We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Debt Free Diary Newbie. Post 1

Total Debt to date 9th July 2025

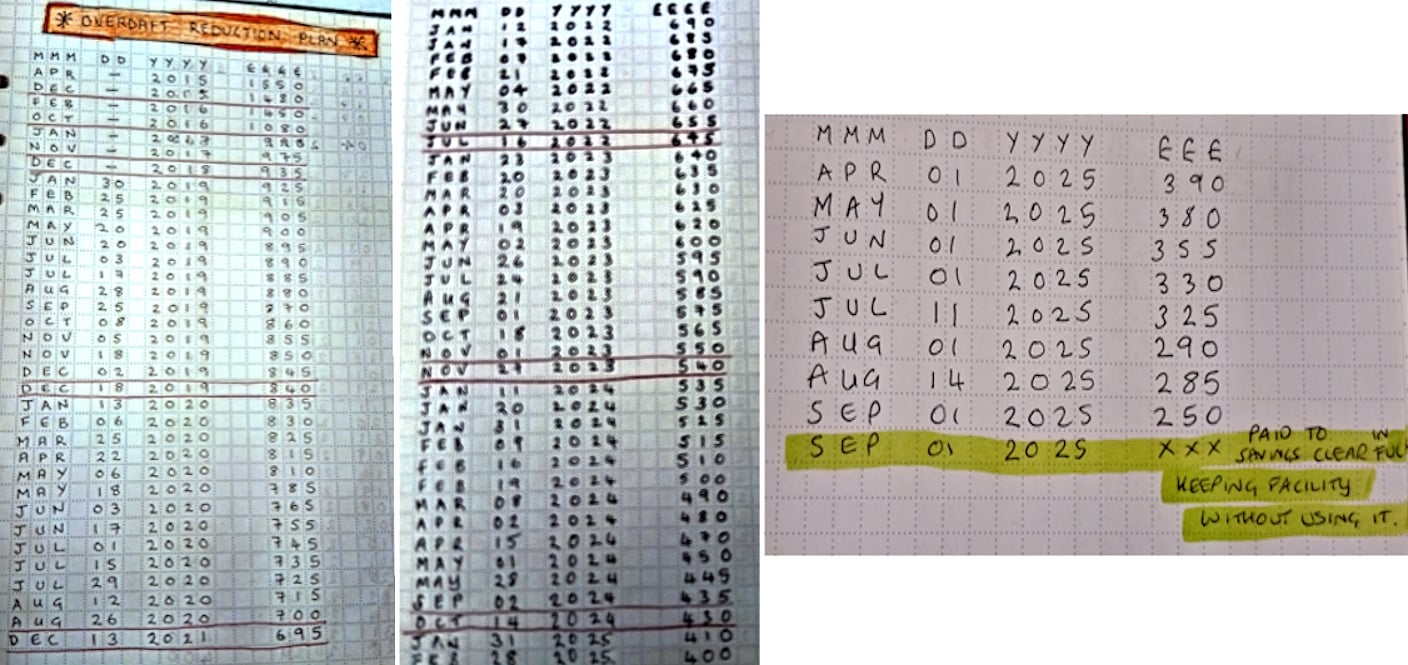

Student overdraft from 2015: £1550 now at £330

Credit card from 1999:£5615 now £2068 (0% Interest on repayment plan for 15+ years)

Student Loan from 2013 £18,203.84 now £23,788.02

(BNPL: £22.18, BNPL: £20.67, Credit card: £77.49= Total £120.34 will be cleared in full 1 Aug)

Savings Balances in 6 accounts:

1. £280 (Long term savings) (Pay in £4/month)

2. £175 (Savings to clear overdraft when I have reduced it to £250) (£25-£35/month)

3. £90 (Credit Union. Used for ad hoc needs/occasional treats) (£40/month)

4. £60 (Xmas - no access til Nov. Usually reaches £100 per year) (£8/month)

5. £2.01 (Specific - non-urgent: shoe repair, shower head, under £50 total) (£4/month)

6. £6.01 (Specific - £50-£100 e.g. podiatry appointment) (£8/month)

(£89 approx currently)

I am unable to work and was migrated from ESA (Payments 2 weekly) to Universal Credit (Monthly Payments) in January this year. Has taken me a few months to get my head around it all, but now that the increase was applied and my payment amount is stable I'm getting to grips with it.

Monthly expenses:

Rent: £800

Council Tax:£20

Energy:£70 (likely to up it to £100 for winter)

Water: £23.99

Broadband: £20

Mobile Phone: £5

Credit Card Repayment Plan: £10

Overdraft reduction: £25-35

Bank overdraft fees: £5-8

^Bank account fee: £2

Funeral Plan: £28.65

Society Membership: £1

Suno Ai: £8

*Disney+: £4.99

+Drop Out TV: £5

(£1041 approx currently)

* Ending when new Criminal Minds season ends!

+Suspect I will only have this for a couple of months

^The rewards that come with the fee cover the cost and are also being used to reduce my overdraft

I have no relatives, no financial safety net and had a lousy credit score that over the past three years has now reached excellent. However, my affordability is still low and I'd like that improved.

My mental health issues were diagnosed late (age 39) and now more physical health issues are creeping in, I want to have more savings in case of need. Recently paid out for private physio sessions unexpectedly after an excruciating back injury. 2 more sessions to go, had to spend some savings and put some on credit card but thankfully didn't cripple my budget, just tightened it a lot.

Short Term Goals/Plan of action:

Sep 1st 2025 Reduce overdraft limit to £250 and pay in £250 (Savings 2) to zero out bank balance but keep overdraft in case of need

1st October increase credit card on repayment plan to £20 monthly

1st October save £50-£100 per month (Savings 2) to build up lump sum to pay off credit card on repayment plan. From researching settlement amounts on very old debts I am hoping they will be willing to accept 25-30% of the outstanding balance.

| From some maths on Excel, best case scenario, they accept 25% and I manage to save £100 each month, I can pay £500 January 2026 and have it settled. Worst case scenario, I can only save £50 a month and they want 30%, I can pay £550 in July 2026. I'm debating also not saving and making the higher £50-£100 payments direct to them for several months to reach a final settled amount - I know I will need this guaranteed in writing before increasing payments. I'm going to give them a call today and sound them out anyway. If anyone reads this and has had experiences of old debts being settled, do my percentages sound feasible to be accepted? And how bad a dent did it make on your credit score after doing so? I'm not overly worried as I have an active credit card, but would be annoyed if it set my score back a lot, and for 6 full years? I take seriously my responsibility to repay debt but this card was taken out while I was in a financially and emotionally abusive relationship in my twenties and was earning peanuts (no clue how I even got approved!) but it did also help me get out of the relationship. However, a tonne of charges were added on because I was told they would not accept a repayment plan until I was at least 3 months in arrears - how times have changed in terms of supporting financially vulnerable people, thankfully. It has been taken on by 3 different debt management firms and has been with Capquest for a few years now. I have not been in arrears with any other accounts/rent/council tax etc since 2002 - when I had a few months mortgage default before selling my flat after redundancy following 9/11 job cuts and a boiler I couldn't afford to replace. Sold up and settled arrears immediately. Final thoughts: Haven't mentioned spending yet as feel that is a separate topic, but impulsivity due to my conditions do cause some issues there with spending. But I am at least up to date with every bill/debt payment as mentioned. This all came to a head today when I was checking my bank statements last night and saw how unhealthy they looked. By which I mean, money in and money out each month wasn't an accurate reflection of how I had actually been managing my money much better for the past few years. I realised that with my UC going in on the first of the month, but my statements running mid month to mid month, it wasn't easy at a glance to see how the individual months were running. Wasn't so much of an issue when I was on ESA as money went in two weekly anyway. Now switching to 1st month payments, I'd like it all lined up. I had no idea the bank could change the dates but went in today and they have fixed it so my bank statements will run 1st month to last of the month from August onwards. Is it mad I feel excited about that?! Thank you if you read all this. Never imagined I'd have so many thoughts about the situation! |

Comments

-

Update after long chat with Capquest: On the £2068 debt, todays settlement amount would be £827 (40%). I didn't try to negoatiate as obviously I'm not ready to really think about it for the next couple of months, but that's hopeful. (Based on my savings goals, at that amount it would be between April and December next year before I could clear it.) I can either make the full repayment in 3 large payments, or one lump sum and because it is so old and came off my credit report in 2008, the partial settlement won't show up, so shouldn't affect things on that side. Very helpful chap, 20 minute call, non-judgemental and supportive of my situation. Went better than I thought.2

-

Post 2: Found out today that my eye test was due so just added an unexpected £42 to my credit card bill. Annoying but had to be done as my eyesight was definitely getting worse, plus turns out I need to be using warming pads on my eyes and eye drops. More unexpected expenses, but such is life. Will make things tighter again for the coming weeks but still doable hopefully. Need to travel for dental work in November but most of the costs I've paid for in advance and the rest I have budgeted for. Hopefully that all goes to plan. Tomorrow is definitely an admin and financial recalibration day though.0

-

Welcome to the forums. You've made a great start by getting all your figures collated and in one place. That will help you manage your money and track your progress. Changing bank statement dates will really help you now that the date for payments into the account have changed.There are lots of great diaries on here to inspire you and give you hints and tips.

the monthly grocery challenge over on the old style boards is really useful for recipes and helping to manage spending on food.

keep posting!1 -

What a month! More unexpected health costs unfortunately and spending got a little away from me, but am still on track to pay off overdraft completely on 1st September. I'll be clearing it, and no plans to use it but am keeping it at the minimum £250 limit in case of dire need. Had random good luck when I found mould inside a newly purchased pouch of rice and Tesco's instantly credited me a £5 voucher as a thank you for reporting the batch number etc. I also accrued £7.36 of rewards from my bank account scheme of which £5 is another overdraft reduction payment. Small wins!

Not convinced my bank statements have been reset to the 1st of the month as arranged so will check that tomorrow as just got statement today running from the 8th to the 9th. Very annoying.

But I did do my Income and Expenditure for my Capquest debt repayment. Will be upping monthly repayments to £20 and saving separately to build up a lump sum. Have told them I will re-assess and update my progress in May 2026. Thankfully with my mental health issues, when I relocated 7 years ago, I made it clear I want zero contact from them unless I miss a payment, which I never have. And they have respected that, thankfully - I used to get a fair few evening calls from them when there was no change in my situation and being offered a discounted £1,500 settlement amount was utterly distressing. Telling me to borrow money from friends and family was not appreciated, but they did finally back off. And based on last month's call, they are taking a kinder approach to people with mental health issues on top of debts.

So not the best month, but not the worst.1 -

Do you claim PIP @PostHoc25? You've mentioned going from ESA to UC but not about any PIP. If you're experiencing difficulties through your mental and physical health, you might be able to get PIP depending on where you struggle/need support.

https://www.citizensadvice.org.uk/benefits/sick-or-disabled-people-and-carers/pip/help-with-your-claim/how-decisions-are-made/

This link explains the descriptors you'd be assessed on so could be worth considering.1 -

Thanks for your support. No, sadly not eligibe for PIP as my needs don't reach the criteria. Did apply several years ago, but to be honest for now, I feel I have enough from UC, the fun will start next April when my rent likely increases and I'm at the max for my area (£800pcm) already, so then it will effectively lose the small gains from the uplift of this year. Swings and roundabouts as always :-) With a bit more spending control, I can manage on what I receive luckily - no kids/car/alcohol/tobacco/meat costs thankfully - I really have no clue how families on UC survive.

I've purchased a lot of - hopefully - one off things this year and last (vacuum, armchair, printer, winter coat, mattress) but I do also need a new desk and chair since my back troubles and have four more physio sessions at £65 each month. (I'm waiting for Black Friday/Cyber Monday deals on the desk and chair), so aside from the dreaded unforseen personal or world changes, I think my finances are finally coming under more control aged 50!

As mentioned in previous posts, Sep 1st I clear my overdraft finally, then next year settle my old credit card from 25+ years ago (gargh). Then I won't have any debts other than my 5 year funeral plan (which I intend to chunk down with ad-hoc savings like I did my overdraft). I'm ignoring the student loan as I can't do anything about it.

This month has been rough but I'm trying hard to control my spending impulsivity. I need £6 for the bus as have some hospital tests tomorrow, leaving me £10 cash, £5 nectar points and £5 Tesco voucher for groceries over the next 10 days - should only need milk/fruit/veg. Will be staying in most days to avoid shopping temptation from dipping into savings!

Checked with bank and yup, despite advisor telling me he'd switched the statement dates, they were still mid-month. Another lady reset them all to the first, assuring me it would start from 1st Sep, so let's see!

Thanks again though for the thoughts on PIP 0

0 -

Had an interesting email from Student Finance yesterday, totally out of the blue, and not really sure why now of all times they felt like getting in touch, but it says:

Repayment of your student loan

Your student loan is in repayment. We know you're not working just now, so this means you won't make any repayments towards your loan. If you start working and earning above the threshold, then you'll start making repayments.

You can find out your repayment threshold and other repayment information at www.gov.uk/repaying-your-student-loan

If you're planning to go overseas for more than three months, you'll repay us directly. So, it's important that you let us know before you go.

Thanks

Student Loans CompanyAm guessing it's some automated date triggered thing, I finished Uni in 2012 and was low income then hospitalised and been unable to work since 2013. Feels like a bit of a pointless communication all in all :-)

0 -

APRIL 2015 £1550 to SEPTEMBER 2025 £0!

Finally cleared my student overdraft from 2007!!! Through periods of low emplyment, no employment, homelessness and hospitalisation, this will be the first month I no longer actively use my overdraft and therefore incur no monthly charges.

I have kept the facility open at the minimum £250 but paid in savings to effectively zero out my current account balance. It will be nice not to see the (-) symbol next to my balance in future.

Now onward and upward to saving so I can clear my defaulted credit card from 1999!!!2 -

Fabulous, well done. That will make life a lot easier. V x1

-

Thanks for the encouragement. I feel more motivated to clear my next debt as quick as possible now. :-)vampirotoothus said:Fabulous, well done. That will make life a lot easier. V x1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards