We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Learn by about investments

Comments

-

You want help with basic investing then watch these in this order:Sunshine_and_Roses said:Thus is something I would benefit from learning more about too, will be looking at these links. I am better learning from podcasts and thought Martin's recent special about investing was really useful.

Hope the OP does not mind me asking on Thursday thread, but any basic investing podcasts recommendations would be appreciated. Might help others too.

1. https://www.kroijer.com/

2. https://www.youtube.com/watch?v=lGQ9KyQq8Jw

https://www.youtube.com/watch?v=lGQ9KyQq8Jw

3.

https://meaningfulmoney.tv/2023/05/20/how-to-choose-investment-funds-too-many-options/?sfw=pass17256548171 -

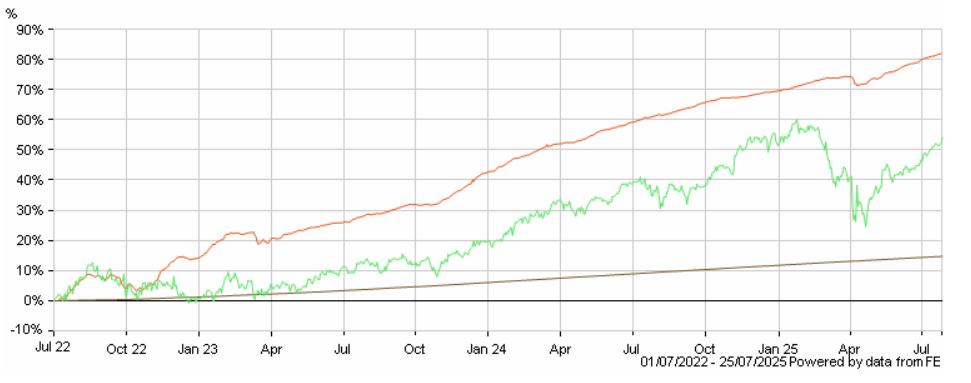

Your managed hedged bond fund very likely did tank in the period just before July 2022, because that was when global interest rates were climbing. But it would be interesting to know what it is, because a growth of 80% in 3 years from a bond fund, even in the period when interest rates still fell a bit, looks unusual.gascar said:There's a huge spectrum of advice out there. I suppose most of it is good for somenone, just not much for me.Much of the advice seems to be from an age when people squirreled their money away and forgot about it, driven by men in bowler hats who told everyone they wouldn't understand. Do keep looking at it. Have a phone app and take a look every couple of weeks and keep your ear on the news. You can set up price alerts with some brokers.Watch Bloomberg or something topical, from time to time. They have bank chiefs and fund managers expounding, wuite often. They're mostly right, on trends.Diversification is a religion for some. To a point, but only stuff which is doing OK or better, thankyou. I'll pass on the Bosnian blacksmithing sector. Low cost index funds? No thanks. Far too volatile to be left alone, and slightly higher cost hedged and managed funds do better. Here's a chart I posted elsewhere:3 years to date.Brown is approx Building society or Money MarketGreen is your low cost index fund - the S&P 500. OK 50% in 3 years is ok.Orange is a managed hedged bond fund. 80% in 3 years, is better.Past performance is no guarantee yada yada but after being that smooth for that long, I doubt it'll tank tomorrow.3

Here's a chart I posted elsewhere:3 years to date.Brown is approx Building society or Money MarketGreen is your low cost index fund - the S&P 500. OK 50% in 3 years is ok.Orange is a managed hedged bond fund. 80% in 3 years, is better.Past performance is no guarantee yada yada but after being that smooth for that long, I doubt it'll tank tomorrow.3 -

I was curious too, but as the poster says, they'd already posted this elsewhere, in which it was clarified that "It's MAN Group's Dynamic Income IH", which was only launched three years ago....EthicsGradient said:Your managed hedged bond fund very likely did tank in the period just before July 2022, because that was when global interest rates were climbing. But it would be interesting to know what it is, because a growth of 80% in 3 years from a bond fund, even in the period when interest rates still fell a bit, looks unusual.2 -

Launched just after one of the largest falls in over 100 years. So, by luck, they don't have that period in their past returns data.eskbanker said:

I was curious too, but as the poster says, they'd already posted this elsewhere, in which it was clarified that "It's MAN Group's Dynamic Income IH", which was only launched three years ago....EthicsGradient said:Your managed hedged bond fund very likely did tank in the period just before July 2022, because that was when global interest rates were climbing. But it would be interesting to know what it is, because a growth of 80% in 3 years from a bond fund, even in the period when interest rates still fell a bit, looks unusual.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.5 -

Indeed, very convenient that a poster advocating performance of a bond fund chooses a timeframe that happens to coincide with that recovery!dunstonh said:

Launched just after one of the largest falls in over 100 years. So, by luck, they don't have that period in their past returns data.eskbanker said:

I was curious too, but as the poster says, they'd already posted this elsewhere, in which it was clarified that "It's MAN Group's Dynamic Income IH", which was only launched three years ago....EthicsGradient said:Your managed hedged bond fund very likely did tank in the period just before July 2022, because that was when global interest rates were climbing. But it would be interesting to know what it is, because a growth of 80% in 3 years from a bond fund, even in the period when interest rates still fell a bit, looks unusual.5 -

I've recently watched this one:

https://www.youtube.com/watch?v=9dhG0penhzgQuite basic but clear to people who have not known much or just want to hear about everything systematically (you can go back to earlier weeks for other money issues).I suppose this is for learning the principles - for the mass.

https://www.youtube.com/watch?v=9dhG0penhzgQuite basic but clear to people who have not known much or just want to hear about everything systematically (you can go back to earlier weeks for other money issues).I suppose this is for learning the principles - for the mass.

0 -

dunstonh said:

Launched just after one of the largest falls in over 100 years. So, by luck, they don't have that period in their past returns data.eskbanker said:

I was curious too, but as the poster says, they'd already posted this elsewhere, in which it was clarified that "It's MAN Group's Dynamic Income IH", which was only launched three years ago....EthicsGradient said:Your managed hedged bond fund very likely did tank in the period just before July 2022, because that was when global interest rates were climbing. But it would be interesting to know what it is, because a growth of 80% in 3 years from a bond fund, even in the period when interest rates still fell a bit, looks unusual.The manager was previously at Schroder running a similar, but somewhat more constrained, fund, and that fell about 30% shortly after he departed, and a little over 20% during Covid while he was still at the helm.I think there is some conflating of low risk with low volatility here. The smooth nature of the performance plot is perhaps related to infrequent pricing of assets, as this fund invests in junk bonds, CLOs, and up to 40% in emerging market debt. It also uses derivatives, both long and short.People thought bricks and mortar property funds were low risk because of the smooth return profile, and that ended well. Likewise, an investment manager leaving a firm in search of more freedom can have a mixed outcome.That said, the short term performance is impressive, it will be interesting to see how it performs over the rest of the market cycle.3 -

I'd suggest splitting this into three areas, personal finance and pensions and investments. This may make you realise you know more than you think.

For personal finance this site is excellent, though by no means the only option.

For general defined contribution pension information the bigger pension providers all have some good information on pensions and how they work. I'm thinking of companies such as aviva, aj bell, fidelity and interactive Investor. Remember these are all companies who also sell pensions.

For general information on investments and pensions I'd suggest

https://www.boringmoney.co.uk/ and for ratings of providers I'd suggest the money section of https://www.which.co.uk/.

For information on specific classes of investments I'd suggest https://global.morningstar.com/en-gb?marketID=gb (multiple asset classes), https://www.theaic.co.uk/ (investment trusts) and https://www.justetf.com/uk/academy/what-is-an-etf.html (exchange traded funds).

I'd suggest these are more suitable if you want to dig into specific asset classes.

I'd also suggest some honest self reflection for anyone looking to invest. What's your attitude and tolerance to risk? What would you do (and feel) if you saw your portfolio drop by 25% or 50%? What do you need from investments? Growth, stability, income are some of many valid things to seek, and all come with trade offs.

Be sceptical about anything offering amazing returns. Given the number of amateur and professional investors, ask what's the catch? In practice amazing returns tend to have been short term blips that are unlikely to be repeated, or come with risks that may be unpalatable, or are perilously close to an actual scam. Lots of people try and beat the market and most fail, which partly accounts for the popularity of index tracking funds and etfs.2 -

The 'Rebel Finance School' sessions have been brilliant for this, I went from knowing even less than I thought I did to feeling almost confident about what I'm talking about

. Very accessible content, on YouTube, designed to make it easy for ordinary people to understand.

. Very accessible content, on YouTube, designed to make it easy for ordinary people to understand.

https://rebeldonegans.com/finance/rfs/Starting debt (Aug 2018) £17,900

Debt free September 20210

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.4K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards