We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Reeves' ISA review

Comments

-

I would wager it is higher in the past few years. In 2021/22 cash returns, particularly ISA ones were on the floor, so people would have withdrawn. It took a lot more to hit the PSA then, so ISAs weren't needed for most people (though they remained the best way to invest.) Full subscriptions over the past couple of years might well be people returning funds withdrawn at this time.

1 -

I agree. The chart is also in the middle of the Covid pandemic which may affect the data. I think the results are likely to be significantly different in the current tax year.Kim_13 said:I would wager it is higher in the past few years. In 2021/22 cash returns, particularly ISA ones were on the floor, so people would have withdrawn. It took a lot more to hit the PSA then, so ISAs weren't needed for most people (though they remained the best way to invest.) Full subscriptions over the past couple of years might well be people returning funds withdrawn at this time.0 -

You can have a look at the spreadsheet Isa providers have to send HMRC every year here:clairec666 said:

Well, not impossible, but for earlier years you could just analyse data from individual accounts, without grouping them by NI numberwmb194 said:

Shouldn't be. To open an Isa you have to supply an NI number so it should be easy to analyse these data using this as a unique identifier.clairec666 said:

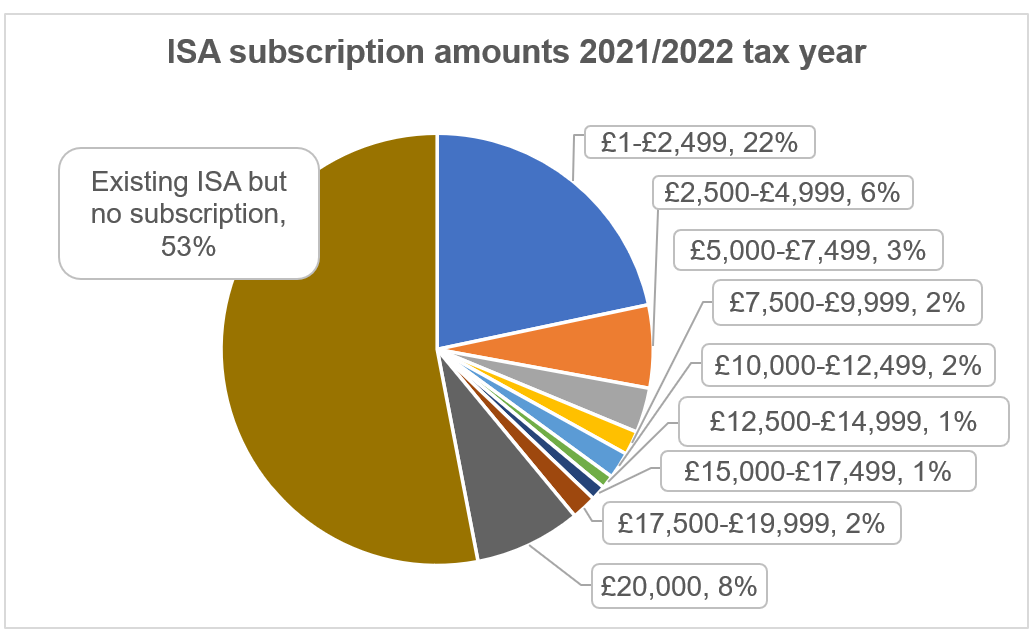

That's an interesting pie chart. Presumably it would be harder to collate that data for more recent years when we were able to pay into more than one ISA per tax year.SnowMan said:poseidon1 said:

Interesting article below from A J Bell which backs up your statement. Particularly interesting how the total value in stocks and shares isas completely dwarfs that of cash isas by a magnitude of 7 times.masonic said:So about 75% of ISA subscribers will not be impacted as they don't use more allowance than that ordinarily. Seems well worth the political heat.

https://www.ajbell.co.uk/group/news/isas-unpacked-who-holds-them-and-how-much-do-they-have#:~:text=Around 1.8 million use up their full,60% contributing less than £5,000 a year

Obviously a large chunk of the population cannot afford to get anywhere near the maximum £20k annual contribution, so our little echo chamber of forumites in no way reflects the wider saving public.

I fear for that reason, other than the inevitable backlash from the Tory press, reducing cash isas to £10k annually will still be a generous limit for the vast majority.

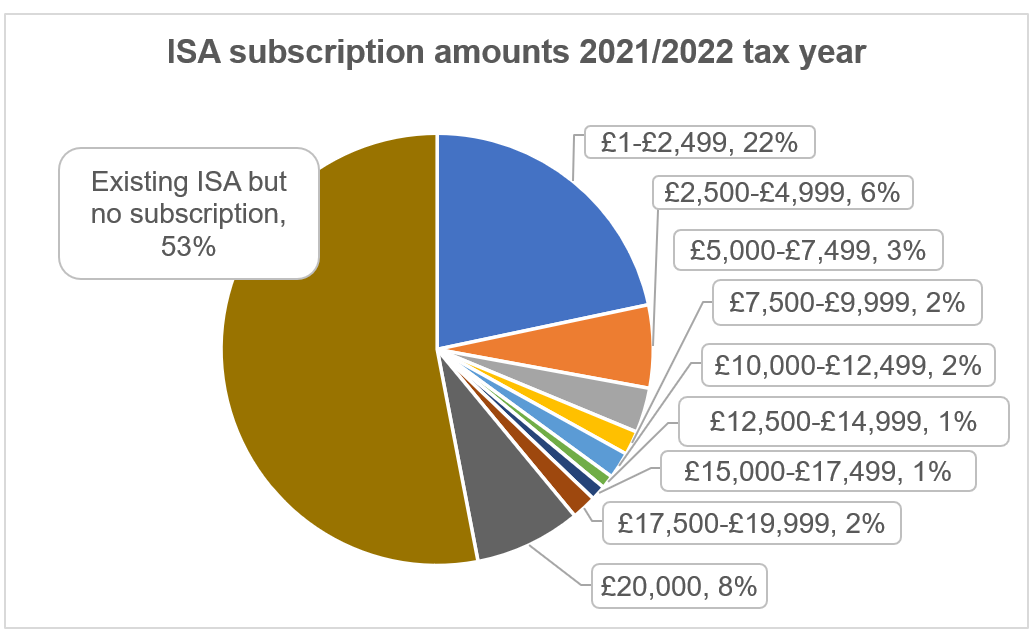

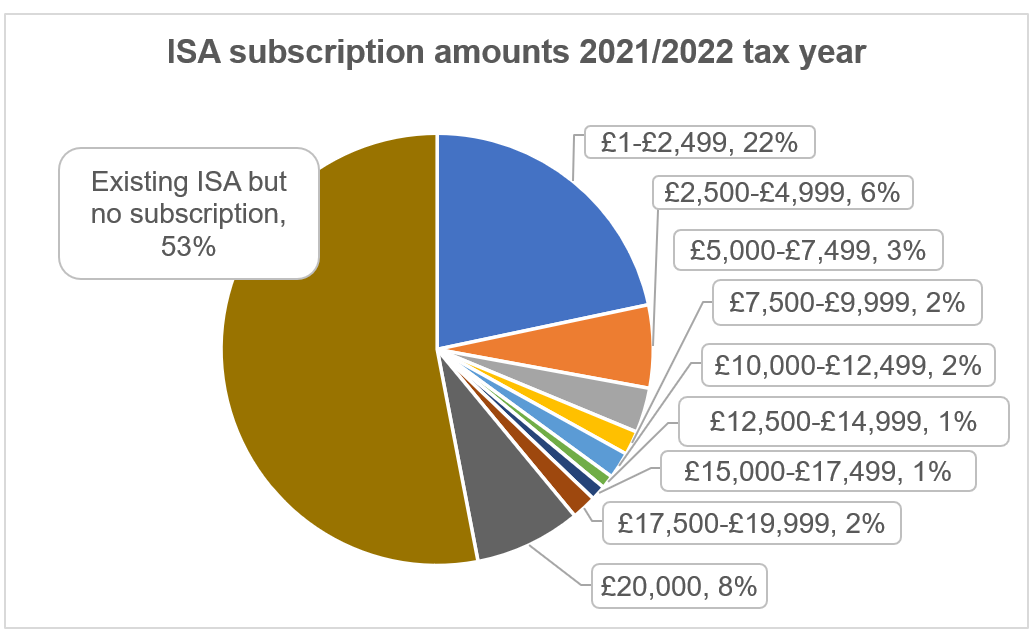

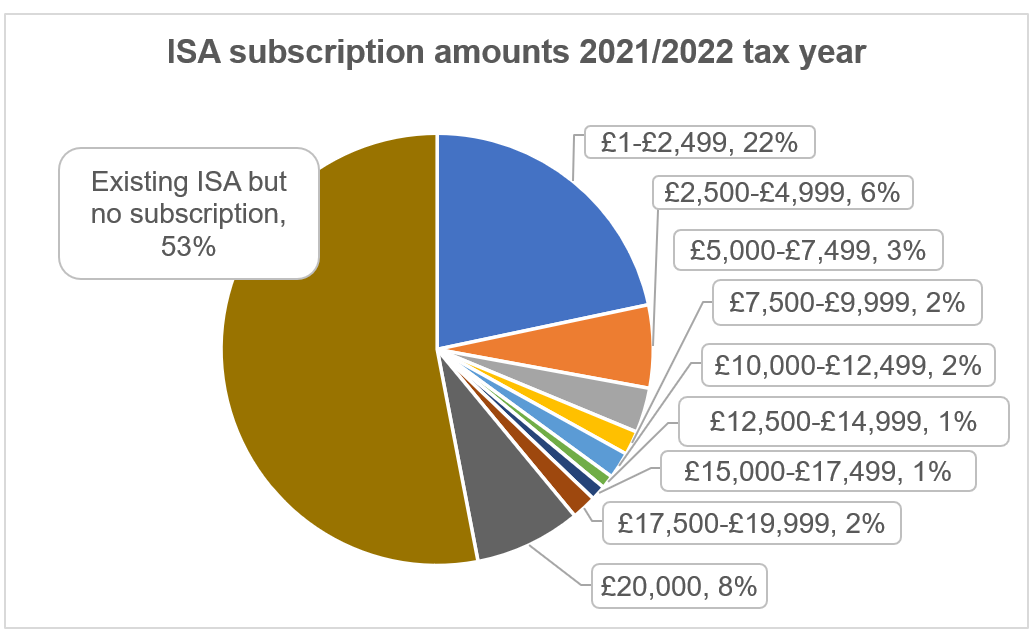

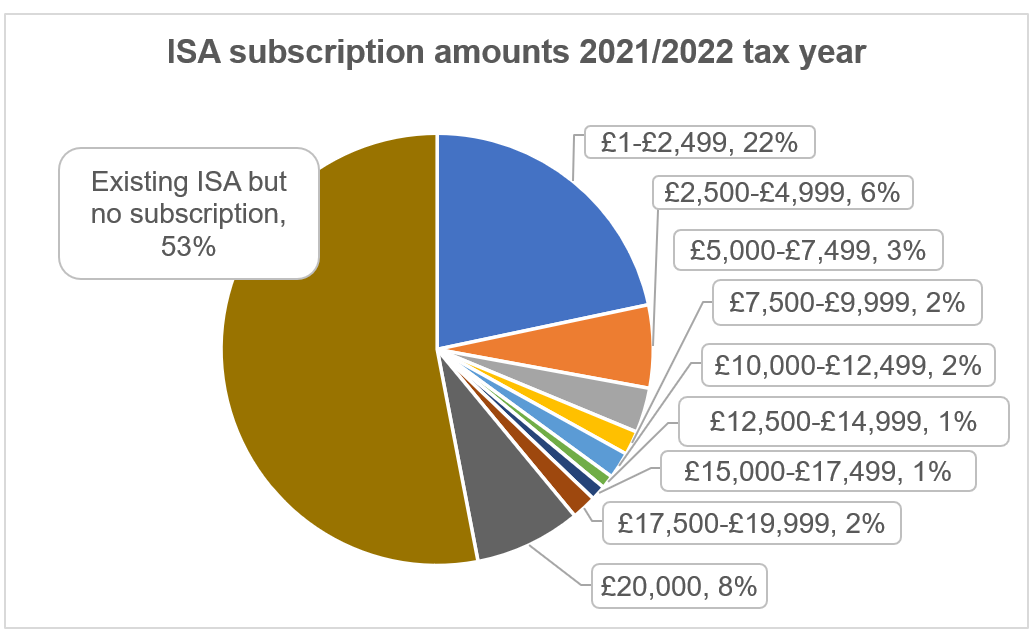

Personally as long as the £20k overall annual limit is retained, I won't be bothered either way.The data is all at the link below although it's only available up to the 2021/2022 tax yearOf the 22 million UK residents who had an ISA (cash or stocks and shares) at all (so many don't even have one and so aren't represented in the chart below at all) the percentages contributing over 10K pa is only 14% (of which 8% contribute the full 20K)

https://www.gov.uk/government/publications/annual-return-spreadsheet-template-for-isa-managers

1 -

Clear link of above FT article: https://removepaywalls.com/https://www.ft.com/content/289775ee-d2ec-434f-8989-f37232dac60cThe_Green_Hornet said:

I know the Mail is a source of fun but then the Financial Times has also run similar stories.2010 said:The Mail for example has had ISA limit cuts as down to £4/£10/£12 thousand, so far.

For example, a recent article contained the following:

"In recent weeks the Treasury has privately floated a level of £12,000 a year, down from the current £20,000 but higher than Reeves’ initial £10,000 proposal, according to people familiar with the plans."

Rachel Reeves considers less dramatic cut to cash Isa allowance (Firewalled).

So the FT are inferring that the source of these rumours is the Government itself.0 -

clairec666 said:

That's an interesting pie chart. Presumably it would be harder to collate that data for more recent years when we were able to pay into more than one ISA per tax year.SnowMan said:poseidon1 said:

Interesting article below from A J Bell which backs up your statement. Particularly interesting how the total value in stocks and shares isas completely dwarfs that of cash isas by a magnitude of 7 times.masonic said:So about 75% of ISA subscribers will not be impacted as they don't use more allowance than that ordinarily. Seems well worth the political heat.

https://www.ajbell.co.uk/group/news/isas-unpacked-who-holds-them-and-how-much-do-they-have#:~:text=Around 1.8 million use up their full,60% contributing less than £5,000 a year

Obviously a large chunk of the population cannot afford to get anywhere near the maximum £20k annual contribution, so our little echo chamber of forumites in no way reflects the wider saving public.

I fear for that reason, other than the inevitable backlash from the Tory press, reducing cash isas to £10k annually will still be a generous limit for the vast majority.

Personally as long as the £20k overall annual limit is retained, I won't be bothered either way.The data is all at the link below although it's only available up to the 2021/2022 tax yearOf the 22 million UK residents who had an ISA (cash or stocks and shares) at all (so many don't even have one and so aren't represented in the chart below at all) the percentages contributing over 10K pa is only 14% (of which 8% contribute the full 20K)

I find it difficult to identify how they may have come up with those overall figures from table 9.7 of the Individual Savings Account (ISA) tables: September 2024. There will be people who have transferred current year ISAs within the tax year and then subscribed to the new ISA and those who've subscribed to both stocks and shares and cash ISAs with different providers in 2021/2022. Potentially it is more difficult to collate for later years where subscriptions are made to more than one cash ISA. But then again in theory as wmb194 says, if they had a complete list of subscriptions by NI number they could produce figures directly but I sense that they don't have that data. To add to the confusion they say

The total number of ISA holders is not reported by ISA managers. Estimates of the total numbers of ISA holders are based on average market values of ISAs for a sample of individuals combined with reported aggregate ISA market values.

Is that talking about those with ISAs who haven't subscribed at all or do they not even have numbers for those who have subscribed, I don't know.

For the puposes of getting a rough feel for the distribution of whether and how much ISA subscriptions are I think we have to assume that their figures are near enough right.

I came, I saw, I melted1 -

But presumably only for the 21/22 tax year and not necessarily representative of current data.SnowMan said:clairec666 said:

That's an interesting pie chart. Presumably it would be harder to collate that data for more recent years when we were able to pay into more than one ISA per tax year.SnowMan said:poseidon1 said:

Interesting article below from A J Bell which backs up your statement. Particularly interesting how the total value in stocks and shares isas completely dwarfs that of cash isas by a magnitude of 7 times.masonic said:So about 75% of ISA subscribers will not be impacted as they don't use more allowance than that ordinarily. Seems well worth the political heat.

https://www.ajbell.co.uk/group/news/isas-unpacked-who-holds-them-and-how-much-do-they-have#:~:text=Around 1.8 million use up their full,60% contributing less than £5,000 a year

Obviously a large chunk of the population cannot afford to get anywhere near the maximum £20k annual contribution, so our little echo chamber of forumites in no way reflects the wider saving public.

I fear for that reason, other than the inevitable backlash from the Tory press, reducing cash isas to £10k annually will still be a generous limit for the vast majority.

Personally as long as the £20k overall annual limit is retained, I won't be bothered either way.The data is all at the link below although it's only available up to the 2021/2022 tax yearOf the 22 million UK residents who had an ISA (cash or stocks and shares) at all (so many don't even have one and so aren't represented in the chart below at all) the percentages contributing over 10K pa is only 14% (of which 8% contribute the full 20K)

For the puposes of getting a rough feel for the distribution of whether and how much ISA subscriptions are I think we have to assume that their figures are near enough right.1 -

subjecttocontract said:

But presumably only for the 21/22 tax year and not necessarily representative of current data.SnowMan said:clairec666 said:

That's an interesting pie chart. Presumably it would be harder to collate that data for more recent years when we were able to pay into more than one ISA per tax year.SnowMan said:poseidon1 said:

Interesting article below from A J Bell which backs up your statement. Particularly interesting how the total value in stocks and shares isas completely dwarfs that of cash isas by a magnitude of 7 times.masonic said:So about 75% of ISA subscribers will not be impacted as they don't use more allowance than that ordinarily. Seems well worth the political heat.

https://www.ajbell.co.uk/group/news/isas-unpacked-who-holds-them-and-how-much-do-they-have#:~:text=Around 1.8 million use up their full,60% contributing less than £5,000 a year

Obviously a large chunk of the population cannot afford to get anywhere near the maximum £20k annual contribution, so our little echo chamber of forumites in no way reflects the wider saving public.

I fear for that reason, other than the inevitable backlash from the Tory press, reducing cash isas to £10k annually will still be a generous limit for the vast majority.

Personally as long as the £20k overall annual limit is retained, I won't be bothered either way.The data is all at the link below although it's only available up to the 2021/2022 tax yearOf the 22 million UK residents who had an ISA (cash or stocks and shares) at all (so many don't even have one and so aren't represented in the chart below at all) the percentages contributing over 10K pa is only 14% (of which 8% contribute the full 20K)

For the puposes of getting a rough feel for the distribution of whether and how much ISA subscriptions are I think we have to assume that their figures are near enough right.We can only work with the data we haveTotal ISA subscriptions in 2023/2024 are shown in the report below (see page 9). Certainly there has been an increase in amounts subscribed since 2021/2022. And there have been some significant changes in the distribution between cash and stocks and shares also (the amount of cash ISA subscriptions more than doubled between these years but the amount of stocks and shares subscriptions decreased).https://committees.parliament.uk/publications/49909/documents/268186/default/

I came, I saw, I melted1 -

Interesting pie chart.SnowMan said:poseidon1 said:

Interesting article below from A J Bell which backs up your statement. Particularly interesting how the total value in stocks and shares isas completely dwarfs that of cash isas by a magnitude of 7 times.masonic said:So about 75% of ISA subscribers will not be impacted as they don't use more allowance than that ordinarily. Seems well worth the political heat.

https://www.ajbell.co.uk/group/news/isas-unpacked-who-holds-them-and-how-much-do-they-have#:~:text=Around 1.8 million use up their full,60% contributing less than £5,000 a year

Obviously a large chunk of the population cannot afford to get anywhere near the maximum £20k annual contribution, so our little echo chamber of forumites in no way reflects the wider saving public.

I fear for that reason, other than the inevitable backlash from the Tory press, reducing cash isas to £10k annually will still be a generous limit for the vast majority.

Personally as long as the £20k overall annual limit is retained, I won't be bothered either way.The data is all at the link below although it's only available up to the 2021/2022 tax yearOf the 22 million UK residents who had an ISA (cash or stocks and shares) at all (so many don't even have one and so aren't represented in the chart below at all) the percentages contributing over 10K pa is only 14% (of which 8% contribute the full 20K)

Unless I'm mistaken, It's interesting to note that those who took out a 20k ISA actually represented 17% of those who saved ..... 47% took out ISAs and 8% of those opted for 20k. I'd suggest that is a sizeable number of people. Also of those who did save the 20k savers were the second highest group.

The 53% of those with existing ISAs "might" well have saved many years before with minimal savings.Butt Spelle Chequers Two Khan Make Awe Full Miss Steaks3 -

subjecttocontract said:

Yes but I'm so not interested in wether the changes create political 'heat' or keep 75% of ISA subscribers happy. I'm interested in how changes are going to affect me personally.masonic said:So about 75% of ISA subscribers will not be impacted as they don't use more allowance than that ordinarily. Seems well worth the political heat.Presumably you, or people like you, will be contributing to the political heat. If not then it will cost them very little.But it will also gain them very little.Personally I just see it as rather pointless, whether the aim is to increase investment in UK stocks or raise more tax. It isn't going to move the needle if over three quarters won't be impacted.But if a side effect is I can no longer hold gilts in my S&S ISA then I'll be unimpressed.3 -

This I’m of same belief they are testing the waters, see what the response is.boingy said:Careful what you wish for. If they change the name it will give them a perfect excuse to change the rules.

As for the newspaper rumours, you can be sure that they originate from an unofficial govt source. It's fairly standard practice to test the waters with rumours before making it a policy. It gives them a chance to u-turn without u-turning if there is a massive backlash.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.8K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.2K Spending & Discounts

- 246.9K Work, Benefits & Business

- 603.4K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards