We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

£31,000 Credit Card Debt and My Anxiety is Unbearable

Comments

-

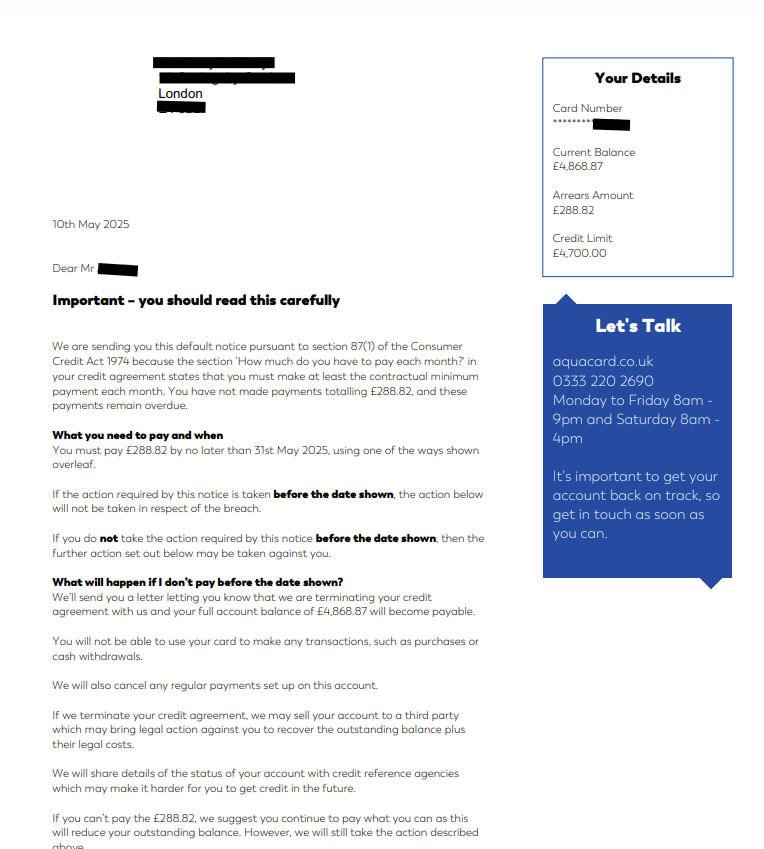

Hi everyone, I just received the following in my inbox. Is this a formal Default Notice? If it is, what do I do next? Do I wait for the default to appear in my Credit File first before I do anything? I have not received a letter by post yet.

Honestly, this waiting game is stressing me out.

0 -

You need to wait for the letter via snail mail demanding repayment of the entire sum. No-one expects you to pay that off, but the letter is legally required before they are allowed to issue the default.

You'll then need to wait for the default to appear on your credit records. Which is this creditor reporting to?

At some stage, the creditor will write with an reference number and details of how to pay, or news that they have assigned or sold the debt. Could be a couple of weeks, or several months. Come back and let us know when you hear.If you've have not made a mistake, you've made nothing1 -

There's no need to get stressed, they are in yhe process of defaulting the account which is good news for you. Just take it easy, wait for confirmation it has defaulted, and then start your payments up once someone starts asking for them.1

-

Thanks. What do you mean by "and then start your payments up once someone starts asking for them."Rob5342 said:There's no need to get stressed, they are in yhe process of defaulting the account which is good news for you. Just take it easy, wait for confirmation it has defaulted, and then start your payments up once someone starts asking for them.

0 -

So, does the default officially happen once it is registered on my credit report? Not before then?RAS said:You need to wait for the letter via snail mail demanding repayment of the entire sum. No-one expects you to pay that off, but the letter is legally required before they are allowed to issue the default.

You'll then need to wait for the default to appear on your credit records. Which is this creditor reporting to?

At some stage, the creditor will write with an reference number and details of how to pay, or news that they have assigned or sold the debt. Could be a couple of weeks, or several months. Come back and let us know when you hear.0 -

The default is removed from your credit record 6 years after it is registered on your credit record, even if you haven't paid off the debt.

So you want those as soon as possible. For safety sake, it's better to wait to make payments until it's actually there. Otherwise someone might 'do you a favour' by not registering it, even after they've sent the default letter.If you've have not made a mistake, you've made nothing1 -

OP You have to realise sometimes things happen very slowly in debt collection. Don't be in a hurry to start paying, let things progress at the speed ( or lack of it ) of the creditors.

It can take 18 months for a default, the creditor will in all probability sell it on and you will get a letter from whoever has bought it.If you go down to the woods today you better not go alone.1 -

You'll get people writing to you wanting you to pay the debt. If you have confirmation the debt is defaulted and are in a position to start paying then you can start paying with the details they'll provide. Just let it run at its own pace and if nobody's asking just dave it until they do.husnu1 said:

Thanks. What do you mean by "and then start your payments up once someone starts asking for them."Rob5342 said:There's no need to get stressed, they are in yhe process of defaulting the account which is good news for you. Just take it easy, wait for confirmation it has defaulted, and then start your payments up once someone starts asking for them.1 -

It will default before it shows up on your credit report, but its sensible to wait for the default to show up there to be sure it has actually defaulted. You don't want to risk the default not happening as that could set you back years.husnu1 said:

So, does the default officially happen once it is registered on my credit report? Not before then?RAS said:You need to wait for the letter via snail mail demanding repayment of the entire sum. No-one expects you to pay that off, but the letter is legally required before they are allowed to issue the default.

You'll then need to wait for the default to appear on your credit records. Which is this creditor reporting to?

At some stage, the creditor will write with an reference number and details of how to pay, or news that they have assigned or sold the debt. Could be a couple of weeks, or several months. Come back and let us know when you hear.1 -

Hi Everyone,

There have been some recent changes in my circumstances, and I would greatly appreciate some advice.

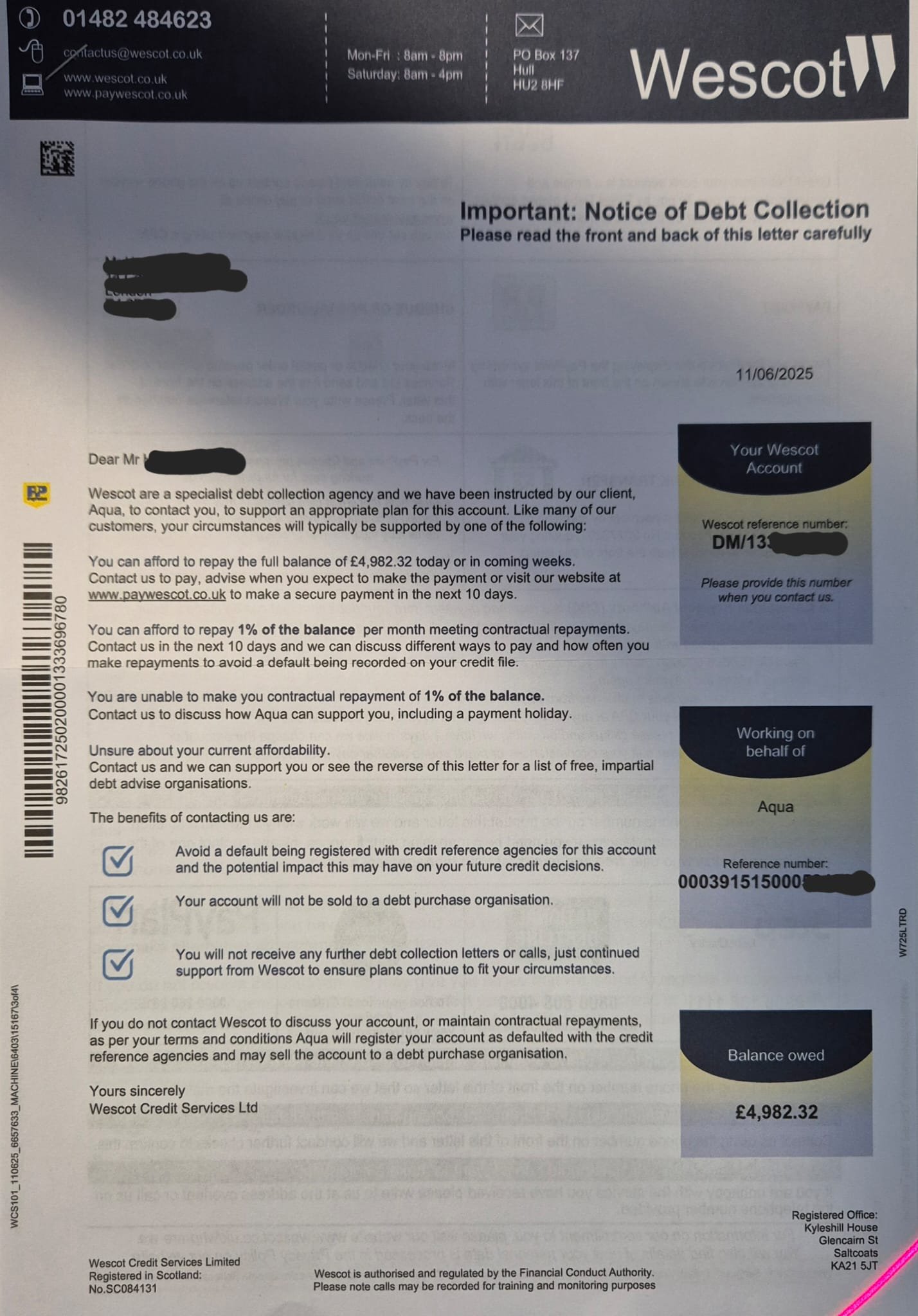

As some of you know, I received a default notice from Aqua on the 10th of May, but so far, it hasn't yet appeared on my credit report and they passed it over to Westcot as seen in the screenshot below.

Unfortunately, my financial situation has worsened significantly since I last posted. I can now only just about cover my priority bills (mortgage, utilities, etc.), and there's nothing left over for my unsecured creditors. When I last spoke to you all, I was considering offering my creditors around £300 per month between them. But that is no longer possible.

I'm now considering offering token payments (e.g., £1 per creditor) as a gesture of goodwill until my situation improves.

How will offering token payments affect me? Will my house and car still be safe? Do I have to wait for defaults to appear on my credit reports before making the token offer, or should I make the token payment offers now? Won't the token payments eventually trigger defaults anyway?

I am getting more anxious day by day. I just can't wait for the day that they will all accept my token payments so that I can relax a bit.

Thanks in advance. 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards