We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Draw down from my pension to pay debts but not ready to retire yet

Comments

-

Thanks everyone for the advice; I knew I would get good advice here- of course I am due to discuss with an IFA as well as my accountant but I wanted to know if it was even possible before having the conversation. I appreciate the rest of the advice- there are other complications which I didn’t mention because they’re not really relevant to the main question. There’s a life limiting illness in the mix so 20 years ago I wasn’t sure if I would make it to retirement age- I made a decision then that I would rather be retired and broke with a lifetime’s worth of memories than wealthy and too ill to do anything (or dead.) there will be some inheritance down the line too at some point. But anyway, thanks for the advice about the withdrawal; that is a big help and I’ll sort out the rest with help from others, as recommended.1

-

Bad idea, particularly if this is your entire pension provision as you are already way behind on where you should be. You really need to find another way.Megahertz456 said:I'm thinking of drawing down the 25% tax free amount (around £28k) from my SIPP) to reduce personal debts to a manageable level but leave the rest invested until I'm ready to retire, at 67 if health allows.1 -

Put succinctly, a stopped clock is right twice a day.Exodi said:

While I appreciate you are playing devils advocate, and I'm not for one second suggesting that there will never be a stock market crash, I can't help but draw some parallels with the housing market.El_Torro said:The global stock market is currently at a record high. Sure, global stock markets spend most of their time at record highs, hence the exponential growth phenomenon. Stock markets are also considered way overvalued and there are various signs that a crash is looming. Better to cash in before the crash rather than during or just after it. Nobody knows for sure when the next crash is coming of course, though seeing as we haven't had a huge disruption since 2008 we are well overdue.

For decades the HPC brigade has been predicting an imminent crash in house prices. And to give credit to them, they've correctly predicted 35 of the last 1 crashes (of which they proudly boast about on their home page: https://www.housepricecrash.co.uk/).

There were a few from the HPC crowd that posted on here a few years ago warning of an imminent crash, but fortunately they've disappeared as far I've seen (though I'm sure you'll remember the likes of CrashyTime!) . Though given what has happened with house prices over the past couple of decades, it's not surprising. They may come out the woodwork should the prophesied crash happen.

When they were posting, they would argue effectively the same as you are - that houses are way overvalued, unaffordable to most, propped up by bank of mum and dad and government subsidies, etc. There are some who have spent at least the past decade renting waiting for the crash.

The problem with keeping out of the market in anticipation of a crash, is you don't know how long it will be, and you also lose any potential gains before it happens. I know you've posted on here long enough to know people have been saying a crash is coming for many, many years now. I appreciate a crash is inevitable, but I'd hope that any gains made until that happens will have made up for it. Or at the very least, I wouldn't want to be one of the HPC crowd, sitting in my rented flat with greying hair and all of my money in cash, trying to convince myself that it hasn't been all for nothing and 'this will be the year'. 0

0 -

What's the interest rate on your debt? Do you have a plan to pay that off and if so when? Rather than taking from your pension have you done a budget and applied money you save to your debt?And so we beat on, boats against the current, borne back ceaselessly into the past.0

-

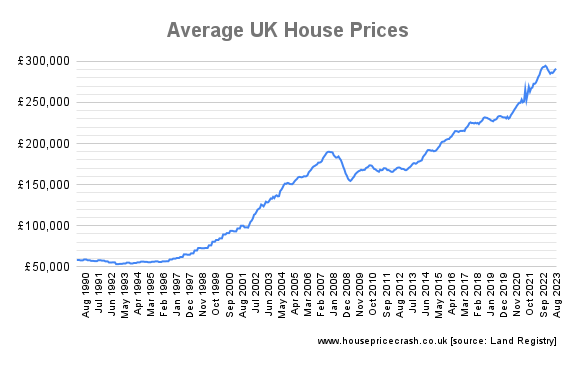

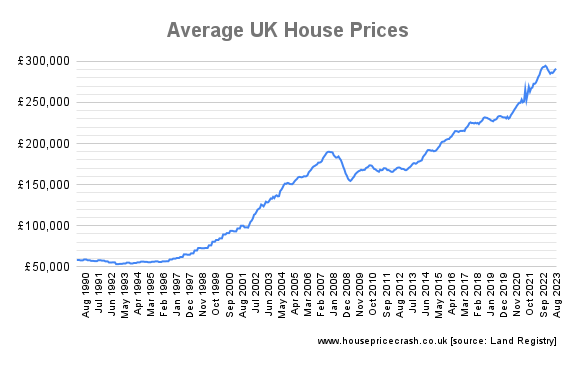

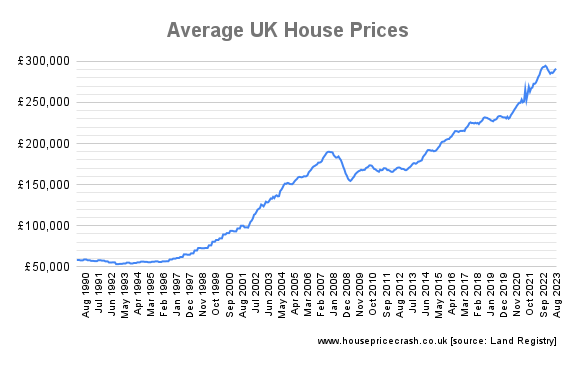

It's interesting to see the graph of average house prices in the UK. Looking at that graph house prices were about £190k average in Jan 2008, then crashed. It took until June 2014 to go back to that level. I'm sure this hides a lot of geographical disparities though. Those of us living in the South East of England probably saw a much quicker recovery.Exodi said:

While I appreciate you are playing devils advocate, and I'm not for one second suggesting that there will never be a stock market crash, I can't help but draw some parallels with the housing market.El_Torro said:The global stock market is currently at a record high. Sure, global stock markets spend most of their time at record highs, hence the exponential growth phenomenon. Stock markets are also considered way overvalued and there are various signs that a crash is looming. Better to cash in before the crash rather than during or just after it. Nobody knows for sure when the next crash is coming of course, though seeing as we haven't had a huge disruption since 2008 we are well overdue.

For decades the HPC brigade has been predicting an imminent crash in house prices. And to give credit to them, they've correctly predicted 35 of the last 1 crashes (of which they proudly boast about on their home page: https://www.housepricecrash.co.uk/).

There were a few from the HPC crowd that posted on here a few years ago warning of an imminent crash, but fortunately they've disappeared as far I've seen (though I'm sure you'll remember the likes of CrashyTime!) . Though given what has happened with house prices over the past couple of decades, it's not surprising. They may come out the woodwork should the prophesied crash happen.

When they were posting, they would argue effectively the same as you are - that houses are way overvalued, unaffordable to most, propped up by bank of mum and dad and government subsidies, etc. There are some who have spent at least the past decade renting waiting for the crash.

The problem with keeping out of the market in anticipation of a crash, is you don't know how long it will be, and you also lose any potential gains before it happens. I know you've posted on here long enough to know people have been saying a crash is coming for many, many years now. I appreciate a crash is inevitable, but I'd hope that any gains made until that happens will have made up for it. Or at the very least, I wouldn't want to be one of the HPC crowd, sitting in my rented flat with greying hair and all of my money in cash, trying to convince myself that it hasn't been all for nothing and 'this will be the year'.

I hesitate to draw too many parallels between global stock markets and house prices though. Houses are in finite supply, especially with UK governments (not finger pointing at any one particular political party here) doing such a stellar job at not keeping up with demand. The value of stocks and shares is a bit different.

Yes, I have been on this forum long enough to know that there's always someone warning of an impending crash; whether it's in the stock market or house prices. One thing we do know is that there will be a significant stock market crash at some point. History has also taught us that when the crash does come the value of global shares will recover. It might take 1 year, or 3 years, or possibly even longer. The recovery will come though.

My underlying point was more that if someone wants to take their 25% tax free lump sum from their pension then now is probably as good a time as any. Whether it's wise to take the lump sum before retirement is almost a separate issue. Sure, 2026 might be a great year in terms of stock market growth (I doubt it, but time will tell) but it's always the case that we can't wait forever before cashing in.

0 -

There were a few from the HPC crowd that posted on here a few years ago warning of an imminent crash, but fortunately they've disappeared as far I've seen (though I'm sure you'll remember the likes of CrashyTime!) . Though given what has happened with house prices over the past couple of decades, it's not surprising. They may come out the woodwork should the prophesied crash happen.Exodi said:

While I appreciate you are playing devils advocate, and I'm not for one second suggesting that there will never be a stock market crash, I can't help but draw some parallels with the housing market.El_Torro said:The global stock market is currently at a record high. Sure, global stock markets spend most of their time at record highs, hence the exponential growth phenomenon. Stock markets are also considered way overvalued and there are various signs that a crash is looming. Better to cash in before the crash rather than during or just after it. Nobody knows for sure when the next crash is coming of course, though seeing as we haven't had a huge disruption since 2008 we are well overdue.

For decades the HPC brigade has been predicting an imminent crash in house prices. And to give credit to them, they've correctly predicted 35 of the last 1 crashes (of which they proudly boast about on their home page: https://www.housepricecrash.co.uk/).

When they were posting, they would argue effectively the same as you are - that houses are way overvalued, unaffordable to most, propped up by bank of mum and dad and government subsidies, etc. There are some who have spent at least the past decade renting waiting for the crash.

The problem with keeping out of the market in anticipation of a crash, is you don't know how long it will be, and you also lose any potential gains before it happens. I know you've posted on here long enough to know people have been saying a crash is coming for many, many years now. I appreciate a crash is inevitable, but I'd hope that any gains made until that happens will have made up for it. Or at the very least, I wouldn't want to be one of the HPC crowd, sitting in my rented flat with greying hair and all of my money in cash, trying to convince myself that it hasn't been all for nothing and 'this will be the year'.

'ReadySteadyPop' is a prolific poster on the House Buying forum, I understand he is a resurrection of the original 'Crashy'

Apparently he sold up many years ago in anticipation of a HPC and has lost out big time.1 -

Play silly games, win silly prizes?Albermarle said:'ReadySteadyPop' is a prolific poster on the House Buying forum, I understand he is a resurrection of the original 'Crashy'

Apparently he sold up many years ago in anticipation of a HPC and has lost out big time.N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.4K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards