We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Considering an annuity with another provider. Is an IFA really needed to do this?

Comments

-

And this is an example where an IFA can be cheaper (as long as they are not greedy - and there will be some of those). e.g. a £1500- £2,000 fixed fee.PhoneBook said:I've been exploring annuities using the Hargreaves Lansdown annuity quotation tool. On transferring around £150,000 from my SIPP into an annuity it would see HL be paid a £4,800 commission. Ouch! If I go down the annuity route I'll certainly be looking for a cost-effective way to purchase it. £4,800!!!! What?!?!?

I seem to recall the average initial fee for IFAs is 1.8% (average, of course, meaning some more, some less), but that is £2,700.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

If you play around with the numbers (eg up the 150 to 250 or 500) does the £4800 change?PhoneBook said:I've been exploring annuities using the Hargreaves Lansdown annuity quotation tool. On transferring around £150,000 from my SIPP into an annuity it would see HL be paid a £4,800 commission. Ouch! If I go down the annuity route I'll certainly be looking for a cost-effective way to purchase it. £4,800!!!! What?!?!?

And does it change according to the annuity provider? It is the provider who pays the commission.0 -

Where does it show the commission on the HL annuity quotes?0

-

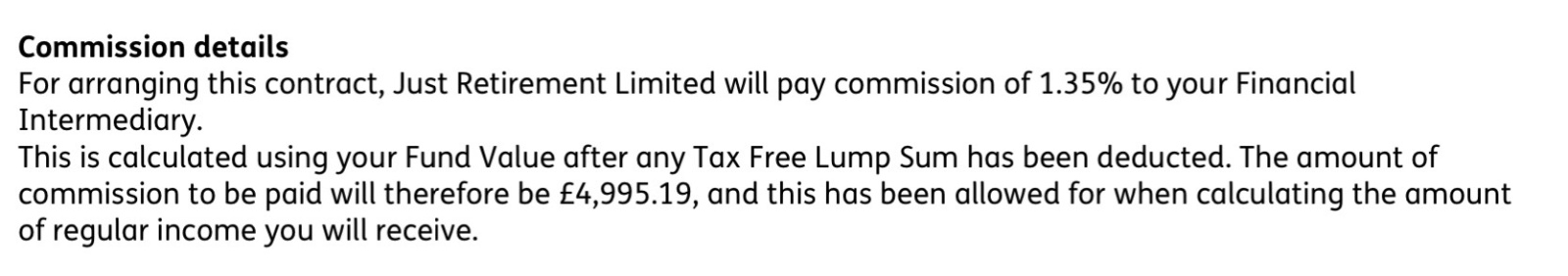

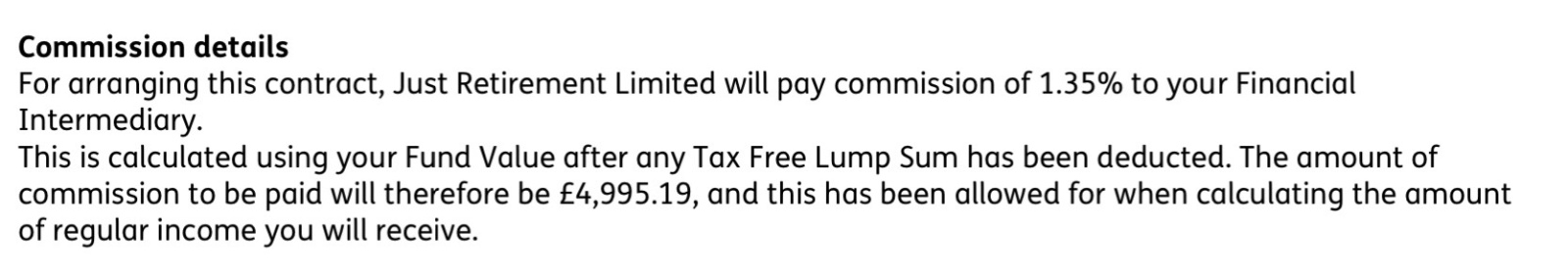

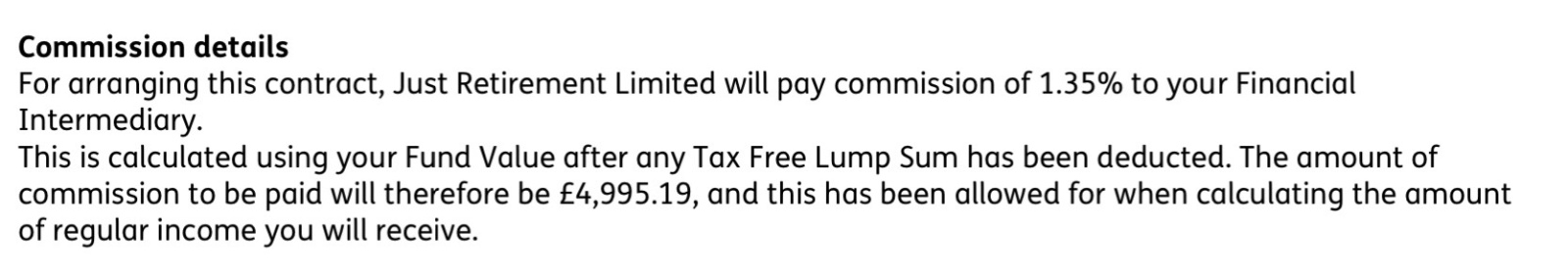

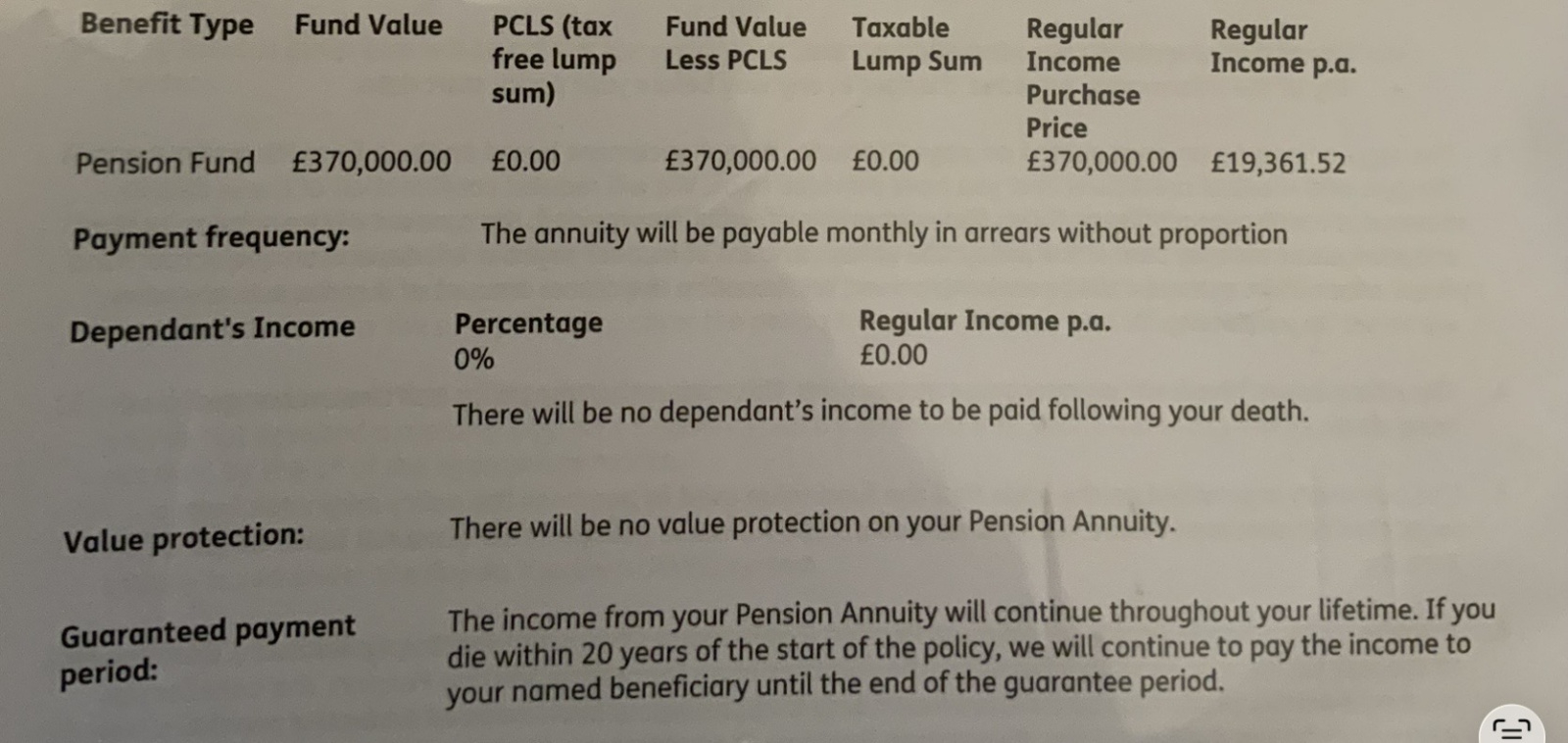

For my annuity above (£370,000 purchase price I effectively paid Hargreaves the following)…PhoneBook said:I've been exploring annuities using the Hargreaves Lansdown annuity quotation tool. On transferring around £150,000 from my SIPP into an annuity it would see HL be paid a £4,800 commission. Ouch! If I go down the annuity route I'll certainly be looking for a cost-effective way to purchase it. £4,800!!!! What?!?!? As the rate dropped 12% the next day I think I lucked out on the quote and the commission paid was a bargain.0

As the rate dropped 12% the next day I think I lucked out on the quote and the commission paid was a bargain.0 -

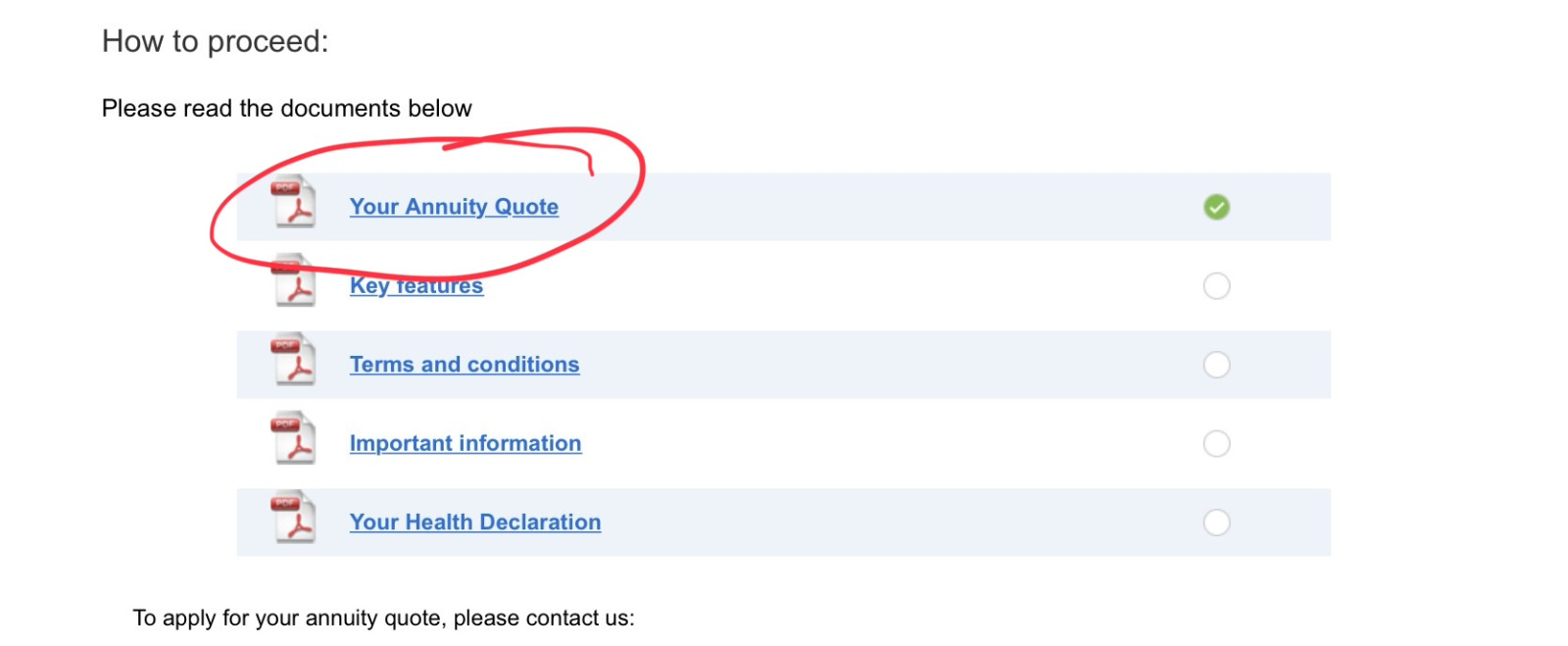

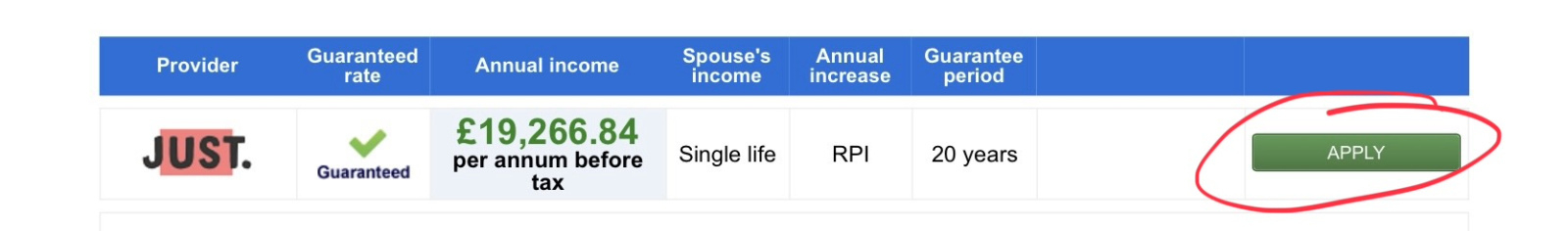

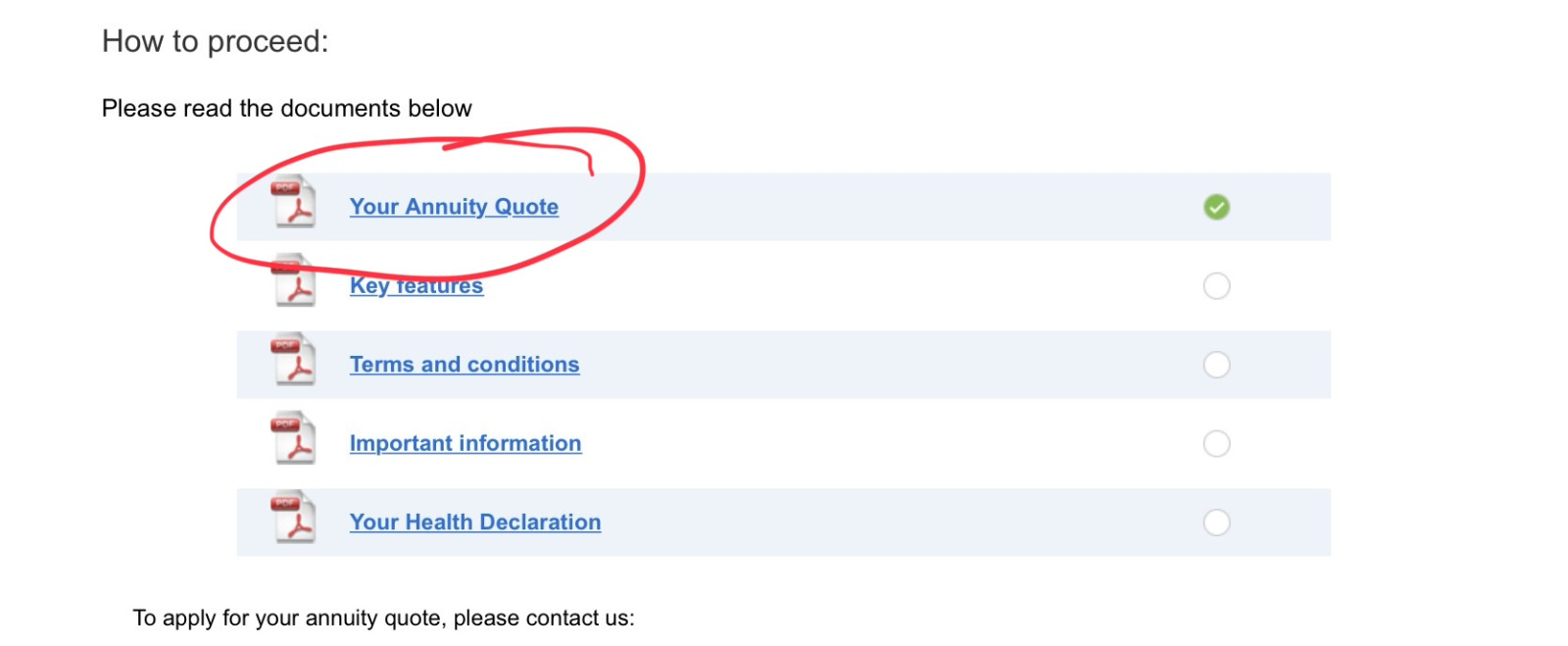

Run the quotewestv said:Where does it show the commission on the HL annuity quotes? Click on Apply then open the pdf file highlighted below ..

Click on Apply then open the pdf file highlighted below .. .., and it’s contained a few pages down the document …

.., and it’s contained a few pages down the document … 1

1 -

Apart from the issues discussed in the thread, there are a large number of annuity types on offer. Level term, Lifetime or fixed term, annual escalation, guarantee periods, spousal provision etc etc.grn99 said:Having build up a pensions pot over the years with Clerical Medical (now part of Scottish Widows) and I am now at the point of needing to start a pension.

I have spoken to an IFA who is pushing down a phased drawdown route via another provider and a whole series of fairly involved investments on a single platform they seem to use for everything they propose, be it the pension, ISAs, onshore bonds etc.... to wring out enough money to meet our projected annual costs! But with plenty of charges for setting up and ongoing management, which eats into the pot at around 2.32% - 1.30% charges for initial work and .75% for the ongoing drawdown, plus platform, wrapper and investment charges etc. I'd be paying more in charges in the first few years than I get! Extremely tax efficient, but seems cumbersome and expensive.

Having looked into all this again over the weekend, I'm sure that I can get to the same end game via the old fashioned annuity route via Standard Life or maybe Scottish Widows. My plan is to see if either provider will quote me with the various protection options I want (I have used the moneyhelper annity Quote tool); but unless I'm reading too much into the Standard's website "guidance", they seem to want an IFA involved to do anything for a new customer...and that's my question, is that the case and is this a regulation thing. I cannot see why I should pay yet more fees to do what is fairly straightforward purchasing decision? Any experience, advice or thoughts on whether I'm going to have problems are welcome...

Large numbers of the public are very poor at understanding these kind of issues, and could well pick the wrong one ( usually the one with the highest initial payments ) .

As buying an annuity is a forever decision, then some professional help may well come in useful, for some anyway.0 -

Ok thanks.FIREDreamer said:

Run the quotewestv said:Where does it show the commission on the HL annuity quotes? Click on Apply then open the pdf file highlighted below ..

Click on Apply then open the pdf file highlighted below .. .., and it’s contained a few pages down the document …

.., and it’s contained a few pages down the document … 0

0 -

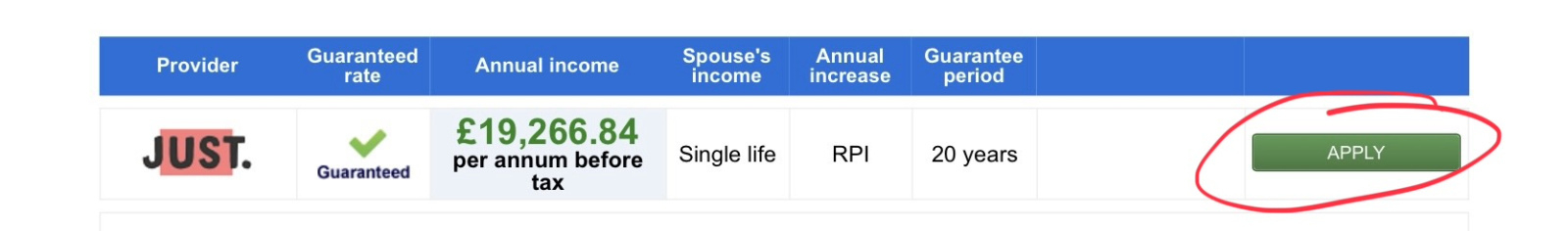

After the Trump dump of early April I started looking at annuity rates daily in May.dunstonh said:

May 2025 was a bit of a !!!!!! with Just. Although it wasn't their fault, it was the markets. Gilt yields were volatile, and Just's daily pricing and real-time pricing reflected the volatility. The others were smoothing it out but Just were following the volatility. If you got your timing right, you did very well out of it.

For £370k, the RPI annuity values were oscillating between £16,500 and £18,500 per annum. On May 30 it spiked to £19,200 then dropped significantly on May 31.

I asked to secure the May 30 quote which Hargreaves secured for me at a commission rate of 1.35%.

Had I gone to an IFA I might have missed out but only due to a very peculiar set of circumstances as @dunstonh said. Note that whilst I no longer have a DC pension to speak of I am still doing the round Robin £3,600 gross per annum for a retiree in the hope of fully using what’s left of my lump sum allowance.

Note that whilst I no longer have a DC pension to speak of I am still doing the round Robin £3,600 gross per annum for a retiree in the hope of fully using what’s left of my lump sum allowance.

I also have a large shares ISA built up from full contributions since 1997 which is enough risk-on for me.0 -

Mine has just quoted £3,100, so I'll be arranging direct I think.dunstonh said:

And this is an example where an IFA can be cheaper (as long as they are not greedy - and there will be some of those). e.g. a £1500- £2,000 fixed fee.PhoneBook said:I've been exploring annuities using the Hargreaves Lansdown annuity quotation tool. On transferring around £150,000 from my SIPP into an annuity it would see HL be paid a £4,800 commission. Ouch! If I go down the annuity route I'll certainly be looking for a cost-effective way to purchase it. £4,800!!!! What?!?!?

I seem to recall the average initial fee for IFAs is 1.8% (average, of course, meaning some more, some less), but that is £2,700.0 -

And in my HL quote for SW on the 310k, " For arranging this Annuity having taken tax-free cash, Scottish Widows will pay commission of £2,665.01 to your financial adviser, HARGREAVES LANSDOWN ASSET MGMT LTD."0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.4K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards