We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Claiming Pension Contribution refund 2024/25

Comments

-

Which would be wrong for the type of contribution your daughter has apparently made.tetrarch said:Finally some movement from the HMRC, but no resolultion

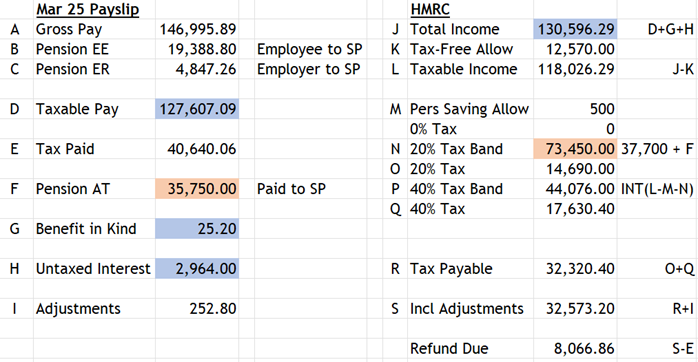

HMRC have extended my daughter's 20% taxable band by the post-tax contribution amount

PLEASE REMEMBER THAT THIS HAS COME ABOUT AS A RESULT OF A COMPANY TAKEOVER

Exact numbers - I've ignored some savings and small benefit in kind values

Gross Income £149,985

Employer Pension Contribution £4,847.26

Employee Pension Contribution £19,388.80

Employee Payment out of net income to Smart Pension £35,750

Summary:

Total Income £149,985

Total Pension Contribution £59,986.06 (maximised under £60K limit)

Taxable Income

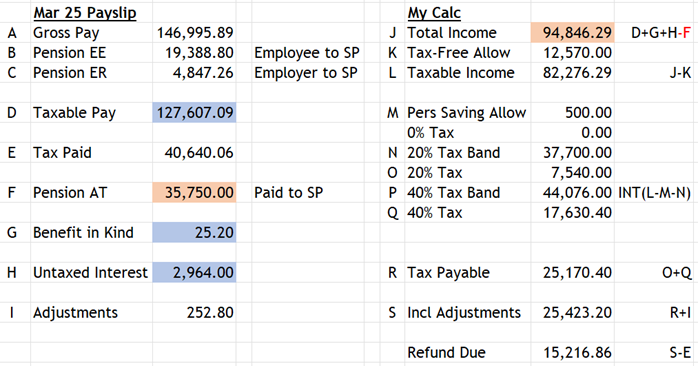

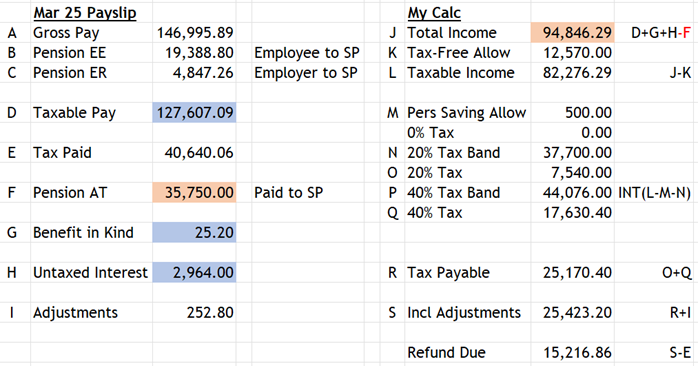

By my maths that makes total Income Tax Liability: £94,846.20

12,570 @ 0% = 0.00

37,700 @ 20% = 7,540.00

44,576.20 @ 40% = 17,830.48

Total Tax = 25,370.48

Regards

Tet

You seem to be referring to some figures that simply aren't relevant to any of this.

What does her P60 show her taxable was?0 -

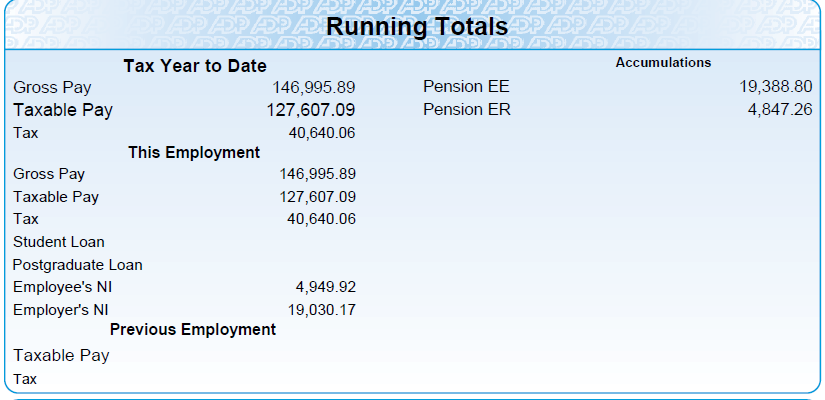

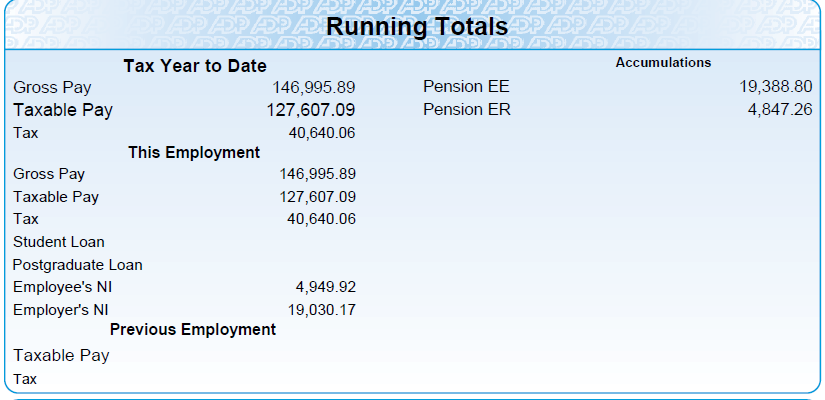

Attached are pics of the P45 (no P60 as change of company)

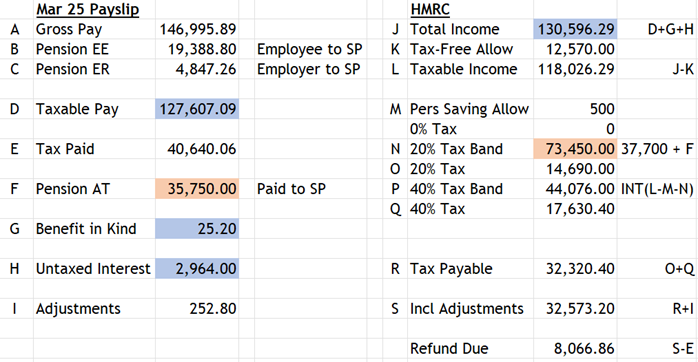

Using the above I can replicate the new HMRC numbers exactly

These are my numbers:

Regards

Tet0 -

HMRC have clearly treated the pension contribution as being made using the relief at source method, with the £35,750 being treated as the gross amount not the net amount.tetrarch said:Attached are pics of the P45 (no P60 as change of company)

Using the above I can replicate the new HMRC numbers exactly

These are my numbers:

Regards

Tet

From what you have posted she isn't entitled to an increased basic rate band but the pension contribution would reduce the income that falls to be taxed at 20/40%.

I'm not sure why you are persisting with including utterly irrelevant details, which can only serve to confuse HMRC.

What does the adjustment of £252.80 relate to? Is it underpaid tax from a prior year?0 -

HMRC have clearly treated the pension contribution as being made using the relief at source method, with the £35,750 being treated as the gross amount not the net amount.

From what you have posted she isn't entitled to an increased basic rate band but the pension contribution would reduce the income that falls to be taxed at 20/40%.

I'm not sure why you are persisting with including utterly irrelevant details, which can only serve to confuse HMRC.

What does the adjustment of £252.80 relate to? Is it underpaid tax from a prior year?

I was providing details so as to have you guys check my maths and understanding. Your emboldened comments above are exactly the right basis for a conversation with the HMRC

The adjustment is from previous year

As it stands they've "offered" £8k when my daughter is entitled to £15.2K, It's is probably best to query and get it corrected at this stage rather than formally claim the £8K and then get it re-corrected

Thanks for the assist

Regards

Tet0 -

There shouldn't be a problem if she claims the £8k. All that that will mean is when the correct calculation is issued it will include an extra line to reflect the fact that £8k has already been repaid.tetrarch said:HMRC have clearly treated the pension contribution as being made using the relief at source method, with the £35,750 being treated as the gross amount not the net amount.

From what you have posted she isn't entitled to an increased basic rate band but the pension contribution would reduce the income that falls to be taxed at 20/40%.

I'm not sure why you are persisting with including utterly irrelevant details, which can only serve to confuse HMRC.

What does the adjustment of £252.80 relate to? Is it underpaid tax from a prior year?

I was providing details so as to have you guys check my maths and understanding. Your emboldened comments above are exactly the right basis for a conversation with the HMRC

The adjustment is from previous year

As it stands they've "offered" £8k when my daughter is entitled to £15.2K, It's is probably best to query and get it corrected at this stage rather than formally claim the £8K and then get it re-corrected

Thanks for the assist

Regards

Tet0 -

Update:

Obviously my daughter was "important to them" for her call to be eventually answered

They have agreed that she is able to reclaim 40%

They agree that the advice in the "Do I need to complete a self-assesment" workflow contradicts the information on the "personal pension taxation guidance" blurb

They say that she must now complete a self-assessment form and that she won't be penalised for doing so

She will claim the £8,000 offered and she's doing her first ever Self Assessment Tax Return this weekend

Thanks for all the help

Regards

Tet0 -

I don't know why you would think she could be penalised but if she goes down that route it's key that she remembers to include the refund of £8k on her Self Assessment return.tetrarch said:Update:

Obviously my daughter was "important to them" for her call to be eventually answered

They have agreed that she is able to reclaim 40%

They agree that the advice in the "Do I need to complete a self-assesment" workflow contradicts the information on the "personal pension taxation guidance" blurb

They say that she must now complete a self-assessment form and that she won't be penalised for doing so

She will claim the £8,000 offered and she's doing her first ever Self Assessment Tax Return this weekend

Thanks for all the help

Regards

Tet

Easy pickings for HMRC investigators if she omits that and gets the £8k twice.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards