We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Should I change my gilt investments

Comments

-

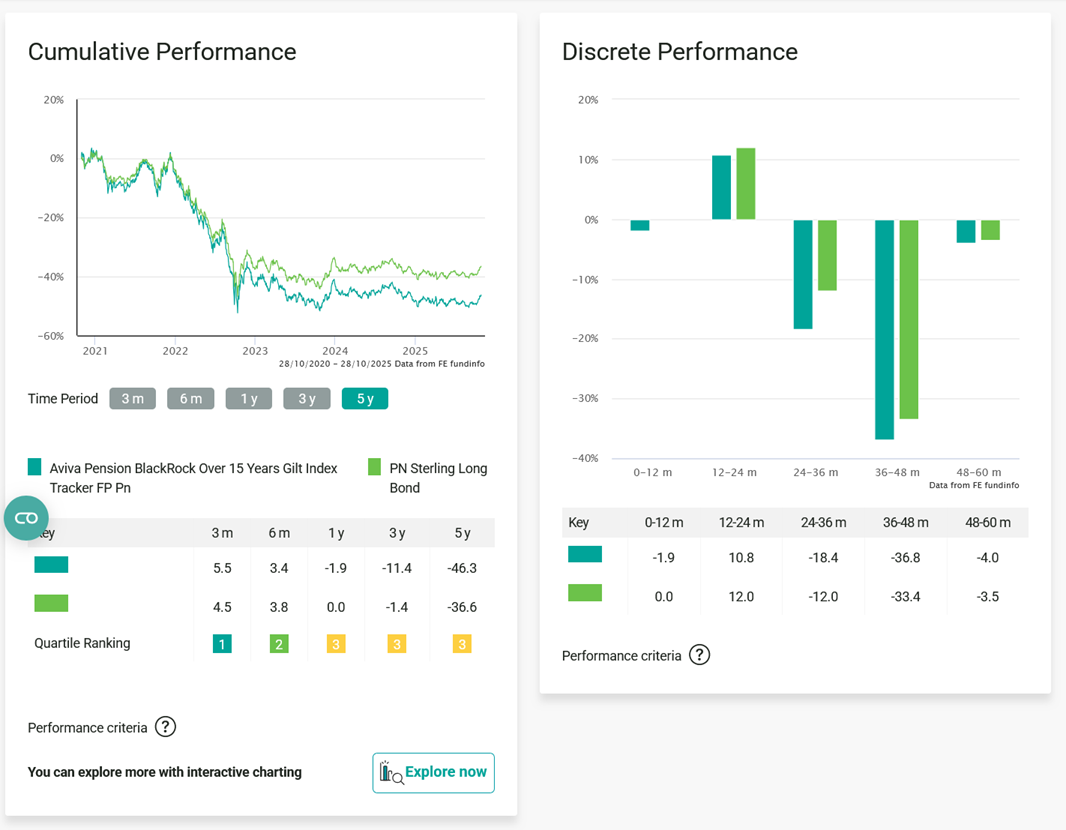

Oranda said:All I can see on performance of the guilt index tracker fund I’m in for the last 5 years is -12.0%, -37%, -12.9%,10% and latest is -9.5%. So that was the reason for my initial question as I’m 4 months from retirement.That's unusually poor.What's the name of the fund?N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.0 -

The fund is BlackRock Over 15 years Gilt Index Tracker.QrizB said:Oranda said:All I can see on performance of the guilt index tracker fund I’m in for the last 5 years is -12.0%, -37%, -12.9%,10% and latest is -9.5%. So that was the reason for my initial question as I’m 4 months from retirement.That's unusually poor.What's the name of the fund?

And unfortunately during the first 3 of those last 5 years the lifestyle process kicked in and moved a large %age of my uncrystallised pot into that fund. I lost around 30% of my pension pot 5 years before my retirement. My own fault I guess for not keeping an eye on it, and naively thinking it should have been low risk and "set and forget" as part of the "suggested" lifestyle process. Still, I have read that others have suffered similarly, and nobody saw Covid or guilt crash.

I crystallised a large chunk of my pot a couple of years ago, which is in a better performing fund but still have some in the guilt tracker.

Split milk now but don't really want to leave it there as I cant see it will recover with the next 2-3 years.

0 -

Still, I have read that others have suffered similarly, and nobody saw Covid or guilt crash.It's not to do with Covid, other than perhaps Covid extending the period of quantitative easing longer than it would have otherwise.Split milk now but don't really want to leave it there as I cant see it will recover with the next 2-3 years.Although gilts are the best performers of all the defensive options over the last 3 months and beating STMM over 6 months.

The bonds crash has happened. You cannot change that. Now it is starting a recovery, you are looking to avoid that recovery.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.2 -

I'm aware I cant change it (hence my reference to spilt milk).dunstonh said:Still, I have read that others have suffered similarly, and nobody saw Covid or guilt crash.It's not to do with Covid, other than perhaps Covid extending the period of quantitative easing longer than it would have otherwise.Split milk now but don't really want to leave it there as I cant see it will recover with the next 2-3 years.Although gilts are the best performers of all the defensive options over the last 3 months and beating STMM over 6 months.

The bonds crash has happened. You cannot change that. Now it is starting a recovery, you are looking to avoid that recovery.

If you had £24K in that guilt fund and needed to crystallise it to take TFLS's over the next 2 years, would you leave it there, or move it to another fund?0 -

OP, you appeared to have missed a few less than subtle comments, but just to be absolutely, 100% clear....Oranda said:

I'm aware I cant change it (hence my reference to spilt milk).dunstonh said:Still, I have read that others have suffered similarly, and nobody saw Covid or guilt crash.It's not to do with Covid, other than perhaps Covid extending the period of quantitative easing longer than it would have otherwise.Split milk now but don't really want to leave it there as I cant see it will recover with the next 2-3 years.Although gilts are the best performers of all the defensive options over the last 3 months and beating STMM over 6 months.

The bonds crash has happened. You cannot change that. Now it is starting a recovery, you are looking to avoid that recovery.

If you had £24K in that guilt fund and needed to crystallise it to take TFLS's over the next 2 years, would you leave it there, or move it to another fund?

it is GILT

not GUILT4 -

We all knew a virus outbreak was a possibility there were already films about it.Oranda said:

nobody saw Covid or guilt crash.

Several of us were posting warnings here about bonds (which includes gilts) leading up to the crash

Here's a couple of posts from November 2021 just weeks before the crash started:

https://forums.moneysavingexpert.com/discussion/comment/78787785/#Comment_78787785

Bonds are offering an 'almost return free risk' at the moment so I wouldn't touch VLS20 with a barge pole.

https://forums.moneysavingexpert.com/discussion/comment/78745826/#Comment_78745826

It does feel like bond investors are going to be slowly boiled like a frog to inflation and interest rates given just enough hope along the way that they don't see the full danger of their circumstances until it is too late.

And a fuller explanation of what was going to happen earlier in March 2021:

https://forums.moneysavingexpert.com/discussion/comment/78199051/#Comment_78199051

"Bonds have historically been considered a safe asset when used in portfolio construction but anything can become risky if the price gets too high and they now offer very little yield and there are signs that the 40 year positive run for bonds is coming to an end and they could be poor investments going forwards."

2 -

If you are going to be taking tax free cash over the next 2 years ( is it £24k or 25% of £24k)

then that amount needs to be in either cash or short term money market funds already.

It’s not worth taking any risk with for such a short amount of time.1 -

Earlier posts suggested the total uncrystallised was c £30k and that £8k of that was in something called Pension Deposit (which sounded like a cash/cash equivalent fund).SVaz said:If you are going to be taking tax free cash over the next 2 years ( is it £24k or 25% of £24k)

then that amount needs to be in either cash or short term money market funds already.

It’s not worth taking any risk with for such a short amount of time.

I confess I don't know how that tallies with £24k in the gilts fund and some other amount in equities.1 -

This one?Oranda said:

The fund is BlackRock Over 15 years Gilt Index Tracker.QrizB said:Oranda said:All I can see on performance of the guilt index tracker fund I’m in for the last 5 years is -12.0%, -37%, -12.9%,10% and latest is -9.5%. So that was the reason for my initial question as I’m 4 months from retirement.That's unusually poor.What's the name of the fund?https://www.trustnet.com/factsheets/p/lm60/aviva-pen-blackrock-over-15-year-gilt-index-tracker-fp-pnThe current performance isn't quite as you state, but even so it's down almost 50% over 5 years:

Over those same five years, however, annuity rates have doubled.Oranda said:I lost around 30% of my pension pot 5 years before my retirement.Look at this post, for example:In 2021, £100k would have bought a 65-year-old an RPI-linked annuity of £2685 a year.Take that £100k and knock off 46% (the loss in your gilt fund over 5 years). You've now got £54k.In 2025, £54k will buy a 65-year-old an RPI-linked annuity of £2918 a year.So the gilt fund as done what it was designed to do; it's preserved the value of the annuity you'll be able to buy with your pension.

It is a low-risk fund for anyone intending to buy an annuity, and is exactly what would be expected for a lifestyle fund targeting an annuity purchase.Oranda said:My own fault I guess for not keeping an eye on it, and naively thinking it should have been low risk and "set and forget" as part of the "suggested" lifestyle process.N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.2 -

DRS1 - I’ve had further money go into the uncrystallised pot today from another small pension that I had, so total uncrystallised pot has increased to 33K. So the 3 funds in which it is invested have increased in proportion of the lifestyle investment path. Hence why 24K is now sat in the gilt fund.DRS1 said:

Earlier posts suggested the total uncrystallised was c £30k and that £8k of that was in something called Pension Deposit (which sounded like a cash/cash equivalent fund).SVaz said:If you are going to be taking tax free cash over the next 2 years ( is it £24k or 25% of £24k)

then that amount needs to be in either cash or short term money market funds already.

It’s not worth taking any risk with for such a short amount of time.

I confess I don't know how that tallies with £24k in the gilts fund and some other amount in equities.SVaz - Over next 2 years will be taking 25% of this in tax free cash. The 75% then moves to my drawdown pot (different fund) which has been performing well.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.4K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards