We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Lowell Letter (vague threat) - advice appreciated

Hello

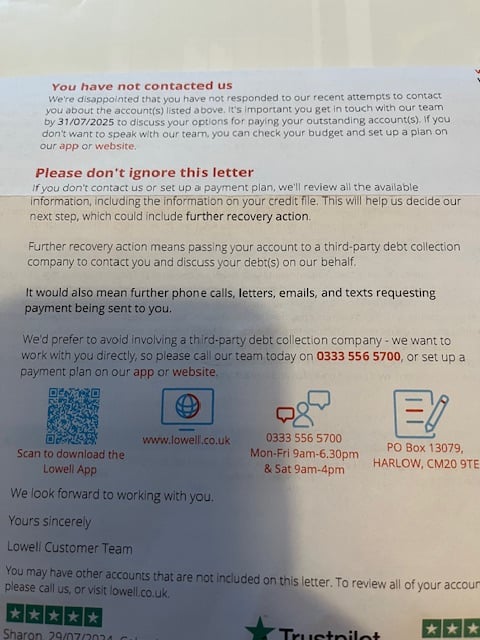

I’ve had the letter below from Lowell for one of my debts of c£12k. I have had the CCA back upon request (which looks complete, but I am double checking), and subsequently a few letters chasing. This is the first time they have mentioned a deadline to get in touch, which is actually less than a week from when I received the letter yesterday.

When they say they will refer me to another debt collection agency, is the next letter likely to be from their legal team and a Letter Before Action (which I want to avoid)?

I think from advice on a previous post that I can just go online and set up e.g. a direct debit for £25/£50 per month, or will they start hounding me to increase (and is DD right way to pay?). I need to be careful as I have other debts where I have had CCA back so will have to start paying those soon too, as I want to avoid any LBA or court action (too scary!).

As always, thanks for your help with this. Any advice or sharing of previous experience very much appreciated.

Comments

-

Do not set a direct debit up, you can set a standing order up .

If you want just hold off to see what comes next.

They use the contact us urgently to try and frighten you into contacting them and agreeing to pay more than you can afford, don't fall for it.If you go down to the woods today you better not go alone.1 -

That's just a standard threatogram. Doesn't mean anything. Stick to your strategy1

-

I agree, just another one of Lowell`s standard letters.

Their deadlines are totally meaningless lol, the utter rubbish they put in these letters always makes me chuckle.

Fatbelly mentions a strategy, do you have one?I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter1 -

Have you reviewed your budget so you know what you have available for clearing any debts? The statement of account (SOA see below) is a great way to start. Do be sure you are using real figures for your bills, not guesses, so check on your last couple of bank statements for both the standard monthly ones and the things that might fluctuate like food.

Some creditors will ask to see something like this and send you out their own version. It's up to you if you want to send them that level of detail but if they do see that you have a reasonable budget and only £X to split between a few creditors they might be more likely to accept any payment off you might make. Offers should be pro rata per creditor although I do know it's sometimes nice to clear a small one quickly just to have a nice victory.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅2 -

Thanks everyone for your advice, I will have a think about the next steps I should take.0

-

One more question, if I do get an LBA do I have to complete the SOA/budget outgoing sheet which would be included with this, or can I just make an offer to pay a monthly amount on the form? I’m not comfortable with sharing all my finances/outgoings with a debt collection agency. Thanks0

-

OK Don't even think about a LBA . If it does come to that the form is from the court .If you go down to the woods today you better not go alone.1

-

I dont agree with @Grumpelstiltskin that you should ignore a LBA. That is the point at which you should challenge if they have never sent you a default notice, ask them to supply a copy of the CCA agreement, and also think about an affordability complaint if you havent done so.

If they have sent a default notice and supplied a CCA and you have lost an affordability complaint or don't have grounds for making one, then that is a good time to make a payment offer.

A CCJ isnt the end of the world for most people, but if you dont have a possible defence its best to avoid it. And if you do have a possible defence, the LBA is the time to raise it.1 -

Many Ways I didn't mean ignore a LBA, whet i was trying to say was that if the proper forms are sent then the information is being asked for by the court not the debt collection company.If you go down to the woods today you better not go alone.1

-

Thanks for all your advice on this. I expect I may have to set up a monthly payment plan, I’m dreading having to start actually interacting with them, so trying to delay as long as possible.

I think what I’m actually trying to work out is: when is the best time to set up something online without be forced by legal forms to submit a SOA/budget sheet, which I don’t agree with submitting to a debt collection agency so they can see what I spend my money on and other debts I have.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.2K Banking & Borrowing

- 253.6K Reduce Debt & Boost Income

- 454.3K Spending & Discounts

- 245.3K Work, Benefits & Business

- 601K Mortgages, Homes & Bills

- 177.5K Life & Family

- 259.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards