We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Some Payable options omit some payable gap years - confused!

Summary:

Retirement tax year 2035 (not currently working, living off lodgers/savings)

Forecast amount as at State Pension Age - £221.20 a week

Forecast amount earned up to April 2024 - £181.58 a week

Number of years you still need to contribute to reach the forecast - 7y

Number of pre-2016 years full - 25

Number or post-2016 years full - 0

Your COPE estimate is £25.46 a week

When I check my online payment options, the below question is confusing since I’m not currently employed or paying NI but could restart in future - but this situation doesn’t seem to be catered for, so for now I selected that I’ve already stopped NI:

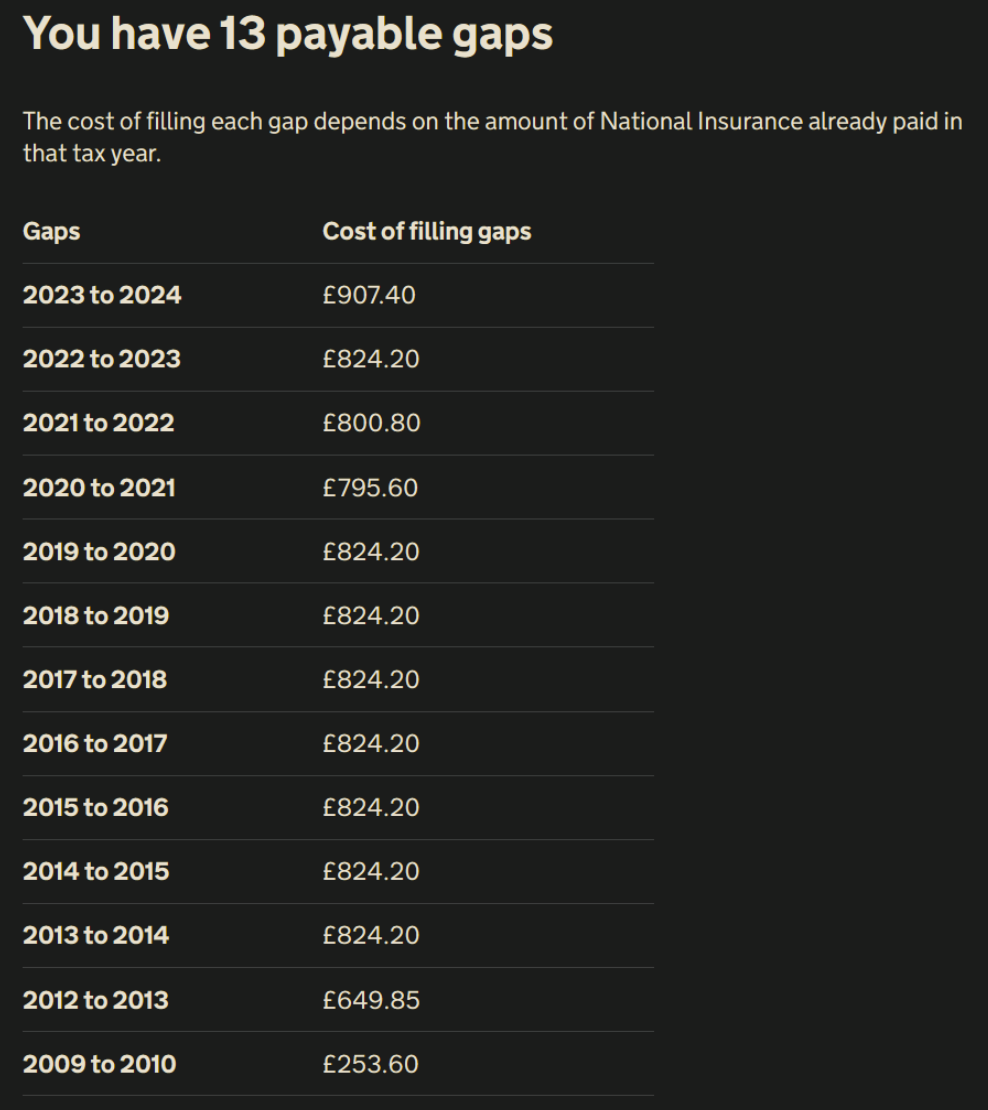

The options start at the cheapest:

then become more expensive e.g.

and end with the msot expensive option:

But the most expensive option 18 omits multiple gap years (2016 to 2020) that are included in option 13. Huh?

Grateful for any explanations or suggestions for the best approach.

Are the cheapest years the best ones?

Comments

-

It gives you options not advice, there are multiple ways of getting the same outcome, it is down to you to choose. You just need to pick any option that contains those 4 cheapest plus any 3 at £824.20 to get to £221.20, any cheaper options will not get you to that full amount.1

-

Tx, yes I appreicate that it is not advice. But only #18 gets me to £221.20, the others are on a sliding scale to the first. e.g.

I guess I need a way to find out how much each option will translate to future pension payments.

0 -

09-10 and 12-13 give £5.65 each, everything else gives £6.32 with the final year giving £3.04, £2.37 or £1.70 depending on the pre / post 2016 split of 2/5, 1/6 or 0/7. Those 2 cheapest together will give £11.30 for £903.45, cheaper than 23-24 which will give £6.32.It looks like the options give you the cheapest method of achieving the various different amounts. So it boils down to how much you want to achieve and how much you want to spend.1

-

First note your starting amount is based on the old state pension rules not the new state pension rules

That's why molerat mentions pre 2016 years give you £5.65pw each (in 2024/2025 terms) which is 1/30th of the basic state pension (5.65 =1/30 x 169.50), and post 2016 years give you £6.32pw (= 1/35 of the new state pension = 1/35 x 221.20). Pre 2016 years increase your starting amount (which is based on the old rules in your case) and post 2016 years increase the new state pension that adds onto your starting amount.Just bear in mind that in total you need 7 years to get you up to the full new state pension, either through 2/5, 1/6 or 0/7 pre 2016/post 2016 years. If your plan is to get up to the maximum through earned years and voluntarily purchased years, then the relevance of the pre/post 2016 split is only in relation to how much it costs you, as they all take you to £221.20pw as molerat has explained it's just the seventh year part amount that takes you up to the full new state pension which is different. It's more complicated if you achieve automatically and/or buy less than 7 in total as your state pension is slightly dependant on the pre/post 2016 split.While you're not working now, you've indicated that you may get further qualifying years automatically in the future through work or credits. So if you buy 7 years now and do get some future years automatically through work etc then some of what you pay now will be wasted.Buying 2009/2010 and 2012/2013 might be worth it now as they are relatively cheap years, but that assumes you won't achieve more than 5 years automatically in the future.If you buy 2009/2010 and 2012/2013 you've always got the option to buy those 5 other years you need at a later date when you know for sure you aren't going to get extra years automatically through work. The cost will increase but the money you would have paid now will also have grown with interest.

That's why molerat mentions pre 2016 years give you £5.65pw each (in 2024/2025 terms) which is 1/30th of the basic state pension (5.65 =1/30 x 169.50), and post 2016 years give you £6.32pw (= 1/35 of the new state pension = 1/35 x 221.20). Pre 2016 years increase your starting amount (which is based on the old rules in your case) and post 2016 years increase the new state pension that adds onto your starting amount.Just bear in mind that in total you need 7 years to get you up to the full new state pension, either through 2/5, 1/6 or 0/7 pre 2016/post 2016 years. If your plan is to get up to the maximum through earned years and voluntarily purchased years, then the relevance of the pre/post 2016 split is only in relation to how much it costs you, as they all take you to £221.20pw as molerat has explained it's just the seventh year part amount that takes you up to the full new state pension which is different. It's more complicated if you achieve automatically and/or buy less than 7 in total as your state pension is slightly dependant on the pre/post 2016 split.While you're not working now, you've indicated that you may get further qualifying years automatically in the future through work or credits. So if you buy 7 years now and do get some future years automatically through work etc then some of what you pay now will be wasted.Buying 2009/2010 and 2012/2013 might be worth it now as they are relatively cheap years, but that assumes you won't achieve more than 5 years automatically in the future.If you buy 2009/2010 and 2012/2013 you've always got the option to buy those 5 other years you need at a later date when you know for sure you aren't going to get extra years automatically through work. The cost will increase but the money you would have paid now will also have grown with interest.

I came, I saw, I melted1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.7K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.8K Work, Benefits & Business

- 603.2K Mortgages, Homes & Bills

- 178.2K Life & Family

- 260.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards