We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Self Assessment - seemingly huge rise in tax %age?

Mosh

Posts: 166 Forumite

I've posted more detailed numbers in a comment a bit further down

Apologies in advance for being another person who's struggling to understand the tax system. I started declaring additional income last year via Self Assessment and think I navigated it OK. They asked for numbers for the previous year also which, of course, resulted in fines and interest but - hey - my fault as I should have started declaring sooner. All sorted.

However, I balked when I saw my tax for this year. Given an approximate doubling in self-employment income after deductions I expected a doubling in tax as it should fall under the same tax bracket (42% as I'm based in Scotland). However, I've noticed that last year my self employment was taxed at 47% and this year at 64%

Frustratingly I have a handy "View your calculation" page which I've printed for this year, but didn't get one last year and there seems no way to get to it on the SA web page, only the large-form "view your tax return".

I'm sure you'll need more numbers, but the summary lines are that in 23/24 I had £5924 taxable profit for which I was charged £2491 (47%) tax. This year I had £14736 taxable profit for which I'm being charged £9447 (64%)! I'd expected nearer £6-7000 so obviously this is a hell of a hit.

My full time job has had a pay rise over the year (I'm a teacher), but all taxes for that and my other seasonal work (exam marking) have already been taken into account. The full total of all my income comes in at £70474 for 24/25 so I don't stray into any further tax brackets.

Can anyone shed any light on this? Happy to provide further breakdown if required.

Apologies in advance for being another person who's struggling to understand the tax system. I started declaring additional income last year via Self Assessment and think I navigated it OK. They asked for numbers for the previous year also which, of course, resulted in fines and interest but - hey - my fault as I should have started declaring sooner. All sorted.

However, I balked when I saw my tax for this year. Given an approximate doubling in self-employment income after deductions I expected a doubling in tax as it should fall under the same tax bracket (42% as I'm based in Scotland). However, I've noticed that last year my self employment was taxed at 47% and this year at 64%

Frustratingly I have a handy "View your calculation" page which I've printed for this year, but didn't get one last year and there seems no way to get to it on the SA web page, only the large-form "view your tax return".

I'm sure you'll need more numbers, but the summary lines are that in 23/24 I had £5924 taxable profit for which I was charged £2491 (47%) tax. This year I had £14736 taxable profit for which I'm being charged £9447 (64%)! I'd expected nearer £6-7000 so obviously this is a hell of a hit.

My full time job has had a pay rise over the year (I'm a teacher), but all taxes for that and my other seasonal work (exam marking) have already been taken into account. The full total of all my income comes in at £70474 for 24/25 so I don't stray into any further tax brackets.

Can anyone shed any light on this? Happy to provide further breakdown if required.

0

Comments

-

Could it be that you're being billed for 24/25 tax at 42% and half of next year's tax on account ?0

-

I've taken that into account. The Tax on account is an additional £4723.52 (50% of the £9447) so the total they're requesting is £14170.57subjecttocontract said:Could it be that you're being billed for 24/25 tax at 42% and half of next year's tax on account ?

Same with the numbers from 23/24 - that's the figure prior to the addition of Tax on Account.0 -

Without a full breakdown of each stream - income, code used and tax deducted - plus any interest and dividend income it is impossible to say what has happened. You cannot look at any single stream and deduce whether too much or too little tax has been deducted, your SA makes the final and only real calculation and correction.1

-

OK, I'll copy paste some more info. I really can't get my head around all thismolerat said:Without a full breakdown of each stream - income, code used and tax deducted - plus any interest and dividend income it is impossible to say what has happened. You cannot look at any single stream and deduce whether too much or too little tax has been deducted, your SA makes the final and only real calculation and correction. 0

0 -

Bigger picture. I'm at this point wondering why I bother with my additional earning as the time / effort I've put in this year are resulting in next to nothing in terms of £/hr

2023/24

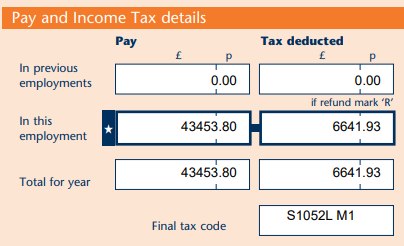

Main employment1. Pay from this employment - the total from your P45 or P60 - before tax was taken off: £ 43453.002. UK tax taken off pay in box 1: £ 6641.93

19. Professional fees and subscriptions: £ 65.00

Seasonal job1. Pay from this employment - the total from your P45 or P60 - before tax was taken off: £ 1386.002. UK tax taken off pay in box 1: £ 291.0631. Total taxable profits from this business (if box 28 + box 30 minus box 29 is positive): £ 5924.00

Self employment

9. Turnover - takings, fees, sales or money earned by your business: £ 10136.0020. Total allowable expenses - total of boxes 11 to 19: £ 4212.0021. Net profit - if your business income is more than your expenses (if box 9 + box 10 minus box 20 is positive): £ 5924.00

Summary

1. Total tax, Student Loan repayment and Class 4 NICs due before any payments on account: £ 2491.37

4.1 Class 2 NICs due £ 179.40

2024/25

Main employment

1. Pay from this employment - the total from your P45 or P60 - before tax was taken off: £ 53996.00

2. UK tax taken off pay in box 1: £ 7770.83

19. Professional fees and subscriptions: £ 75.00

Seasonal job

1. Pay from this employment - the total from your P45 or P60 - before tax was taken off: £ 1487.00

2. UK tax taken off pay in box 1: £ 258.09

Self employment

9. Turnover - takings, fees, sales or money earned by your business: £ 19224.00

20. Total allowable expenses - total of boxes 11 to 19: £ 4488.00

21. Net profit - if your business income is more than your expenses (if box 9 + box 10 minus box 20 is positive): £ 14736.00

28. Net business profit for tax purposes (if box 21 + box 26 + box 27 minus (boxes 22 to 25) is positive). If you are claiming trading income allowance (box 21 + box 26 + box 27 minus box 10.1) : £ 14736.00

Summary

1. Total tax, Student Loan repayment and Class 4 NICs due before any payments on account: £ 9447.05

4. Class 4 NICs due £ 129.960 -

Looking at your figures you seem to owe significant amounts on both your main and seasonal job. The tax (and Class 4 NI) due on your self employment is only part of the picture.Mosh said:Bigger picture. I'm at this point wondering why I bother with my additional earning as the time / effort I've put in this year are resulting in next to nothing in terms of £/hr

2023/24

Main employment1. Pay from this employment - the total from your P45 or P60 - before tax was taken off: £ 43453.002. UK tax taken off pay in box 1: £ 6641.93

19. Professional fees and subscriptions: £ 65.00

Seasonal job1. Pay from this employment - the total from your P45 or P60 - before tax was taken off: £ 1386.002. UK tax taken off pay in box 1: £ 291.0631. Total taxable profits from this business (if box 28 + box 30 minus box 29 is positive): £ 5924.00

Self employment

9. Turnover - takings, fees, sales or money earned by your business: £ 10136.0020. Total allowable expenses - total of boxes 11 to 19: £ 4212.0021. Net profit - if your business income is more than your expenses (if box 9 + box 10 minus box 20 is positive): £ 5924.00

Summary

1. Total tax, Student Loan repayment and Class 4 NICs due before any payments on account: £ 2491.37

4.1 Class 2 NICs due £ 179.40

2024/25

Main employment

1. Pay from this employment - the total from your P45 or P60 - before tax was taken off: £ 53996.00

2. UK tax taken off pay in box 1: £ 7770.83

19. Professional fees and subscriptions: £ 75.00

Seasonal job

1. Pay from this employment - the total from your P45 or P60 - before tax was taken off: £ 1487.00

2. UK tax taken off pay in box 1: £ 258.09

Self employment

9. Turnover - takings, fees, sales or money earned by your business: £ 19224.00

20. Total allowable expenses - total of boxes 11 to 19: £ 4488.00

21. Net profit - if your business income is more than your expenses (if box 9 + box 10 minus box 20 is positive): £ 14736.00

28. Net business profit for tax purposes (if box 21 + box 26 + box 27 minus (boxes 22 to 25) is positive). If you are claiming trading income allowance (box 21 + box 26 + box 27 minus box 10.1) : £ 14736.00

Summary

1. Total tax, Student Loan repayment and Class 4 NICs due before any payments on account: £ 9447.05

4. Class 4 NICs due £ 129.96

What tax codes were used against each job?1 -

@Dazed_and_C0nfused @BookWorm

Thanks for getting back to me. Apologies, I'm working off the "view return" screen on the SA website, struggling to get all the info in one place. To answer your questions:

2023/24

Tax code on main job: S1052L M1

Tax code on seasonal: SD0

2024/25

Tax code on main job: S1178L

Tax code on seasonal: SD0

Zero student loan. That was paid off many years ago (I'm old...!)0 -

I think I've spotted something. Last year I earned approx £51k on main job and £53k this year. However, I don't think I've read my P60 properly (and in my defence it's not obvious). It says "Pay" and "Tax deducted". Looks like for 23/24 I've taken "pay" as being "gross pay", whereas I think it's actually net. I have, however, put the correct "tax deducted" in both. Similar for the seasonal work.

In 24/25 I have (correctly) added the two numbers together to provide the gross earnings. I honestly don't recall doing this, though, and I only did the taxes this morning!0 -

Your P60 should show your taxable pay, you cannot deduct the tax from that. And you don't add it on either.Mosh said:I think I've spotted something. Last year I earned approx £51k on main job and £53k this year. However, I don't think I've read my P60 properly (and in my defence it's not obvious). It says "Pay" and "Tax deducted". Looks like for 23/24 I've taken "pay" as being "gross pay", whereas I think it's actually net. I have, however, put the correct "tax deducted" in both. Similar for the seasonal work.

In 24/25 I have (correctly) added the two numbers together to provide the gross earnings. I honestly don't recall doing this, though, and I only did the taxes this morning!

What does your P60 actually show, without you making assumptions and adding stuff together????1 -

@d@Dazed_and_C0nfusedDazed_and_C0nfused said:

Your P60 should show your taxable pay, you cannot deduct the tax from that. And you don't add it on either.Mosh said:In 24/25 I have (correctly) added the two numbers together to provide the gross earnings. I honestly don't recall doing this, though, and I only did the taxes this morning!

What does your P60 actually show, without you making assumptions and adding stuff together????

All four P60s are identical skeleton documents so the layout is the same. I've attached a shot of the appropriate section of one of them. As a teacher my pay rate is public record so I don't mind popping it up here. In 2023/24 my gross pay was approx £50k (pay rises were added over the academic / financial year due to pay negotiations, and I have a £1k uplift for a promoted position) which is essentially the total of the "Pay" and "Tax deducted" boxes.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards