We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Confused about Stock Market?

BrixMorta

Posts: 236 Forumite

I notice with interest that since FTSE 100 was formed in 1984 it rose steadily at about 1000 points every 3-4 years until reaching 5800 in february 1998.

Here we are 10 years later at the same level with some experts predicting it may go as low as 5000 before the end of the year. So, if I had invested in a FTSE 100 tracker fund 10 years ago, it would not have increased in value?

Indeed, given the current downturn generally, it looks as though we will not see a recovery for a few more years! So much for long term investment on the stock market.

Perhaps the FTSE100 increased too quickly between its inception in 84 and 1998 and had to adjust itself. Maybe we will see it shoot up to 10000 over the next 5 years to make up for this long period of stagnation?

Perhaps someone in the know can explain?

Here we are 10 years later at the same level with some experts predicting it may go as low as 5000 before the end of the year. So, if I had invested in a FTSE 100 tracker fund 10 years ago, it would not have increased in value?

Indeed, given the current downturn generally, it looks as though we will not see a recovery for a few more years! So much for long term investment on the stock market.

Perhaps the FTSE100 increased too quickly between its inception in 84 and 1998 and had to adjust itself. Maybe we will see it shoot up to 10000 over the next 5 years to make up for this long period of stagnation?

Perhaps someone in the know can explain?

0

Comments

-

Here we are 10 years later at the same level with some experts predicting it may go as low as 5000 before the end of the year. So, if I had invested in a FTSE 100 tracker fund 10 years ago, it would not have increased in value?

Don't forget the dividends.

Your example highlights why investing in just a single sector (e.g. UK large-caps) is risky. If this fund was part of a larger porfolio of uncorrelated assets with annual rebalancing you'd have faired much better: you be moving money out while the market was relatively high and putting it back in when it was low.0 -

He is talking about a FTSE tracker, these usually follow the FTSE, not individual companies, therefore dividends don't count.

Basiclly OP, yes you are right but as jon3001 says, it hasn't been 5000 all the time. It has gone down and up. If you started a FTSE tracker when it was lower then after 10 years you will have won (in terms of the tracker showing an improvement).

Thats why a lot of companies offer a 25% interest if it improves after, say, 5 years, you maybe lucky, you may not.0 -

They look at the start point.

They wait until the end point.

If its higher you win, if its lower, you lose.

Thats how Egg did theirs anyway...0 -

-

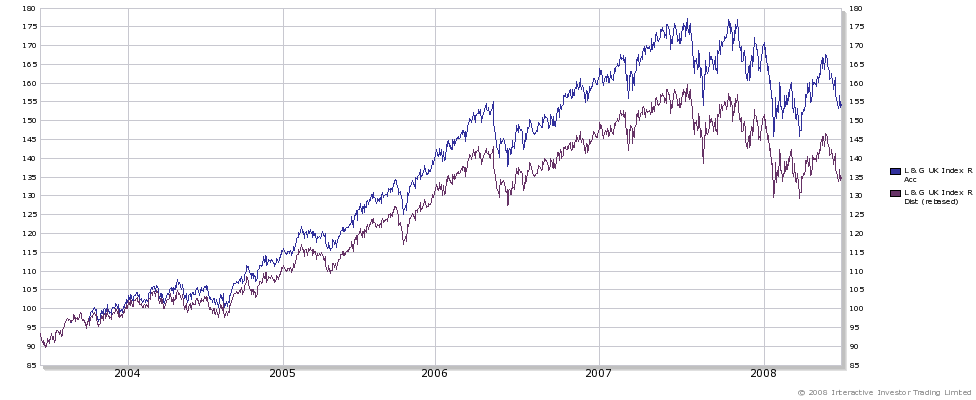

Yes the dividends can be counted. If you get a 'distribution' tracker, you get the dividends paid back to you, but if you get an 'accumulative' tracker, then the price of the tracker goes up to take the dividends into account, even if the underlying value of what's being tracked doesn't.He is talking about a FTSE tracker, these usually follow the FTSE, not individual companies, therefore dividends don't count.

For example, over the past 5 years:

These are both UK FTSE all share trackers - the difference between them is one's Dist (the bottom one,) the other is Acc.Conjugating the verb 'to be":

-o I am humble -o You are attention seeking -o She is Nadine Dorries0 -

Wasn't '5800' about the 'peak' of the 1998? This argument is like claiming that a stopped clock is right twice a day. Most of the time the FTSE (for instance) has been somewhere above (AND below) is present/1998 level.

'6000' is an interesting level because it used to slip through that one (up or down) like a knife through butter (i.e. it would move between 5980 and 6080 approx) - so the level of '6000' had no particular significance. Also the FTSE almost never closed to 6000 - thus is was almost a 'watershed' number.

Of late though the FTSE has repeatedly moved through the 6000 level and seemed to spending quite a bit of time there. It looks as though 6000 has now become 'resistance' level (i.e. the FTSE now stays below it and has trouble rising to or above it) rather than a more 'symmetric' watershed......under construction.... COVID is a [discontinued] scam0 -

Well the ftse hit over 6900 in 1999 so a 9 year investment would be losing quite a lot. Until a year or two ago it was making up that loss but now has got the jitters and people are scared to invest in it again. That is the problem with buying shares, it is sentiment led. It can go up or down for no good reason. Investing is gambling dressed up respectfully.0

-

the average investor has the attention span of a gnat, i.e if they can get a guaranteed 5.71% why should they invest in anything else, plus if they have any spare cash they may purchase premium bonds as they give a regular chance at winning it big don't they, meanwhile in the real world business goes on, and on, making money above the rate of return on cash, how do they do that?

http://investor.invescoperpetual.co.uk/invesco/ecdsfactsheetpdf.ig?dnsName=ipinvestor&fundId=3303126:EN_UKCheck out the returns of professionally managed fund, not an index tracker, for example, Invesco Perpetual Income Fund - 10 year return is 168.8% which is an annualised compound return of 10.4%If it takes a man a week to walk to walk a fortnight how long does it take a fly with tackity boots on to walk through a barrel of treacle?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.4K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.4K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards