We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Fixed rate savings vs gilts

Good evening . I am a retired person and my situation is that I have £85000 saved in a fixed rate bond and a similar amount in a cash ISA (also fixed rate). My wife also mirrors those savings with her own.

I also have 50k invested in premium bonds which since I acquired them in April have produced rather disappointing returns, in fact for two months they delivered nothing and the other 3 a sum total off about £425. Anyway, I promised myself that I would keep them for a year so will sell them before April 4th, 2026 come what may. Then I will consider investing the capital over a 3-year period into a global ETF or mutual fund and leave well alone for 10 years. I have now learnt not be scared by downturns and view them more as investment opportunities.

I am not going to throw all my eggs into any such fund hence why I am pondering whether it would be wise for me to buy gilts when my ISA and savings bonds mature next January 2026 or or continue as i am The problem for me is that I while I understand the latter , the maths behind Gilts utterly baffle me. I spent the last two days trying to get my head around how they work and I have got nowhere bar understanding that some deliver capital growth but with low interest and the others the opposite. The former are good because they are exempt of CGT but whilst I can see the sense in high rate taxpayers taking advantage of that I am not sure that basic rate taxpayers such as my wife and I would benefit as well.

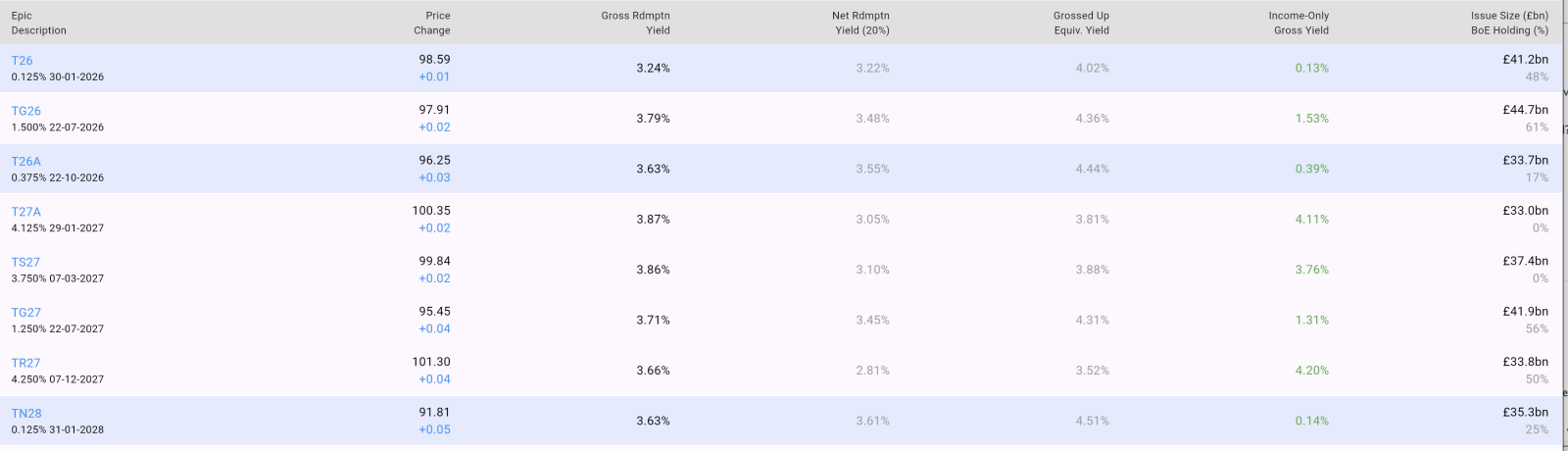

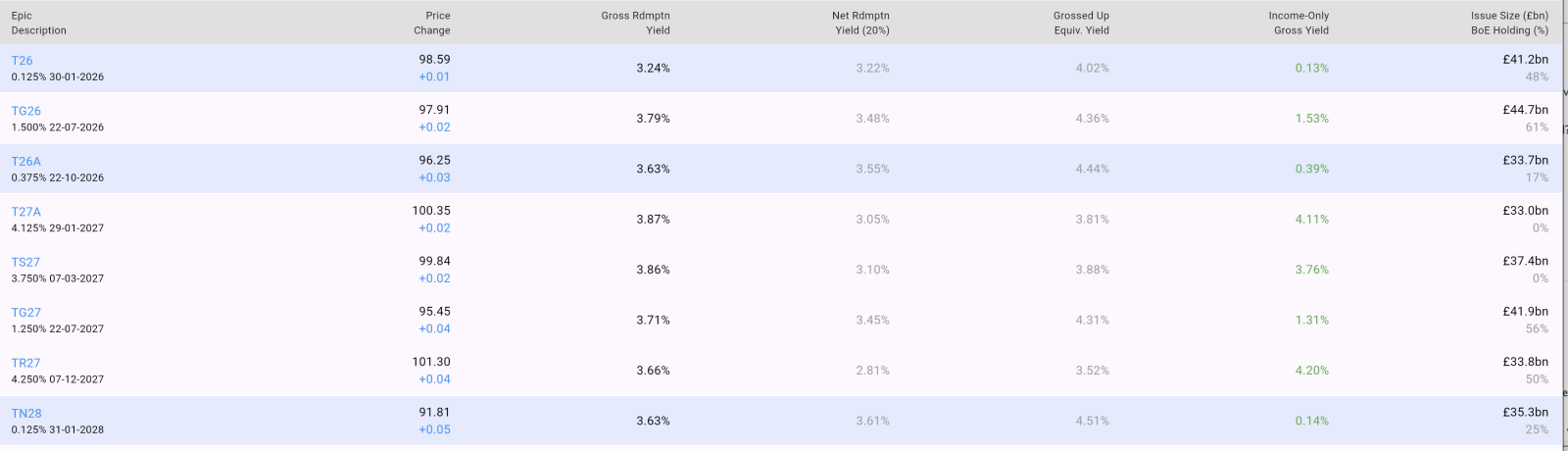

. I have included a screenshot of a Yield Gimp table going up to 2028 and bearing in mind my January 2026 starting point, I thought T27a would seem good place to begin with regard to my ISA but a 3.63% gross yield seems to compare unfavourably with most 1 year fixed rate ISAs or even the easy access ones, unless, of course, I am missing something

Looking further down at TN28 has a much lower coupon rate but a redemption rate of 3.61% nett seems very low. What would £85000 return -£85000x 3.61% = £3,068.5 over two and half year period ?

I would be most grateful for any advice you could give me , thanks

Comments

-

I don't think you're missing anything. Short duration gilts are not looking all that attractive vs retail savings at the moment. There are times when they've been more attractive. It's a bit different for longer duration, but then you need to be concerned about inflation risk, or opt for index linked gilts. For the long term, your global ETF/mutual fund is likely the better option providing you can tolerate the short-term loss potential.Short duration index linked could offer something you don't currently have, namely a guarantee they'll mature with slightly more spending power (as judged from RPI) than you started with (with the caveat they track the index with a lag).1

-

The yield figure is per annum......but you are right in that for many, buying short maturity gilts may often not really be worth it, as you may get a better return in fixed rate savings products. However, it can depend on your tax position, and whether the money in question is within an ISA or not. For money outside an ISA, gilts can have an advantage due to the tax treatment, especially low coupon gilts.1

-

Unless you want index linking, directly held gilts are not particularly attractive for basic rate tax payers, unless you are having to work hard to avoid becoming a higher rate tax payer. Gilts are also more complicated than savings accounts when you are investing £85K. If you add a nought to that, gilts become simpler than having over 10 savings accounts. You can safely use a single savings account with NS&I, but the rates are not particularly attractive, and the tax man will be rubbing his hands.1

-

One thing that helped me understand was to click on the gilt of interest and then the 'cash flows' button - with the tax set correctly this enables you to really see how much return you will get (and when) - compare this to an equivalent savings account/premium bonds. But generally I agree with all the above posts - for short duration, under FSCS protection sized, basic tax rate payer/spare ISA allowance, there is good competition to gilts. But as soon as you're considering 3 years or so, and having to pay tax, gilts start winning out (using the 'grossed up equivalent column from the above you'd need a 3-yr fix to be paying 4.51% to beat TN28, and they don't exist).1

-

TN28 matures on 31/01/28. That is a little less than 2.5 years time. The best 2 and year fixes are both 4.45%, according to MSE. More often than not, fixed rate savings accounts offer basic rate tax payers higher returns than gilts, but sometimes they do not. Gilts do have the advantage that they can be sold before maturity, but that may be at a loss.InvesterJones said:But as soon as you're considering 3 years or so, and having to pay tax, gilts start winning out (using the 'grossed up equivalent column from the above you'd need a 3-yr fix to be paying 4.51% to beat TN28, and they don't exist).2 -

Is that on the assumption that all three years' interest is paid and taxable on maturity, rather than on an annual basis? That is not always the case.InvesterJones said:One thing that helped me understand was to click on the gilt of interest and then the 'cash flows' button - with the tax set correctly this enables you to really see how much return you will get (and when) - compare this to an equivalent savings account/premium bonds. But generally I agree with all the above posts - for short duration, under FSCS protection sized, basic tax rate payer/spare ISA allowance, there is good competition to gilts. But as soon as you're considering 3 years or so, and having to pay tax, gilts start winning out (using the 'grossed up equivalent column from the above you'd need a 3-yr fix to be paying 4.51% to beat TN28, and they don't exist).0 -

A few small points.lagransiete said:Good evening . I am a retired person and my situation is that I have £85000 saved in a fixed rate bond and a similar amount in a cash ISA (also fixed rate). My wife also mirrors those savings with her own.

I also have 50k invested in premium bonds which since I acquired them in April have produced rather disappointing returns, in fact for two months they delivered nothing and the other 3 a sum total off about £425. Anyway, I promised myself that I would keep them for a year so will sell them before April 4th, 2026 come what may. Then I will consider investing the capital over a 3-year period into a global ETF or mutual fund and leave well alone for 10 years. I have now learnt not be scared by downturns and view them more as investment opportunities.

I am not going to throw all my eggs into any such fund hence why I am pondering whether it would be wise for me to buy gilts when my ISA and savings bonds mature next January 2026 or or continue as i am The problem for me is that I while I understand the latter , the maths behind Gilts utterly baffle me. I spent the last two days trying to get my head around how they work and I have got nowhere bar understanding that some deliver capital growth but with low interest and the others the opposite. The former are good because they are exempt of CGT but whilst I can see the sense in high rate taxpayers taking advantage of that I am not sure that basic rate taxpayers such as my wife and I would benefit as well.

. I have included a screenshot of a Yield Gimp table going up to 2028 and bearing in mind my January 2026 starting point, I thought T27a would seem good place to begin with regard to my ISA but a 3.63% gross yield seems to compare unfavourably with most 1 year fixed rate ISAs or even the easy access ones, unless, of course, I am missing something

Looking further down at TN28 has a much lower coupon rate but a redemption rate of 3.61% nett seems very low. What would £85000 return -£85000x 3.61% = £3,068.5 over two and half year period ?

I would be most grateful for any advice you could give me , thanks

The gross yield of T27A is 3.87% in the table (I think you read across the T26A line) Still not great and with a clean price of over 100 you will make a loss on maturity which means the CGT free "benefit" of gilts is lost.

TN28 would be a better gilt to hold outside an ISA..

Personally when I looked at how good a gilt might be as compared to a fixed rate bond from a building society I would compare the grossed up equivalent rate rather than the gross redemption yield. Not for doing any sums just to compare headline rates.

Within an ISA you can go for the higher yielding gilts but maybe look longer to find ones with a decent yield? T56 seems to have attracted some attention (although neither of us is likely to be around when that matures) What will you do with the coupons? I think the table may assume you reinvest them (like adding the interest to the capital of your fixed rate bonds). But that is not as easy as ticking the "add interest to this account" box. And of course you may want the income to spend. In which case the low coupon gilts will be useless for you.1 -

This is where i get confused because i was treading what i thought was the gross redemption yield ( ie yield to maturity) believing that was the pre-tax figure which in my case being an ISA I wouldn't have to pay fo.r The figure seems to have changed to 3.91% which is still nowhere near most savings bonds.DRS1 said:

A few small points.

The gross yield of T27A is 3.87% in the table (I think you read across the T26A line) Still not great and with a clean price of over 100 you will make a loss on maturity which means the CGT free "benefit" of gilts is lost.

TN28 would be a better gilt to hold outside an ISA..

Personally when I looked at how good a gilt might be as compared to a fixed rate bond from a building society I would compare the grossed up equivalent rate rather than the gross redemption yield. Not for doing any sums just to compare headline rates.

Within an ISA you can go for the higher yielding gilts but maybe look longer to find ones with a decent yield? T56 seems to have attracted some attention (although neither of us is likely to be around when that matures) What will you do with the coupons? I think the table may assume you reinvest them (like adding the interest to the capital of your fixed rate bonds). But that is not as easy as ticking the "add interest to this account" box. And of course you may want the income to spend. In which case the low coupon gilts will be useless for you.

I see the TN 28 has a grossed up figure of 4.55 % but is that per annum or between now and when it matures ?

As for T56 , i'll leave that for my great-grandchildren

The coupons I would reinvest

What got me excited about gilts was the number of Youtube videos i watched recently promoting the idea of investing in them, but I can see they probably are not for me . Still, i would like to thank all the contributors to this thread👍0 -

With yieldgimp I think you can play with the tax rates underlying the grossed up equivalent. So you can see the difference between holding in an ISA (0% tax) and holding outside if you pay 20%, 40% or 45% tax. I may be wrong about that though: I haven't used yieldgimp since they went on the app.1

-

No - it's on the assumption that capital gains remain non-taxed for gilts so boosting their (especially low-coupon) value for tax payers - I was only considering an annual equivalent, not taking into account thresholds which may or may not be exceeded by when other savings accounts pay interest.aroominyork said:

Is that on the assumption that all three years' interest is paid and taxable on maturity, rather than on an annual basis? That is not always the case.InvesterJones said:One thing that helped me understand was to click on the gilt of interest and then the 'cash flows' button - with the tax set correctly this enables you to really see how much return you will get (and when) - compare this to an equivalent savings account/premium bonds. But generally I agree with all the above posts - for short duration, under FSCS protection sized, basic tax rate payer/spare ISA allowance, there is good competition to gilts. But as soon as you're considering 3 years or so, and having to pay tax, gilts start winning out (using the 'grossed up equivalent column from the above you'd need a 3-yr fix to be paying 4.51% to beat TN28, and they don't exist).0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards