We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

ISA mistake - opened a General Investment Account.

Comments

-

I can only see 'contributions' (55k). I've looked everywhere and cant see a 'cost' or similar. Even if it doesn't explicitly state the 'cost' though it should be factored in, in a sense, already through previous purchases+disposals?DRS1 said:

Yes. In principle you started with £55k of money in which would be your base cost but let's say Nutmeg have made gains on deals of £2500 in each of the last two years then your current base cost would be more like £60k.James19791 said:Thanks for that.

Can I ask please; that if some of my 'gain' has been 'realised' in last FY and previously years (due to the sales/adjustments in the portfolio) that should reduce slightly CGT due if and when I come to sell some shares?

Also, after selling £20k and putting in a new s&s ISA (plan is other platform) in this and next few FY, is there benefit to selling the rest and putting into another GIA (on same platform as a&s ISA) that only has 1 fund (diverse Index fund) if only to simplify CGT calculations for future years. Then the only years with multiple fund sales would be 2025-2026 tax year. Future years would be sale of 1 fund only as the money is moved to the ISA. Assuming similar growth/loss to current Nutmeg GIA. Or am I overthinking it?

Thanks,

Usually you can tell by looking at your portfolio what the current base cost is - it should be the total of the Cost column.

I think the issue with selling the Nutmeg portfolio all at once is that you may be missing out on the benefit of the £3k annual allowance in the future years. If you sell it all now and the gain is £19k then £16k is subject to CGT but if you spread the sales over 4 years then maybe only £7k is subject to CGT (or less if the bottom falls out of the market).

I've previously thought of internal sales/purchases as eating into my allowance but I can see now that it is removing some gain and thus reducing future CGT liability.0 -

A market drop is a good time for a CGT disposal as you can churn a greater percentage of your total holding through the annual £3K limit.James19791 said:It's a monumental f**k up from me no doubt about it. In a sense though it's a 'good' problem to have in that I'm only in this situation because my investment has grown. I'd much prefer a tax headache than a loss. I'm still banking 76% of growth (more when allowance is utilised). At least that's what I'm telling myself....

The worst scenario would be to sell on or near a peak, lock in your capital gains, and then prices fell suddenly.

If these were normal shares, you would have the protection of buying back the exact same investments within 30 days to cancel the CGT disposal under the bed and breakfasting rules, but I have no idea how this would apply to an acive portfolio which is constantly adjusting investments on your behalf?

I'm sure the smart guys on the thread will enlighten me as always. • The rich buy assets.

• The rich buy assets.

• The poor only have expenses.

• The middle class buy liabilities they think are assets.1 -

If these were normal shares, you would have the protection of buying back the exact same investments within 30 days to cancel the CGT disposal under the bed and breakfasting rules, but I have no idea how this would apply to an acive portfolio which is constantly adjusting investments on your behalf?And if it was a whole of market platform and funds were being used, you can usually find similar alternative funds. Especially with passive investing so you don't have to wait 30 days.

Active portfolios using funds as the underlying assets tend to be quarterly, half-yearly or yearly (monthly has long been found to result in underperformance in most cases)

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.2 -

That's gone above my head I'm afraid! Is selling from my GIA and rebuying the same funds in a (Nutmeg) ISA an option for me in terms of cancelling CGT liability? Could I just buy the same portfolio which would contain the same funds as before?dunstonh said:If these were normal shares, you would have the protection of buying back the exact same investments within 30 days to cancel the CGT disposal under the bed and breakfasting rules, but I have no idea how this would apply to an acive portfolio which is constantly adjusting investments on your behalf?And if it was a whole of market platform and funds were being used, you can usually find similar alternative funds. Especially with passive investing so you don't have to wait 30 days.

Active portfolios using funds as the underlying assets tend to be quarterly, half-yearly or yearly (monthly has long been found to result in underperformance in most cases)0 -

No, any transactions within an ISA are ignored for CGT purposes, i.e. the CGT calculation would only take the GIA sale into account.James19791 said:

Is selling from my GIA and rebuying the same funds in a (Nutmeg) ISA an option for me in terms of cancelling CGT liability?2 -

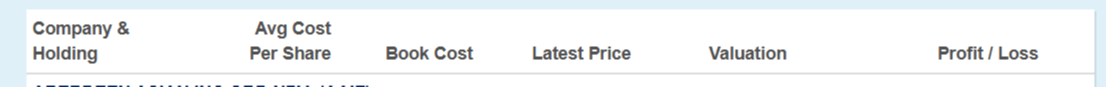

Well as I say I don't know how Nutmeg works but these are the headings I see on IwebJames19791 said:

I can only see 'contributions' (55k). I've looked everywhere and cant see a 'cost' or similar. Even if it doesn't explicitly state the 'cost' though it should be factored in, in a sense, already through previous purchases+disposals?DRS1 said:

Yes. In principle you started with £55k of money in which would be your base cost but let's say Nutmeg have made gains on deals of £2500 in each of the last two years then your current base cost would be more like £60k.James19791 said:Thanks for that.

Can I ask please; that if some of my 'gain' has been 'realised' in last FY and previously years (due to the sales/adjustments in the portfolio) that should reduce slightly CGT due if and when I come to sell some shares?

Also, after selling £20k and putting in a new s&s ISA (plan is other platform) in this and next few FY, is there benefit to selling the rest and putting into another GIA (on same platform as a&s ISA) that only has 1 fund (diverse Index fund) if only to simplify CGT calculations for future years. Then the only years with multiple fund sales would be 2025-2026 tax year. Future years would be sale of 1 fund only as the money is moved to the ISA. Assuming similar growth/loss to current Nutmeg GIA. Or am I overthinking it?

Thanks,

Usually you can tell by looking at your portfolio what the current base cost is - it should be the total of the Cost column.

I think the issue with selling the Nutmeg portfolio all at once is that you may be missing out on the benefit of the £3k annual allowance in the future years. If you sell it all now and the gain is £19k then £16k is subject to CGT but if you spread the sales over 4 years then maybe only £7k is subject to CGT (or less if the bottom falls out of the market).

I've previously thought of internal sales/purchases as eating into my allowance but I can see now that it is removing some gain and thus reducing future CGT liability.

1 -

If tax rules are changed in the Budget, say CGT increased to 28%, do those changes take place immediately or next FY? If immediately, are any disposals/dividends/interest prior to that day taxed at the old rate and any after that date subject to new rates?0

-

Well, just look at last year's mid-year change: the increase in the CGT rate was backdated to the beginning of the day of the announcement* and disposals made prior to that date were taxed at the previous rate.James19791 said:If tax rules are changed in the Budget, say CGT increased to 28%, do those changes take place immediately or next FY? If immediately, are any disposals/dividends/interest prior to that day taxed at the old rate and any after that date subject to new rates?

*The trading day had already begun...1 -

Wow that's pretty harsh.wmb194 said:

Well, just look at last year's mid-year change: the increase in the CGT rate was backdated to the beginning of the day of the announcement* and disposals made prior to that date were taxed at the previous rate.James19791 said:If tax rules are changed in the Budget, say CGT increased to 28%, do those changes take place immediately or next FY? If immediately, are any disposals/dividends/interest prior to that day taxed at the old rate and any after that date subject to new rates?

*The trading day had already begun...

I'm guessing if an allowance is completely removed, you then don't get any for that whole year? They don't give you a reduced portion for the part of the year that it had existed?0 -

You mean the annual CGT allowance, currently £3,000? In prior years that’s always been a change for the next tax year.James19791 said:

Wow that's pretty harsh.wmb194 said:

Well, just look at last year's mid-year change: the increase in the CGT rate was backdated to the beginning of the day of the announcement* and disposals made prior to that date were taxed at the previous rate.James19791 said:If tax rules are changed in the Budget, say CGT increased to 28%, do those changes take place immediately or next FY? If immediately, are any disposals/dividends/interest prior to that day taxed at the old rate and any after that date subject to new rates?

*The trading day had already begun...

I'm guessing if an allowance is completely removed, you then don't get any for that whole year? They don't give you a reduced portion for the part of the year that it had existed?

If you’re really worried you could make sure you use it before the budget but there might be ways around that anyway if e.g., you’re sitting on capital losses you could use after a mid-year change to offset against gains.I think they’d be getting a bit desperate and pushing on a string if they reduce it much further. The Treasury would do better biting the political bullet and adding a penny to basic rate income tax.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards