We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debate House Prices

In order to help keep the Forum a useful, safe and friendly place for our users, discussions around non MoneySaving matters are no longer permitted. This includes wider debates about general house prices, the economy and politics. As a result, we have taken the decision to keep this board permanently closed, but it remains viewable for users who may find some useful information in it. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Anybody see where recovery is going to come from?

Comments

-

Richard Heinberg's web site:

http://www.richardheinberg.com/

Plenty of video available too:

http://uk.youtube.com/watch?v=ajqgOCxGEAo

I decided some time ago there was little I could do, other than make partial self sufficiency a reality, so that's what my house move has been all about.

Unfortunately, as ad says above, if you mention any of this stuff to relatives or friends, at best, you'll be politely ignored. TV programmes like 'It's Not Easy Being Green,' haven't had much impact, partly because it isn't easy if you've no TV company for back-up and income! Finding suitable, reasonably affordable sites is tricky, particularly if you're still working full time.0 -

There will be a recovery, but I'd watch the stockmarket first, and definitely not the housing market. The Government has been loosening its spending and the money supply, and with Interest Rates so low, a lot of shares like BP are starting to looking far more attractive than bonds. As for house prices, don't kid yourself, they will take more than 10 years to reach their 2007 levels and will overshoot on the way down. You'll get a bargain in 2010, but don't expect to see any rises until 2013-15.0

-

mikelivingstone wrote: »There will be a recovery, but I'd watch the stockmarket first, and definitely not the housing market. The Government has been loosening its spending and the money supply, and with Interest Rates so low, a lot of shares like BP are starting to looking far more attractive than bonds. As for house prices, don't kid yourself, they will take more than 10 years to reach their 2007 levels and will overshoot on the way down. You'll get a bargain in 2010, but don't expect to see any rises until 2013-15.

The stock market is generally 18-24 months in front of the economy, so it's certain that we will see movement here first, however as there is none at this time, Darling's prediction of us heading out of the [STRIKE]Brownturn[/STRIKE], ahem downturn by this time next year seems remote, expect a General Election a few months before we have to goto the IMF.0 -

I`m just getting stuck into Robert Peston s " Who runs Britain". Looking like a good read.0

-

Hmmm. Working on the land, tilling the honest soil, getting by with a few potatoes and a generator. Hard work. Versus another unsustainable bubble, this time built on wind generators and green energy. Being a lazy sort I'm preferring the bubble option.0

-

quantitative easing (printing money) and hence devaluing the pound seems to be the way.

You can print money but you can't print real wealth.

If all that was happening was some arbitrary event causing the credit markets to freeze up then these policies might make sense.

What has actually happened is that the engine of credit creation during the last decade has thrown a rod and seized completely. It's a write-off.

What we need to do now is adjust and try to become more productive and much less reliant on using credit to live beyond our means. It'll be painful in the short term but half-baked attempts to kick start the credit-fuelled consumer led economy again are futile and dangerous to long term economic health.

Brown just doesn't seem to get this. He still seems wedded to the idea that the economy was on the right track and would have continued going along nicely if only some completely extraneous happening messed it up. Wrong wrong wrong.--

Every pound less borrowed (to buy a house) is more than two pounds less to repay and more than three pounds less to earn, over the course of a typical mortgage.0 -

the next tech booms will likely come from biotech and new energy products like fuel cells,fusion and hydrogen storage or if things go really badly we will have to wait for robotics.

tech booms increase productivity and create real wealth when and which countries start them is another matter0 -

Hmmm. Working on the land, tilling the honest soil, getting by with a few potatoes and a generator. Hard work. Versus another unsustainable bubble, this time built on wind generators and green energy. Being a lazy sort I'm preferring the bubble option.

Wind generators and green energy are part of the global warming theory which in turn is the 'nice' public face to fossil fuel depletion.

Global Warming is happening, no doubt, but all the facts that the government pedal to promote the prevention of global warming, is exactly the same as fossil fuel depletion. Funny that isn't it ? Anyone think global warming is bad ??, try telling the public the real reason, like in 20 years almost all the countries exporting gas and oil now will have stopped doing so.

Wind, solar, wave, tidal even hydrogen, all very well but it's not enough and there isn't enough time.

We need a re-invention of the wheel by some guys in a laboratory with an IQ of 200 otherwise we are so far in the s**t, it's not funny.0 -

No politician will go near the topic, the the unarguable fact is that the sustainable global population is 2,000,000,000. To go beyond that is the realm of deforestation, mass extinctions, synthetic fertilisers from oils, food aid requiring air-lifts into Africa etc.

A Malthusian tumble from the current 7,000,000,000 population is a raging certainty unless we figure out cold-fusion.

Children alive today will know a Dickensian standard of living in their lifetime.0 -

I've put the Wiki entry here in case any one else is as thick as me and has never heard of Malthusian.amcluesent wrote: »A Malthusian tumble from the current 7,000,000,000 population is a raging certainty unless we figure out cold-fusion.

http://en.wikipedia.org/wiki/Malthusian_catastrophe

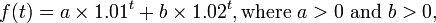

Its got some pretty pictures but this bit almost lost me... will eventually come to resemble

will eventually come to resemble 0

0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards