We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

BBGI Corporate takeover - possible loss of entire value of shareholding?

Comments

-

Some good NewsHad This from BBGI this morning:looks like they are going to pay dividend 136.1p per share on 22 August.and there will most likely be a final dividend when the company is fully liquidated.Email from BBGI contained the following highlights:Pre-liquidation dividend

The proceeds from the Asset Sale (less certain deductions representing liquidation costs and expenses and in order to maintain minimum share capital under Luxembourg law) will be distributed to BBGI Shareholders in the form of a cash dividend of 136.1 pence per BBGI Share (the “Pre-liquidation Dividend”).

Details of the Pre-liquidation Dividend are as follows:

Dividend per share: 136.1 pence

Dividend record date: 7 August 2025

Payment Date: 22 August 2025Subject to the settlement of all outstanding liabilities of BBGI in liquidation, any residual proceeds (if any) from the Asset Sale will be distributed to BBGI Shareholders through a liquidation distribution payment.

There is no certainty that BBGI Shareholders will receive, in the aggregate under both the Pre-liquidation Dividend and in any liquidation distribution (if made), the same amount in respect of their BBGI Shares as they would have received had they sold their BBGI Shares to Bidco by accepting the Offer.

Important notices

1 -

No doubt that will be a relief to those who did nothing, although not the most tax efficient way of getting your money back. Hopefully the dividend will not bust anyone's basic rate tax threshold.1

-

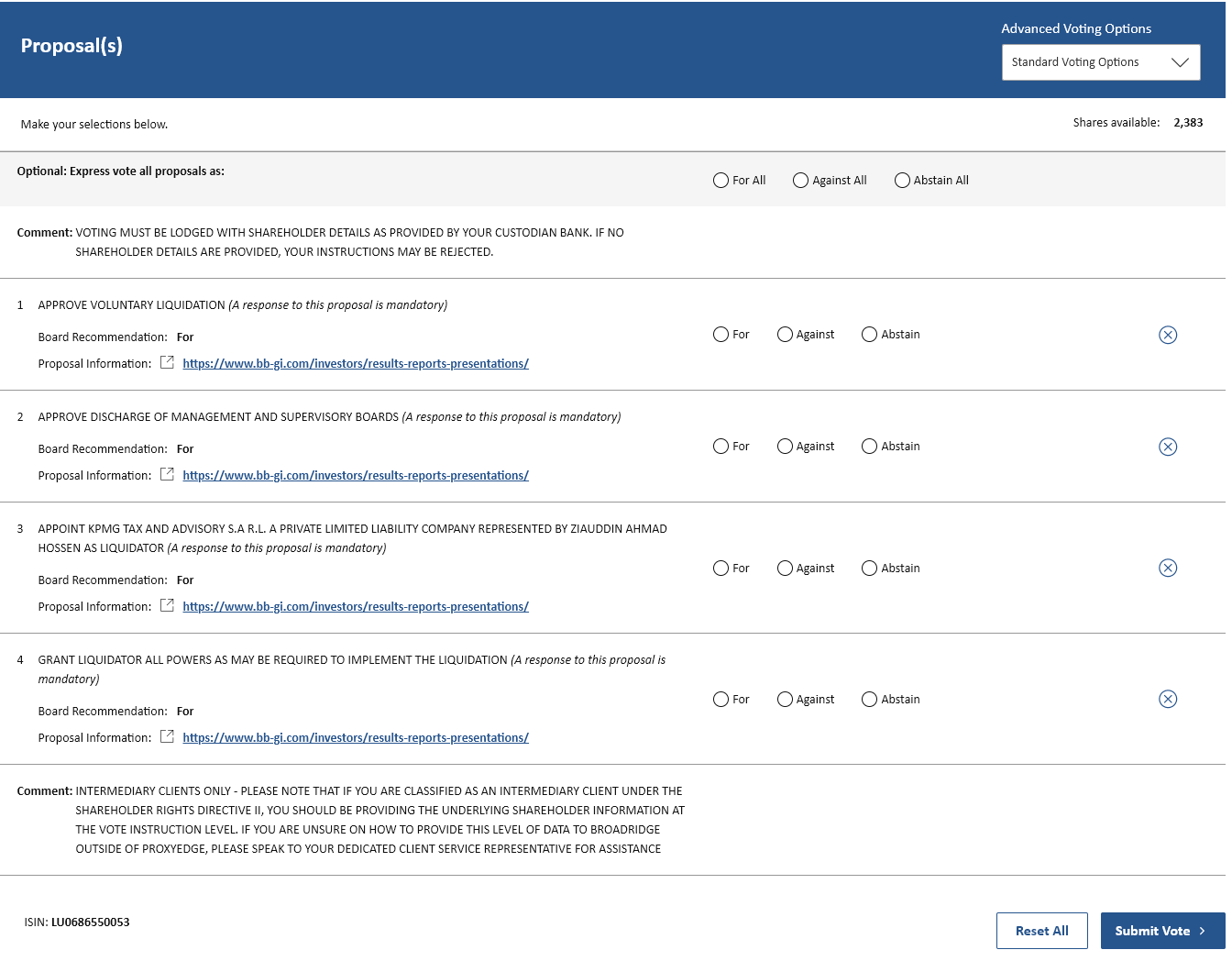

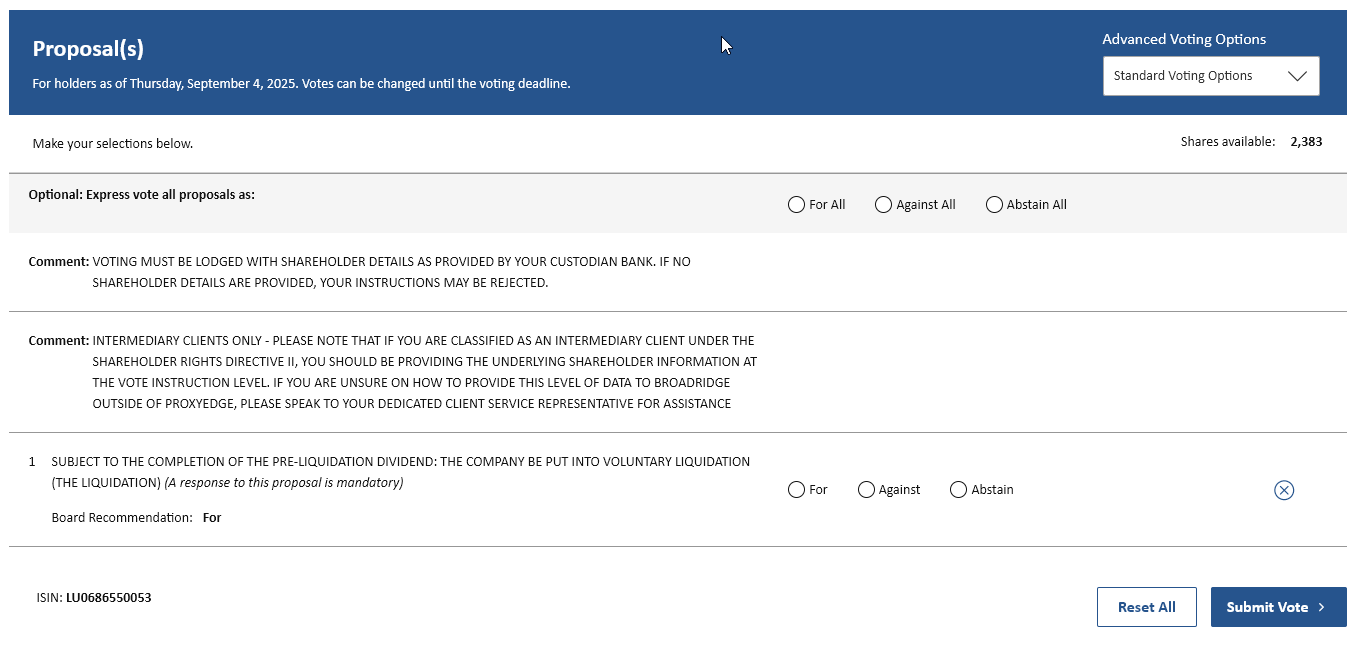

I have a couple of voting forms in my inbox at II this morning. I guess the sensible thing is to go with the Board recommendation:

0 -

If you want the assets to be liquidated and a distribution made to you, then vote for. If you want to remain locked into your unlisted shares vote against. Though I think it is quite unlikely these resolutions won't pass.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards