We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Draw down from my pension to pay debts but not ready to retire yet

Megahertz456

Posts: 9 Forumite

Hi - long story short (or as short as I can make it) . Company

Director, with about £115k in a SIPP. 58 years old, not planning to

retire yet. Company has been through a rocky patch since Covid but profitable again now.

I'm thinking of drawing down the 25% tax free amount (around £28k) from my SIPP) to reduce personal debts to a manageable level but leave the rest invested until I'm ready to retire, at 67 if health allows.

40% tax payer currently, but I think I can access the 25% tax free (around £28k) ? Can I still continue to contribute to the SIPP - I think I read I can only put in £10k per year from then on?

And then when I do stop working it would all be taxable?

Have I read this correctly?

0

Comments

-

Yes to taking tax free 25% and you can still contribute. If you only take tax free cash you don't trigger the £10k per annum limitGoogling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!1

-

Cashing pension to pay debt is very bad idea. That is not the purpose of pension.

But, yes, you can cash in 25% and continue to contibute up to existing limits.

Hope you are using company to credit your sipp and not from your own accounts.1 -

Sam_666 said:Cashing pension to pay debt is very bad idea. That is not the purpose of pension.

But, yes, you can cash in 25% and continue to contibute up to existing limits.

Hope you are using company to credit your sipp and not from your own accounts.

Yes I've been propping up the company during a tough time, incurred personal debts to keep afloat. Covid hit us really hard and it's taken until now to see us back to where we were in 2019. Company is profitable again now but it's been tough.0 -

And then when I do stop working it would all be taxable?

If the pension is worth precisely £115k and you take a lump sum of precisely £28K then that will leave £87k. Of that £87k £84k (£28k x 3) will be "crystallised" and £3k will be "uncrystallised". The crystallised part will all be taxable when you draw it but the uncrystallised part can still have 25% tax free lump sum with the remaining 75% taxable. Any new contributions paid in will boost the uncrystallised bit.

You may want to check how your SIPP deals with crystallised and uncrystallised bits of the pension. Some keep the assets all in one pot and just apply a percentage split while others physically separate the two parts (so you could have different investments in the different parts).

Oh and check on fees as well. They may go up.

1 -

Don't take any lump sum or in fact anything from your pension. You should be paying into it. You're earning over 50k a year, yet have debt of a few 10's of K by the sound of it. Jeez get some proper financial advice.A little FIRE lights the cigar1

-

I didn't want to be rude but this was my first thought also.ali_bear said:Don't take any lump sum or in fact anything from your pension. You should be paying into it. You're earning over 50k a year, yet have debt of a few 10's of K by the sound of it. Jeez get some proper financial advice.

@Megahertz456 do you have any other pension provision?

If this SIPP is the only one, and OP is a 40% taxpayer earning over £50k per year, it's a tad concerning to have £115k in a SIPP at 58. If we followed through the OP's plan of taking out 25%, they'd be left with~£86.25k. Assuming investment returns are 4% above inflation, that's a pot of ~£127.7k in todays money (not considering additional contributions).

Assuming a SWR of 3.5%, that's an annual income of £4468.49, or £372.37 per month (in todays money). Combine that with the state pension of ~£997.75 per month (assuming it keeps track with inflation) and you have a combined monthly retirement income of £1,370.12 in todays money. Considering you are a higher rate tax payer now, your tax home pay is likely to be over £3k per month, that's a big difference. I appreciate the common response to this might be "but I won't have a mortgage to pay", but you must consider you'll also be at home all day and presumably you didn't envision retirement as watching TV and little else.

I wouldn't usually do this, as I appreciate it's oftentimes not welcomed, and off-topic as the OP asked a specific question (of which they've had great answers) - I'd at least considering heading to the DFW forums and posting a full statement of affairs to work out this debt situation. IMO you should absolutely not robbing Peter (your retired self) to pay Paul (your current self), even if this includes cutting expenditure or even defaulting.

Really, you should be working out how you can significantly increase your pension contributions over the next 10 years. Currently you're paying higher rate tax on money you're paying yourself, whereas you're looking to be barely paying basic rate tax in retirement, it seems a no-brainer.

I think I agree with @ali_bear, getting some proper financial advise about maximising your tax efficiency, building a proper retirement plan and potentially coming up with some options for the debts would pay dividends.Know what you don't1 -

Note that when we say "75% will be taxable" that means that normal tax rules will apply - so if the pension is your only income when you come to draw it you'll still have your personal tax allowance of £12750 or whatever it is at that point which you won't pay tax on.DRS1 said:And then when I do stop working it would all be taxable?

If the pension is worth precisely £115k and you take a lump sum of precisely £28K then that will leave £87k. Of that £87k £84k (£28k x 3) will be "crystallised" and £3k will be "uncrystallised". The crystallised part will all be taxable when you draw it but the uncrystallised part can still have 25% tax free lump sum with the remaining 75% taxable. Any new contributions paid in will boost the uncrystallised bit.

You may want to check how your SIPP deals with crystallised and uncrystallised bits of the pension. Some keep the assets all in one pot and just apply a percentage split while others physically separate the two parts (so you could have different investments in the different parts).

Oh and check on fees as well. They may go up.0 -

If it is down to net affordability you reduce your pension contributions to clear your debts. Directly or indirectly, if paying into a pension creates debt elsewhere, it isn't the best idea. Unless if it is part of a longer range plan with something that a mortgage on a low rate that you can clear at the end of the term.

....and as Ali Bear said, get some advice if needed.0 -

While I agree that we shouldn't be raiding our pensions before we retire here is a counterpoint:

The global stock market is currently at a record high. Sure, global stock markets spend most of their time at record highs, hence the exponential growth phenomenon. Stock markets are also considered way overvalued and there are various signs that a crash is looming. Better to cash in before the crash rather than during or just after it. Nobody knows for sure when the next crash is coming of course, though seeing as we haven't had a huge disruption since 2008 we are well overdue.

As I said I think as a rule we shouldn't be accessing our pensions early to service debt. However each person's situation is different. If the OP is confident that they can make up the shortfall before they retire then there could be a case for it. Big risk though, while the business is doing well today will it continue to do well over the next 10 years?

Also, on the face of it a 58 year old higher rate tax payer with a pension pot of £115k should really be looking to increase the size of that pot, not decrease it.0 -

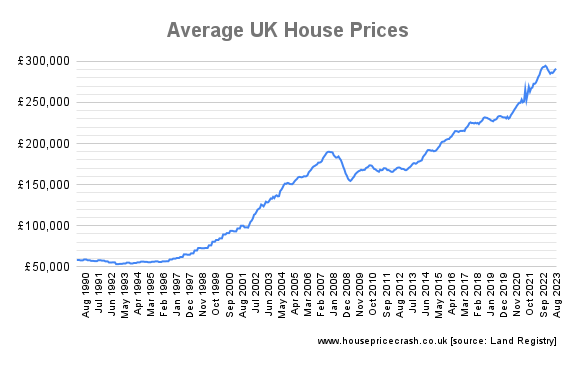

While I appreciate you are playing devils advocate, and I'm not for one second suggesting that there will never be a stock market crash, I can't help but draw some parallels with the housing market.El_Torro said:The global stock market is currently at a record high. Sure, global stock markets spend most of their time at record highs, hence the exponential growth phenomenon. Stock markets are also considered way overvalued and there are various signs that a crash is looming. Better to cash in before the crash rather than during or just after it. Nobody knows for sure when the next crash is coming of course, though seeing as we haven't had a huge disruption since 2008 we are well overdue.

For decades the HPC brigade has been predicting an imminent crash in house prices. And to give credit to them, they've correctly predicted 35 of the last 1 crashes (of which they proudly boast about on their home page: https://www.housepricecrash.co.uk/).

There were a few from the HPC crowd that posted on here a few years ago warning of an imminent crash, but fortunately they've disappeared as far I've seen (though I'm sure you'll remember the likes of CrashyTime!) . Though given what has happened with house prices over the past couple of decades, it's not surprising. They may come out the woodwork should the prophesied crash happen.

When they were posting, they would argue effectively the same as you are - that houses are way overvalued, unaffordable to most, propped up by bank of mum and dad and government subsidies, etc. There are some who have spent at least the past decade renting waiting for the crash.

The problem with keeping out of the market in anticipation of a crash, is you don't know how long it will be, and you also lose any potential gains before it happens. I know you've posted on here long enough to know people have been saying a crash is coming for many, many years now. I appreciate a crash is inevitable, but I'd hope that any gains made until that happens will have made up for it. Or at the very least, I wouldn't want to be one of the HPC crowd, sitting in my rented flat with greying hair and all of my money in cash, trying to convince myself that it hasn't been all for nothing and 'this will be the year'. Know what you don't3

Know what you don't3

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.4K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards