We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Anyone with an AJ Bell SIPP and Drawdown?

Comments

-

It’s worth checking your charges with HL. They charge separately for the SIPP account and the Drawdown account which can result in higher charges than having everything in one account. For example, if you had all your investments in shares, investment trusts and ETFs you’ll pay up to £200 in charges for the SIPP and pay up to £200 on the Drawdown account as well. If they were in one account you’d pay a maximum of £200.

Even if you have funds, you can still pay more as the first £250k is 0.45% on each account. So if you have £500k in one account you pay 0.45% on the first £250k and 0.25% on the rest. If you have £250K on the SIPP and £250k in Drawdown, you pay 0.45% on the whole £500k!1 -

Thanks.jaybeetoo said:It’s worth checking your charges with HL. They charge separately for the SIPP account and the Drawdown account which can result in higher charges than having everything in one account. For example, if you had all your investments in shares, investment trusts and ETFs you’ll pay up to £200 in charges for the SIPP and pay up to £200 on the Drawdown account as well. If they were in one account you’d pay a maximum of £200.

Even if you have funds, you can still pay more as the first £250k is 0.45% on each account. So if you have £500k in one account you pay 0.45% on the first £250k and 0.25% on the rest. If you have £250K on the SIPP and £250k in Drawdown, you pay 0.45% on the whole £500k!

I look at my HL charges every month and you’re right that the charges are separate, with the £200 cap applying to both the SIPP and Drawdown (individually), rather than across both.

Because of the amounts I have invested across the two accounts and my normal transaction volumes, it still remains a very close call for me as to whether or not I’d be better off transferring.

If it wasn’t for my frequent ad hoc small lump sum investments into funds and the free dividend re-investments, it would be a relatively straightforward decision.0 -

It might be worth looking at interactive investor. Their fees were certainly cheaper for me (share dealing costs are less than HL too). I’ve recently transferred from HL to ii and it all happened without any problems. I timed it so there wouldn’t be an interruption to my monthly drawdown payment.

Thanks.jaybeetoo said:It’s worth checking your charges with HL. They charge separately for the SIPP account and the Drawdown account which can result in higher charges than having everything in one account. For example, if you had all your investments in shares, investment trusts and ETFs you’ll pay up to £200 in charges for the SIPP and pay up to £200 on the Drawdown account as well. If they were in one account you’d pay a maximum of £200.

Even if you have funds, you can still pay more as the first £250k is 0.45% on each account. So if you have £500k in one account you pay 0.45% on the first £250k and 0.25% on the rest. If you have £250K on the SIPP and £250k in Drawdown, you pay 0.45% on the whole £500k!

I look at my HL charges every month and you’re right that the charges are separate, with the £200 cap applying to both the SIPP and Drawdown (individually), rather than across both.

Because of the amounts I have invested across the two accounts and my normal transaction volumes, it still remains a very close call for me as to whether or not I’d be better off transferring.

If it wasn’t for my frequent ad hoc small lump sum investments into funds and the free dividend re-investments, it would be a relatively straightforward decision.1 -

Thanks. I’ll have a look at ii.jaybeetoo said:

It might be worth looking at interactive investor. Their fees were certainly cheaper for me (share dealing costs are less than HL too). I’ve recently transferred from HL to ii and it all happened without any problems. I timed it so there wouldn’t be an interruption to my monthly drawdown payment.

Thanks.jaybeetoo said:It’s worth checking your charges with HL. They charge separately for the SIPP account and the Drawdown account which can result in higher charges than having everything in one account. For example, if you had all your investments in shares, investment trusts and ETFs you’ll pay up to £200 in charges for the SIPP and pay up to £200 on the Drawdown account as well. If they were in one account you’d pay a maximum of £200.

Even if you have funds, you can still pay more as the first £250k is 0.45% on each account. So if you have £500k in one account you pay 0.45% on the first £250k and 0.25% on the rest. If you have £250K on the SIPP and £250k in Drawdown, you pay 0.45% on the whole £500k!

I look at my HL charges every month and you’re right that the charges are separate, with the £200 cap applying to both the SIPP and Drawdown (individually), rather than across both.

Because of the amounts I have invested across the two accounts and my normal transaction volumes, it still remains a very close call for me as to whether or not I’d be better off transferring.

If it wasn’t for my frequent ad hoc small lump sum investments into funds and the free dividend re-investments, it would be a relatively straightforward decision.0 -

II fees are cheaper but they don't have the separate crystallised pot concept - they operate as percentages

Thanks. I’ll have a look at ii.jaybeetoo said:

It might be worth looking at interactive investor. Their fees were certainly cheaper for me (share dealing costs are less than HL too). I’ve recently transferred from HL to ii and it all happened without any problems. I timed it so there wouldn’t be an interruption to my monthly drawdown payment.

Thanks.jaybeetoo said:It’s worth checking your charges with HL. They charge separately for the SIPP account and the Drawdown account which can result in higher charges than having everything in one account. For example, if you had all your investments in shares, investment trusts and ETFs you’ll pay up to £200 in charges for the SIPP and pay up to £200 on the Drawdown account as well. If they were in one account you’d pay a maximum of £200.

Even if you have funds, you can still pay more as the first £250k is 0.45% on each account. So if you have £500k in one account you pay 0.45% on the first £250k and 0.25% on the rest. If you have £250K on the SIPP and £250k in Drawdown, you pay 0.45% on the whole £500k!

I look at my HL charges every month and you’re right that the charges are separate, with the £200 cap applying to both the SIPP and Drawdown (individually), rather than across both.

Because of the amounts I have invested across the two accounts and my normal transaction volumes, it still remains a very close call for me as to whether or not I’d be better off transferring.

If it wasn’t for my frequent ad hoc small lump sum investments into funds and the free dividend re-investments, it would be a relatively straightforward decision.I’m a Senior Forum Ambassador and I support the Forum Team on the Pensions, Annuities & Retirement Planning, Loans

& Credit Cards boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com.

All views are my own and not the official line of MoneySavingExpert.1 -

Apologies for coming back to this after the best part of 3 weeks.fisher66 said:A J Bell record what percentage of your total SIPP has been crystallised. As the values of existing investments change then the values of the crystallised portion and uncrystallised portion change too. If you crystallise more of your SIPP then the percentages crystallised and uncrystallised are recalculated.

I have been trying - unsuccessfully - to try and get hold of something visual which would help me see how their system works. AJB say they have no ‘demo’ material they could send me!

I hope no-one minds me just running over this.

Say I have a SIPP and separate drawdown account with HL. Sipp £50k (shares and cash). Drawdown £150k shares and cash. Not real figures by the way.

If I move my accounts to AJB, they get combined into 1 account. Correct?

On day 1 - assuming no changes to the values above - the new combined SIPP account has a balance of £200k, presumably annotated ‘uncrystallised 25%, crystallised 75%’. Is this fundamentally correct?

So the percentages are applied to the overall account value, not to individual shares/funds?

Sorry to appear pedantic - don’t mean to be.

The point I want to get very clear in my mind is what happens if a share increases substantially in value (say an AIM share).

At the moment, I leave all of my AIM shares in my HL SIPP and won’t move them into my HL Drawdown account. If I do and then a share ‘multibags’, then I would effectively be paying (income tax) on the full gain when I withdraw. By leaving them in the uncrystallised SIPP, if there is a large gain in the future then at least I can take 25% of that gain tax free.

I’m trying to understand what the implications are (for the value of that same share) if my account was with AJB, not HL.

I realise this is all ‘ifs, buts and maybes’ but I’d like to be clear before deciding whether to transfer.

Thanks to anyone who has read through this whole lengthy post!!0 -

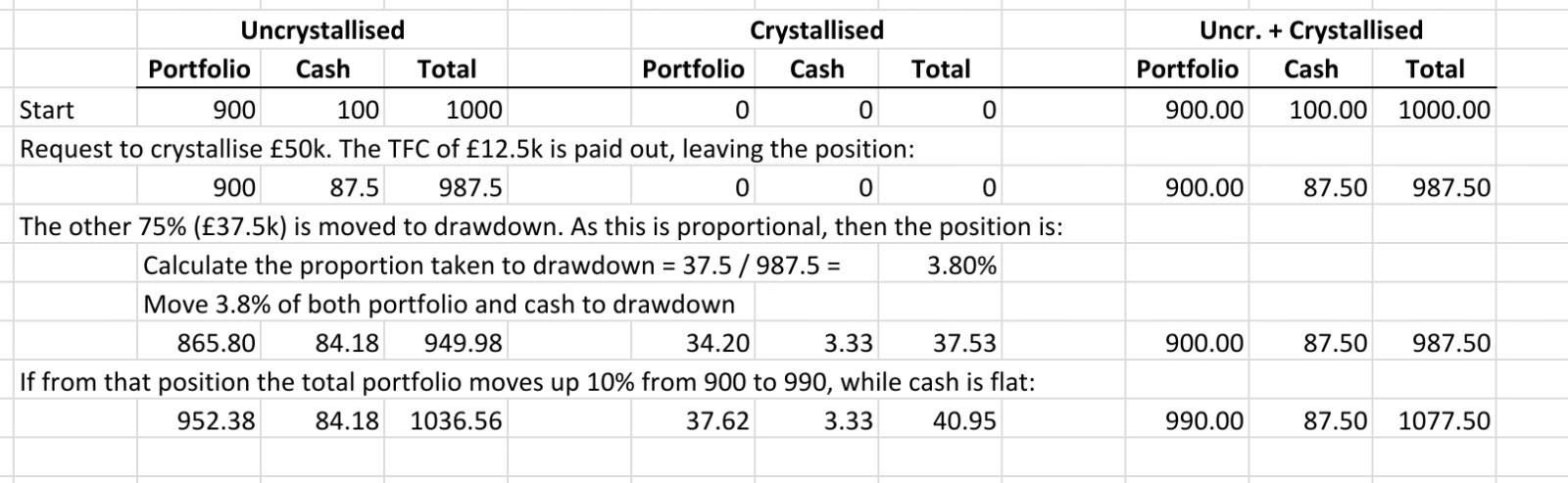

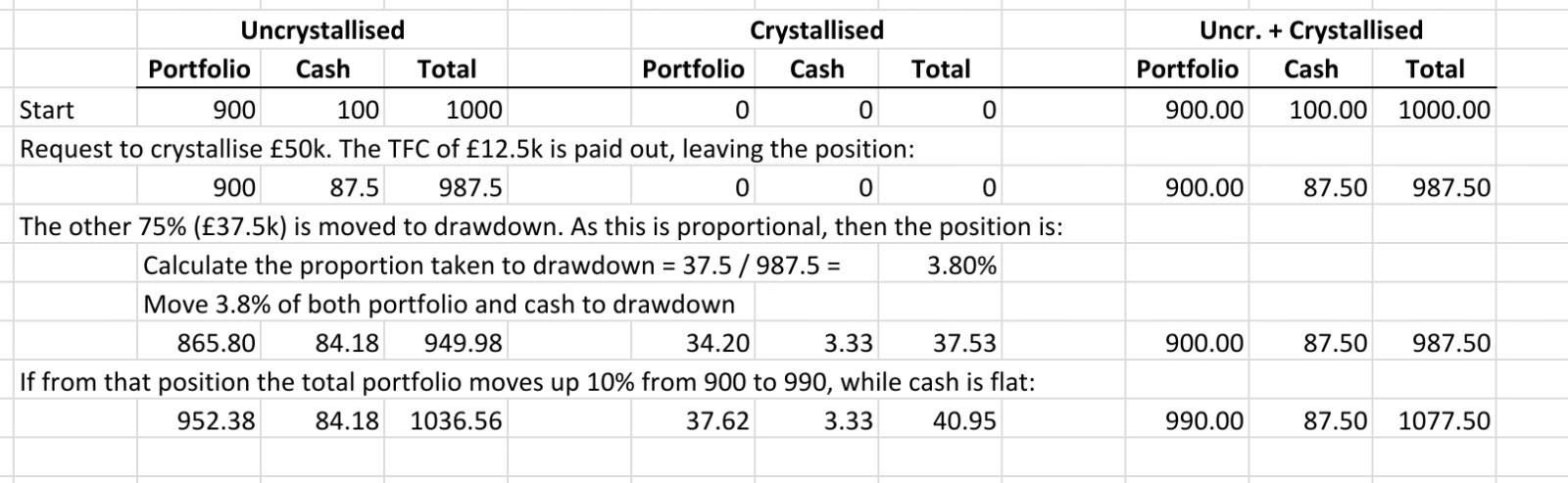

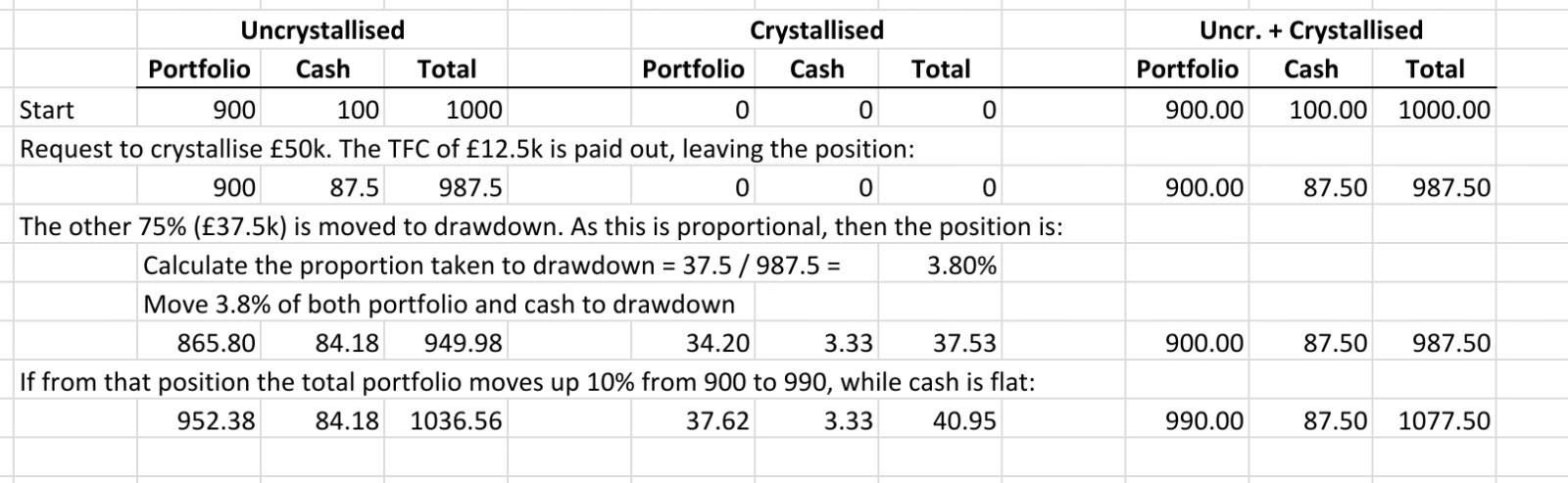

I have been in touch with AJ Bell with similar questions and yes, the percentages are applied to the overall pot, not individual shares or funds. You cannot choose to crystallise only specific shares or funds.In terms of your fear, the problem is minimised as long as the crystallised proportion is not too large, and the particular share does not constitute too large a proportion of your overall holdings, because the growth lifts both sides (crystallised and uncrystallised).Here is a worked example. I hope that helps.

1

1 -

Thank you so much for putting in all the time and effort to produce the above spreadsheet. I can’t tell you how helpful it is.RecliningInPeace said:I have been in touch with AJ Bell with similar questions and yes, the percentages are applied to the overall pot, not individual shares or funds. You cannot choose to crystallise only specific shares or funds.In terms of your fear, the problem is minimised as long as the crystallised proportion is not too large, and the particular share does not constitute too large a proportion of your overall holdings, because the growth lifts both sides (crystallised and uncrystallised).Here is a worked example. I hope that helps.

I appreciate the ‘warnings’ about the size of the crystallised portion v the uncrystallised and how that could interact with a large increase in just one share price. I guess we all live in hope, though.

At the time of setting up my SIPP and investing in several AIM companies, it was on the understanding that i could leave anything in my pension accounts to my children and grandchildren, free of IHT. But we all now know what takes effect from April 2027 and how the carefully laid plans of thousands are likely to be affected.

If I had my time over again, I’d have gone the ISA route with the same investments.

Anyway, I digress. I’m going to run a few figures using my actual SIPP and drawdown balances and assume that just one of my small company shares comes up trumps. I’ll then decide what to do in terms of transferring or staying put.

Thanks again.

1 -

If they allow it I suppose you could transfer the required value from AJ Bell to HL prior to when you need to draw down. Repeat every year.0

-

Would you have not ended up with less money that way, due to not getting the tax relief?

Thank you so much for putting in all the time and effort to produce the above spreadsheet. I can’t tell you how helpful it is.RecliningInPeace said:I have been in touch with AJ Bell with similar questions and yes, the percentages are applied to the overall pot, not individual shares or funds. You cannot choose to crystallise only specific shares or funds.In terms of your fear, the problem is minimised as long as the crystallised proportion is not too large, and the particular share does not constitute too large a proportion of your overall holdings, because the growth lifts both sides (crystallised and uncrystallised).Here is a worked example. I hope that helps.

I appreciate the ‘warnings’ about the size of the crystallised portion v the uncrystallised and how that could interact with a large increase in just one share price. I guess we all live in hope, though.

At the time of setting up my SIPP and investing in several AIM companies, it was on the understanding that i could leave anything in my pension accounts to my children and grandchildren, free of IHT. But we all now know what takes effect from April 2027 and how the carefully laid plans of thousands are likely to be affected.

If I had my time over again, I’d have gone the ISA route with the same investments.

Anyway, I digress. I’m going to run a few figures using my actual SIPP and drawdown balances and assume that just one of my small company shares comes up trumps. I’ll then decide what to do in terms of transferring or staying put.

Thanks again.

As from 2027 , ISA and SIPP money will be treated the same for IHT purposes.

So you might end up paying more IHT with the SIPP but overall you would still be ahead.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.4K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards