We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

£2000 NI relief cap on pension salary sacrifice from April 2029 (confirmed)

Comments

-

If they employ any significant number of low paid staff, they are not allowed to use salary sacrifice for those people, which means it may not make sense for them to offer it to others and run two distinct systems.westv said:

The tax system does offer equal treatment. It"s down to the employer as to whether they can be bothered to offer SS or not.zagfles said:

Pension offerings by employers, just like any other benefit offerings, clearly won't be equal. That would be ridiculous. But as far as possible, the tax system should aim for equal treatment between someone who gets a good pension from their employer and someone who doesn't but voluntarily contributes extra to get an equally good pension.Cobbler_tone said:Ultimately people are almost trying to suggest that all pensions should be equal. They are clearly not and a big aspect in the attractiveness of a role. How many times do you hear “the police get a good pension” etc?

Some people only will have known something using SS. Things clearly change, the best example are DB schemes that no longer exist. It might make a few reconsider their current employer if things change, although you could say it might be a leveller. Employers will feel another negative impact too.

Assuming most people can’t afford a big hit on net pay, it will probably translate into smaller pension pots.0 -

We do (SS) hence why the lowest paid have been getting disproportionate pay rises to enable access to our benefits and stay above NMW. I believe our lowest paid are on around £33k now. It has certainly been closing the gap between some people.af1963 said:

If they employ any significant number of low paid staff, they are not allowed to use salary sacrifice for those people, which means it may not make sense for them to offer it to others and run two distinct systems.westv said:

The tax system does offer equal treatment. It"s down to the employer as to whether they can be bothered to offer SS or not.zagfles said:

Pension offerings by employers, just like any other benefit offerings, clearly won't be equal. That would be ridiculous. But as far as possible, the tax system should aim for equal treatment between someone who gets a good pension from their employer and someone who doesn't but voluntarily contributes extra to get an equally good pension.Cobbler_tone said:Ultimately people are almost trying to suggest that all pensions should be equal. They are clearly not and a big aspect in the attractiveness of a role. How many times do you hear “the police get a good pension” etc?

Some people only will have known something using SS. Things clearly change, the best example are DB schemes that no longer exist. It might make a few reconsider their current employer if things change, although you could say it might be a leveller. Employers will feel another negative impact too.

Assuming most people can’t afford a big hit on net pay, it will probably translate into smaller pension pots.0 -

Maybe everyone should pay the same absolute value, not proportion, of tax?michaels said:

I don't see it, those who can afford big pots will work longer or retire with less but this is likely to have minimal impact in paying for care. I really can't see that we should be spending billions more on giving tax breaks for the retirement of those on above average incomes than we do on those on below average incomes. I think everyone should get the same absolute value not proportion of tax break.Grumpy_chap said:Changing SS for the worse would quite likely result in less overall funding to pensions.

Less well funded pensions has a counter-effect for the Government in that people do not then have funds to finance their care when the need arises for later life so this would require the future Government to step in and fund.

All more than a simple assessment.

That would be fair to match tax to tax relief....0 -

No it doesn't. That's the point.westv said:

The tax system does offer equal treatment. It"s down to the employer as to whether they can be bothered to offer SS or not.zagfles said:

Pension offerings by employers, just like any other benefit offerings, clearly won't be equal. That would be ridiculous. But as far as possible, the tax system should aim for equal treatment between someone who gets a good pension from their employer and someone who doesn't but voluntarily contributes extra to get an equally good pension.Cobbler_tone said:Ultimately people are almost trying to suggest that all pensions should be equal. They are clearly not and a big aspect in the attractiveness of a role. How many times do you hear “the police get a good pension” etc?

Some people only will have known something using SS. Things clearly change, the best example are DB schemes that no longer exist. It might make a few reconsider their current employer if things change, although you could say it might be a leveller. Employers will feel another negative impact too.

Assuming most people can’t afford a big hit on net pay, it will probably translate into smaller pension pots.0 -

I still think it’s narrow minded to suggest SS is unfair because it presents an advantage to some. A bit like saying a gold plated DB is unfair. Employers can choose to use SS or you can choose to work at one that does. The same as the employers who offer the savings on top.

Assuming it would be pension specific and not areas such as company share schemes.0 -

The benefit for anybody close to minimum wage is negligible so the lack of ss is irrelevant.af1963 said:

If they employ any significant number of low paid staff, they are not allowed to use salary sacrifice for those people, which means it may not make sense for them to offer it to others and run two distinct systems.westv said:

The tax system does offer equal treatment. It"s down to the employer as to whether they can be bothered to offer SS or not.zagfles said:

Pension offerings by employers, just like any other benefit offerings, clearly won't be equal. That would be ridiculous. But as far as possible, the tax system should aim for equal treatment between someone who gets a good pension from their employer and someone who doesn't but voluntarily contributes extra to get an equally good pension.Cobbler_tone said:Ultimately people are almost trying to suggest that all pensions should be equal. They are clearly not and a big aspect in the attractiveness of a role. How many times do you hear “the police get a good pension” etc?

Some people only will have known something using SS. Things clearly change, the best example are DB schemes that no longer exist. It might make a few reconsider their current employer if things change, although you could say it might be a leveller. Employers will feel another negative impact too.

Assuming most people can’t afford a big hit on net pay, it will probably translate into smaller pension pots.

0 -

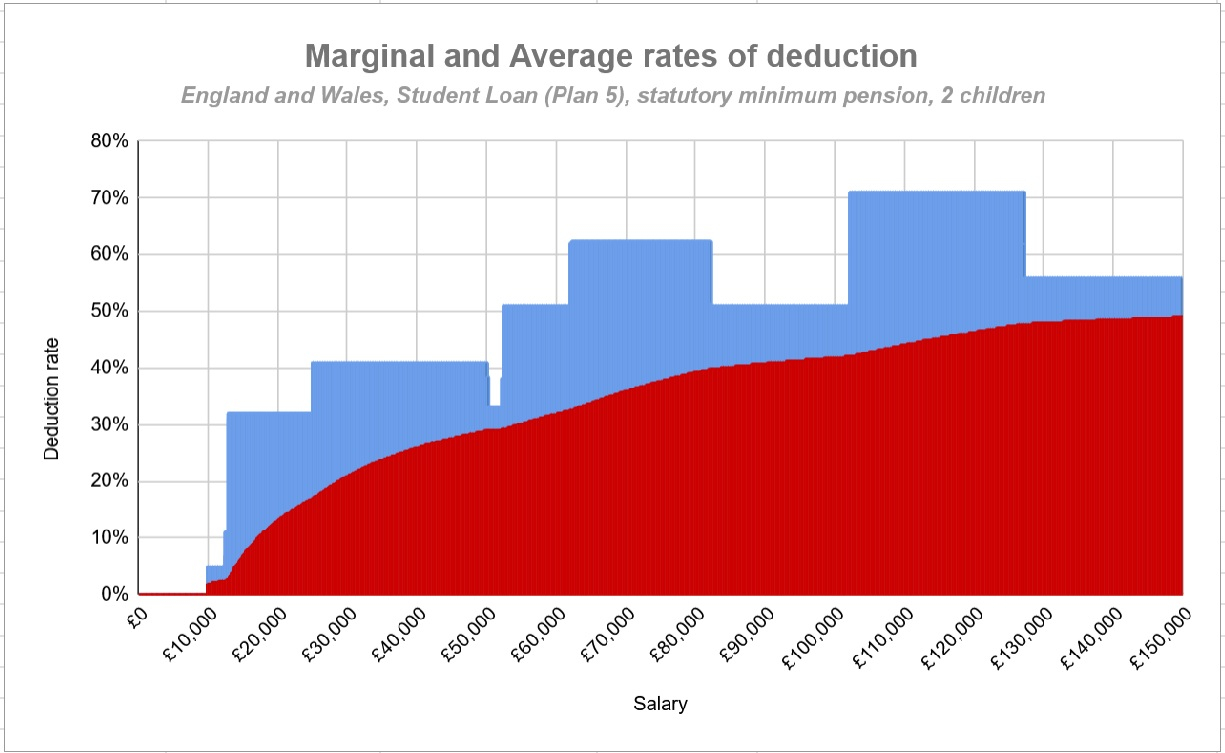

Of course the higher your income the sooner you re likely to pay off the student loan so perhaps the marginal rate is more u-shaped with those earning between 25k and 60k paying their loan effectively forever whereas those earning more can pay it off and face lower rates - given the interest rate charged those who can pay it off are probably best advised to pay it off early if possible.hugheskevi said:If we assume the basic rate of income tax increases to 22% (higher rate left at 40%), and that the 8% rate of National Insurance reduces to 6%, this is what the working incentives look like based on the latest version of Student Loans for a person with a Student Loan and 2 children who participates in a statutory minimum pension scheme using net pay contributions.Note this does not include Universal Credit. If that is included, there would be a 55% reduction rate on the lower part of the income chart. That means that at pretty much every level of earnings, they face a deduction rate in excess of half of their income.Also note that employer national insurance contributions and employer pension contributions are not included in any way, although changes to these will either partially or wholly indirectly feed through to pay, so are arguably deductions too. Pension contributions have a longer term benefit that is not shown.Table: Deduction rates based on 22% basic rate income tax and 6% standard rate of National Insurance

- At £10,000 they qualify to be automatically enrolled into a private pension.

- At around £12,000 of income they start to pay National Insurance and Income Tax.

- At £25,000 they start having student loan repayments deducted

- At just over £50,000 pension contributions stop increasing, and for a brief window they only pay 20% tax, 0% pension and 2% NICs on income due to pension tax relief

- By £53,000 of income they are paying higher rate tax, 2% National Insurance and their Student Loan

- At just over £60,000 their Child Benefit starts to be withdrawn, being fully removed at just over £80,000

- At just over £100,000 the Personal Allowance is removed, being fully removed by £127,500

- After that they have a 56% deduction rate, consisting of 45% income tax, 2% National Insurance and 9% Student Loan

I think a lot of the above is not so well appreciated, compared to the much simpler deduction arrangements for pensioners, who do not face National Insurance, Child Benefit reductions, pension contributions, or Student Loan repayments (nor the indirect deductions of employer National Insurance and employer pension contributions). Hence they have a simple deduction rate of 20%, 40%, 60% or 45% via income tax.Salary sacrifice is a way to avoid all the reductions and instead face deductions on income tax only when received as pension income, so is an increasingly valuable tool to avoid high deduction rates.The incentive provided appears to be part of a couple, both working and taking an income up to about £50-£60K, and putting everything above that into a pension, and retiring once you have both have assets sufficient to provide an income of about £50-£60K each, including State Pension. That limits salary to about £120,000, after which you hit the pension Annual Allowance. With that sort of income, the time/effort trade becomes very questionable with the high deduction rate whilst having a good income anyway.I think....0 -

Why is this all so divisive?

As someone above mentioned encourage senior medics and surgeons to stay in work by reducing tax! Why only surgeons? Why not everybody that has a trade or profession such that that builds prosperity?

We really come across as the dumb kid nation here, we are finding ways to penny pinch, scrimp and borrow (especially from the future) rather than working out how to meet our aspirations.

If I want an Aston, (some days I think I do but I'm not really sure, but if I really do) then I need to ensure I can generate the income to sustain the payments.

If I want to buy a 6 bed detached house with a gym wing and indoor/outdoor swimming pool, then again I need to ensure I can generate the income to sustain the payments.

Now that may entail, going back t school or uni, upskilling and getting a better job but I have to own that and deliver. Else I am just Walter Mitty.

Why is running the country any different?

We need to upskill, get ourselves better equipped, get better jobs and generate the income and then we can afford the things we "want", without robbing our kids and grandkids.1 -

Glad to hear you’ve done well out of it, and not bothered that this benefit is being taken away for others.Aretnap said:

That's a justification for why some employers might offer salary sacrifice while others don't. Not a justification for why the tax system should offer two different ways of doing the same thing, one of which attracts much better tax treatment than the other, in the first place.MeteredOut said:

And you could equally say why should someone get paid more than someone else at a different company for very similar jobs.westv said:

You could equally say why should someone with a DB pension get a better deal than someone with a DC pension. Just because one might be better than the other is no reason to criticise it.af1963 said:I've yet to see any argument put forward here (or elsewhere) that gives a good reason why someone using salary sacrifice for their pension should get a better deal than someone using relief at source.

I used salary sacrifice a lot when working for employers who provided it - but it's not universally available, and plenty of people manage to save towards their pension without using it. And low paid staff don't have the option at all.

It's part of the package offered to attract the employee.

The correct answer of course is that someone spotted a loophole that allowed people to get a better tax break from pension contributions than was originally intended. I've done very well out of the loophole, but ultimately if it finally gets closed my response will be to shrug and say that it was good while it lasted, not howl about the fact that I am being persecuted be being asked to pay the same amount of tax as someone else who is being paid the same as me and making the same contributions as me.0 -

Incorrect.michaels said:

The triple lock was introduced in 2016. In 2025 money terms the basic state pension was £174.10 (RPI). It is now £176.45. So about 1% more than inflation over 10 year is not 'massively in real terms' imhoAretnap said:

Who has been telling you that? Certainly not the government - the trend for the last 15 years, and apparently for the foreseeable future, has been for the state pension to increase massively in real terms, not decrease because it's unsustainable. Do not mistake noisy people on the internet for government policy.prowla said:We've had many years of being told that the State Pension isn't sustainable...

The triple lock was introduced by the Coalition Government in its first Budget after the 2010 election. It was implemented from the 2011/12 financial year and has been applied every year since, except for a temporary suspension in 2022/23. Before 2011, pensions had been uprated at least in line with prices since 1980, when an earnings link was ended by the then incoming Conservative Government.

https://commonslibrary.parliament.uk/research-briefings/cbp-7812/

2

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.7K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards