We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Claiming Pension Contribution refund 2024/25

Comments

-

Although they offered a refund, I called again as the calculations were wrong. After checking they called back and confirmed I was right. I'm now awaiting a recalculated assessment...0

-

In case anyone is still interested, after more phone calls I now have the correct money in my bank account. At the suggestion of the HMRC help desk I raised a formal complaint. I was owed more than £20k. Had I not been confident in my calculations (thanks in part to the MSE forums) I could have accepted the initial amount and be more than £1k out of pocket. I received a letter with a manual calculation. I then received a call to follow up on my complaint. Thankfully I will never have to do this again, I'm hoping that my feedback to the complaints team may help HMRC improve the process.1

-

I never understand why staff (anywhere, not just HMRC) suggest you make a complaint about their own business/organisation.c_beam said:In case anyone is still interested, after more phone calls I now have the correct money in my bank account. At the suggestion of the HMRC help desk I raised a formal complaint. I was owed more than £20k. Had I not been confident in my calculations (thanks in part to the MSE forums) I could have accepted the initial amount and be more than £1k out of pocket. I received a letter with a manual calculation. I then received a call to follow up on my complaint. Thankfully I will never have to do this again, I'm hoping that my feedback to the complaints team may help HMRC improve the process.

Resolving the issue themselves, even if they need to get help from someone else, would seem a better option for everyone really.

£20k is a massive refund in pension relief terms mind, especially for a relief at source contribution! Or maybe there were other reasons some of the tax was overpaid.1 -

Hi Everyone,

Finally an update from my end, but not a good one. this is the tex of the letter that my daughter received (dated 24-Jul) from an application made on 9th April

"Your PPR claim for the 2024-2025 tax year has been processed. However, because your PPR statistics did not correspond to your evidence, I was unable to finalise your claim for 2024-2025. To submit your claim for that tax year, you have to submit documents that clearly show the amount of your pension contribution"

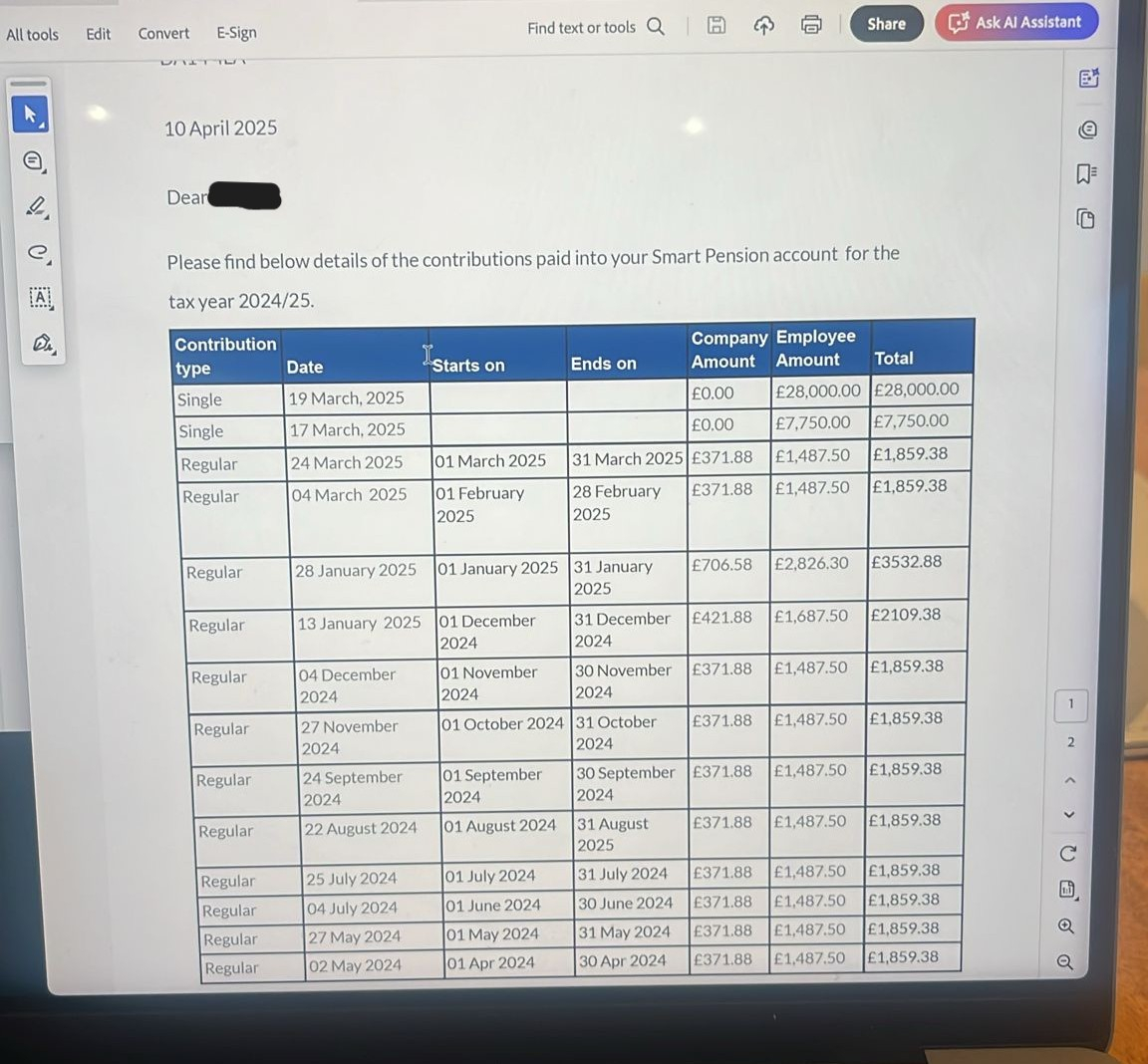

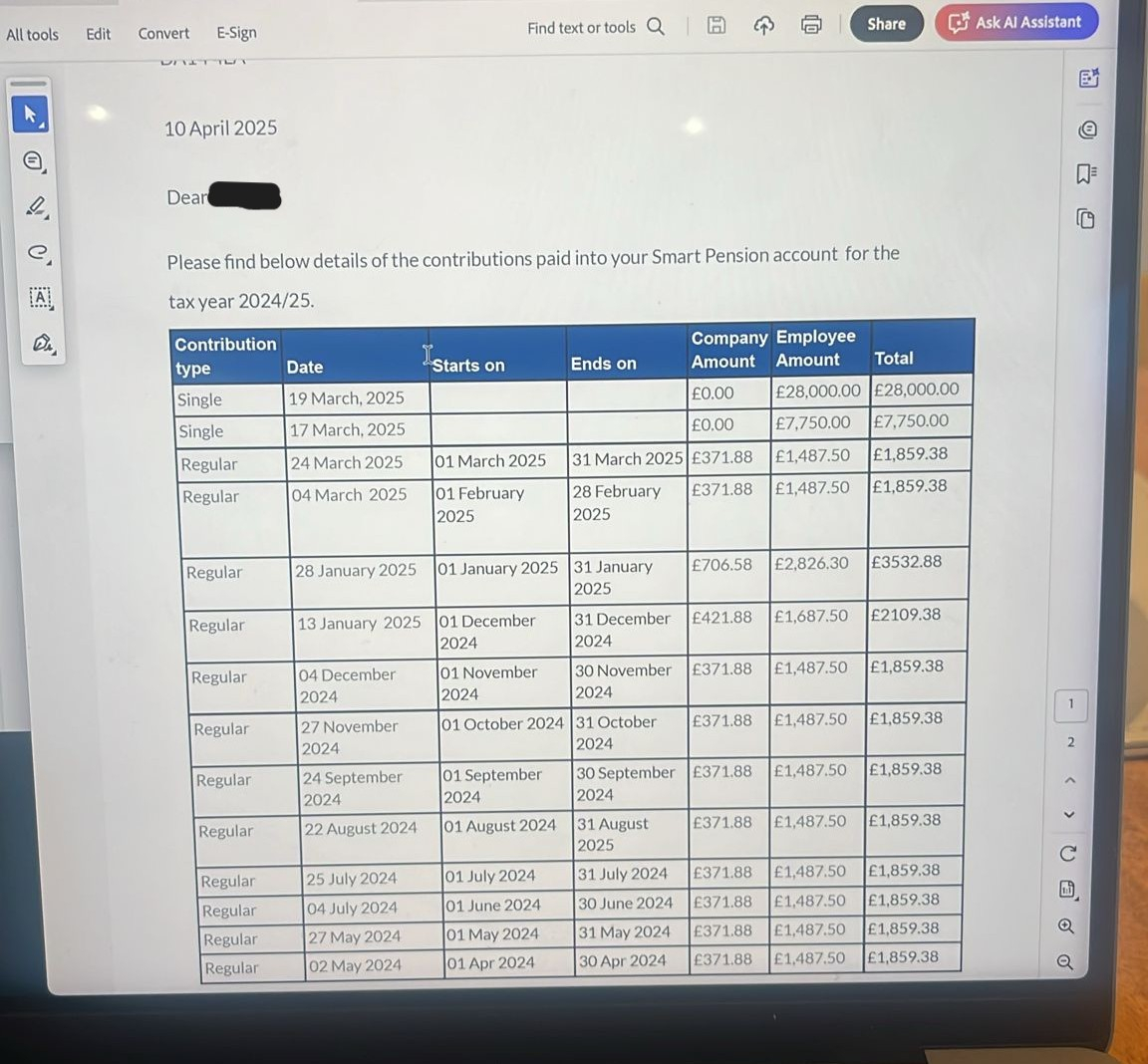

This below looks pretty clear to me

Next stop I'll join my daughter on her HMRC phone call........

Regards

Tet 0

0 -

That screenshot probably confuses things rather than clarifies.tetrarch said:Hi Everyone,

Finally an update from my end, but not a good one. this is the tex of the letter that my daughter received (dated 24-Jul) from an application made on 9th April

"Your PPR claim for the 2024-2025 tax year has been processed. However, because your PPR statistics did not correspond to your evidence, I was unable to finalise your claim for 2024-2025. To submit your claim for that tax year, you have to submit documents that clearly show the amount of your pension contribution"

This below looks pretty clear to me

Next stop I'll join my daughter on her HMRC phone call........

Regards

Tet

What does "Company amount" relate to 🤔

The final two contributions are seemingly not made using the relief at source method. That is relatively rare and likely to add to the confusion (at HMRC's end).

Does someone earning the amount your daughter's does need your help on a phone call 😳0 -

The biggest problem here isn't HMRC - it's SmartPension.

They're basically understaffed AND incompetent.

The statement they provided is meaningless, as it doesn't say whether the employee contribution has been deducted from taxed (20% relief applied by pension provider or untaxed pay relieved via PAYE).

Before my employer started using salary sacrifice, my SmartPension contributions showed separate employer and employee contributions, none of which were entitled to 20% relief at source, because they all came from untaxed income (Auto enrolment). (After salary sacrifice started, all the contributions were shown as "Employer" with nil "Employee").

I would suggest making a complaint to SmartPension something like

"I made additional contributions to my pension on DATE and DATE in the belief that 20% relief at source would be applied. SmartPension have treated these contributions as coming from gross pay, and have not reclaimed the 20% relief, and have incorrectly reported the contributions to HMRC.

This error has been further compounded by SmartPension incorrectly reporting my contributions to HMRC.

This means that not only have I failed to receive 20% relief at source, I have been unable to claim further tax relief at my marginal rate from HMRC.

I need SmartPension to:

- Correct their records to reflect that the employee contributions in question came from taxed pay, and are eligible for 20% relief at source

- Correct the return you sent to HMRC to reflect this, and actually claim the 20% relief at source

- Inform me when you have completed these actions.

- I also request that Smart Pension compensate me:

-- for the time, and distress dealing with this matter, I estimate I have spent X hours dealing with this issue."

-- for the loss of interest on the tax refund that would have been paid on time to me by HMRC, had SmartPension not made this error."

My advice is next time you want to make pension contributions to take yourself out of the 40%+ tax bands, you should use any other pension provider other than SmartPension.

For the record, I have a pension with SmartPension, for no other reason than they are the bunch of numpties my employer chose for their auto-enrolment scheme, and the complete lack of transparency (unit based pension, where the unit prices aren't published), and general incompetence I've experienced, is the price I pay to get my employer's contribution+salary sacrifice NI saving. When I leave my current employer, I'll be submitting a request to get the the pension transferred to my other pension provider - equally useless when it comes to management, but at least I can work out my unit holdings, and the price per unit is publicly available.

Lessons to others

- Don't use SmartPension if you are making contributions from your own bank account, from monies which have already been taxed.

- Only stay with SmartPension for as long as you employer is making contributions. Once they stop - "get the hell out of Dodge".

- Once you find out HMRC aren't playing ball because someone else has screwed up, make sure that HMRC acknowledge your dispute, then go after the "incompetents" to get them to undo their mistake.

PochiSoldi

0 -

Hi y'all

HMRC Update:

My daughter zoomed me in for her HMRC call....

15 minute wait

Agent #1 : Know nothing script follower, no clue - escalate

Agent #2 : Understood the concept referred to "technician"

Answer - Yes, we've got it wrong we accept your figures match your submission and you'll get a confirmation in the post in a few days and a calculation (I assume a P800) "shortly therafter"

Now we wait.....

Regards

Tet

PS To defend SmartPension - the documentation we provided (there was more explanatory text after the picture I copied) was sufficient to support the claim0 -

I'm no fan of the opaque nature of Smart Pension and the minimal amount of REAL information that you can get access to. My daughter will be transferring her pension to another provider (likely Aviva where her new employer keeps their provision for simplicity). I also have no confidence that an in-specie transfer will be possible as their funds seem to have very bespoke names that may well preculde thatpochisoldi said:The biggest problem here isn't HMRC - it's SmartPension.

They're basically understaffed AND incompetent.

The statement they provided is meaningless, as it doesn't say whether the employee contribution has been deducted from taxed (20% relief applied by pension provider or untaxed pay relieved via PAYE).

Before my employer started using salary sacrifice, my SmartPension contributions showed separate employer and employee contributions, none of which were entitled to 20% relief at source, because they all came from untaxed income (Auto enrolment). (After salary sacrifice started, all the contributions were shown as "Employer" with nil "Employee").

I would suggest making a complaint to SmartPension something like

"I made additional contributions to my pension on DATE and DATE in the belief that 20% relief at source would be applied. SmartPension have treated these contributions as coming from gross pay, and have not reclaimed the 20% relief, and have incorrectly reported the contributions to HMRC.

This error has been further compounded by SmartPension incorrectly reporting my contributions to HMRC.

This means that not only have I failed to receive 20% relief at source, I have been unable to claim further tax relief at my marginal rate from HMRC.

All that said - Smart Pension DID state at the outset that to tthey would NOT be applying any tex relief he external additional payment. Also, as I've stated above their letter (which I may have misrepresented) was comprehensive in declaring which payments were gross and which had NOT been grossed up and has been accepted by HMRC

Regards

Tet0 -

Finally some movement from the HMRC, but no resolultion

HMRC have extended my daughter's 20% taxable band by the post-tax contribution amount

PLEASE REMEMBER THAT THIS HAS COME ABOUT AS A RESULT OF A COMPANY TAKEOVER

Exact numbers - I've ignored some savings and small benefit in kind values

Gross Income £149,985

Employer Pension Contribution £4,847.26

Employee Pension Contribution £19,388.80

Employee Payment out of net income to Smart Pension £35,750

Summary:

Total Income £149,985

Total Pension Contribution £59,986.06 (maximised under £60K limit)

Taxable Income

By my maths that makes total Income Tax Liability: £94,846.20

12,570 @ 0% = 0.00

37,700 @ 20% = 7,540.00

44,576.20 @ 40% = 17,830.48

Total Tax = 25,370.48

Regards

Tet

0 -

But you said HMRC had extended her basic rate band.tetrarch said:Finally some movement from the HMRC, but no resolultion

HMRC have extended my daughter's 20% taxable band by the post-tax contribution amount

PLEASE REMEMBER THAT THIS HAS COME ABOUT AS A RESULT OF A COMPANY TAKEOVER

Exact numbers - I've ignored some savings and small benefit in kind values

Gross Income £149,985

Employer Pension Contribution £4,847.26

Employee Pension Contribution £19,388.80

Employee Payment out of net income to Smart Pension £35,750

Summary:

Total Income £149,985

Total Pension Contribution £59,986.06 (maximised under £60K limit)

Taxable Income

By my maths that makes total Income Tax Liability: £94,846.20

12,570 @ 0% = 0.00

37,700 @ 20% = 7,540.00

44,576.20 @ 40% = 17,830.48

Total Tax = 25,370.48

Regards

Tet0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards