We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Alternatives to AJ Bell for Funds

Comments

-

They would be the ETF equivalents of the Fidelity fund. Nonetheless, the other fund that the OP's wife has (VWRP) holds only FTSE 100 sized companies. CUKX would therefore be a suitable alternative to the Fidelity fund. The UK market is just over 3% of the world market, but the OP's wife has more money invested in the UK than overseas. The most popular option is to only have a global tracker like VWRP.EthicsGradient said:While iShares and SPDR have ETFs that track the FTSE All Share like the Fidelity OEIC, their charges are higher (both 0.20%) than Fidelity's 0.06% ongoing charge + 0.03% transaction costs.1 -

But being a FTSE 100 tracker, it holds even fewer medium and small companies:

Giant 55.86%

Large 30.76%

Medium 12.92%

Small 0.45%

Micro 0.01%

0 -

EthicsGradient said:But being a FTSE 100 tracker, it holds even fewer medium and small companies:

Giant 55.86%

Large 30.76%

Medium 12.92%

Small 0.45%

Micro 0.01%Does that matter? Compare the number of stocks in Vanguard Developed World ex UK and VEVE, which both track FTSE indexes:VEVE currently has 106 additional stocks. The cut off point for the FTSE Developed World index closely coincides with the smallest stock in the FTSE 100.There is not much point in adding smaller stocks just for the UK market, which is little more than 3% of the global market. The FTSE 250 also contains a lot of Investment Trusts, which mostly contain stocks that you will already have in a global tracker, but with additional costs.The OP's wife has massively overweighted the UK, so perhaps adding smaller UK stocks will make a significant difference for her. That does not mean that it makes a lot of sense though. CUKX has an OCF of 0.07%, which makes it cheaper than the FTSE All Share tracker ETFs, and we have been asked for cost cutting measures.Of course, you may want to bet on the future outperformance of small cap stocks, but that is another matter.0 -

It may not 'matter', but with the question being "is there an ETF equivalent to the Fidelity OEIC?", the Amundi ETF is closer - and has slightly lower ongoing charges than the iShares FTSE 100 ETF too (0.04% v. 0.07%). It's not so much that it would "adding smaller stocks", more "not getting rid of so many smaller stocks".GeoffTF said:EthicsGradient said:But being a FTSE 100 tracker, it holds even fewer medium and small companies:

Giant 55.86%

Large 30.76%

Medium 12.92%

Small 0.45%

Micro 0.01%Does that matter? Compare the number of stocks in Vanguard Developed World ex UK and VEVE, which both track FTSE indexes:VEVE currently has 106 additional stocks. The cut off point for the FTSE Developed World index closely coincides with the smallest stock in the FTSE 100.There is not much point in adding smaller stocks just for the UK market, which is little more than 3% of the global market. The FTSE 250 also contains a lot of Investment Trusts, which mostly contain stocks that you will already have in a global tracker, but with additional costs.The OP's wife has massively overweighted the UK, so perhaps adding smaller UK stocks will make a significant difference for her. That does not mean that it makes a lot of sense though.Of course, you may want to bet on the future outperformance of small cap stocks, but that is another matter.

Yes, VEVE has very few 'Small' stocks; that's actually less representative of the global market than it could be. Maybe the balance was chosen to correct that a bit, albeit with UK-only small stocks. More likely it was because someone desired a substantial home bias.0 -

EthicsGradient said:It may not 'matter', but with the question being "is there an ETF equivalent to the Fidelity OEIC?", the Amundi ETF is closer - and has slightly lower ongoing charges than the iShares FTSE 100 ETF too (0.04% v. 0.07%). It's not so much that it would "adding smaller stocks", more "not getting rid of so many smaller stocks".

Yes, VEVE has very few 'Small' stocks; that's actually less representative of the global market than it could be. Maybe the balance was chosen to correct that a bit, albeit with UK-only small stocks. More likely it was because someone desired a substantial home bias.Yes, the Amundi fund is cheap. Amundi does not appear to be as popular here as Vanguard and BlackRock, but that does not make it a poor choice. Some of the Amundi funds are domiciled in Luxembourg, which has less favourable tax treaties that Ireland, but that does not matter for a UK fund.Vanguard does sell global all cap funds, but they are only available as OEICs and they are expensive, as is the OP's wife's VWRP. VHVG is much cheaper. It does not include emerging markets, but they can be added with about 10% VFEG. On a portfolio of £500K, a reduction in the OCF of 0.1% amounts to £500 per year. The OP's wife is being scalped not only by AJ Bell but also by Vanguard.1 -

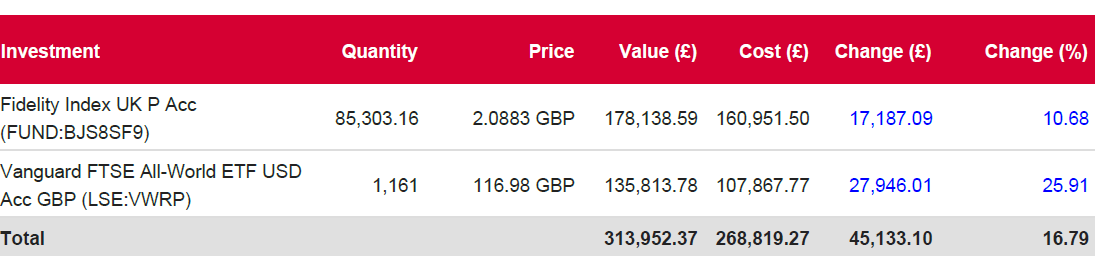

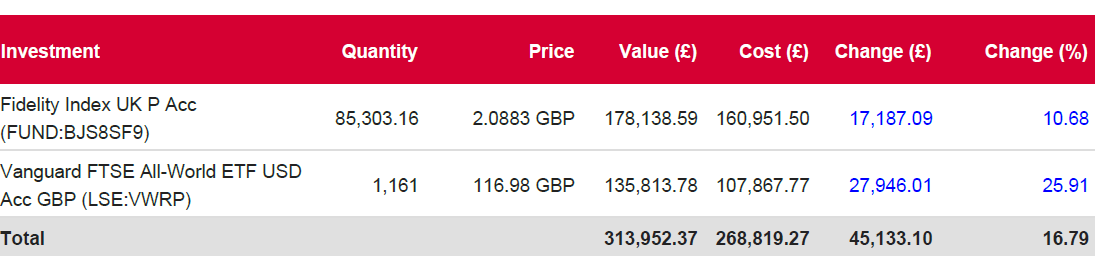

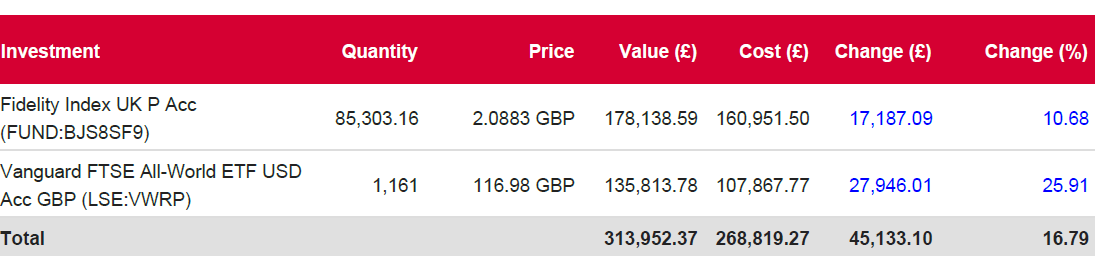

Ok looking at the Fidelity Index UK Fund (FUND:BJS8SF9) - Costs | AJ Bell with your value of the FUND your charges are seemingly correct. I know you have mentioned iWeb and II as options and as highlighted above iWeb is not offering SIPPs to new customers. Have a look at II as they have the exact fund you already have and allow free in-specie transfersvaliant24 said:

I got this wrong! It wasn't CSH2:Ch1ll1Phlakes said:valiant24 said:At present I am holding quite a lot of cash, via money market fund CSH2 in my SIPP: AJ Bell's SIPP charges for ETFs etc are good, 0.25% capped at £10/mth, but their charges for Funds are uncapped so I am getting monthly bills of £40 or more.

As mentioned CSH2 is an ETF.EthicsGradient said:"CSH2" is an ETF: Amundi Smart Overnight Return UCITS ETF GBP Hedged Acc | CSH2 | LU1230136894

So I don't see why you're getting charged like it's an OEIC. Does AJ Bell have an exception for money market ETFs? Or actively-managed ETFs?

Nonetheless the question stands, as I (actually, my wife) is still getting scalped by AJBell on the Fund charges:Date Description Payment (GBP) 13/06/2025 Account charge for shares - May 2025 - XXXXXX -10 13/06/2025 Account charge for funds - May 2025 - XXXXXX -35.24

Fidelity Index UK P Acc | BJS8SF9 Fund Price, Performance & Information - interactive investor

On the page linked here, there is a 'Costs Disclosure Document' which will give you a good illustration of the fees for the fund you have.

Note, II charges fixed fees. While their SIPP only account charge is £12.99 per month (the ‘Pension Builder’ plan) as you have other small accounts with them, I imagine you are already on their 'Investor Essentials' plan (£4.99 per month) however this won't let you bundle the SIPP (as this plan has a max value of £50k) so you will probably have to change to the £21.99 per month 'Investor' plan. This is the equivalent of paying £17 per month to how the fund you have. Hope this helps.0 -

In my mind one very good reason NOT to have a SIPP with Iweb, because the SIPP is run by a third party, so must be scope for mistakes and disputes.Chickereeeee said:

Last I looked (when I had a SIPP with iWeb) it was actually run and managed by A J Bell. Added extra complexity when I moved to II.wmb194 said:

So move them to iWeb (soon to be renamed Scottish Widows).valiant24 said:

I got this wrong! It wasn't CSH2:Ch1ll1Phlakes said:valiant24 said:At present I am holding quite a lot of cash, via money market fund CSH2 in my SIPP: AJ Bell's SIPP charges for ETFs etc are good, 0.25% capped at £10/mth, but their charges for Funds are uncapped so I am getting monthly bills of £40 or more.

As mentioned CSH2 is an ETF.EthicsGradient said:"CSH2" is an ETF: Amundi Smart Overnight Return UCITS ETF GBP Hedged Acc | CSH2 | LU1230136894

So I don't see why you're getting charged like it's an OEIC. Does AJ Bell have an exception for money market ETFs? Or actively-managed ETFs?

Nonetheless the question stands, as I (actually, my wife) is still getting scalped by AJBell on the Fund charges:Date Description Payment (GBP) 13/06/2025 Account charge for shares - May 2025 - XXXXXX -10 13/06/2025 Account charge for funds - May 2025 - XXXXXX -35.24

Especially now as the SIPP provider is changing ( Embark or Scottish Widows I think) .

and especially if you are withdrawing from the SIPP and not just adding to it.

Not worth all the potential headaches to save a few quid.0 -

You cannot currently open a SIPP with iWeb. I expect that you will soon be able to open one when iWeb is rebranded Scottish Widows. Your brokerage account and SIPP will then both be branded Scottish Widows. There will be just two parties, you and Lloyds Banking Group. The Lloyds and Halifax branded accounts already have Scottish Widows SIPPs.Albermarle said:

In my mind one very good reason NOT to have a SIPP with Iweb, because the SIPP is run by a third party, so must be scope for mistakes and disputes.Chickereeeee said:

Last I looked (when I had a SIPP with iWeb) it was actually run and managed by A J Bell. Added extra complexity when I moved to II.wmb194 said:

So move them to iWeb (soon to be renamed Scottish Widows).valiant24 said:

I got this wrong! It wasn't CSH2:Ch1ll1Phlakes said:valiant24 said:At present I am holding quite a lot of cash, via money market fund CSH2 in my SIPP: AJ Bell's SIPP charges for ETFs etc are good, 0.25% capped at £10/mth, but their charges for Funds are uncapped so I am getting monthly bills of £40 or more.

As mentioned CSH2 is an ETF.EthicsGradient said:"CSH2" is an ETF: Amundi Smart Overnight Return UCITS ETF GBP Hedged Acc | CSH2 | LU1230136894

So I don't see why you're getting charged like it's an OEIC. Does AJ Bell have an exception for money market ETFs? Or actively-managed ETFs?

Nonetheless the question stands, as I (actually, my wife) is still getting scalped by AJBell on the Fund charges:Date Description Payment (GBP) 13/06/2025 Account charge for shares - May 2025 - XXXXXX -10 13/06/2025 Account charge for funds - May 2025 - XXXXXX -35.24

Especially now as the SIPP provider is changing ( Embark or Scottish Widows I think) .

and especially if you are withdrawing from the SIPP and not just adding to it.

Not worth all the potential headaches to save a few quid.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.4K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards