We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

5-10 Year Recommendation

Comments

-

If you don't mind putting in a bit of legwork, inflation can easily be beaten via special savings accounts and regular savers. For example, the santander edge saver will give you 6% on £4K, MONBS recently offered a RS 7% (variable) for £1K pcm.magd36 said:

I don't disagree but can you give me a simple example of how you'd try to achieve that outside an ISA when cash generally doesn't match inflation over time? Thanks.Altior said:Away from linkers there's currently no way to guarantee capital against potential inflation erosion over the medium term. As evidently, nobody knows what future inflation will be.

In my view, the most suitable strategy is to protect capital as a minimum, then try to maximise yield, and hope that matches (or supersedes) inflation.

There's much more scope for this outside of an ISA.

Obviously there's a potential tax implication that will depend on other variables, however you might well have some flexibility with that as you're retiring. Right now it comfortably beats anything you can get in the ISA space (with no capital risk).

I enjoy it a lot, so not a chore for me, but it's something that requires regular monitoring to maximise opportunity. For example, Virgin briefly offered a 10% RS. I also jumped on long term cash bonds when interest rates spiked, I have several bonds paying 6% up to 2028, and an ISA paying 5% up to next year.0 -

I understand and admire your diligence. Not sure it's achievable over 10 years based on savings account rates over the last 10 years but possibly. Wish I could be so engaged but great to hear it has been achievable. Thanks.Altior said:

If you don't mind putting in a bit of legwork, inflation can easily be beaten via special savings accounts and regular savers. For example, the santander edge saver will give you 6% on £4K, MONBS recently offered a RS 7% (variable) for £1K pcm.magd36 said:

I don't disagree but can you give me a simple example of how you'd try to achieve that outside an ISA when cash generally doesn't match inflation over time? Thanks.Altior said:Away from linkers there's currently no way to guarantee capital against potential inflation erosion over the medium term. As evidently, nobody knows what future inflation will be.

In my view, the most suitable strategy is to protect capital as a minimum, then try to maximise yield, and hope that matches (or supersedes) inflation.

There's much more scope for this outside of an ISA.

Obviously there's a potential tax implication that will depend on other variables, however you might well have some flexibility with that as you're retiring. Right now it comfortably beats anything you can get in the ISA space (with no capital risk).

I enjoy it a lot, so not a chore for me, but it's something that requires regular monitoring to maximise opportunity. For example, Virgin briefly offered a 10% RS. I also jumped on long term cash bonds when interest rates spiked, I have several bonds paying 6% up to 2028, and an ISA paying 5% up to next year.0 -

This forum does most of the work, to be honest!magd36 said:

I understand and admire your diligence. Not sure it's achievable over 10 years based on savings account rates over the last 10 years but possibly. Wish I could be so engaged but great to hear it has been achievable. Thanks.Altior said:

If you don't mind putting in a bit of legwork, inflation can easily be beaten via special savings accounts and regular savers. For example, the santander edge saver will give you 6% on £4K, MONBS recently offered a RS 7% (variable) for £1K pcm.magd36 said:

I don't disagree but can you give me a simple example of how you'd try to achieve that outside an ISA when cash generally doesn't match inflation over time? Thanks.Altior said:Away from linkers there's currently no way to guarantee capital against potential inflation erosion over the medium term. As evidently, nobody knows what future inflation will be.

In my view, the most suitable strategy is to protect capital as a minimum, then try to maximise yield, and hope that matches (or supersedes) inflation.

There's much more scope for this outside of an ISA.

Obviously there's a potential tax implication that will depend on other variables, however you might well have some flexibility with that as you're retiring. Right now it comfortably beats anything you can get in the ISA space (with no capital risk).

I enjoy it a lot, so not a chore for me, but it's something that requires regular monitoring to maximise opportunity. For example, Virgin briefly offered a 10% RS. I also jumped on long term cash bonds when interest rates spiked, I have several bonds paying 6% up to 2028, and an ISA paying 5% up to next year.

It gets more challenging as the funds accumulate, but circa £20K is comfortable. Currently my 'feeder' account is Chase with a bonus for a year, paying 4.75%.

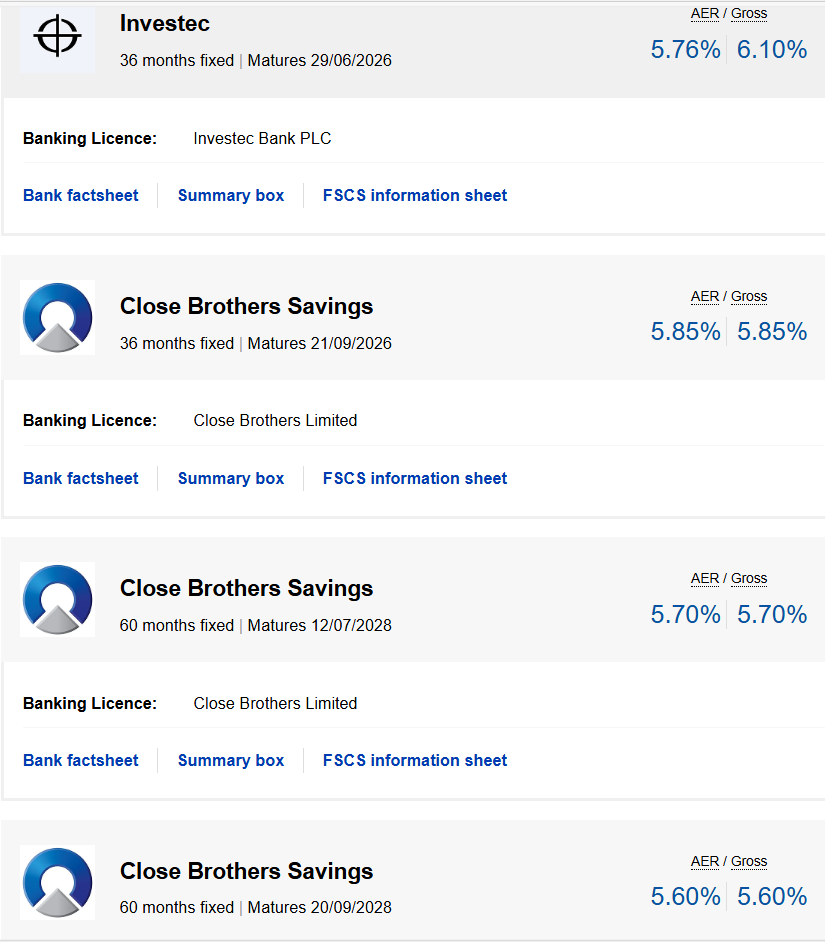

The low engagement option is cash bonds. I've added a screenshot of some of mine as an example. These rates are long gone, so it's a case of monitoring the market for when opportunities arise. A theoretical minor gamble, but the odds of beating inflation over the period are very high. And I don't put all the eggs in those baskets.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards