We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Inheritance Tax Forms 435 and 436

fordy16

Posts: 2 Newbie

My Father in Law passed away in February 2025, leaving his house to his direct descendants, his son and daughter.

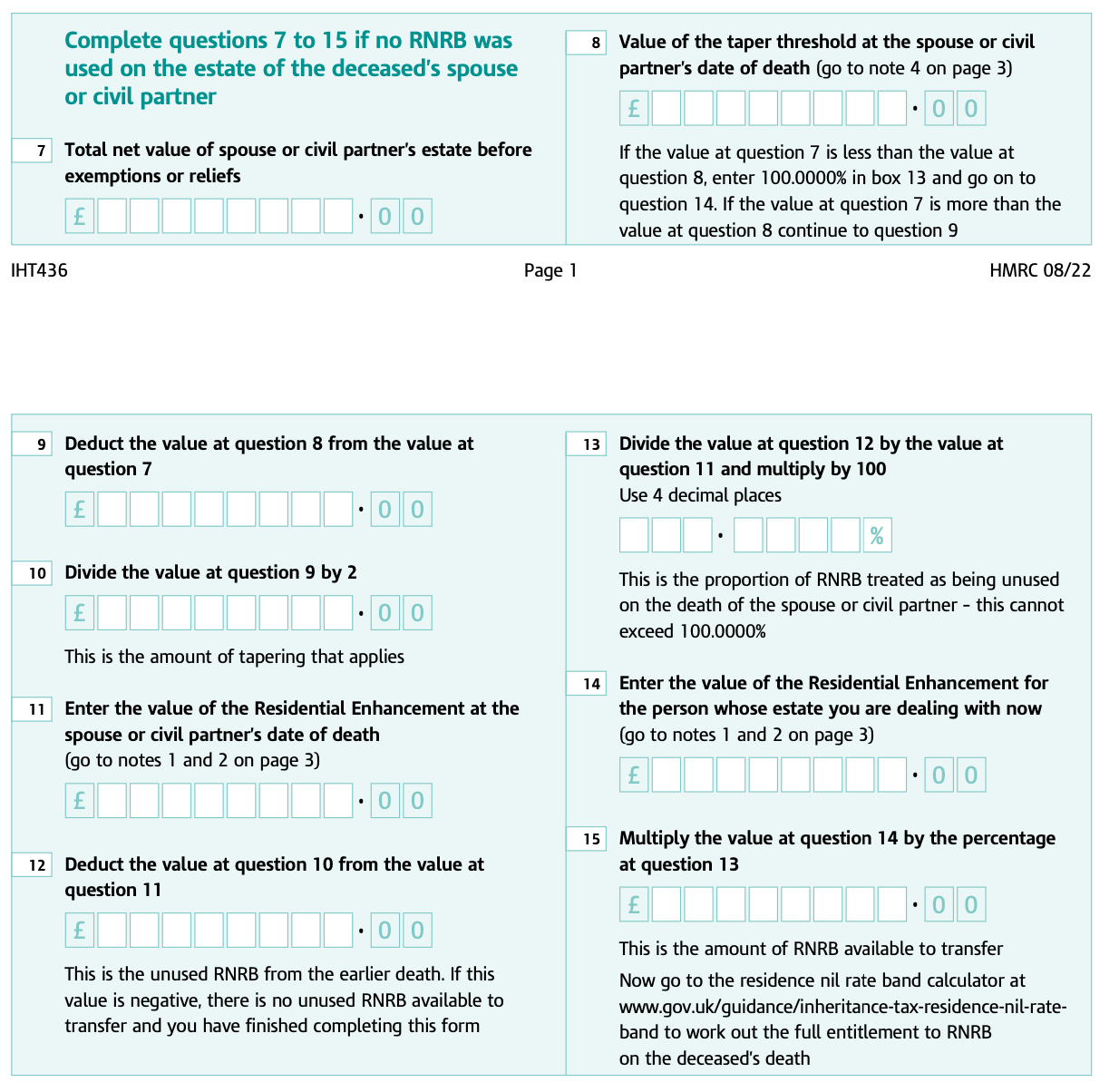

His wife passed away in April 2016, am I right in thinking I have to submit 2 forms for IHT purposes. For him IHT435 and for his wife IHT436. Also are the amounts of unused residence nil rate band different?

I've read somewhere it's £175K for him and £100K for her.

Any help would be much appreciated.Thank you.

His wife passed away in April 2016, am I right in thinking I have to submit 2 forms for IHT purposes. For him IHT435 and for his wife IHT436. Also are the amounts of unused residence nil rate band different?

I've read somewhere it's £175K for him and £100K for her.

Any help would be much appreciated.Thank you.

0

Comments

-

This very much depends on total value of the estate. If he inherited everything from his wife and she had not made any non exempt gifts in the 7 years prior to her death an IHT return will only be required if his estate exceeded £650k (2 x NRB). If it is more than that then an IHT return will be required to claim his residential NRB and if needed the transferable RNRB as well.

This is not the best board for this so I have asked for it to be moved to deaths, funerals and probate.0 -

Thank you for your reply, still not sure what the allowance for RNRB for someone who died before April 2017 is?

Also on the IHT436 you are asked for the value of the estate at the time of death...... I have no idea, what should I do? 0

0 -

Note 2 of that firm tells you to use £100,000 for deaths before April 2007. If probate was not carried out for the first death then you are going to have to come up with reasonable estimate.What is the value of FILs estate?0

-

When I filled this in, for my mother who died in 2024 and my father who died in 2010 -

Box 7 - in our case circa £500k

Box 8 - Taper threshold for deaths prior to 2017 - £2million

Straight to Box 13 - ( because estate value less than £2million)

Box 13 - 100.0000%

Box 14 - £175k (RNRB prevailing at my mothers death)

Box 15 -£175k (i.e 100% of box 14) - available to transfer.

So from my layman's point of view, as long as the total estate of your FIL is less than £2m, then 100% of the RNRB is available (assuming none used)

What is confusing is that it's the percentage unused that counts, not the amount prevailing at the time. So whilst you use the £100k prevailing at the time of your FIL's death to calculate the percentage of RNRB unused, you get 100% of the amount prevailing at your MIL's death - so potentially £175k.

HTH

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards