We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Reeves' ISA review

Comments

-

One thing that seems to be overlooked in the media about the £20k limit is the flexibility that offers.Shylock_249 said:

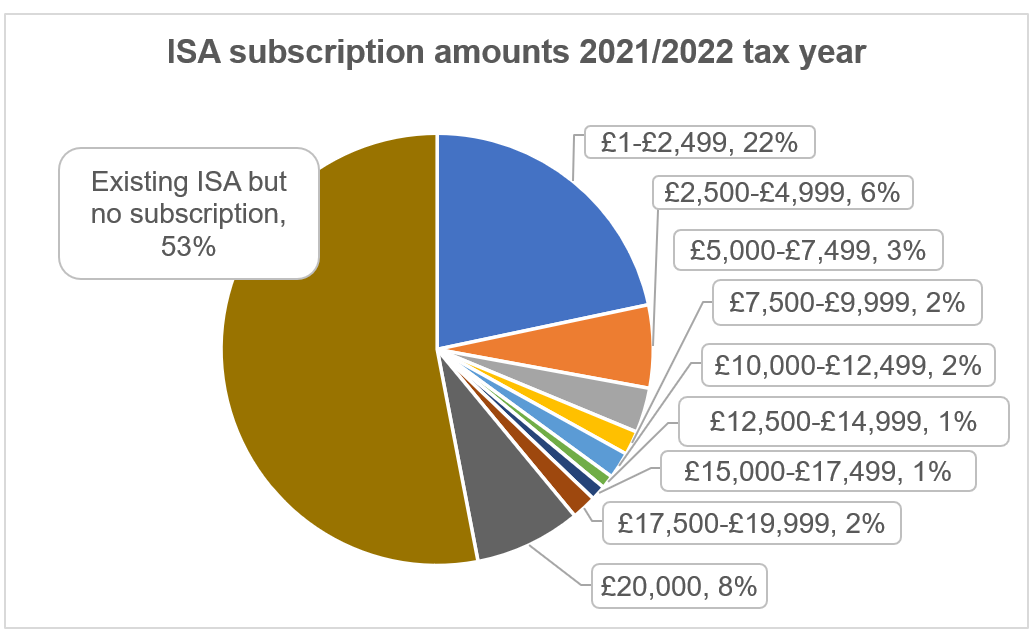

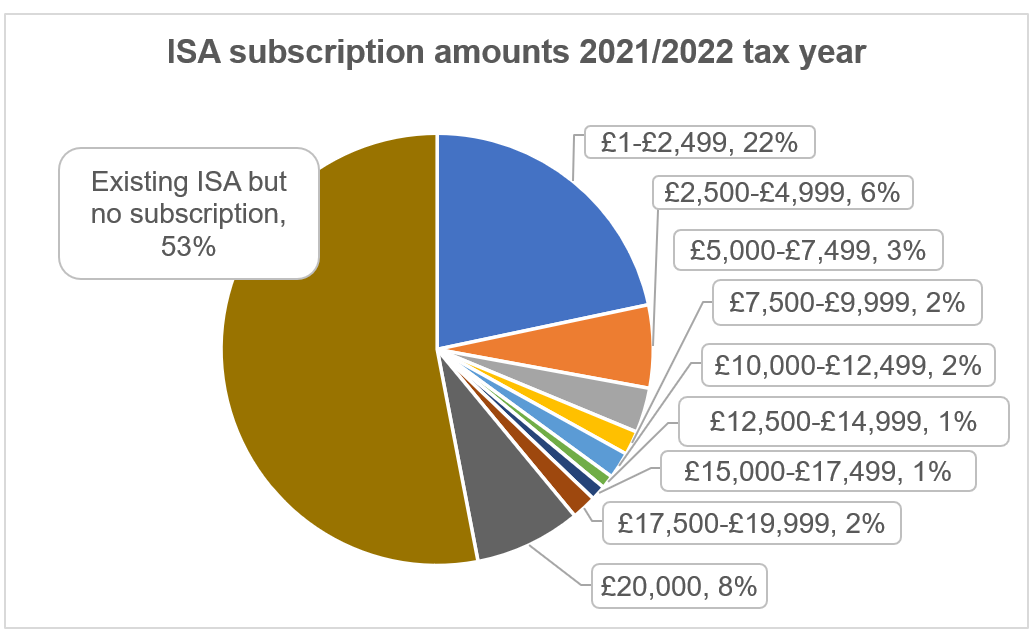

Interesting pie chart.SnowMan said:poseidon1 said:

Interesting article below from A J Bell which backs up your statement. Particularly interesting how the total value in stocks and shares isas completely dwarfs that of cash isas by a magnitude of 7 times.masonic said:So about 75% of ISA subscribers will not be impacted as they don't use more allowance than that ordinarily. Seems well worth the political heat.

https://www.ajbell.co.uk/group/news/isas-unpacked-who-holds-them-and-how-much-do-they-have#:~:text=Around 1.8 million use up their full,60% contributing less than £5,000 a year

Obviously a large chunk of the population cannot afford to get anywhere near the maximum £20k annual contribution, so our little echo chamber of forumites in no way reflects the wider saving public.

I fear for that reason, other than the inevitable backlash from the Tory press, reducing cash isas to £10k annually will still be a generous limit for the vast majority.

Personally as long as the £20k overall annual limit is retained, I won't be bothered either way.The data is all at the link below although it's only available up to the 2021/2022 tax yearOf the 22 million UK residents who had an ISA (cash or stocks and shares) at all (so many don't even have one and so aren't represented in the chart below at all) the percentages contributing over 10K pa is only 14% (of which 8% contribute the full 20K)

Unless I'm mistaken, It's interesting to note that those who took out a 20k ISA actually represented 17% of those who saved ..... 47% took out ISAs and 8% of those opted for 20k. I'd suggest that is a sizeable number of people. Also of those who did save the 20k savers were the second highest group.

The 53% of those with existing ISAs "might" well have saved many years before with minimal savings.

The narrative that has been reported by some channels is "those saving £20k every year don't need a tax break".

I suggest that the number saving £20k every year (potentially after other tax-efficient channels such as pension) are going to be a very small number.

They are also quite probably financially astute and have some level of advice to achieve a risk-balanced portfolio. Consider an individual who is regularly funding their pension to a good level, that is long term investment and may well be on a higher risk basis and almost certainly predominantly in shares. If that individual then also invests £20k per year in cash ISA, that might be a prudent approach given the individual's overall investment portfolio and risk profile.

It seems to be a false assumption that individuals paying £20k into a cash ISA are doing so from an uninformed position and can be encouraged to move that cash deposit to shares.

What I suspect is more likely with the contributions at £20k in the year is that these are savings from one off events such as redundancy / inheritance. If those funds are diverted from cash ISA, they also do not obviously end up in shares.

I also imagine that it is likely that the just over half shown as having an ISA and adding nothing to it will be people for whom the ISA is an integral part of their retirement planning and now retired.2 -

I use it to transfer 20k a year from taxable FRBs, when they mature, to non-taxable ISAs.Grumpy_chap said:

What I suspect is more likely with the contributions at £20k in the year is that these are savings from one off events such as redundancy / inheritance.1 -

Your final paragraph is spot on in our case, our ISAs are used to generate additional monthly income above our pensions so we can stay warm etc. without worrying about the costs...and yes we know this will erode the value of our capital but as we're both in our late 70s it's not really a worry to us.Grumpy_chap said:

One thing that seems to be overlooked in the media about the £20k limit is the flexibility that offers.Shylock_249 said:

Interesting pie chart.SnowMan said:poseidon1 said:

Interesting article below from A J Bell which backs up your statement. Particularly interesting how the total value in stocks and shares isas completely dwarfs that of cash isas by a magnitude of 7 times.masonic said:So about 75% of ISA subscribers will not be impacted as they don't use more allowance than that ordinarily. Seems well worth the political heat.

https://www.ajbell.co.uk/group/news/isas-unpacked-who-holds-them-and-how-much-do-they-have#:~:text=Around 1.8 million use up their full,60% contributing less than £5,000 a year

Obviously a large chunk of the population cannot afford to get anywhere near the maximum £20k annual contribution, so our little echo chamber of forumites in no way reflects the wider saving public.

I fear for that reason, other than the inevitable backlash from the Tory press, reducing cash isas to £10k annually will still be a generous limit for the vast majority.

Personally as long as the £20k overall annual limit is retained, I won't be bothered either way.The data is all at the link below although it's only available up to the 2021/2022 tax yearOf the 22 million UK residents who had an ISA (cash or stocks and shares) at all (so many don't even have one and so aren't represented in the chart below at all) the percentages contributing over 10K pa is only 14% (of which 8% contribute the full 20K)

Unless I'm mistaken, It's interesting to note that those who took out a 20k ISA actually represented 17% of those who saved ..... 47% took out ISAs and 8% of those opted for 20k. I'd suggest that is a sizeable number of people. Also of those who did save the 20k savers were the second highest group.

The 53% of those with existing ISAs "might" well have saved many years before with minimal savings.

The narrative that has been reported by some channels is "those saving £20k every year don't need a tax break".

I suggest that the number saving £20k every year (potentially after other tax-efficient channels such as pension) are going to be a very small number.

They are also quite probably financially astute and have some level of advice to achieve a risk-balanced portfolio. Consider an individual who is regularly funding their pension to a good level, that is long term investment and may well be on a higher risk basis and almost certainly predominantly in shares. If that individual then also invests £20k per year in cash ISA, that might be a prudent approach given the individual's overall investment portfolio and risk profile.

It seems to be a false assumption that individuals paying £20k into a cash ISA are doing so from an uninformed position and can be encouraged to move that cash deposit to shares.

What I suspect is more likely with the contributions at £20k in the year is that these are savings from one off events such as redundancy / inheritance. If those funds are diverted from cash ISA, they also do not obviously end up in shares.

I also imagine that it is likely that the just over half shown as having an ISA and adding nothing to it will be people for whom the ISA is an integral part of their retirement planning and now retired.2 -

Sky News report income tax won't go up, have to bridge the hole another way, possibly increasing likelihood of hits on savers...0

-

Savers would have been hit with the rate increase as it wouldn't have been offset by the NI rate decrease, the same for anyone over 66. It could be a case of frying pan into the fireintalex said:Sky News report income tax won't go up, have to bridge the hole another way, possibly increasing likelihood of hits on savers...0 -

Agreed, but I wonder what each of the saver-exclusive perks are worth: starting rate band, ISA exemptions, gilt "capital gain" exemption, premium bond winnings exemption, etc...ColdIron said:

Savers would have been hit with the rate increase as it wouldn't have been offset by the NI rate decrease, the same for anyone over 66. It could be a case of frying pan into the fireintalex said:Sky News report income tax won't go up, have to bridge the hole another way, possibly increasing likelihood of hits on savers...0 -

The size of the hole seems to vary a lot.intalex said:Sky News report income tax won't go up, have to bridge the hole another way, possibly increasing likelihood of hits on savers...

The talk of £50 Billion seems to have subsided, to more in the £20/£30 billion area.

Maybe after the usual back and forth between the Treasury and the OBR.1 -

Albermarle said:

The size of the hole seems to vary a lot.intalex said:Sky News report income tax won't go up, have to bridge the hole another way, possibly increasing likelihood of hits on savers...

The talk of £50 Billion seems to have subsided, to more in the £20/£30 billion area.

Maybe after the usual back and forth between the Treasury and the OBR.It's not really a surprise that lots of scenarios are being passed back and forth, given the OBR will need to sign off that whatever is picked will adhere to the self-imposed fiscal rules. And having painted themselves into a corner, that isn't going to be easy.In this case I wouldn't be surprised if this has had to be ruled out given the drama this week and an overt manifesto breach would pave the way for a confidence vote. But nothing should be ruled out in advance, precisely because this is a fluid situation.As usual, ignoring the speculation seems to be the best approach.1 -

Except that the speculation is causing some swings in the markets... might end up putting better fixed rate options on the table... but could stress test the property market too...0

-

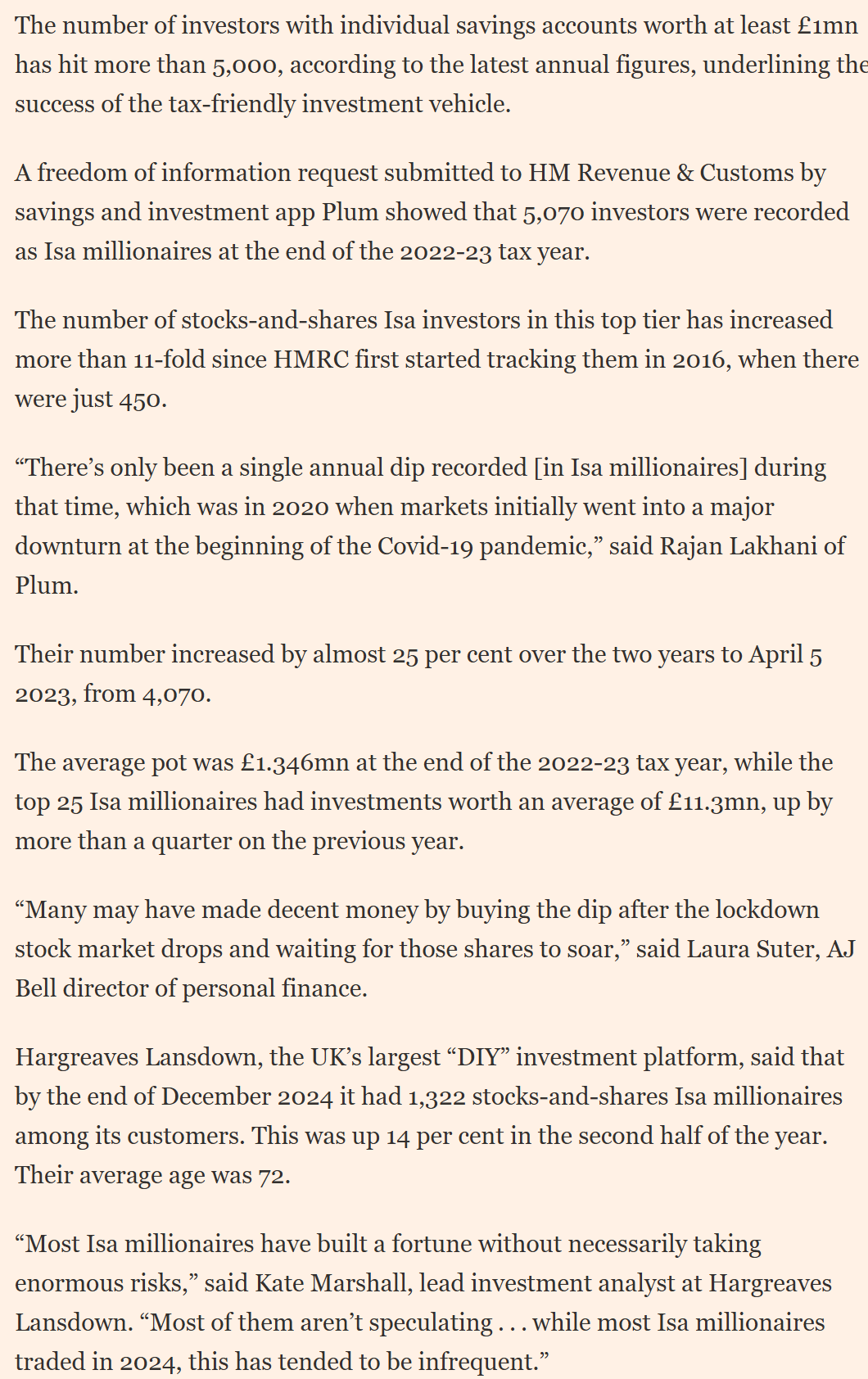

From today's FT Online.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards