We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Which SIPP platforms give immediate tax relief?

dont_use_vistaprint

Posts: 893 Forumite

When I was on the Aviva platform (IPP) if I made a personal contribution, I got a tax relief credited immediately so I was able to buy additional units at the current price.

On the interactive investor platform I got notified it will be 6 to 8 weeks for the tax relief to appear in my account, so I cannot buy additional units at this price today and will incur additional buy fees later.

is this normal for a SIPP platform like H&L or Vanguard, or is it dependent on tax code or not having a direct debit set up for regular contributions?

is this normal for a SIPP platform like H&L or Vanguard, or is it dependent on tax code or not having a direct debit set up for regular contributions?

The greatest prediction of your future is your daily actions.

0

Comments

-

Some platforms, not usually the retail ones, prefund. Others don't, and the timings are out of their control. It may take as long as 11 weeks

2

2 -

dont_use_vistaprint said:

is this normal for a SIPP platform like H&L or Vanguard, or is it dependent on tax code or not having a direct debit set up for regular contributions?It is platform specific, nothing to do with funding method or personal tax situation.In broad terms, insurance based platforms and those with in-house pension funds might prefund the tax relief, stock brokers and fund platforms offering whole of market stocks, shares and funds access probably don't.But there's no hard and fast rule.

1 -

AFAIK, for the Sipp platforms often mentioned on here, none of them prefund.2

-

Halifax/Embark do, you get it to spend immediately.

Possibly some of the other Lloyds group companies might also if they use Embark I guess.1 -

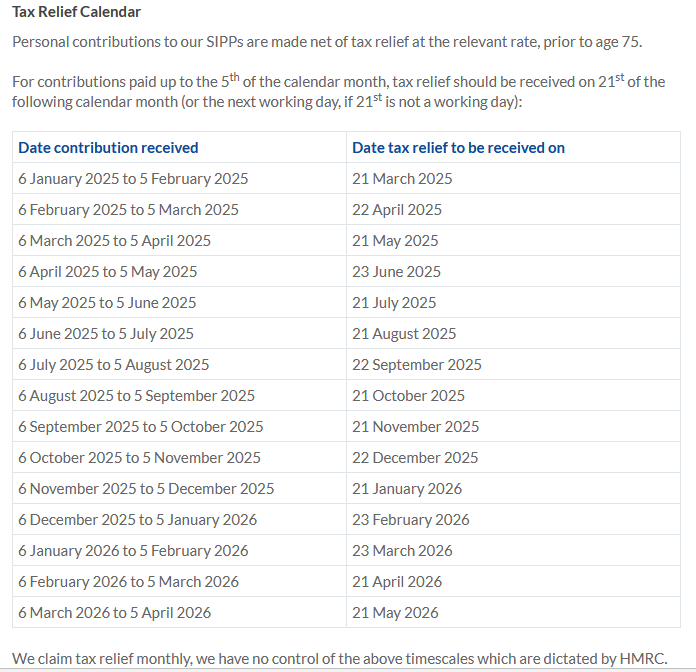

I always pay into my AJ Bell SIPP on 6th April. The tax relief appears, regular as clockwork, on 21st June (or first business day thereafter). I didn't realise that some companies pay it at the same time as the contribution.0

-

It is mainly the traditional providers like Standard Life, Scottish Widows, Prudential etcHattie627 said:I always pay into my AJ Bell SIPP on 6th April. The tax relief appears, regular as clockwork, on 21st June (or first business day thereafter). I didn't realise that some companies pay it at the same time as the contribution.0 -

is this normal for a SIPP platform like H&L or Vanguard, or is it dependent on tax code or not having a direct debit set up for regular contributions?Pre-funding costs the platforms millions of pounds as the money is effectively lent to you for a period. Most of the traditional provider SIPPs/Wraps and personal pensions pre-fund (tax relief, fund switches, tax free cash etc - although some may not pre-fund everything). However, on the DIY side, there are hardly any providers that pre-fund.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

No platform actually adds the tax relief immediately. The tax relief is paid by HMRC some time after they are informed by the platform that you have made your monthly contribution. The whole process takes several weeks and there's no real way to speed it up as HMRC have no incentive to do it any faster than they already do.

What some platform do is give you an interest free loan equivalent to the tax relief when you make the contribution, then claim it back from the tax relief when it arrives. Obviously providing you with an interest free loan has a cost - and that cost is a lot more now than it was when interest rates were close to zero a few years ago. I vaguely remember that a few years ago some of the big SIPP platforms did pre-fund, but if they have stopped now interest rates have gone up it wouldn't be a huge surprise.0 -

I get what you’re saying but it’s inaccurate to describe it as an interest free loan, because that’s not what it is.Aretnap said:No platform actually adds the tax relief immediately. The tax relief is paid by HMRC some time after they are informed by the platform that you have made your monthly contribution. The whole process takes several weeks and there's no real way to speed it up as HMRC have no incentive to do it any faster than they already do.

What some platform do is give you an interest free loan equivalent to the tax relief when you make the contribution, then claim it back from the tax relief when it arrives. Obviously providing you with an interest free loan has a cost - and that cost is a lot more now than it was when interest rates were close to zero a few years ago. I vaguely remember that a few years ago some of the big SIPP platforms did pre-fund, but if they have stopped now interest rates have gone up it wouldn't be a huge surprise.They simply credit your account and reconcile it later internally when they get payment. There is no agreement with the customer for a loanThe greatest prediction of your future is your daily actions.0 -

Interesting thread and good learnings, I too was a little annoyed when I moved from Scottish Widows to AJ Bell and saw the crediting of tax relief change from instant to almost 2 months later... it is annoying with investments when you want to acquire units with the whole lot at once.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.5K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards