We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Calculation Explanation

Comments

-

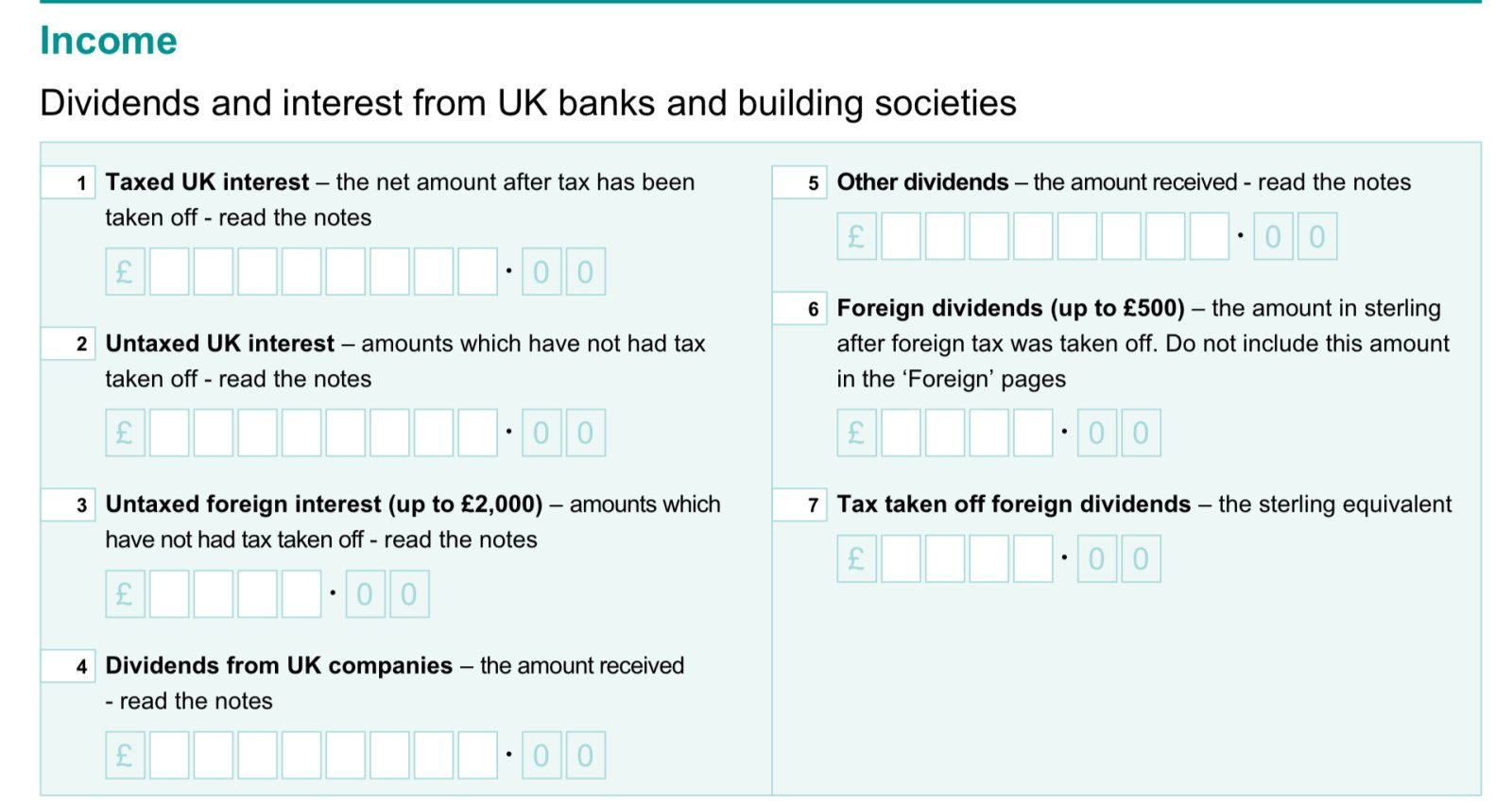

No, there is a box for untaxed interest and one for interest taxed at source. If it's 'normal' savings interest it will be untaxed. By entering it in the taxed interest box you have been given credit for tax you haven't paid.rob78 said:It asked for it on the site. It did say voluntary. Even if it was zero can yourself my point about the tax owed should be more with the 1525 self employment profit added?0 -

And will doubtless be high on HMRC's radar for an investigation given how relatively rare taxed interest is nowadays 😳Isthisforreal99 said:

No, there is a box for untaxed interest and one for interest taxed at source. If it's 'normal' savings interest it will be untaxed. By entering it in the taxed interest box you have been given credit for tax you haven't paid.rob78 said:It asked for it on the site. It did say voluntary. Even if it was zero can yourself my point about the tax owed should be more with the 1525 self employment profit added?0 -

I'm sure you've helped OP understand what the self-assessment form is asking for. I consider that several sections of the form are worded badly and ambiguously, this one included.Dazed_and_C0nfused said:

And will doubtless be high on HMRC's radar for an investigation given how relatively rare taxed interest is nowadays 😳Isthisforreal99 said:

No, there is a box for untaxed interest and one for interest taxed at source. If it's 'normal' savings interest it will be untaxed. By entering it in the taxed interest box you have been given credit for tax you haven't paid.rob78 said:It asked for it on the site. It did say voluntary. Even if it was zero can yourself my point about the tax owed should be more with the 1525 self employment profit added?

To someone unfamiliar with the taxation system the term 'untaxed interest' could be interpreted as interest on which no tax is due, i.e. interest below the £500 or £1,000 allowance, and 'taxed interest' could be interpreted as interest on which tax is due - rather than the correct interpretation, which is that tax has already been paid on it.

I fell foul of similar ambiguity when submitting my first self-assessment:

"If you’ve received notification from Student Loans Company that your repayment of an Income Contingent Loan was due before 6 April 2025, put ‘X’ in the box. We’ll use your plan and or loan type to calculate amounts due"

At the time of my first SA I was paying off the final installments of my loan by direct debit, so there were no deductions made by my employer. HMRC thought I owed £1,700 in student loan repayments, even though I'd paid these directly to SLC. I was so confused.

Taking a literal reading of the request on the SA form, I should still put an X in the box, as I did receive notification from SLC that repayments were due after I graduated in 2009. The wording of the SA form and notes give no consideration to whether or not the loan has been paid off (which mine was in 2022). Of course, I now ignore this question when completing my SA.

0 -

I honestly cannot see any ambiguity in this section as it quite clearly states what is meant by taxed and untaxed interest. The notes they suggest you read are even more detailed.Strummer22 said:

I'm sure you've helped OP understand what the self-assessment form is asking for. I consider that several sections of the form are worded badly and ambiguously, this one included.HDazed_and_C0nfused said:

And will doubtless be high on HMRC's radar for an investigation given how relatively rare taxed interest is nowadays 😳Isthisforreal99 said:

No, there is a box for untaxed interest and one for interest taxed at source. If it's 'normal' savings interest it will be untaxed. By entering it in the taxed interest box you have been given credit for tax you haven't paid.rob78 said:It asked for it on the site. It did say voluntary. Even if it was zero can yourself my point about the tax owed should be more with the 1525 self employment profit added?

To someone unfamiliar with the taxation system the term 'untaxed interest' could be interpreted as interest on which no tax is due, i.e. interest below the £500 or £1,000 allowance, and 'taxed interest' could be interpreted as interest on which tax is due - rather than the correct interpretation, which is that tax has already been paid on it. 2

2 -

You refer to profit from self employment.

Is the turnover £1525 with no expenses?

Or is that turnover less expenses to give profit figure.

If you claim expenses you cannot also claim the trading allowance of £1000.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards