We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Tax treatment of the Indexed uplift of a Discretionary Nil Rate Band Trust.

Parkhouse20

Posts: 13 Forumite

Hello, I am currently trying to sort out the tax implications related to winding up a Discretionary Nil Rate Band Trust following the death of my father, the surviving spouse. The Trust fund contained £285,000 ( the full nil rate band allowance at the time) and was indexed . This indexation amount over the 18 years which have passed since the first death ( and DNRB set up ) amounts to about £270,000. This I know is deemed as income by HMRC and so is liable to an initial 45% tax charge. If the remaining indexation money left after tax is appointed to a non-tax payer ( my son) is the whole amount then charged at a lower tax rate ( and he gets a refund ) ? Or is the money received treated as income for 1 tax year where most of this will be taxed at 40% and 45% ? Other threads I have found only relate to small sums covered by the personal tax allowances .

0

Comments

-

You really need professional advice on this one.1

-

I am, but I thought this was a simple question about how HMRC apply the tax rates.0

-

It is unclear what you mean by the trust fund having been 'indexed' over the past 18 years.Parkhouse20 said:Hello, I am currently trying to sort out the tax implications related to winding up a Discretionary Nil Rate Band Trust following the death of my father, the surviving spouse. The Trust fund contained £285,000 ( the full nil rate band allowance at the time) and was indexed . This indexation amount over the 18 years which have passed since the first death ( and DNRB set up ) amounts to about £270,000. This I know is deemed as income by HMRC and so is liable to an initial 45% tax charge. If the remaining indexation money left after tax is appointed to a non-tax payer ( my son) is the whole amount then charged at a lower tax rate ( and he gets a refund ) ? Or is the money received treated as income for 1 tax year where most of this will be taxed at 40% and 45% ? Other threads I have found only relate to small sums covered by the personal tax allowances .

Questions:

* How was the trust fund actualy invested? Stocks and shares, life company investment bonds, something else?

* Has the trust been producing taxable income or capital gains from its inception? If so have annual trust income tax returns been submitted and taxes paid?

* Was the trust fund revalued on its 10 year anniversary in or around 2017? Did the value exceed the nil rate band of £325k, if so, did the trust pay IHT at 6% on the excess exceeding the NRB?

Finally is the trust fund currently valued at £285k + £270k ie £555k? On what basis do you 'know' the £270k increase in value is deemed to be income? Was the original trust investment actually an investment bond ?

At this point and at the very least it seems to me you may have already missed an IHT compliance event at the trust's10th anniversary. Without clarity on how the trust was actually invested, impossible to form any view of the tax outcome of 'appointing' trust funds to your son at this time.2 -

If what you are asking about is an arrangement similar to that discussed in the threadParkhouse20 said:Hello, I am currently trying to sort out the tax implications related to winding up a Discretionary Nil Rate Band Trust following the death of my father, the surviving spouse. The Trust fund contained £285,000 ( the full nil rate band allowance at the time) and was indexed . This indexation amount over the 18 years which have passed since the first death ( and DNRB set up ) amounts to about £270,000. This I know is deemed as income by HMRC and so is liable to an initial 45% tax charge. If the remaining indexation money left after tax is appointed to a non-tax payer ( my son) is the whole amount then charged at a lower tax rate ( and he gets a refund ) ? Or is the money received treated as income for 1 tax year where most of this will be taxed at 40% and 45% ? Other threads I have found only relate to small sums covered by the personal tax allowances .

https://trustsdiscussionforum.co.uk/t/debt-and-charge-scheme-income-tax-on-the-increase/8440

It'll be down to whether the amount taxed as income is distributed to the beneficiary in one tax year. If so, it'll be the latter as, based on the info provided, he'll have trust income of £270,000 with a 45% tax credit.1 -

A great spot @poblomov, it's a very long time since I last had sight of this type of debt scheme secured on the family home.poblomov said:

If what you are asking about is an arrangement similar to that discussed in the threadParkhouse20 said:Hello, I am currently trying to sort out the tax implications related to winding up a Discretionary Nil Rate Band Trust following the death of my father, the surviving spouse. The Trust fund contained £285,000 ( the full nil rate band allowance at the time) and was indexed . This indexation amount over the 18 years which have passed since the first death ( and DNRB set up ) amounts to about £270,000. This I know is deemed as income by HMRC and so is liable to an initial 45% tax charge. If the remaining indexation money left after tax is appointed to a non-tax payer ( my son) is the whole amount then charged at a lower tax rate ( and he gets a refund ) ? Or is the money received treated as income for 1 tax year where most of this will be taxed at 40% and 45% ? Other threads I have found only relate to small sums covered by the personal tax allowances .

https://trustsdiscussionforum.co.uk/t/debt-and-charge-scheme-income-tax-on-the-increase/8440

It'll be down to whether the amount taxed as income is distributed to the beneficiary in one tax year. If so, it'll be the latter as, based on the info provided, he'll have trust income of £270,000 with a 45% tax credit.

If this indeed is what the OP is referring to, then for the indexed amount to now be available for distribution, the property upon which the debt was secured may have been sold ( or due to be sold shortly).

The scheme ( if that is what the OP is referring to) would have been set up by a private client specialist solicitor, so one wonders why they are speculating on the tax outcome of a proposed distribution to the son here on this forum, rather than consulting the firm that created it.

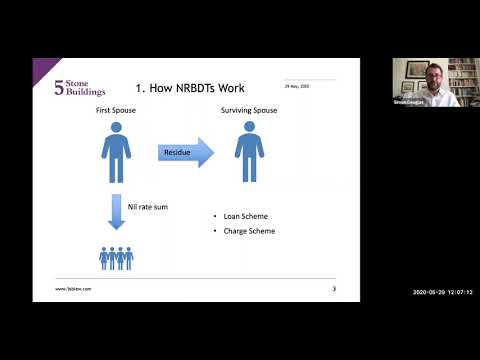

Be that as it may, the OP may find the following video presentation from a private client barrister practicing in Lincoln's Inn of particular interest - https://youtu.be/7t1lDVs8-fE?si=PfOeqbAxszQM_f5W

https://youtu.be/7t1lDVs8-fE?si=PfOeqbAxszQM_f5W

Since the trust was originally established before the inception of the Residential nil rate band, there is an extra £350,000 of NRBs ( 2 x £175k) available to the deceased estate that could not have been envisaged when the trust was created.

One of the courses of action proposed by the barrister in the video ( around 30 minutes in), is rather than face a 45% income tax charge on interest by enforcing the indexation, instead waive the indexation in its entirety, so the debt charge on the deceased estate is restricted to the original NRB. This could be a sensible course of action if little or no IHT becomes chargeable on the father's residuary estate after deducting £285k rather than £285k + £270k.

The son could be compensated direct from the estate ( via DOV) for loss of the £270k waived by the trustees, assuming the IHT consequences on the estate are favourable in this regard.

Armed with the contents of the barrister's video dissertation, I would suggest the OP either return to the original firm that created the trust, or find another STEP qualified lawyer to discuss the best strategy to mitigate/avoid tax outflows from the trust/ estate by judicious consideration as to whether to enforce the indexed interest.

2 -

Many thanks all for taking the time to reply. I am working with the original firm who have dealt with both my parents’ wills , probate , power of attorney and now the trust, although the original solicitor is long since retired. It is clear that the existence of the DNRB trust no longer fulfils it’s original purpose although I would have been glad of it had the government decided to stop the transferrable NRB policy. My mum passed away a year before the TNRB policy was introduced so the trust money could have been appointed to my Dad within the 2 year window . I don’t know how much onus there is on solicitors to contact clients if a law change impacts something like a trust they have set up for their clients. My dad would not have known of the changes and their implications to the trust. As it stands, with the trust in existence , indexing will lead to a bigger tax bill so waiving the indexing is most likely. I am the sole beneficiary of the trust and the estate so that makes thing less complicated although I will do a deed of variation to pass much of the estate direct to my 2 children to reduce a potentially large IHT further down the line. Unfortunately the trust without indexing or interest fixes the IOU to the trust fund at £285, 000 so there is an extra unused £40,000 NRB wasted.0

-

Parkhouse20 said:Many thanks all for taking the time to reply. I am working with the original firm who have dealt with both my parents’ wills , probate , power of attorney and now the trust, although the original solicitor is long since retired. It is clear that the existence of the DNRB trust no longer fulfils it’s original purpose although I would have been glad of it had the government decided to stop the transferrable NRB policy. My mum passed away a year before the TNRB policy was introduced so the trust money could have been appointed to my Dad within the 2 year window . I don’t know how much onus there is on solicitors to contact clients if a law change impacts something like a trust they have set up for their clients. My dad would not have known of the changes and their implications to the trust. As it stands, with the trust in existence , indexing will lead to a bigger tax bill so waiving the indexing is most likely. I am the sole beneficiary of the trust and the estate so that makes thing less complicated although I will do a deed of variation to pass much of the estate direct to my 2 children to reduce a potentially large IHT further down the line. Unfortunately the trust without indexing or interest fixes the IOU to the trust fund at £285, 000 so there is an extra unused £40,000 NRB wasted.

Yes it is unfortunate that your mother's Will was not reviewed in the light of the introduction of the transferable nil rate band, which now necessitates a more costly unwinding of the trust.

Interestingly ( and in my experience) upper tier Chartered Accountancy firms handling annual income tax compliance for their clients were more likely to pick up on the possibility to revise old wills which made use of NRBs on 1st death, due to their ongoing 'rolling' relationship with the client.

Solicitors tend to operate on a more 'one off ' transactional basis, especially where there is a lack of continuity with regard to whomever set up the original wills. Chartered Accountancy firms with active private client departments tended to have more proactive systems and practices to pick up on legislative tax changes affecting their client's affairs.

Notwithstanding loss of £40k of your mother's NRB, your father should still have a total of £675k in NRBs to shelter the estate before considering the trust, so hopefully waiving the indexed interest leads to a lesser tax outflow of IHT at 40% compared to 45% income tax.1 -

I would imagine that, if they aren't already in a class of potential beneficiaries, you could add your children as beneficiaries of the trust and thereby split up the income distributions between more than one person.Parkhouse20 said:Many thanks all for taking the time to reply. I am working with the original firm who have dealt with both my parents’ wills , probate , power of attorney and now the trust, although the original solicitor is long since retired. It is clear that the existence of the DNRB trust no longer fulfils it’s original purpose although I would have been glad of it had the government decided to stop the transferrable NRB policy. My mum passed away a year before the TNRB policy was introduced so the trust money could have been appointed to my Dad within the 2 year window . I don’t know how much onus there is on solicitors to contact clients if a law change impacts something like a trust they have set up for their clients. My dad would not have known of the changes and their implications to the trust. As it stands, with the trust in existence , indexing will lead to a bigger tax bill so waiving the indexing is most likely. I am the sole beneficiary of the trust and the estate so that makes thing less complicated although I will do a deed of variation to pass much of the estate direct to my 2 children to reduce a potentially large IHT further down the line. Unfortunately the trust without indexing or interest fixes the IOU to the trust fund at £285, 000 so there is an extra unused £40,000 NRB wasted.

It didn't appear to be mentioned in the video - I only watched up to the section mentioning waiving the interest - but apparently a waiver of interest will be treated as a capital distribution from the trust. Or at least that is HMRC's view.

As indicated in the video it seems that some legal people don't agree with HMRC's view that the indexation is taxable as interest, but no-one has been willing to go forward with a case to challenge HMRC's view. And it may also depend on the precise drafting of the will.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.4K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards