MSCI World Index

Options

Hildegard_O'_Nellie

Posts: 6 Forumite

Hello all,

I'm investing in a world tracker ISA based on the MSCI world index. Recently it has taken quite a tumble - 7%. However, the index seems to be recovering strongly now...

I'm wondering whether to park this investment in cash for a while, or stay invested, in view of the strong recovery. I'm counting on the latter, to be honest.

I wonder what advice people might have?

Cheers, folks.

:beer:

I'm investing in a world tracker ISA based on the MSCI world index. Recently it has taken quite a tumble - 7%. However, the index seems to be recovering strongly now...

I'm wondering whether to park this investment in cash for a while, or stay invested, in view of the strong recovery. I'm counting on the latter, to be honest.

I wonder what advice people might have?

Cheers, folks.

:beer:

0

Comments

-

I am not an expert by a long way. So other people here will be able to offer more detailed advice, but I think the first thing to decide is how long you are investing for and how risk tolerant you are.

If you are happy and understand the risk profile of that fund, then how long is the more important point. These recent movements are blips in the scope of things. Don't try to time the market.0 -

Concern yourself with getting the lowest charges for EXACTLY what it is you want, meaning is the "World" tracker actually tracking all the markets you want exposure to?

http://monevator.com/how-to-chooose-total-world-equity-trackers/

"The top two funds are genuine total world equity index trackers and one is considerably cheaper and better diversified than the other."

If you really believe that markets will provide returns in the future and that trackers are the best way to gain exposure to these markets -7% is a buying opportunity.0 -

Hildegard_O'_Nellie wrote: »Hello all,

I wonder what advice people might have?

Same as always.

Some people will say the price will go up

Some people will say the price will go down.

But if the majority thought the price was going up they would have bought and it would have already gone up.

Wheras if the majority thought the price was going down they would have sold and it would have already gone down.

So the price is always about where the average investor thinks it should be. “It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.” --Upton Sinclair0 -

Stay calm and carry on.0

-

Missed that tumble , will check my small portfolio in the new year, well thats my plan ,Thats a good idea thanks muchly.. 😊0

-

1. Stop checking it all the time.

2. Leave it alone.

3. See 10 -

Crashy_Time wrote: »Concern yourself with getting the lowest charges for EXACTLY what it is you want, meaning is the "World" tracker actually tracking all the markets you want exposure to?

http://monevator.com/how-to-chooose-total-world-equity-trackers/

"The top two funds are genuine total world equity index trackers and one is considerably cheaper and better diversified than the other."

If you really believe that markets will provide returns in the future and that trackers are the best way to gain exposure to these markets -7% is a buying opportunity.

The Monevator article is from March 2015 and hasn't been updated.

Since then Vanguard have introduced their FTSE Global All Cap Index Fund, a UK based OEIC index tracker with an OCF of 0.24% and holdings in 6037 companies worldwide, including emerging markets, and which follows the FTSE Global All Cap Index. It was launched in November 2016.

https://www.vanguardinvestor.co.uk/investments/vanguard-ftse-global-all-cap-index-fund-gbp-income-shares

There is also the HSBC FTSE All World Index Fund, another UK based OEIC index tracker with an OCF of 0.16% and holdings in 2967 companies worldwide, including emerging markets, and which follows the FTSE All World Index. It was launched in September 2014.

https://www.assetmanagement.hsbc.com/uk/individuals/gfc?fundid=HITF009&SH=Inc%20C0 -

If by "counting on" a recovery you mean it needs to recover otherwise the impact will be in some way intolerable then you're investing above your risk tolerance.

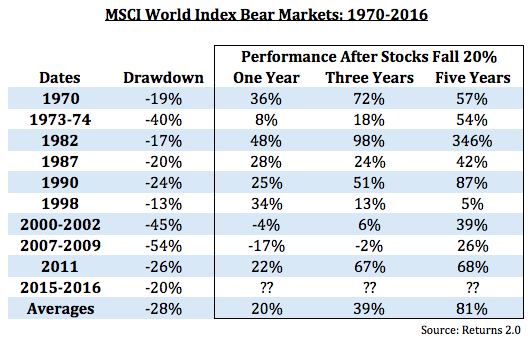

The MSCI world index, like most if not all indexes, has historically fallen a lot more than 7% on a fairly regular basis, as the first two columns of the table below demonstrate. It would be reasonable to expect falls such as those below, and possibly even worse, to continue occurring with similar regularity. 0

0 -

Indeed. In fact, it's the biggest fall since the one in February that you've probably forgotten about already.Hildegard_O'_Nellie wrote: »I'm investing in a world tracker ISA based on the MSCI world index. Recently it has taken quite a tumble - 7%.

Seriously, a 7% loss is nothing. If you're going to have most or all of your investments in equities it's the sort of drop you should barely notice. If it's making you think about selling up then you should take a good look in the mirror and ask yourself if you really understand and are comfortable with the risks you're taking with your money. Because if a 7% fall makes you want to get out, what are you going to do when (not if) the markets next suffer a 30% drop?0 -

Hildegard_O'_Nellie wrote: »I'm wondering whether to park this investment in cash for a while, or stay invested, in view of the strong recovery. I'm counting on the latter, to be honest.

This thread might be of interest from another newbie worrying about the correction:

https://forums.moneysavingexpert.com/showthread.php?t=5908940

Alex0

This discussion has been closed.

Categories

- All Categories

- 343.3K Banking & Borrowing

- 250.1K Reduce Debt & Boost Income

- 449.7K Spending & Discounts

- 235.3K Work, Benefits & Business

- 608.1K Mortgages, Homes & Bills

- 173.1K Life & Family

- 248K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 15.1K Coronavirus Support Boards