We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Should I pay off this 0% card or try and roll it over to a new one?

Last year I bought a £20k car. £10k cash (trade in) and £10k on a 0% credit card.

I've been paying it off at £300 a month, which is a little over the minimum amount.

My question is, the 0% offer expires in October and I will still owe about £5500 on it. Do I pay it off (I have the cash to do so but it's sitting in a high interest savings account). Or do I try and roll it into a new 0% balance transfer card? Ths would be something I have never done.

Does balance transfer incur fees? if it does will it be less than the interest i'm gaining elsewhere? or would any fees wipe this out? If it's close to break even I'd probably be inclined to just pay it off to save the "faff" for a small gain.

Any advise very welcome! Thanks.

Comments

-

Do you have a card with at least the £5500 + headroom where a 0% offer is likely at the right time? And with an unrelated bank?? That will be the crucial bit.

Yes there are fees normally for any BT or money transfer. MTs tend to be a bit higher on my cards. So a BT might charge 5% and a MT 5.5%. The % charged will be on the total amount of the transfer. So £5500 at 5% will mean there will be £5725 on the new card. Often this needs to be under 95% of the credit limit (headroom)

Whether that is better than your current high interest amount will take a bit of calculating and guess work. If you are getting 5% on an account and you have a 5% fee then it will only make sense to do a BT/MT if the 0% interest period is more than 12 months and you know that the interest on the account isn't likely to go down.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅1 -

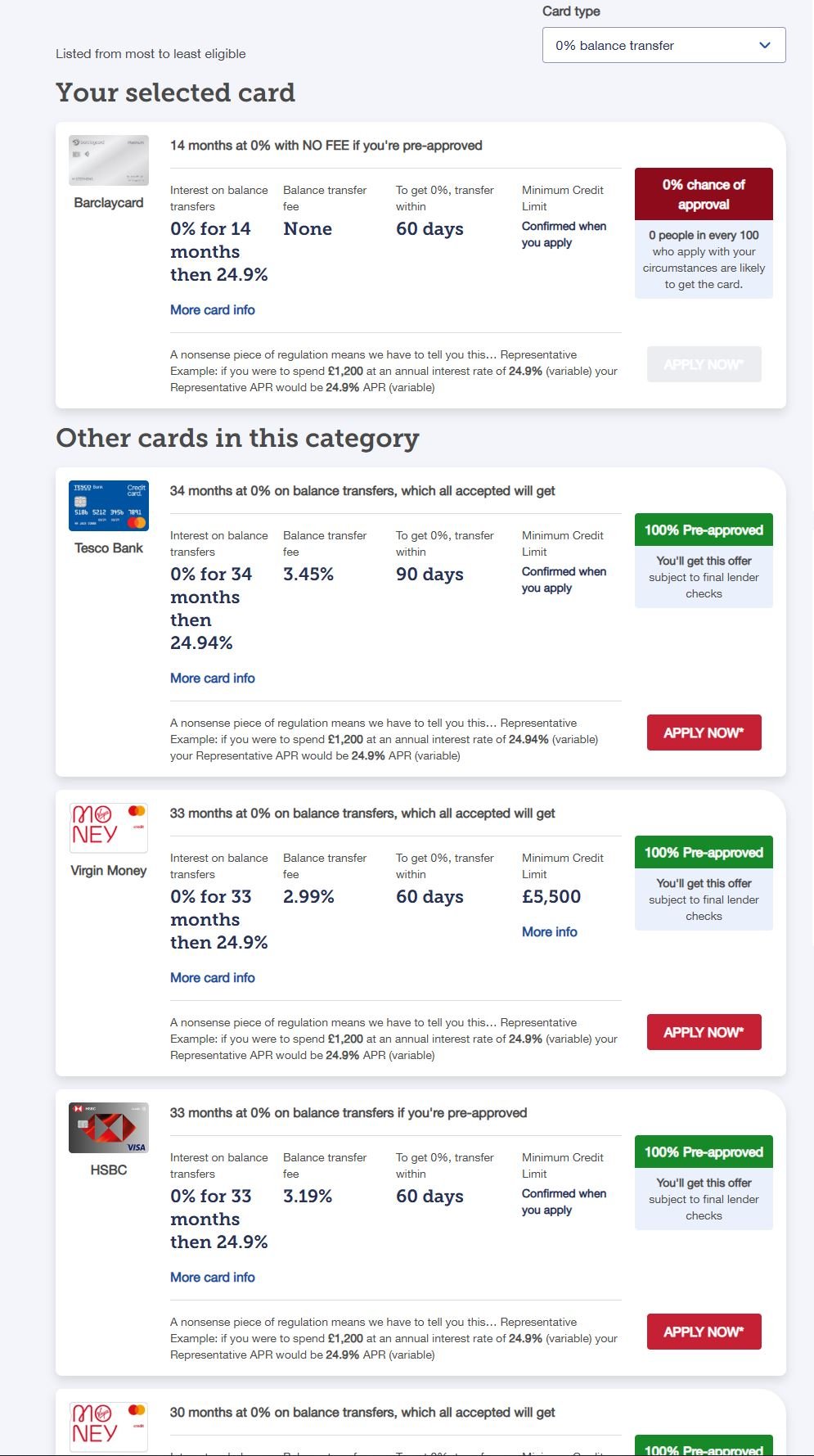

well i found a barclay card with 0 fees balance transfer.

I calculated the interest I would get over the 14 months would be about £220. so probably worth doing.

However I've been given a weird pre-acceptance chance for that card? Not sure why. My credit history is immpeccable. All the other cards are 100% pre-approval so not sure what is going on there. But on those the fee makes it probably not worth my time to be honest. 0

0 -

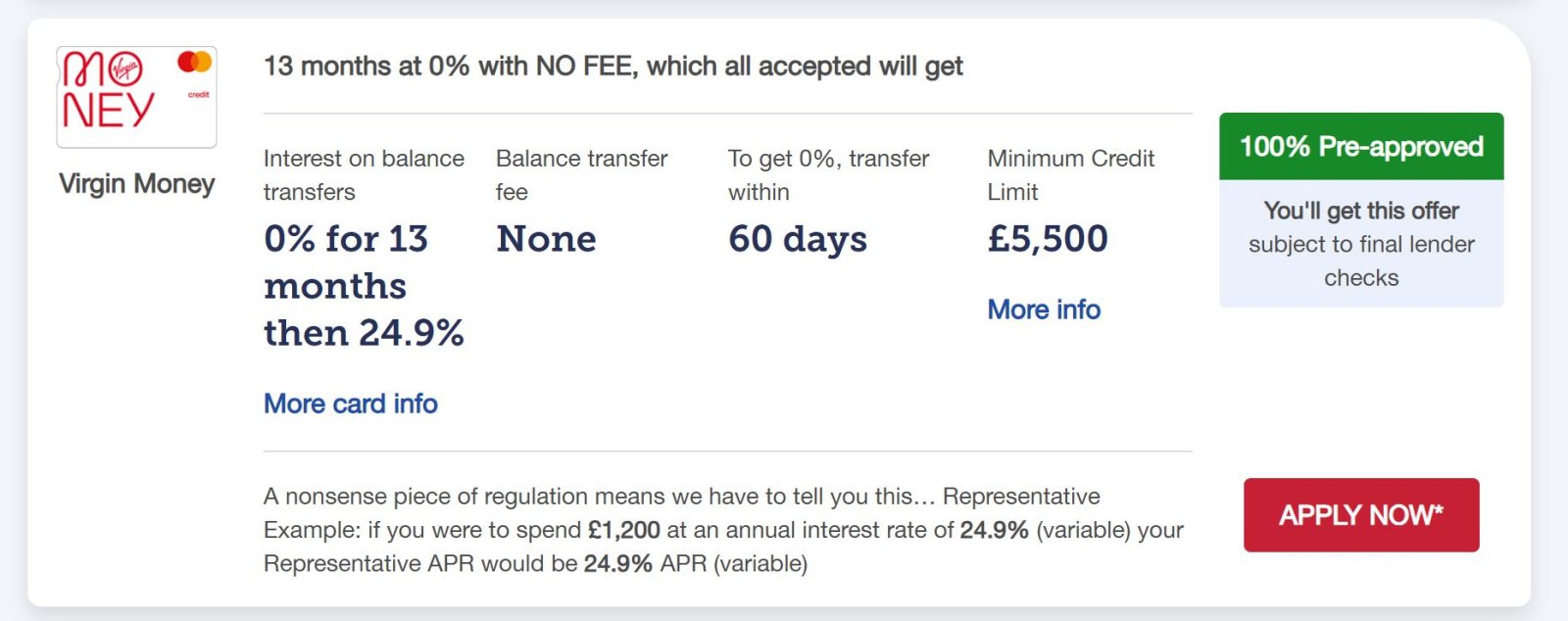

There is this one?

0

0 -

No reason not to do it, all other things being equal. I personally would lean to 2.99% for 33 months, as the 0% fees are pretty rare, and that's just over 1% a year. But I rarely get 0% fee offers.0

-

Try an eligibility checker on the Barclays site, the comparison sites aren't always accurate

https://www.barclays.co.uk/credit-cards/check-your-eligibility/Sam Vimes' Boots Theory of Socioeconomic Unfairness:

People are rich because they spend less money. A poor man buys $10 boots that last a season or two before he's walking in wet shoes and has to buy another pair. A rich man buys $50 boots that are made better and give him 10 years of dry feet. The poor man has spent $100 over those 10 years and still has wet feet.

0 -

That wouldn't make sense ofr me as I would end up paying more in fees that I would get from the cash interest. I would be better off just paying it off unless I can get a 0% BT card I think.Altior said:No reason not to do it, all other things being equal. I personally would lean to 2.99% for 33 months, as the 0% fees are pretty rare, and that's just over 1% a year. But I rarely get 0% fee offers.0 -

I think you might have misunderstood how the fees work on a balance trf , for the quoted Virgin Money card if you transfered £5500 then the total fee would be £164.45 , as long as you made the minimium payments you would not be charged any interest for the 33 month term. You should be able to easily make more than that in interest using various high rate Regular savings accounts, of course if you can get the 13 months with no fees at all then you cant fail to profit and you might be able to trf that bal to another card at the end of the 13 months.Malkytheheed said:

That wouldn't make sense ofr me as I would end up paying more in fees that I would get from the cash interest. I would be better off just paying it off unless I can get a 0% BT card I think.Altior said:No reason not to do it, all other things being equal. I personally would lean to 2.99% for 33 months, as the 0% fees are pretty rare, and that's just over 1% a year. But I rarely get 0% fee offers.

Just remember when calculating the amount of interest that you can make over the term , to make sure you use

the reducing balance and not just the initial balance, different lenders/cards have different % monthly minimium payments. You also need to consider if your total interest earned (not just on the stoozing pile) would take you over your tax free allowance and if any tax would be payable.

Just stick to the golden rules

1) always having at least as much as the outstanding balance in easy access savings account/s

2) always make the minium payment (best to set up a direct debit for this)

3) Fully read and understand ALL the terms and conditions of the new card (in the majority of cases when you have a 0% interest promotional balance trf rate , you DO NOT use that card for any purchases)

1 -

Ok yeah I definately have a knowledge gap then. The Virgin card says "Balance Transfer Fee - NONE" So I assumed there would be.... no charge. Where does this £164 charge come from then? Is there any card that will allow me to transfer the balance for literally no charge? If there is going to be a charge no matter what then I will probably just pay it off as I can't really be bothered with the hassle of application and so on for <£100Shadyocuk said:

I think you might have misunderstood how the fees work on a balance trf , for the quoted Virgin Money card if you transfered £5500 then the total fee would be £164.45 ,Malkytheheed said:

That wouldn't make sense ofr me as I would end up paying more in fees that I would get from the cash interest. I would be better off just paying it off unless I can get a 0% BT card I think.Altior said:No reason not to do it, all other things being equal. I personally would lean to 2.99% for 33 months, as the 0% fees are pretty rare, and that's just over 1% a year. But I rarely get 0% fee offers.

0 -

Scroll up... there are two VM offers, one is 0 fees but only 14 months, the other has a fee but is 33 months so you'd get more than twice the interest in exchange of the feeMalkytheheed said:

Ok yeah I definately have a knowledge gap then. The Virgin card says "Balance Transfer Fee - NONE" So I assumed there would be.... no charge. Where does this £164 charge come from then? Is there any card that will allow me to transfer the balance for literally no charge? If there is going to be a charge no matter what then I will probably just pay it off as I can't really be bothered with the hassle of application and so on for <£100Shadyocuk said:

I think you might have misunderstood how the fees work on a balance trf , for the quoted Virgin Money card if you transfered £5500 then the total fee would be £164.45 ,Malkytheheed said:

That wouldn't make sense ofr me as I would end up paying more in fees that I would get from the cash interest. I would be better off just paying it off unless I can get a 0% BT card I think.Altior said:No reason not to do it, all other things being equal. I personally would lean to 2.99% for 33 months, as the 0% fees are pretty rare, and that's just over 1% a year. But I rarely get 0% fee offers.1 -

For that amount, assuming OP has the funds to repay, £4000 in a Santander Edge Saver at 6% is a far better idea than a regular saver, simply don't setup 2x DD and you don't trigger the Edge current account fee and then you get £15-20 a month interest - even with the 2.99% fee over 33 months, that's realistically best part of £500 interest. A Nationwide Flex Direct account to hold the £1500 pays 5% for a year as well for the first year!Shadyocuk said:

I think you might have misunderstood how the fees work on a balance trf , for the quoted Virgin Money card if you transfered £5500 then the total fee would be £164.45 , as long as you made the minimium payments you would not be charged any interest for the 33 month term. You should be able to easily make more than that in interest using various high rate Regular savings accounts, of course if you can get the 13 months with no fees at all then you cant fail to profit and you might be able to trf that bal to another card at the end of the 13 months.Malkytheheed said:

That wouldn't make sense ofr me as I would end up paying more in fees that I would get from the cash interest. I would be better off just paying it off unless I can get a 0% BT card I think.Altior said:No reason not to do it, all other things being equal. I personally would lean to 2.99% for 33 months, as the 0% fees are pretty rare, and that's just over 1% a year. But I rarely get 0% fee offers.

Just remember when calculating the amount of interest that you can make over the term , to make sure you use

the reducing balance and not just the initial balance, different lenders/cards have different % monthly minimium payments. You also need to consider if your total interest earned (not just on the stoozing pile) would take you over your tax free allowance and if any tax would be payable.

Just stick to the golden rules

1) always having at least as much as the outstanding balance in easy access savings account/s

2) always make the minium payment (best to set up a direct debit for this)

3) Fully read and understand ALL the terms and conditions of the new card (in the majority of cases when you have a 0% interest promotional balance trf rate , you DO NOT use that card for any purchases)Sam Vimes' Boots Theory of Socioeconomic Unfairness:

People are rich because they spend less money. A poor man buys $10 boots that last a season or two before he's walking in wet shoes and has to buy another pair. A rich man buys $50 boots that are made better and give him 10 years of dry feet. The poor man has spent $100 over those 10 years and still has wet feet.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards