We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

TSB is up for sale again

Comments

-

Have a little empathy for the thousands of people that are employed by this bank and are currently extremely worried for their financial future please.subjecttocontract said:I can t imagine that the sale of TSB will bother very many people. They never offered much in the first place so there ain't much to loose. The only thing I ever used at TSB was their reg saver and that wasn't great most of the time. I won't miss them and will probably forget them within a week of their sale.Premier League Baby!0 -

Very practical issue for me: I have an awesome mortgage rate with TSB and am due to remortgage in Nov 2026. I've always had great options with TSB.

So my question is, are Santander any good for mortgages? Or might their offers change in light of the purchase? I've not ever really thought or noticed how these things change in the past, so thought I'd ask those who have an eye on these kinds of things.0 -

Sometimes they're competitive, sometimes they aren't. Same as TSB.WindfallWendy said:Very practical issue for me: I have an awesome mortgage rate with TSB and am due to remortgage in Nov 2026. I've always had great options with TSB.

So my question is, are Santander any good for mortgages? Or might their offers change in light of the purchase? I've not ever really thought or noticed how these things change in the past, so thought I'd ask those who have an eye on these kinds of things.

Too many variables to consider; it's entirely possible (likely even) that TSB and Santander will still be functionally separate in Nov 2026; see Nationwide/VM, Coventry/Co-op... basically every bank takeover in fact.1 -

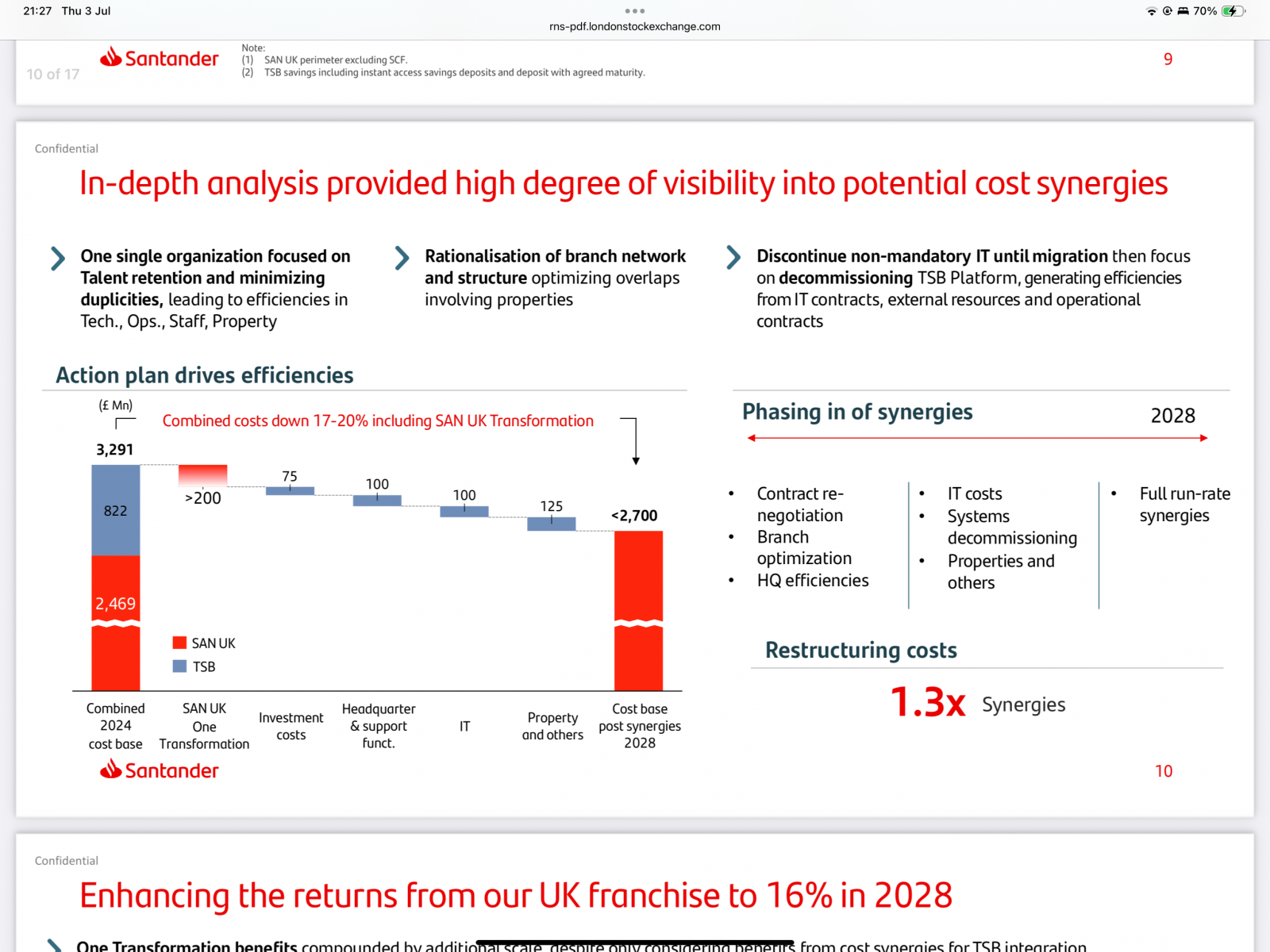

I agree TSB is a weak brand. I kind of feel for it and its people, the 2nd incarnation of TSB was born out of the need to follow regulation, not because anyone wanted it. It's not really a surprise it didn't last long though I am of course sorry for the all staff. Santander have always been so obsessed with cost cutting that I see TSB disappearing the minute it can following integration.wmb194 said:

From the analyst presentation, if the purchase completes in Q1 26 and the plan is to have the integration completed in 2028 two years looks about right. I doubt Abbey will be the benchmark as A&L and B&B both disappeared very quickly. TSB is a weak brand anyway.GeoffTF said:

One of the reports. I do not remember which one, or how reliable the source was. Santander will not have done much detailed technical planning at this stage anyway. Two years sounds about right though. I expect that it will be much longer before the last TSB debit cards and cheque books disappear from use, judging from what happened when Santander took over Abbey National.ranciduk said:2 years?? Where did you read that?

https://www.londonstockexchange.com/news-article/BNC/presentation-to-analysts-about-transaction-on-tsb/17114285

As for Santander leaving the UK, who knows what's going on. I got the impression that the person who made the statement (was it the Chair?) was having a dig at the amount of regulation rather than actually wanting to leave the UK, but it was badly handled and so now there is doubt as to their future here.0 -

The CEO of Banco Santander has made it very clear that Santander is here to stay in the UK. There were press reports that Barclays and NatWest would like to buy Santander, but they did not offer enough money to interest Santander. It possible that the UK operation would have been sold if Santander had been offered a lot more than the business was worth.OrangeBlueGreen said:I got the impression that the person who made the statement (was it the Chair?) was having a dig at the amount of regulation rather than actually wanting to leave the UK, but it was badly handled and so now there is doubt as to their future here.0 -

Santander UK is and was always "here to stay in the UK" that doesn't mean Banco Santander is here to stay.GeoffTF said:

The CEO of Banco Santander has made it very clear that Santander is here to stay in the UK. There were press reports that Barclays and NatWest would like to buy Santander, but they did not offer enough money to interest Santander. It possible that the UK operation would have been sold if Santander had been offered a lot more than the business was worth.OrangeBlueGreen said:I got the impression that the person who made the statement (was it the Chair?) was having a dig at the amount of regulation rather than actually wanting to leave the UK, but it was badly handled and so now there is doubt as to their future here.

Banco Santander can still float, sell or merge their UK business when and if it suits them.

Barclays and NatWest are always going to face large regulatory hurdles to takeover Santander UK and ultimately only interested in the extended customer base so this will reflect what they're willing to offer.0 -

Who would offer more, and what would they want apart from the customer base? Nothing is impossible, but I do not expect the business to be bought out any time soon.[Deleted User] said:

Santander UK is and was always "here to stay in the UK" that doesn't mean Banco Santander is here to stay.GeoffTF said:

The CEO of Banco Santander has made it very clear that Santander is here to stay in the UK. There were press reports that Barclays and NatWest would like to buy Santander, but they did not offer enough money to interest Santander. It possible that the UK operation would have been sold if Santander had been offered a lot more than the business was worth.OrangeBlueGreen said:I got the impression that the person who made the statement (was it the Chair?) was having a dig at the amount of regulation rather than actually wanting to leave the UK, but it was badly handled and so now there is doubt as to their future here.

Banco Santander can still float, sell or merge their UK business when and if it suits them.

Barclays and NatWest are always going to face large regulatory hurdles to takeover Santander UK and ultimately only interested in the extended customer base so this will reflect what they're willing to offer.0 -

I do recall when Santander took over abbey, that abbey had just rebranded under a hideous rainbow style branding and then suddenly they changed again to Santander.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.5K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.3K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards