We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Old CCJ and Statue Barred debt

LA83LA

Posts: 4 Newbie

Any advice will be greatly appreciated!

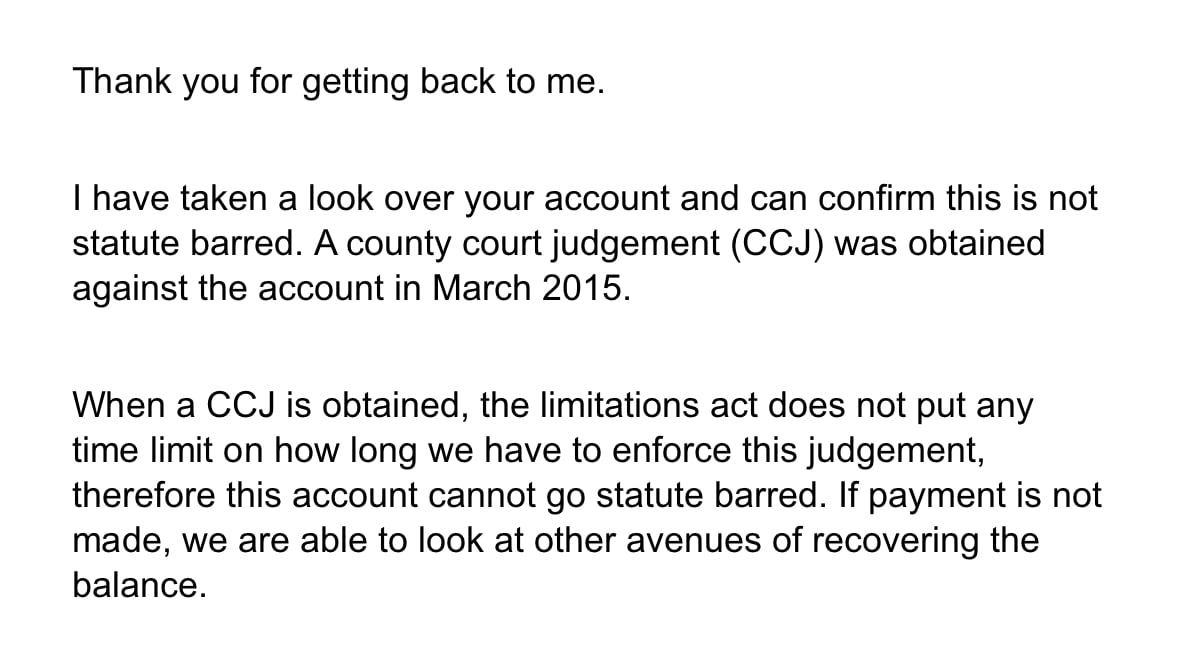

Any advice will be greatly appreciated! Sent out a Statue Barred debt email to a debt collection company and received this response back from them. Trying to understand what they are saying and how is the best way to resolve this with a response. Thanks, L

0

Comments

-

OK In theory what they say is partially correct, but if they didn't do anything within 6 years of the CCJ being issued basically they are snookered, they would have to take it back to court and come up with a reason why they didn't do anything within the 6 years. So the answer is just ignore them.If you go down to the woods today you better not go alone.1

-

Statute barring is about the ability to take the matter to court... if it's already been to court then they are correct it cannot be statute barred because that ship has already sailed.LA83LA said:Any advice will be greatly appreciated!Sent out a Statue Barred debt email to a debt collection company and received this response back from them. Trying to understand what they are saying and how is the best way to resolve this with a response. Thanks, L

That said the initial judgement gives them 6 years for debt enforcement, which it doesnt become statute barred if they want to start recovery action after 6 years they must have the courts approval to do so unless they already have a third party debt order or a charging order. Generally the court will need a compelling reason as to why debt recovery wasnt possible in the first 6 years but is now to authorise them. Just falling between the cracks, forgot about it etc won't wash it and the courts won't give approval.1 -

Appreciate the swift response and clarity gives me ease. Part of me wants to respond in a formal manner so they stop harassing me0

-

Point them to Limitation Act 1980 s24

(Make sure you don't call it Limitations Act)

See what they say3 -

Thank you. Let’s see what Cabot financial respond back0

-

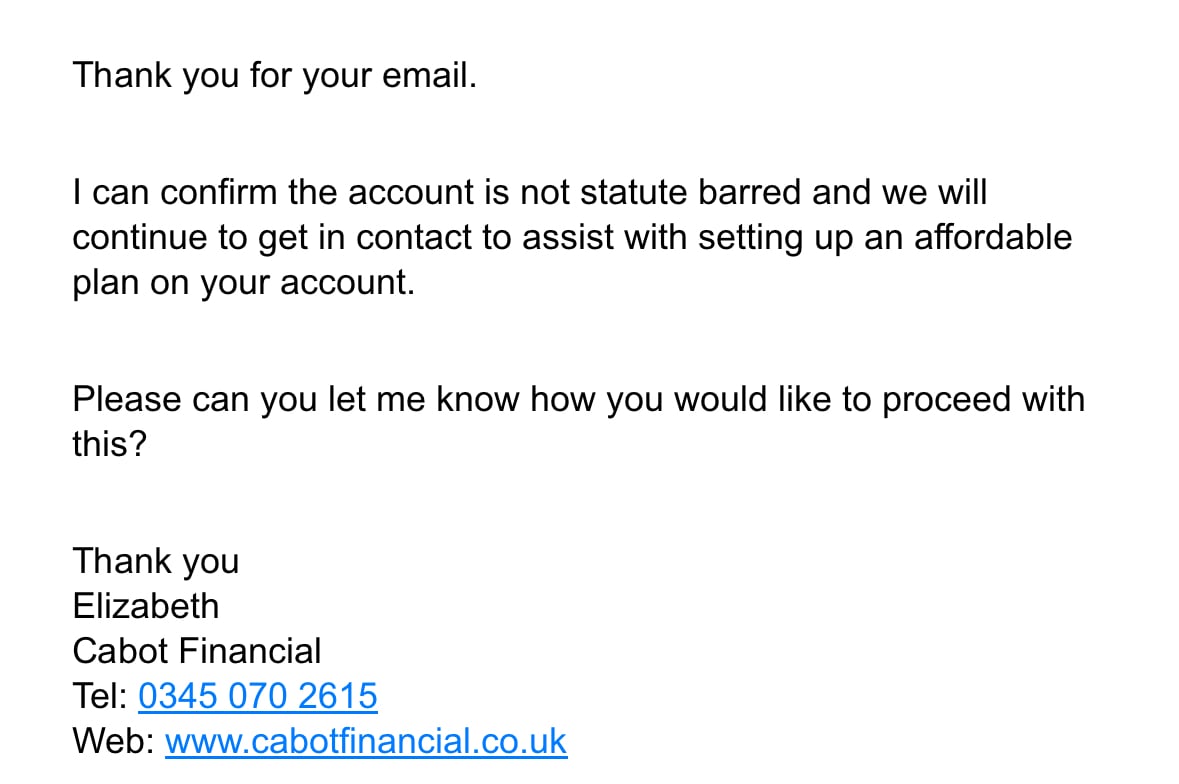

This is what they came back with

0

0 -

Did your communication with them clearly state the wording of s24 of The limitation Act 1980 ?24Time limit for actions to enforce judgments

(1)An action shall not be brought upon any judgment after the expiration of six years from the date on which the judgment became enforceable.

0 -

That's fair enough.

They can't enforce it.

You won't be paying.

Nothing more to discuss with Elizabeth0 -

Without getting court approval... it's not as black & white as simply saying they cannot enforce it. Would need to hear their side of the story and why its resurfaced now to give any view on if the court would approve it or not.fatbelly said:That's fair enough.

They can't enforce it.

You won't be paying.

Nothing more to discuss with Elizabeth0 -

No bailiff is going to take that on.

Just block them0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.6K Work, Benefits & Business

- 601.5K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards