We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Can a Prime Minister, Chancellor of the Exchequer and or a UK Government be Sued?

caroline199

Posts: 1 Newbie

I started a Stakeholder Pension in the year 2006. In the last 5 years a Lifestyle programme kicked in and was supposed to move my funds, increasing each year, into so called "less risky" investments. In the final year this was 25% in a Cash Fund and 75% in UK Government Bonds & Gilts. In my opinion, the percentages should have been the other way round (i.e. 75% in the Cash Fund).

In years 1 to 4 the fund did increase without any further contributions, but at the end of year 5, my agreed retirement date when I reached the age of 65, the Lifestyle plan ended, and just before it did my fund lost £80,000. This was because of the mini budget on the 23rd of September 2022. I didn't find out until I received my annual statement in October 2022. On the advice of a Financial Adviser, I moved all my funds into the cash fund to avoid further loses and eventually I had to buy a Annuity with a much reduced pension pot.

I worked really hard for my pension and feel very bitter about what happened and I would like to see someone made accountable and be able to claim back my losses. Can I sue the Prime Minister, Chancellor of the Exchequer and or a UK Government who were responsible for this crash of my pension, or do they have some sort of legal protection? I know if I could and was successful this would create a precedent and then many others would follow me.

I am surprised in this age of Claim Companies offering "no win, no fee" for personal injury, car finance, PP!, etc., one of them hasn't thought about pension fund loss claims. Maybe the reason is that it isn't legally possible to make claims against the aforementioned. I would like to have peoples thoughts on this please. I did try to make a claim for mis-selling to the company who advised and sold me this pension, but that failed.

In years 1 to 4 the fund did increase without any further contributions, but at the end of year 5, my agreed retirement date when I reached the age of 65, the Lifestyle plan ended, and just before it did my fund lost £80,000. This was because of the mini budget on the 23rd of September 2022. I didn't find out until I received my annual statement in October 2022. On the advice of a Financial Adviser, I moved all my funds into the cash fund to avoid further loses and eventually I had to buy a Annuity with a much reduced pension pot.

I worked really hard for my pension and feel very bitter about what happened and I would like to see someone made accountable and be able to claim back my losses. Can I sue the Prime Minister, Chancellor of the Exchequer and or a UK Government who were responsible for this crash of my pension, or do they have some sort of legal protection? I know if I could and was successful this would create a precedent and then many others would follow me.

I am surprised in this age of Claim Companies offering "no win, no fee" for personal injury, car finance, PP!, etc., one of them hasn't thought about pension fund loss claims. Maybe the reason is that it isn't legally possible to make claims against the aforementioned. I would like to have peoples thoughts on this please. I did try to make a claim for mis-selling to the company who advised and sold me this pension, but that failed.

0

Comments

-

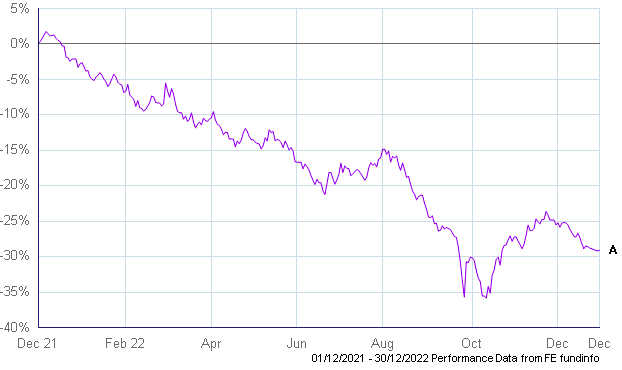

The substantial falls in government bond prices was largely a result of interest rates rising from unprecedented lows. The Truss/Kwarteng budget would have been responsible for very little of the total loss. You can probably pick it out from the chart below.

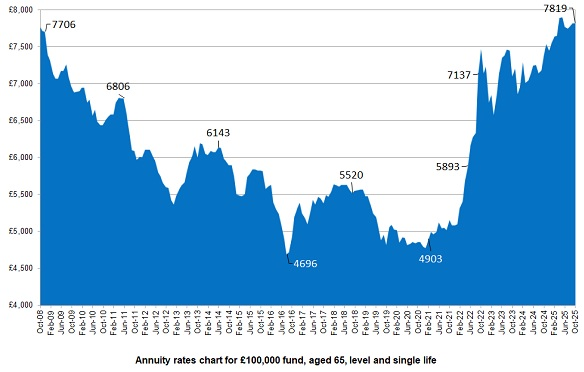

However, annuity rates also rose substantially during that period and someone invested primarily in gilts would would have derisked shortfall risk associated with annuity rate change.

However, annuity rates also rose substantially during that period and someone invested primarily in gilts would would have derisked shortfall risk associated with annuity rate change. It is just unfortunate that this shielded you from annuity rate rises as well as falls. But it is an appropriate thing to do for someone close to retirement who doesn't want to risk getting a smaller annuity in a few years time than they could buy today.Buying a higher rate annuity with a reduced pot doesn't necessarily mean you are any worse off than if you could have bought it before the interest rate rises. Whereas if you held 75% cash and 25% bonds, you would be gambling on annuity rates and could have ended up worse off if global inflation hadn't started biting.The MPC, which sets interest rates is considered independent from government and their mandate is around meeting an inflation target, so increasing interest rates when inflation rose sharply was an expected course of action. If they didn't do that then your pension would be worth less due to even higher inflation and you wouldn't have got the benefit of a higher annuity rate.0

It is just unfortunate that this shielded you from annuity rate rises as well as falls. But it is an appropriate thing to do for someone close to retirement who doesn't want to risk getting a smaller annuity in a few years time than they could buy today.Buying a higher rate annuity with a reduced pot doesn't necessarily mean you are any worse off than if you could have bought it before the interest rate rises. Whereas if you held 75% cash and 25% bonds, you would be gambling on annuity rates and could have ended up worse off if global inflation hadn't started biting.The MPC, which sets interest rates is considered independent from government and their mandate is around meeting an inflation target, so increasing interest rates when inflation rose sharply was an expected course of action. If they didn't do that then your pension would be worth less due to even higher inflation and you wouldn't have got the benefit of a higher annuity rate.0 -

Yes, of course. Anyone can be sued for anything. Good luck0

-

Hopefully OP you have deep pockets to pay for the legal representation you'll need in any court battle.

I would consider what you'll actually achieve and the possible costs of taking the action, given there is no guarantee you'll win.0 -

The fact that there aren't loads of people of a similar age trying to sue suggests that you are going down a legal dead end. Presumably when you started your pension you were warned that the value could fluctuate.caroline199 said:I am surprised in this age of Claim Companies offering "no win, no fee" for personal injury, car finance, PP!, etc., one of them hasn't thought about pension fund loss claims. Maybe the reason is that it isn't legally possible to make claims against the aforementioned. I would like to have peoples thoughts on this please. I did try to make a claim for mis-selling to the company who advised and sold me this pension, but that failed.

We could get into a deep discussion about accountability of those in power, but we are encouraged to avoid political debate on this forum. Previous governments are also responsible for funding issues in education and healthcare, and I'm sure a lot of people affected would like to sue over that too.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.9K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.1K Spending & Discounts

- 244.9K Work, Benefits & Business

- 600.4K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards