We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

LCW/LCWRA status confirmation delays, (and thus TE calculation delays)

Comments

-

Have you got access to the journal?

If you don't get no response make a complaint.

https://www.gov.uk/government/organisations/department-for-work-pensions/about/complaints-procedure

1 -

TimeLord1 said:Have you got access to the journal?

If you don't get no response make a complaint.

https://www.gov.uk/government/organisations/department-for-work-pensions/about/complaints-procedureNo, they closed my journal along with the claim cancellation.Thank you for the link.Blessed are the cracked, for it is they who let in the light...:A0 -

Sorry @kxMx I didn't see your reply.KxMx said:Being a managed migration from ESA isn't relevant as UC is fully means tested.

There is only a specific 12 month exemption for those migrating from Tax Credits with over £16k capital.

Obviously they were incorrect not to disregard most of your capital.

If no joy from the helpline you can try a formal complaint

https://makeacomplaint.dwp.gov.uk/0 -

I’m in the same position as Matt. Managed migration from joint tax credits (and ESA contributions based + support group for husband). Original migration date was 14th March, received a letter from UC in advance (dated 27th Feb) saying this had been extended to 14th April. Since TC were ending on the 5th and I figured I’d be better off leaving it due to my capital, I applied on the 4th April for both of us, but had to be two single claims as OH is now in permanent residential care due to young onset dementia.

His claim proceeded fine and is in payment and included LCWRA in the first payment as I used his journal to inform he was in the SG. My claim was cancelled (after I sent a note on my journal to say there had been no statement generated on my claim) due to capital and that it was not considered to be a migration. I believe I wouldn’t receive transitional protection on the entitlement calculation but should have for the capital disregard. I think I should have had an UC award of around £60 but they deducted something ridiculous like £764 for capital (eh? 🤣), which wiped out my single element, plus child element - work allowance - what should have been £174.

Part of me thinks I should just leave it as my youngest finishes college after his A Levels, but I know they are wrong. Someone called me around 30 before my claim was closed asking why I waited so long to apply, that the extension only applied to OH (wrong, it is addressed to me and specifically says “you and your partner now need to claim by 6th April”, but I didn’t have the letter to hand and subsequently found it), said I should have made a joint claim - we are still married, legally and emotionally, but do not live together - so I’m 99% sure this is incorrect. I’m sure she said she was a decision maker too so it’s astounding. I’d just got out of hospital that day so wasn’t really in the mood to follow up. I know I’ll need to do this tomorrow really before I time out on challenging it, but like I said, it’s probably not work it for a couple of small payments.0 -

My understanding is despite the Migration Notice you wouldn’t be classified as a Managed Migration case as there has been a significant change of circumstance between your Tax Credit claim and your UC claim (i.e. Joint to Single) and therefore you don’t qualify for the capital Transitional Protection.kaysdee said:I’m in the same position as Matt. Managed migration from joint tax credits (and ESA contributions based + support group for husband). Original migration date was 14th March, received a letter from UC in advance (dated 27th Feb) saying this had been extended to 14th April. Since TC were ending on the 5th and I figured I’d be better off leaving it due to my capital, I applied on the 4th April for both of us, but had to be two single claims as OH is now in permanent residential care due to young onset dementia.

His claim proceeded fine and is in payment and included LCWRA in the first payment as I used his journal to inform he was in the SG. My claim was cancelled (after I sent a note on my journal to say there had been no statement generated on my claim) due to capital and that it was not considered to be a migration. I believe I wouldn’t receive transitional protection on the entitlement calculation but should have for the capital disregard. I think I should have had an UC award of around £60 but they deducted something ridiculous like £764 for capital (eh? 🤣), which wiped out my single element, plus child element - work allowance - what should have been £174.

Part of me thinks I should just leave it as my youngest finishes college after his A Levels, but I know they are wrong. Someone called me around 30 before my claim was closed asking why I waited so long to apply, that the extension only applied to OH (wrong, it is addressed to me and specifically says “you and your partner now need to claim by 6th April”, but I didn’t have the letter to hand and subsequently found it), said I should have made a joint claim - we are still married, legally and emotionally, but do not live together - so I’m 99% sure this is incorrect. I’m sure she said she was a decision maker too so it’s astounding. I’d just got out of hospital that day so wasn’t really in the mood to follow up. I know I’ll need to do this tomorrow really before I time out on challenging it, but like I said, it’s probably not work it for a couple of small payments.Presumably if your Husband’s UC claim has gone through you’ve declared they have no or under 16k in Capital.0 -

I'm not sure that I agree.Yes there has been a change of circumstances - but a partner going into care doesn't mean that you are no longer a couple.I think it should still be a couples claim, and still be a MM from Tax Credits so atracting the 12 month capital disregard.(£174 is the deduction for £16k savings, or above, in that situation).To me it sounds as if the claim is still a MM from Tax Credits couples claim - but the £174 deduction for having savings over £16k has wiped out any actual payment.@kaysdee If you want this checked further then you should contact a local welfare/benefits adviser who can look at your paperwork: https://advicelocal.uk/

0 -

If one person goes into a care home as permanent residential when dealing with state pensions both will claim as single people (just happened to my friend's parents) I expect UC would follow those same DWP rules, but haven't checked this.Newcad said:I'm not sure that I agree.Yes there has been a change of circumstances - but a partner going into care doesn't mean that you are no longer a couple.I think it should still be a couples claim, and still be a MM from Tax Credits so atracting the 12 month capital disregard.(£174 is the deduction for £16k savings, or above, in that situation).To me it sounds as if the claim is still a MM from Tax Credits couples claim - but the £174 deduction for having savings over £16k has wiped out any actual payment.@kaysdee If you want this checked further then you should contact a local welfare/benefits adviser who can look at your paperwork: https://advicelocal.uk/

Let's Be Careful Out There0 -

They do - you’re separate Households so would each have individual single UC claims.HillStreetBlues said:

If one person goes into a care home as permanent residential when dealing with state pensions both will claim as single people (just happened to my friend's parents) I expect UC would follow those same DWP rules, but haven't checked this.Newcad said:I'm not sure that I agree.Yes there has been a change of circumstances - but a partner going into care doesn't mean that you are no longer a couple.I think it should still be a couples claim, and still be a MM from Tax Credits so atracting the 12 month capital disregard.(£174 is the deduction for £16k savings, or above, in that situation).To me it sounds as if the claim is still a MM from Tax Credits couples claim - but the £174 deduction for having savings over £16k has wiped out any actual payment.@kaysdee If you want this checked further then you should contact a local welfare/benefits adviser who can look at your paperwork: https://advicelocal.uk/FWIW, any MM case I’ve seen which is single when the prior benefit was joint (or vice versa) has an automated Journal message saying “You will not get Transitional Protection. This is because your circumstance are different to that of your previous benefits…” and is treated as a “natural” migration (so no Capital TP applicable at all, as that only applies for MM from Tax Credits).2 -

Thank you. I have until the 11th to make a mandatory reconsideration. I might just leave it though, as mentioned, son leaves college next month and my entitlement (if treated as MM) would end. Apologies, didn’t want to derail the OP.If they’d deducted £174, I would have been left with an entitlement of £111, but on my zero award statement (before they closed the claim), they deducted £700+ due to capital, so everything was wiped out.

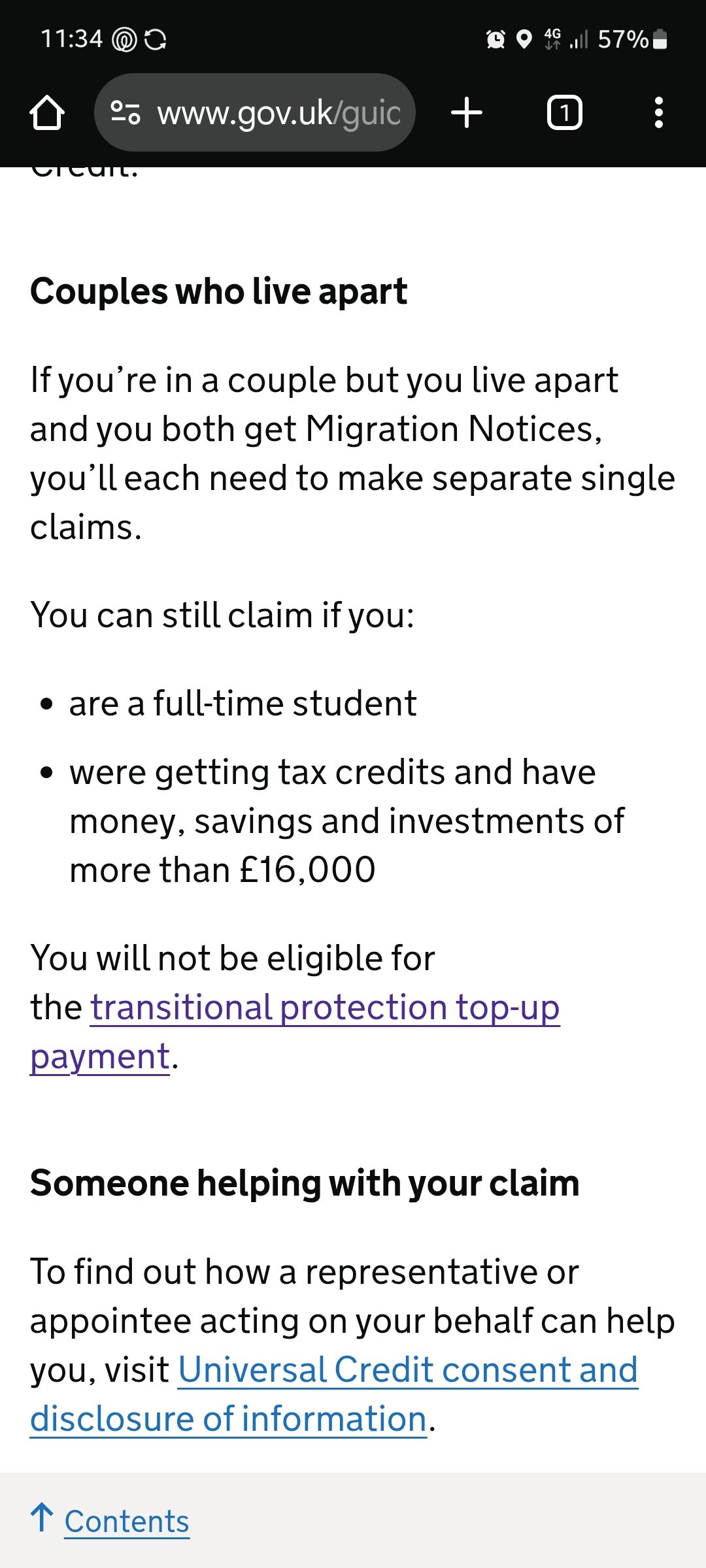

When I submitted my bank statements, the person at the job centre said it hadn’t come through as a MM. We are both under state pension age. Change of address was reported to tax credits when he moved to residential care (under their rules we were allowed to maintain a joint claim living apart), we each received a migration notice, so my understanding is I wouldn’t be entitled to the TE due to change of circumstances, but should have still been allowed capital disregard. I might be reading it wrong - according to gov.uk: 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards