We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Which order to pay debt? Noob Moneysaver :-)

jonnysmile

Posts: 13 Forumite

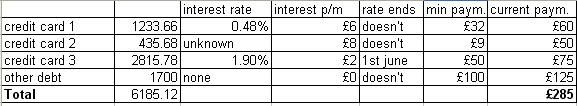

1st column amount owed

Hi my first post. Decided to tackle my debt once and for all

I have 3 credit cards,

creditcard1 is on a 0.48% per month for life deal. I have £700 available credit on it.

creditcard2 is a hcbc classic card, I think the interest is 14% per annum. I have £4000 available credit on it.

creditcard3 is on a 1.90% per month/annum? (can someone tell by the interest im paying) this promo rate runs out on the 1st June. I have £3000 available credit on it.

Otherdebt is a lump sum I owe my OH, I must pay at least £100 a month off it but tend to pay £125.

My problem is £285 is a lot of commitment a month for me and leaves me surviving off beans and toast and coupled with a declining social life due to lack of disposable income im becoming depressed and can't see an end in sight.

£285 is the most I can commit to clearing these debts.

Ive read on here somewhere about paying debts off in the right order and consolidating them.

I'm inclined to think as creditcard 2 appears to have the highest interest, reduce everything else down to minimum payment and put the remainder on that which works out at £103.

My other idea was to concentrate on clearing the 'other debt' as it has the highest minimum payment, that works out at £194 to the 'other debt' and everything else minimum, - as that would be cleared faster my overall commitment to clearing debt each month would be reduced.

Or I could do some balance transfers?

Someone please point me in the right direction. What would you do in my situation, how much off which etc?

I found it very hard to admit I have a debt problem, but now I feel better already now ive expressed it :j

Thanks JS

0

Comments

-

first of all post a statement of affairs (income and outgoings). just because you think you have only have £285 per month, doesn't mean you have. chances are we could save you some money. ok you're in debt - but then so are most of the country (credit cards, mortgages etc). it's nothing to be ashamed of and no one knows who you are anyway!

the apr will be on your credit card statements and you target the debt with the highest apr. thinking it may be 14% is not sufficient. if you're not sure ring up the credit card co. don't be afraid- just say i'm ringing up to check what rate of interest i'm paying- if they ask why just say you want clarification.

as for this 'leaves me surviving off beans and toast and coupled with a declining social life due to lack of disposable income im becoming depressed and can't see an end in sight.' - you don't need alot of income to have an active social life or eat well - you just take advantage of the various available offers (depending on your interests).0 -

Pay off the highest interest debts first. The missing APR is 21.6%! ie: 1.8% per month. So pay all others off at min and pay max on that one.

You numbers don't add up for item no3. Interest rate must be lower than shown.Happy chappy0 -

To work out monthly interest rate:

R = Interest Payment / Total Owed * 100

Yearly rate is 12 times that.

Correct.I'm inclined to think as creditcard 2 appears to have the highest interest, reduce everything else down to minimum payment and put the remainder on that which works out at £103.

If you can post an SOA and people find you numerous ways to save on expenditure then you can make a lot more difference on clearing the debts.Happy chappy0 -

hiya,

Have a look at https://www.whatsthecost.com/snowball.aspx

This will help you, and also if you play around with the amounts you want to pay, will show you how long it will take.

Regards

pot0 -

homersimpson wrote:first of all post a statement of affairs (income and outgoings). just because you think you have only have £285 per month, doesn't mean you have. chances are we could save you some money. ok you're in debt - but then so are most of the country (credit cards, mortgages etc). it's nothing to be ashamed of and no one knows who you are anyway!

the apr will be on your credit card statements and you target the debt with the highest apr. thinking it may be 14% is not sufficient. if you're not sure ring up the credit card co. don't be afraid- just say i'm ringing up to check what rate of interest i'm paying- if they ask why just say you want clarification.

as for this 'leaves me surviving off beans and toast and coupled with a declining social life due to lack of disposable income im becoming depressed and can't see an end in sight.' - you don't need alot of income to have an active social life or eat well - you just take advantage of the various available offers (depending on your interests).

I will try and put together a statement of affairs tonight. I know the creditcard 2 is a high interest rate its only over the xmas period ive run up debt on it. I'm glad ive come to terms with my debt, as for eating well I have been looking into ways to get good deals on food without going to 5 different supermarkets to get the best prices. I used to shop at morrisons for groceries a lot but recently the quality has gone downhill. Thinking of trying Aldi or Netto?0 -

tomstickland wrote:Pay off the highest interest debts first. The missing APR is 21.6%! ie: 1.8% per month. So pay all others off at min and pay max on that one.

You numbers don't add up for item no3. Interest rate must be lower than shown.

Thanks, can't believe Hsbc are charging me 21.6%! Think I'm definetely going to concentrate on clearing this one first. Think the 1.9% is the yearly apr? I got it from the bill. That would mean 0.158% per month? 0

0 -

tomstickland wrote:To work out monthly interest rate:

R = Interest Payment / Total Owed * 100

Yearly rate is 12 times that.

Correct.

If you can post an SOA and people find you numerous ways to save on expenditure then you can make a lot more difference on clearing the debts.

That formula is great thanks. Its handy to be able to check my % rate.

That means my interest rate on cc3 is 0.85% per annum.

Just checked my card online and it does say current rate 1.9% until June. I'll keep quiet if their giving me a better rate 0

0 -

potogold wrote:hiya,

Have a look at https://www.whatsthecost.com/snowball.aspx

This will help you, and also if you play around with the amounts you want to pay, will show you how long it will take.

Regards

pot

I was trying to remember what this was called, ive heard about it through this site, will take a look at it many thanks!0 -

jonnysmile wrote:My problem is £285 is a lot of commitment a month for me and leaves me surviving off beans and toast and coupled with a declining social life due to lack of disposable income im becoming depressed and can't see an end in sight.

You said that you are preparing a SOA and will post shortly. How much each month do you have after your debts? What is your income? I can appreciate that £285 is a lot to be repaying each month, but you have two choices, you can either a) keep repaying this amount and take X months to repay your debt, or b) up your repayments for say 6 months and be debt free that little bit quicker.

I appreciate this might not be possible, and I can appreciate that a lack of disposable income might make socialising hard, but if your friends are true friends I am sure they will understand - perhaps a few of them are in the same boat? Have you talked to them about it? Could you do cheaper things together?

Obviously, until we see your SOA, it's hard to make any suggestions, repaying debt is hard, but you will only need to do it the once, and then it will be gone.

Ms_London0 -

SOA would be helpful, to be honest id concentrate on the 8% card and pay the minimum on the others until it is paid off

Your spreadsheet figures are wrong, the payments add to 310 rather than 285 :S

As for the other debt, would the OH give you a month or two without paying to help you sort this out, (its in their benefit too!)

The first thing id do is pay off CC2 using CC1, to get rid of the highest interest and also get rid of one debt, then id cancel the card (unless they can offer you free interest on balance transfers or similar), this will help your credit rating for future 0% balance transfers

Next the £125 into the Other section, id reduce to a hundred (if negotiation fails) as this is interest free (cant afford to be sentimental here )

)

If you can get this reduced or free for a few months id concentrate on the 3rd credit card

id seriously Consider moving the remaining 300 credit and move that from credit card 1 to the 3rd on to get that balance down

So then ou should have CC1 £1960, CC2 £2515

if you have £310 a month for paying off, this wont be fun, im going through the same at the moment stopping in to pay debts, but keep looking around this site, there are so many freebies and ways to have fun on the cheap that this will become possible,

anyways back to payments

Id pay 60 to credit card 1, 150 to credit card 3, and the 100 pound to the other (or to credit card 3 wherever possible)

By the end of the year you should be down to around 2.5k in debt (rough figures below)

cc1 cc3 other

Jan-06 1969 2515 1700

Feb-06 1915 2367 1600

Mar-06 1861 2219 1500

Apr-06 1807 2071 1400

May-06 1753 1923 1300

Jun-06 1699 1775 1200

Jul-06 1645 1627 1100

Aug-06 1591 1479 1000

Sep-06 1537 1331 900

Oct-06 1483 1183 800

Nov-06 1429 1035 700

Dec-06 1375 887 600

Jan-07 1321 739 500 2560

Hope this helps

*damn dodgy formatting!*0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.3K Banking & Borrowing

- 253.2K Reduce Debt & Boost Income

- 453.7K Spending & Discounts

- 244.3K Work, Benefits & Business

- 599.5K Mortgages, Homes & Bills

- 177.1K Life & Family

- 257.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards