We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Rate Cuts 2025 'Crystal Ball'

saunderd

Posts: 16 Forumite

Question, just looking myself at moving ISA's due to rate cuts but also did I dream it or did Martin Lewis say recently (maybe on GMB this week?) that we should look to move to a fixed rate that is lower than what is currently on offer with the easy access type accounts as the indications are that the base rate will continue to go down much more this year?

So I was thinking of moving to Tembo with their 4.8% (which is probably being reviewed anyway) but then if I go for a fixed rate it's going to be around 4.2% - thoughts on the crystal ball situ or did I dream he said the above?

Risk the higher for a while longer and a fixed then going lower if things drop a lot - hmmm

So I was thinking of moving to Tembo with their 4.8% (which is probably being reviewed anyway) but then if I go for a fixed rate it's going to be around 4.2% - thoughts on the crystal ball situ or did I dream he said the above?

Risk the higher for a while longer and a fixed then going lower if things drop a lot - hmmm

0

Comments

-

I'd say it's a slam dunk that savings rates are going down this year, perhaps up to a whole 1%.1

-

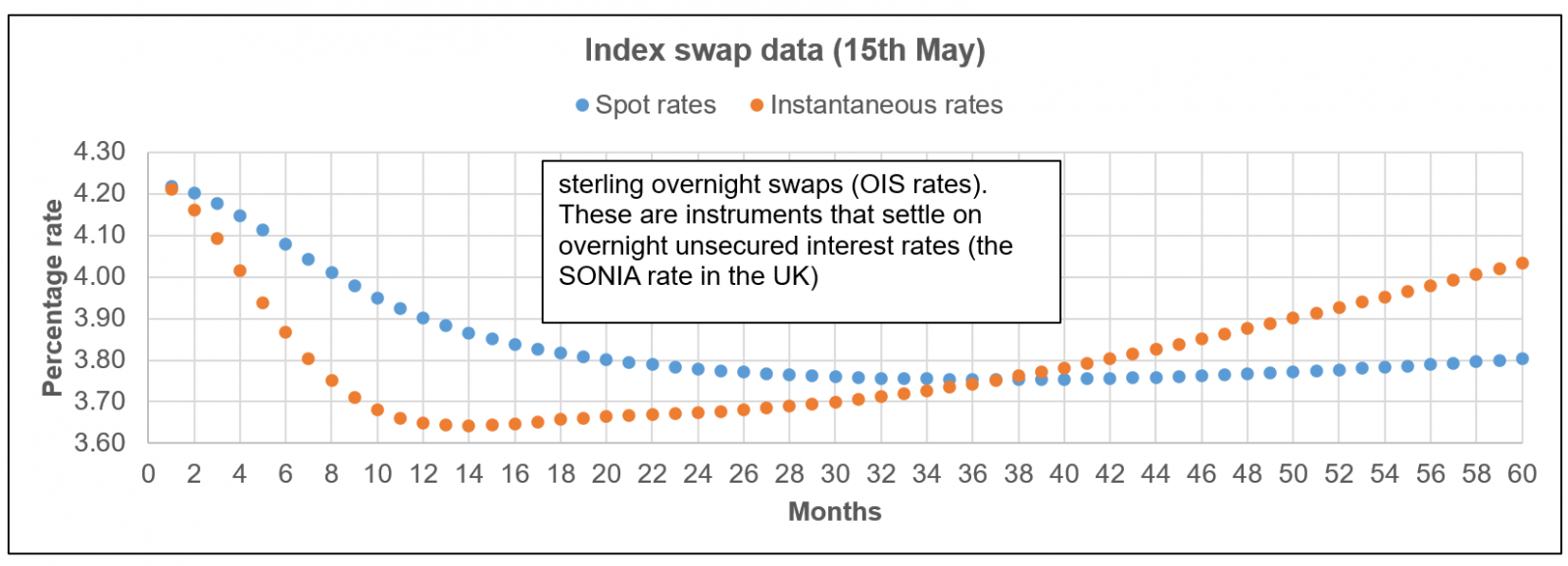

The markets are predicting roughly speaking two further 0.25% cuts in base rate over the next 12 months (and possibly a third).This is a chart from the Bank of England yield curve data (from the OIS daily data current month download). The SONIA rate is a good rough proxy for expected base rate. So the orange line is an indication of what base rate is predicted to be in x months time, and the blue line is the predicted average base rate up to month x.

I came, I saw, I melted7

I came, I saw, I melted7 -

Morningstar have come to the similar conclusions to me, which is not surprising as they are using swap data alsohttps://www.morningstar.co.uk/uk/news/265090/uk-inflation-what-to-expect-from-aprilrsquo;s-data.aspxThe MPC next meets in June, and will meet again in August, September, November, and December. Interest-rate swaps data forecasts a rate hold in June, followed by cuts in August and again in NovemberI came, I saw, I melted5

-

So I was thinking of moving to Tembo with their 4.8% (which is probably being reviewed anyway) but then if I go for a fixed rate it's going to be around 4.2%

In a stable interest rate situation/outlook, you would expect fixed rates to be higher than easy access, as you are having to tie your money up.

So you could read into that negative difference of 0.6%, that the expected drops are higher than that.

Off topic slightly, there quite a few threads about Tembo on the forum, which could be worth a read.4 -

I managed to grab the Charter 1 Year Fix ISA at 4.27% the day before they withdrew it, leaving it unfunded to see what happened at the last BOE meeting! I've been dithering over transferring this year's EA ISA with Charter (4.55%), which I expected to have dropped by now, but hasn't! I've got until 28th May to stop dithering and either do the transfer to the Fix, or let the Fix self-close! It seems so un-MSE to choose to deliberately drop rates, but all predictions seem to point to it being the wise choice under the circumstances.saunderd said:Question, just looking myself at moving ISA's due to rate cuts but also did I dream it or did Martin Lewis say recently (maybe on GMB this week?) that we should look to move to a fixed rate that is lower than what is currently on offer with the easy access type accounts as the indications are that the base rate will continue to go down much more this year?

So I was thinking of moving to Tembo with their 4.8% (which is probably being reviewed anyway) but then if I go for a fixed rate it's going to be around 4.2% - thoughts on the crystal ball situ or did I dream he said the above?

Risk the higher for a while longer and a fixed then going lower if things drop a lot - hmmmCompiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum1 -

As they say events - the UK's monetary policy is influenced by global events.

So while the trend now is down - with more cuts later in the year - nothing is certain given Trump, China, Ukraine, middle east etc etc.0 -

But there are views that inflation is about to go up in the next few months. That's what I've read anyway. Isn't that going to reduce the likelihood of bank rate reductions, which are used to curb inflation?0

-

The MPC considers inflation in the medium term. If the UK (or the world) is heading for recession it's likely to ignore smallish short-term inflation rises and cut rates anyway.

The most likely scenario going forward is still for quarterly rate cuts of 0.25% for the next two or three quarters. Of course, each of us has to decide whether we believe all this or not.0 -

The key point is that everybody is expecting a temporary increase in inflation, and the reasons for it are known.JohnB47 said:But there are views that inflation is about to go up in the next few months. That's what I've read anyway. Isn't that going to reduce the likelihood of bank rate reductions, which are used to curb inflation?

The BoE will be more focused on the underlying trends long term for inflation, and of course on the other side for the threat of recession.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards