We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Savings tax interest - confused!

annie1276

Posts: 16 Forumite

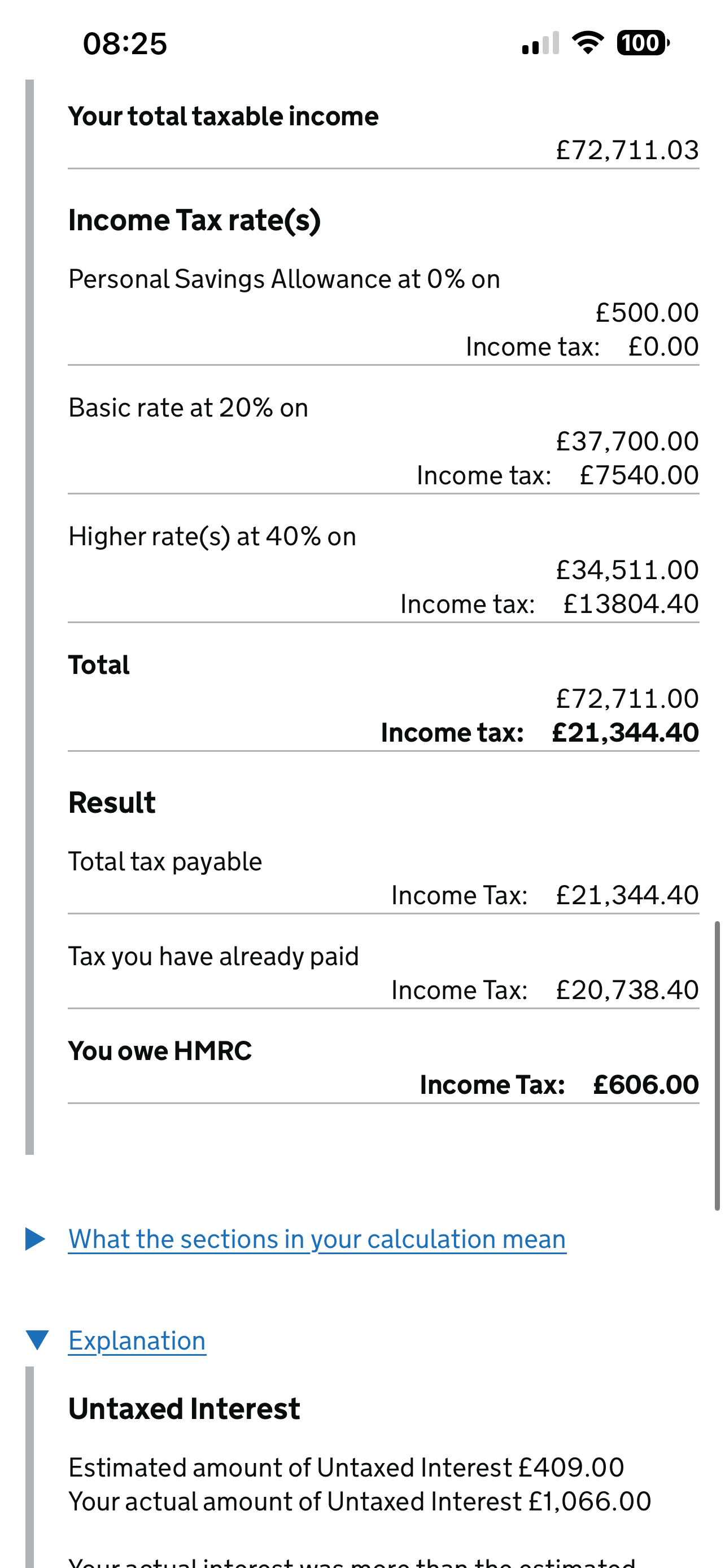

Hi all, I’ve had a letter from HMRC today letting me know I didn’t pay enough tax in the last financial year due to earning interest on savings. Happy to pay it but am struggling to understand their calculation and hoping someone here is more clever than me and can understand it!

I am a higher rate tax payer, earned £1066 in interest and the amount of tax owed is £606 - which is more than 40% of the interest earned - and is there not also a £500 personal allowance on savings? Very confused but am I being daft and missing something obvious? All help much appreciated!

0

Comments

-

Does the letter not show the workings? Sounds like there's more than just tax on interest owed, could be your tax code was wrong, or you got work benefits which weren't taxed etc.1

-

It does show the workings but they don’t make a lot of sense. The summary explanation given is unpaid tax on savings interest of £1066 and £606 owed. My tax code is definitely correct and I don’t get any work benefits.0

-

You'll need to post the workings if you want help otherwise we're just guessing1

-

Would be easier if you posted them.annie1276 said:It does show the workings but they don’t make a lot of sense. The summary explanation given is unpaid tax on savings interest of £1066 and £606 owed. My tax code is definitely correct and I don’t get any work benefits.Statement of Affairs (SOA) link: https://www.lemonfool.co.uk/financecalculators/soa.phpFor free, non-judgemental debt advice, try: Stepchange or National Debtline. Beware fee charging companies with similar names.1 -

Without that detail it's impossible for anyone to explain what has happened.annie1276 said:It does show the workings but they don’t make a lot of sense. The summary explanation given is unpaid tax on savings interest of £1066 and £606 owed. My tax code is definitely correct and I don’t get any work benefits.

Your P60 details would also be useful (pay, tax deducted and tax code)1 -

Sorry everyone, will post workings now - I just wasn’t sure if there was a general principle I was missing that would explain this rather than something relating to me personally!0

-

Hopefully this helps? The total taxable income at the top includes the savings interest earned and is minus normal personal allowance of 12,570.

0

0 -

That does clearly show the £500 of your income has been taxed at 0% (the Personal Savings Allowance).annie1276 said:Hopefully this helps? The total taxable income at the top includes the savings interest earned and is minus normal personal allowance of 12,570.

If your interest was £1,066 in total then the tax due for that element is £226.40 (1066 - 500 = 566 x 40%)

The rest must be for some other reason1 -

Thank you - I was hoping not to have to call them but I guess I will need to - wish me luckDazed_and_C0nfused said:

That does clearly show the £500 of your income has been taxed at 0% (the Personal Savings Allowance).annie1276 said:Hopefully this helps? The total taxable income at the top includes the savings interest earned and is minus normal personal allowance of 12,570.

If your interest was £1,066 in total then the tax due for that element is £226.40 (1066 - 500 = 566 x 40%)

The rest must be for some other reason 0

0 -

You could just work it out yourself (or with our help) though. What is different in the calculation compared to what happened during the year and is on your P60.annie1276 said:

Thank you - I was hoping not to have to call them but I guess I will need to - wish me luckDazed_and_C0nfused said:

That does clearly show the £500 of your income has been taxed at 0% (the Personal Savings Allowance).annie1276 said:Hopefully this helps? The total taxable income at the top includes the savings interest earned and is minus normal personal allowance of 12,570.

If your interest was £1,066 in total then the tax due for that element is £226.40 (1066 - 500 = 566 x 40%)

The rest must be for some other reason 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards