We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

How to calculate 'adjusted net income' for child benefit?

hieveryone

Posts: 3,865 Forumite

Hi,

I'm getting myself very confused over adjusted net income and the helpline, well.. isn't so much a helpline!!

Let's say for ease, the salary is £80,000.

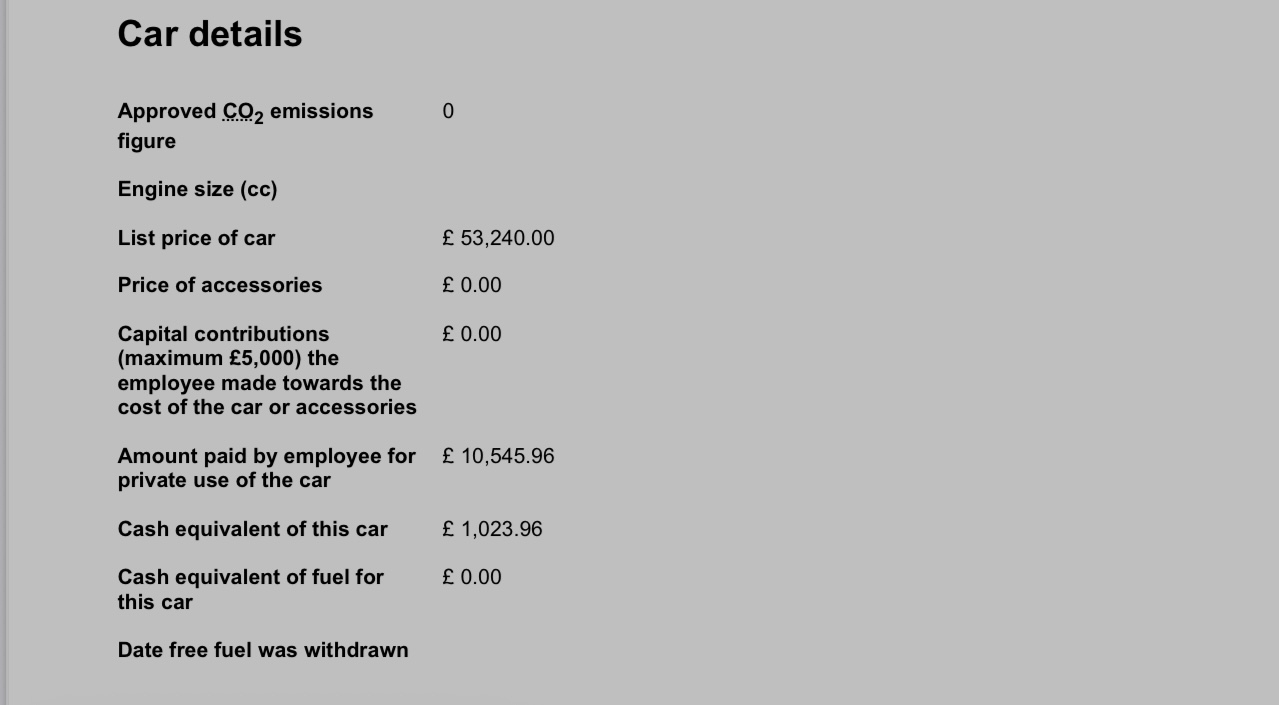

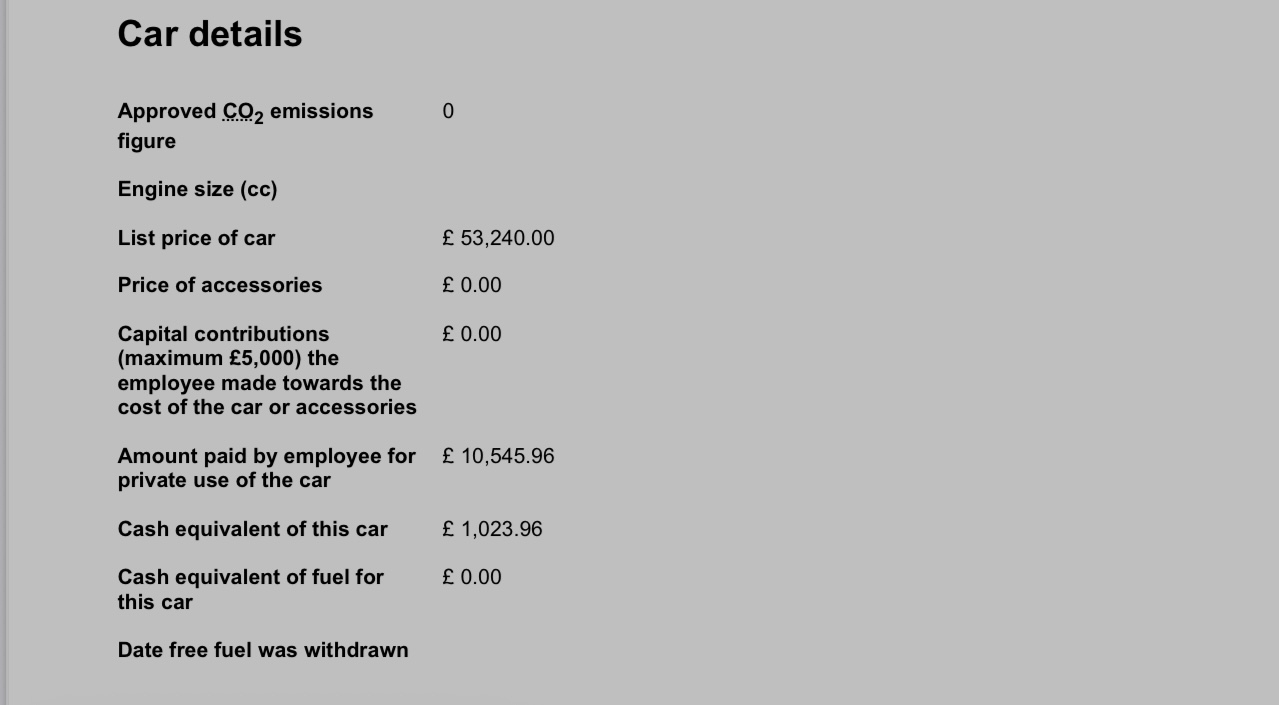

Car on salary sacrifice scheme is £850 a month. On the P11D is says 'amount paid by employee for use of car' - £10,500.

Pension contributions are 7.5%

Medical insurance is £50 a month.

Does this take us under the threshold for child benefit?

Thank you

I'm getting myself very confused over adjusted net income and the helpline, well.. isn't so much a helpline!!

Let's say for ease, the salary is £80,000.

Car on salary sacrifice scheme is £850 a month. On the P11D is says 'amount paid by employee for use of car' - £10,500.

Pension contributions are 7.5%

Medical insurance is £50 a month.

Does this take us under the threshold for child benefit?

Thank you

Bought is to buy. Brought is to bring.

0

Comments

-

HMRC self assessment tax system via the Government Gateway will calculate it for you.1

-

Thank you - I don’t currently claim so this is more a forward look to see if it would be worth our while 🙈daveyjp said:HMRC self assessment tax system via the Government Gateway will calculate it for you.

Bought is to buy. Brought is to bring.0 -

You need to establish what method of tax relief you get on your pension contributions - salary sacrifice, net pay or relief at source?

What is the taxable benefit of the car? Not convinced your employer is correct to say you paid £10,500 for use of the car.

Do you have any savings income such as interest, dividends?1 -

Isthisforreal99 said:You need to establish what method of tax

relief you get on your pension contributions - salary sacrifice, net pay or relief at source?

What is the taxable benefit of the car? Not convinced your employer is correct to say you paid £10,500 for use of the car.

Do you have any savings income such as interest, dividends?

Pension and car both salary sacrifice.Pension is paid in the ‘income’ column and I think employer pays at their end?Car is shown in the deduction column.I think the £10,500 is for the year?

Bought is to buy. Brought is to bring.0 -

You will have a benefit in kind charge added to your income.

Is there an amount shown in your code number for BIK?0 -

Not that I can see anywhere on the P11D?sheramber said:You will have a benefit in kind charge added to your income.

Is there an amount shown in your code number for BIK?

Bought is to buy. Brought is to bring.0 -

I think your employer has mucked up the P11D. What is the £10,500 in relation to - hopefully not the amount of salary sacrifice to actually get the car?hieveryone said:

Not that I can see anywhere on the P11D?sheramber said:You will have a benefit in kind charge added to your income.

Is there an amount shown in your code number for BIK?0 -

Interesting. Isthisforreal99 said:

Isthisforreal99 said:

I think your employer has mucked up the P11D. What is the £10,500 in relation to - hopefully not the amount of salary sacrifice to actually get the car?hieveryone said:

Not that I can see anywhere on the P11D?sheramber said:You will have a benefit in kind charge added to your income.

Is there an amount shown in your code number for BIK?This is a cropped image of the part it details the £10,500.

Bought is to buy. Brought is to bring.0 -

I think this is the yearly cost of the car. We pay £878.83 in salary sacrifice each month which multiplied by 12 is the £10,545.hieveryone said:

Interesting. Isthisforreal99 said:

Isthisforreal99 said:

I think your employer has mucked up the P11D. What is the £10,500 in relation to - hopefully not the amount of salary sacrifice to actually get the car?hieveryone said:

Not that I can see anywhere on the P11D?sheramber said:You will have a benefit in kind charge added to your income.

Is there an amount shown in your code number for BIK?This is a cropped image of the part it details the £10,500.

Bought is to buy. Brought is to bring.0 -

Is there an amount against BiK in your code number?hieveryone said:

Not that I can see anywhere on the P11D?sheramber said:You will have a benefit in kind charge added to your income.

Is there an amount shown in your code number for BIK?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.1K Banking & Borrowing

- 253.5K Reduce Debt & Boost Income

- 454.2K Spending & Discounts

- 245.1K Work, Benefits & Business

- 600.7K Mortgages, Homes & Bills

- 177.4K Life & Family

- 258.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.2K Discuss & Feedback

- 37.6K Read-Only Boards