We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Stewart Investors Asia Pacific management team resigns

aroominyork

Posts: 3,626 Forumite

For anyone invested or thinking of investing in Stewart Investors' Asia Pacific funds (which had generally performed well... until about this time last year), the long-standing management team led by David Gait and Sashi Reddy resigned overnight in late August.

2

Comments

-

Asia hasn't been great generally over recent times but I'm slightly up on this fund in the past year and 116% up overall (a good few years). It's still showing as a Fidelity Select 50 recommendation for what that's worth.

Is part of a decent sized portfolio in a longstanding S&S ISA so no plans to change at this time. Appreciate the info, thanks for sharing.0 -

dunstonh said:I just checked the returns from that point vs an index tracker and it was the right decision with the APL returning 36.67% and the pacific tracker (ex Jap) returning 79.17%. It spent over a decade outperforming trackers but it has underperformed them for over 6 years.That seems a little harsh. It is about two-thirds emerging markets, and whether you consider it EM or AP ex-Japan is did fine until last October. I reduced my holding over the last couple of years (in the All Cap, not Leaders) and in culling my actively managed equity funds this year it is the very last to go; I am moving it to abrdn Asia Pacific Equity Enhanced Index (I thought they were dropping that abrdn nonsense...).

1

1 -

I did exactly the same move a little while ago, now I'm gradually consolidating to ETFs - EMIM in my case, though SEMA would have been good too.aroominyork said:dunstonh said:I just checked the returns from that point vs an index tracker and it was the right decision with the APL returning 36.67% and the pacific tracker (ex Jap) returning 79.17%. It spent over a decade outperforming trackers but it has underperformed them for over 6 years.That seems a little harsh. It is about two-thirds emerging markets, and whether you consider it EM or AP ex-Japan is did fine until last October. I reduced my holding over the last couple of years (in the All Cap, not Leaders) and in culling my actively managed equity funds this year it is the very last to go; I am moving it to abrdn Asia Pacific Equity Enhanced Index (I thought they were dropping that abrdn nonsense...).2 -

Any thoughts on how your ENIM and SEMA compare to HMEF?InvesterJones said:

I did exactly the same move a little while ago, now I'm gradually consolidating to ETFs - EMIM in my case, though SEMA would have been good too.aroominyork said:dunstonh said:I just checked the returns from that point vs an index tracker and it was the right decision with the APL returning 36.67% and the pacific tracker (ex Jap) returning 79.17%. It spent over a decade outperforming trackers but it has underperformed them for over 6 years.That seems a little harsh. It is about two-thirds emerging markets, and whether you consider it EM or AP ex-Japan is did fine until last October. I reduced my holding over the last couple of years (in the All Cap, not Leaders) and in culling my actively managed equity funds this year it is the very last to go; I am moving it to abrdn Asia Pacific Equity Enhanced Index (I thought they were dropping that abrdn nonsense...).0 -

granta said:

Any thoughts on how your ENIM and SEMA compare to HMEF?InvesterJones said:

I did exactly the same move a little while ago, now I'm gradually consolidating to ETFs - EMIM in my case, though SEMA would have been good too.aroominyork said:dunstonh said:I just checked the returns from that point vs an index tracker and it was the right decision with the APL returning 36.67% and the pacific tracker (ex Jap) returning 79.17%. It spent over a decade outperforming trackers but it has underperformed them for over 6 years.That seems a little harsh. It is about two-thirds emerging markets, and whether you consider it EM or AP ex-Japan is did fine until last October. I reduced my holding over the last couple of years (in the All Cap, not Leaders) and in culling my actively managed equity funds this year it is the very last to go; I am moving it to abrdn Asia Pacific Equity Enhanced Index (I thought they were dropping that abrdn nonsense...).SEMA/HMEF are very similar and follow the same index, albeit with slightly different filtering - SEMA has 827 holdings, HMEF has 1195.EMIM has small cap too, and a slightly ridiculous 3070 holdings. It's also slightly outperformed the other two over the last 3/5/10yrs, but I'd be happy with any of them.1 -

Thanks. Like others here, I have been slowly culling actively managed funds over the last few years and by coincidence got rid of Asia Pacific Leaders though unrelated to the departures. So looking to buy into an EM etfInvesterJones said:granta said:

Any thoughts on how your ENIM and SEMA compare to HMEF?InvesterJones said:

I did exactly the same move a little while ago, now I'm gradually consolidating to ETFs - EMIM in my case, though SEMA would have been good too.aroominyork said:dunstonh said:I just checked the returns from that point vs an index tracker and it was the right decision with the APL returning 36.67% and the pacific tracker (ex Jap) returning 79.17%. It spent over a decade outperforming trackers but it has underperformed them for over 6 years.That seems a little harsh. It is about two-thirds emerging markets, and whether you consider it EM or AP ex-Japan is did fine until last October. I reduced my holding over the last couple of years (in the All Cap, not Leaders) and in culling my actively managed equity funds this year it is the very last to go; I am moving it to abrdn Asia Pacific Equity Enhanced Index (I thought they were dropping that abrdn nonsense...).SEMA/HMEF are very similar and follow the same index, albeit with slightly different filtering - SEMA has 827 holdings, HMEF has 1195.EMIM has small cap too, and a slightly ridiculous 3070 holdings. It's also slightly outperformed the other two over the last 3/5/10yrs, but I'd be happy with any of them.0 -

I forgot to mention, I think HMEF is a distributing fund, so if your platform charges to reinvest then that's something to consider vs accumulating.granta said:

Thanks. Like others here, I have been slowly culling actively managed funds over the last few years and by coincidence got rid of Asia Pacific Leaders though unrelated to the departures. So looking to buy into an EM etfInvesterJones said:granta said:

Any thoughts on how your ENIM and SEMA compare to HMEF?InvesterJones said:

I did exactly the same move a little while ago, now I'm gradually consolidating to ETFs - EMIM in my case, though SEMA would have been good too.aroominyork said:dunstonh said:I just checked the returns from that point vs an index tracker and it was the right decision with the APL returning 36.67% and the pacific tracker (ex Jap) returning 79.17%. It spent over a decade outperforming trackers but it has underperformed them for over 6 years.That seems a little harsh. It is about two-thirds emerging markets, and whether you consider it EM or AP ex-Japan is did fine until last October. I reduced my holding over the last couple of years (in the All Cap, not Leaders) and in culling my actively managed equity funds this year it is the very last to go; I am moving it to abrdn Asia Pacific Equity Enhanced Index (I thought they were dropping that abrdn nonsense...).SEMA/HMEF are very similar and follow the same index, albeit with slightly different filtering - SEMA has 827 holdings, HMEF has 1195.EMIM has small cap too, and a slightly ridiculous 3070 holdings. It's also slightly outperformed the other two over the last 3/5/10yrs, but I'd be happy with any of them.1 -

good point, I'm leaning towards HMEF0

-

aroominyork said:dunstonh said:I just checked the returns from that point vs an index tracker and it was the right decision with the APL returning 36.67% and the pacific tracker (ex Jap) returning 79.17%. It spent over a decade outperforming trackers but it has underperformed them for over 6 years.That seems a little harsh. It is about two-thirds emerging markets, and whether you consider it EM or AP ex-Japan is did fine until last October. I reduced my holding over the last couple of years (in the All Cap, not Leaders) and in culling my actively managed equity funds this year it is the very last to go; I am moving it to abrdn Asia Pacific Equity Enhanced Index (I thought they were dropping that abrdn nonsense...).

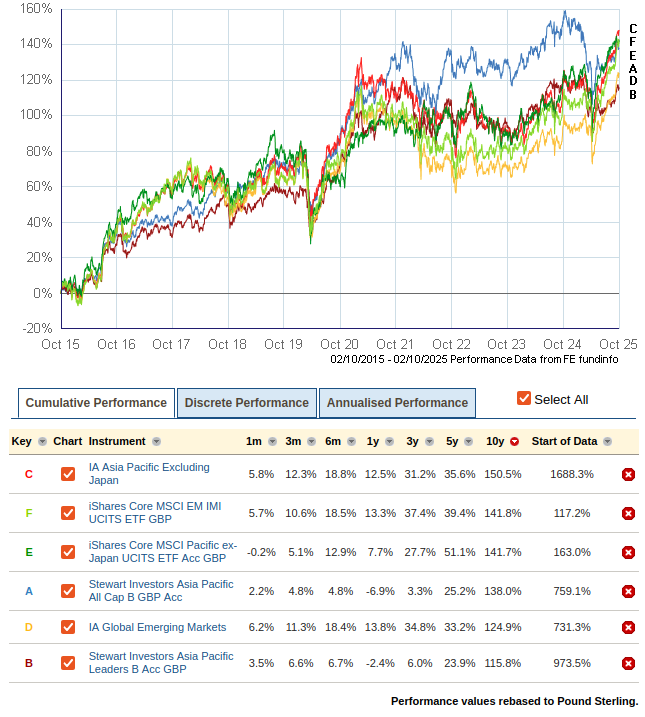

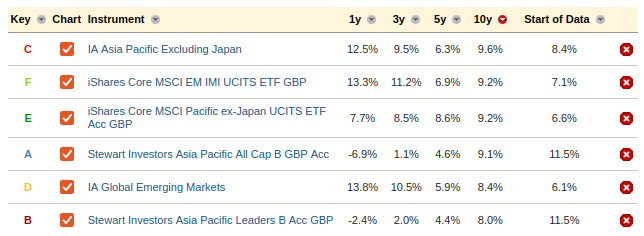

Just a reminder that the IA sector average is not equivalent to the index or an index fund:

Just a reminder that the IA sector average is not equivalent to the index or an index fund: Annualised performance:

Annualised performance: Over 10 years, only "Leaders" seems to disappoint, but over 5 years both Stewart funds trail both the sector average, and more significantly index trackers in the respective sector.0

Over 10 years, only "Leaders" seems to disappoint, but over 5 years both Stewart funds trail both the sector average, and more significantly index trackers in the respective sector.0 -

I was being lazy, masonic, and since index funds generally outperform the sector data (demonstrating that active funds underperform the index) I guess I was providing flawed data. I only came across the resignations after I had already decided to sell the fund next week. Like the other active funds I've sold this year (Fundsmith Sustainable and Liontrust Micro Cap) I'm selling low, but since I've been reducing my stake over the last few years as I moved from active to passive I might have got out of them slightly ahead. For anyone reading this who is new to investing and figures they can beat the market, save yourself a few years and just go passive. I was about 8% ahead of the index a few years ago and thought this game was so easy, but the inevitable caught up with me. (Drinks are on Bostonerimus!)0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards