We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

£2000 NI relief cap on pension salary sacrifice from April 2029 (confirmed)

Comments

-

Those close to minimum wage are however entitled to lots of other benefits that higher earners do not get. (Chiefly childcare).westv said:

The benefit for anybody close to minimum wage is negligible so the lack of ss is irrelevant.af1963 said:

If they employ any significant number of low paid staff, they are not allowed to use salary sacrifice for those people, which means it may not make sense for them to offer it to others and run two distinct systems.westv said:

The tax system does offer equal treatment. It"s down to the employer as to whether they can be bothered to offer SS or not.zagfles said:

Pension offerings by employers, just like any other benefit offerings, clearly won't be equal. That would be ridiculous. But as far as possible, the tax system should aim for equal treatment between someone who gets a good pension from their employer and someone who doesn't but voluntarily contributes extra to get an equally good pension.Cobbler_tone said:Ultimately people are almost trying to suggest that all pensions should be equal. They are clearly not and a big aspect in the attractiveness of a role. How many times do you hear “the police get a good pension” etc?

Some people only will have known something using SS. Things clearly change, the best example are DB schemes that no longer exist. It might make a few reconsider their current employer if things change, although you could say it might be a leveller. Employers will feel another negative impact too.

Assuming most people can’t afford a big hit on net pay, it will probably translate into smaller pension pots.0 -

Access to childcare support for low income families is hardly a justification for the government to be giving unequal tax treatment to different pension contribution methods........

0 -

MK62 said:Access to childcare support for low income families is hardly a justification for the government to be giving unequal tax treatment to different pension contribution methods........

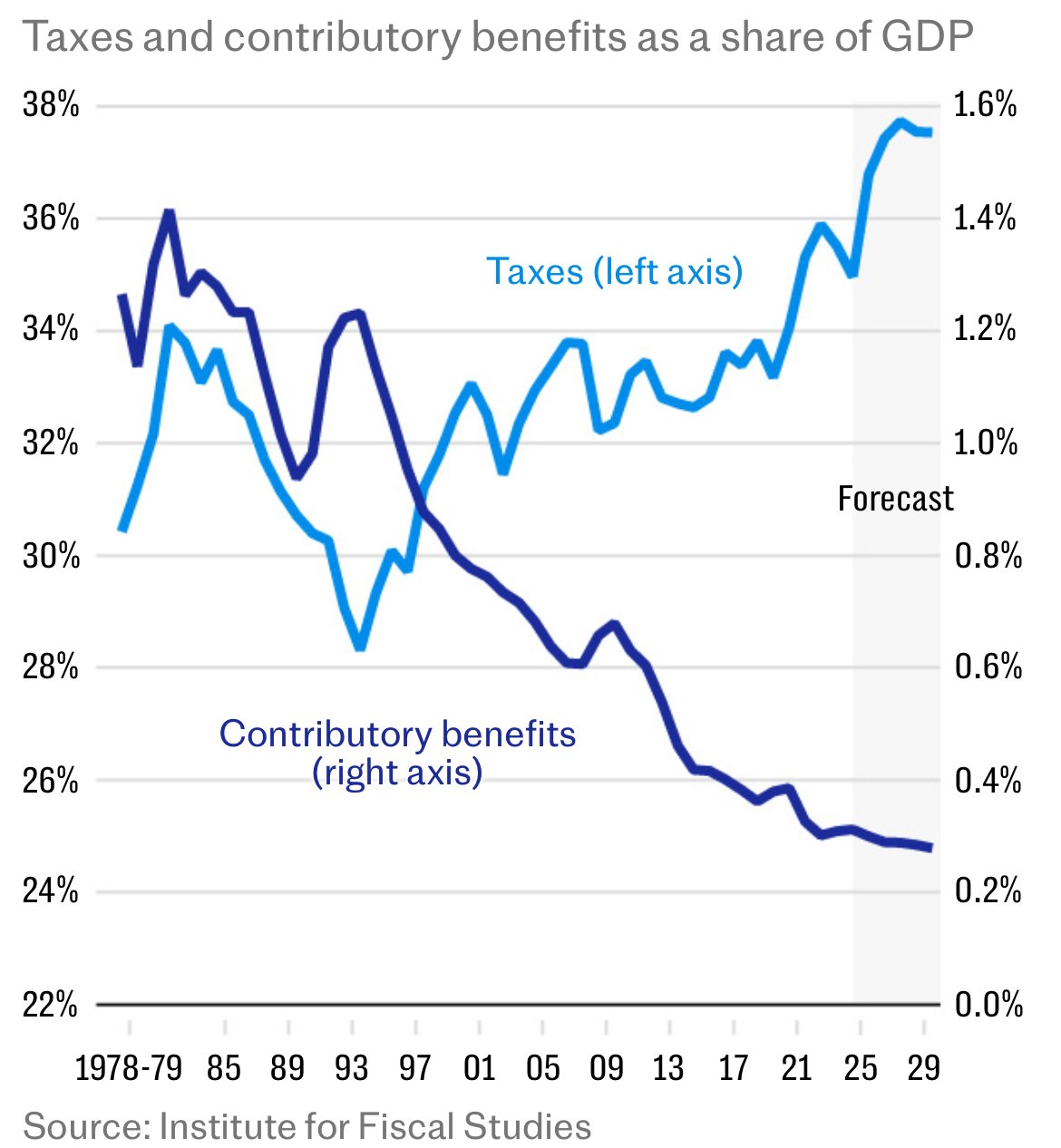

More and more tax for less and less benefits seems a bit unfair on the most productive?

More and more tax for less and less benefits seems a bit unfair on the most productive?

https://www.telegraph.co.uk/business/2025/11/18/how-the-middle-classes-have-been-locked-out-of-benefits/1 -

I guess it depends if you treat the state pension as contributory or not.I think....0

-

Not many contribute enough NI to justify the State Pension though do they ;-).michaels said:I guess it depends if you treat the state pension as contributory or not.

After all total NI (Employer/Employee) from a £35k salary is £5,367.48. How much annuity does that buy over 35 years of contributions?0 -

Hence why state pension is funded by NI and general taxation.BlackKnightMonty said:

Not many contribute enough NI to justify the State Pension though do they ;-).michaels said:I guess it depends if you treat the state pension as contributory or not.

After in total NI (Employer/Employee) from a £35k salary is £5,367.48. How much annuity does that buy over 35 years of contributions?The impossible question is does everyone get true value for the amount of total tax and NI they pay?

Not forgetting the vast amounts everyone pays directly or indirectly in every aspect of life.0 -

I would say current State Pensioners get an absolute steal of a deal. Triple locked SP paid at out at a relatively young age. You’ve never had it so good.Cobbler_tone said:

Hence why state pension is funded by NI and general taxation.BlackKnightMonty said:

Not many contribute enough NI to justify the State Pension though do they ;-).michaels said:I guess it depends if you treat the state pension as contributory or not.

After in total NI (Employer/Employee) from a £35k salary is £5,367.48. How much annuity does that buy over 35 years of contributions?The impossible question is does everyone get true value for the amount of total tax and NI they pay?

Not forgetting the vast amounts everyone pays directly or indirectly in every aspect of life.0 -

BlackKnightMonty said:

Not sure what this has to do with the potential capping of salary sacrifice for pension contributions, but as an aside, what then is your vision of the way forward here?

I would say current State Pensioners get an absolute steal of a deal. Triple locked SP paid at out at a relatively young age. You’ve never had it so good.Cobbler_tone said:

Hence why state pension is funded by NI and general taxation.BlackKnightMonty said:

Not many contribute enough NI to justify the State Pension though do they ;-).michaels said:I guess it depends if you treat the state pension as contributory or not.

After in total NI (Employer/Employee) from a £35k salary is £5,367.48. How much annuity does that buy over 35 years of contributions?The impossible question is does everyone get true value for the amount of total tax and NI they pay?

Not forgetting the vast amounts everyone pays directly or indirectly in every aspect of life.0 -

Great news for future state pensioners too, where increases will be from the current baseline benefiting from the triple lock.BlackKnightMonty said:

I would say current State Pensioners get an absolute steal of a deal. Triple locked SP paid at out at a relatively young age. You’ve never had it so good.Cobbler_tone said:

Hence why state pension is funded by NI and general taxation.BlackKnightMonty said:

Not many contribute enough NI to justify the State Pension though do they ;-).michaels said:I guess it depends if you treat the state pension as contributory or not.

After in total NI (Employer/Employee) from a £35k salary is £5,367.48. How much annuity does that buy over 35 years of contributions?The impossible question is does everyone get true value for the amount of total tax and NI they pay?

Not forgetting the vast amounts everyone pays directly or indirectly in every aspect of life.

Accepting that we might have to wait till 70 to get it (but I can't argue that the attainment age should reflect changes in life expectancy).0 -

BlackKnightMonty said:I would say current State Pensioners get an absolute steal of a deal. Triple locked SP paid at out at a relatively young age. You’ve never had it so good.Don't forget the self-employed and long-serving public sector workers, who were the big winners of the change to the new State Pension in 2016.Whereas previously they would probably have only received Basic State Pension, they now benefit from full State Pension. Combined with Triple Lock from 2011, that has been a big increase in the amount of State Pension they expected to receive.3

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.7K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards