheet to look like yours lol!

My Column E (% change) looks waaay out to yours- it's def wrong on mine!) and the right hand side of mine looks wrong too but one thing at a time or my head'll explode I think :rotfl:

Feel like a bit of a spreadsheet dunce how on earth do you do this in such a whizzy fashion?! You must be an IT genius!

how on earth do you do this in such a whizzy fashion?! You must be an IT genius!

DD:)

Hi DD,

As long as you've followed the formulas, the only likely difference is the formatting.

HPI is to 1 decimal place (DP).

Difference is to two DPs.

Percentage changes set up as a percentage with 2 DPs etc etc.

Two options. I could either email you a copy of the sample sheet I did or I could set up a google docs sheet for all to view - a bit better than an image.

If you want a sheet PM me your email address and I'll send one on. Do not post it here!

I may also create a Google docs sheet anyway, so that people can view the details, but not this evening...

FB.Mortgage and debt free. Building up savings...0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards