We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Urgent Debt Advice

Comments

-

Thanks for the response! Okay yes so I’ve not got any official default notices then! I will carry on ignoring and once I get will touch base back here for some guidance. Thanks so much for your helpsourcrates said:A default notice is issued under sec 87(1) of the consumer credit act.

There will be no doubt as to what it is, as it will ask you for the outstanding arrears to be repaid within 14 days to remedy the breach to the terms and conditions of your account, otherwise a default will be registered on your credit file.

It will also go on to list the possible consequences of non payment.

So your current strategy is fine, no point in talking to your lenders whatsoever, you want defaults, the fastest way to get them is to do nothing and say nothing, remember, your debt will likely be sold, so you may not be repaying your current creditors, it may be the new companies who buy them.

Once defaulted, its very important to wait until you are written too, them make your payment arrangements.2 -

Hey just a quick question..what happened a once my debts defaults and the ones which are sold to debt companies? Will the debt company then be added to by credit report and they will then stay on for 6 years or until the debt is cleared?0

-

If you wait until the default is issued, the details are removed from your credit record after 6 years, even if you owe some money.

If you start repaying before the default is recorded, you'll get AP markers. Those stay on your credit record for 6 years after the debt is paid off.

Which is why we recommend getting defaults first.If you've have not made a mistake, you've made nothing0 -

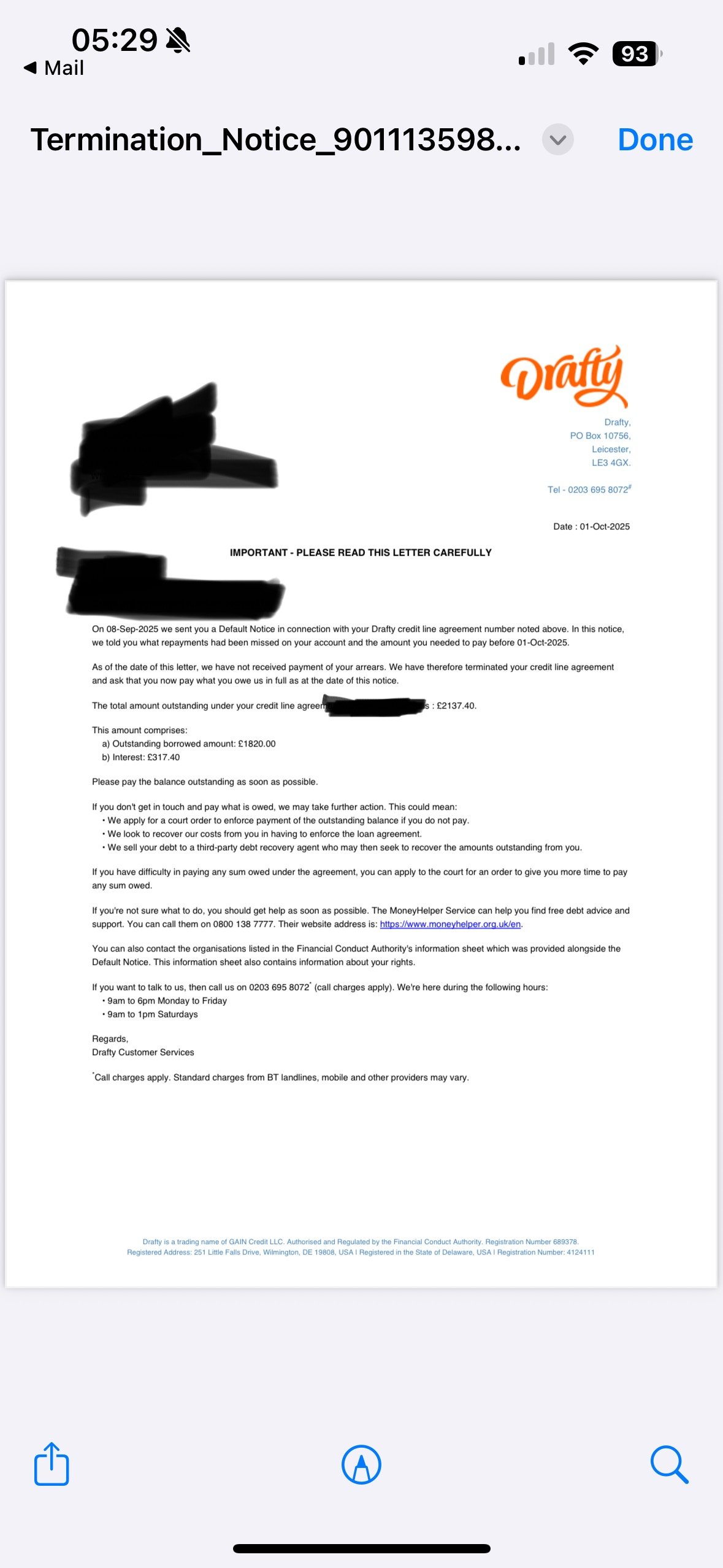

Thanks RAS. But what happens when a debt is sold? Does the debt only run off the original creditor? Or will I then have to wait to default on the debt when it is sold to a debt collection company etc? I have received my first letter today but guess just wait and wait for default on credit file. As you said it takes time. This letter was sent on email. Are the obliged to send paper letter in post?See attached letterThanks very much0

Thanks RAS. But what happens when a debt is sold? Does the debt only run off the original creditor? Or will I then have to wait to default on the debt when it is sold to a debt collection company etc? I have received my first letter today but guess just wait and wait for default on credit file. As you said it takes time. This letter was sent on email. Are the obliged to send paper letter in post?See attached letterThanks very much0 -

Any debt purchaser has to use the same Default Date on your credit record that the original lender did.

The default will get added to the credit record at some point, usually pretty soon after this letter.

Have you made an affordability complaint to Drafty?0 -

Yes done affordability complaints to them all. Awaiting responses have sent 2 off to ombudsman too.0

-

So update both by credit cards mbna and aqua have issues me letters saying my accounts terminated and full balance due. Do i still just wait until defaulted on credit reports? Thanks0

-

Yes hang on to see if they are sold on or passed to someone for collectionCallum1510 said:So update both by credit cards mbna and aqua have issues me letters saying my accounts terminated and full balance due. Do i still just wait until defaulted on credit reports? ThanksIf you go down to the woods today you better not go alone.0 -

I have today had an email from Drafty advising they are passing my account to a debt collection. They say they will get back to me with the details of the agency. Do they need to default my account before they pass this to a collection agency or can they pass it and not default my account? Shall i just wait for the debt agency to be in touch now and hope that Drafty default this on my credit record. Thanks0

-

Wait until you have received an official default and you have heard from whoever the debt has been passed on to.

There is no rush to start paying, keep saving any spare money you have.If you go down to the woods today you better not go alone.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards