We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

alternatives to equity

Comments

-

Some years ago I thought this when I bought INXG and I now think I was wrong.masonic said:There is now the iShares Up To 10 Year Index Linked Gilt fund, which should give reasonable inflation protection. A small amount of a gold ETF would normally be worth considering (not sure I would at the current gold price). Vanguard offers a Global Bond Index fund and Global Aggregate Bond ETF, both currency hedged, that could serve as a core bond holding.15 years is early to be reducing risk significantly, but it may be time to start slowly easing into such options.

iShares II plc Share Price (INXG) GBP Index-Linked Gilts UCITS ETF Dist | INXG

Better to have the individual ILG rather than a fund.0 -

The problem with INXG is that it is long dated, so the effect of interest rates rising to counteract inflation overwhelms the inflation protection. This is why a short-dated fund is essential.DRS1 said:

Some years ago I thought this when I bought INXG and I now think I was wrong.masonic said:There is now the iShares Up To 10 Year Index Linked Gilt fund, which should give reasonable inflation protection. A small amount of a gold ETF would normally be worth considering (not sure I would at the current gold price). Vanguard offers a Global Bond Index fund and Global Aggregate Bond ETF, both currency hedged, that could serve as a core bond holding.15 years is early to be reducing risk significantly, but it may be time to start slowly easing into such options.

iShares II plc Share Price (INXG) GBP Index-Linked Gilts UCITS ETF Dist | INXG

Better to have the individual ILG rather than a fund.1 -

You may well be right. I suspect it is the conveyor belt effect of the funds which is the real issue.0

-

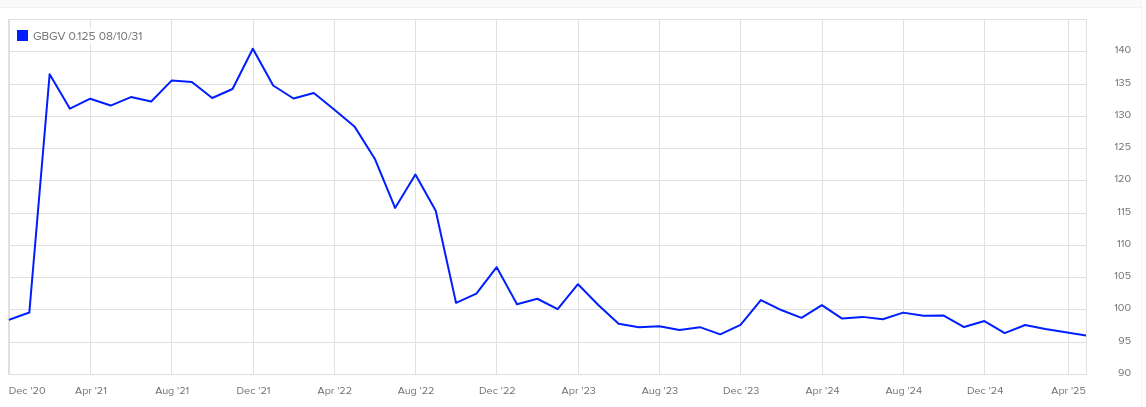

DRS1 said:You may well be right. I suspect it is the conveyor belt effect of the funds which is the real issue.I don't believe either of these funds sells holdings prior to maturity (unlike say a 3-7 year duration fund). So if held forever, it is equivalent to a rolling ladder of bonds bought individually. The problem is that if you don't intend to hold forever, you must sell before the portfolio matures to release any of your capital. In the case of INXG, that means selling underlying holdings an average of 16 years prior to maturity, and in the Up To 10 Year fund selling 5 years before maturity. To exit smoothly, you should switch into a ~16 year or ~5 year IL gilt respectively those number of years before you need the capital and hold that to maturity. Then you would be able to capture any capital gain resulting from the fund constituents trading below par. For example, TR41 is currently trading at £75 and TR31 is trading at £96.Remembering that if you purchased IL gilt a few years ago, you were locking in a negative real YTM and a price above par. So you had the choice between selling for an immediate wounding loss, or holding until maturity for a sustained negative real return. INXG simply reflects the fate of anyone who bought long dated IL gilt ahead of interest rates increasing from unprecedented lows that gave rise to a bubble in the asset class.Here is the price chart for TR31 for example (clean price, so consider this a real return):

Say you bought at around £135, you are on for a real return of just a little better than -3% per year. Or you could have taken an up-front 25% loss in 2023. For TR41, the equivalent loss was around 55% or a real return of -3% for 16 years. So buying individual IL gilts at the wrong time is about as bad as buying the fund at the wrong time.2

Say you bought at around £135, you are on for a real return of just a little better than -3% per year. Or you could have taken an up-front 25% loss in 2023. For TR41, the equivalent loss was around 55% or a real return of -3% for 16 years. So buying individual IL gilts at the wrong time is about as bad as buying the fund at the wrong time.2 -

this is all over my head

1

1 -

The price of gilts is known when you buy them. You know for certain that when they mature you will get a fixed annual rate of interest based on £100 face value and you will get a £100 lump sum back. In the case of indexed linked gilts these £100s are steadily increased with inflation. So gilts are completely safe.dannybbb said:this is all over my head

But, and it is a very important "but", what happens to the price between you buying the gilt and maturity is entirely at the whim of the markets. If you sell near the maturity date, say 5 years or less, the price will be close to £100. If the maturity date is say 30 years away, as is the case with some index linked gilts, the price could be very different.

This means that the shorter the time to maturity the more safe the bond is.

Why would the price change over time? When a bond is issued it is normally at a rate comparable with those offered by other fixed rate investments. Say it was issued 5 years ago at a value of £100 with an interest rate of 0.5%. Then interest rates increased to around 5% and new gilts were issued at that rate. Why would anyone want to pay full price for a 0.5% bond? The price of the 0.5% gilts will fall so that the effective returns if held to maturity would be the same, lower interest being compensated for by higher capital gains. If the bond was 30 years away from maturity ("long dated") the fall in price would be very large, say 50%. If the bond was only 1 year from maturity ("short dated) the difference between 1 year at 0.5% and 1 year at 5% would be much smaller.

Of course as well as selling at the wrong time when prices are low you could buy a long dated gilt at the wrong time when prices are high.

That was the problem with INXG. Matching inflation is regarded as a return of around 2.5%. An IL gilt at issue price gave a return far in excess of those rates available elsewhere and so commanded a very high price. And then interest rates rose to around 5%, a value higher than inflation....

With funds you cannot avoid the problems of trading between issue and maturity since the fund will normally hold gilts with a wide range of issue and maturity dates. The best you can do to minimise risk is to look for short-dated funds.

3 -

Sorry for the minimal information but I would like to find out more about, whether you can invest / buy UK government bond/ gilts in Hong Kong?

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards