We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Tembo - are they any good

Comments

-

I was with TEMBO and had no idea about flexible and non-flexible cash ISAs, as I assumed that in the current tax year they were flexible, as you could have as many as you liked, but not exceed £20k.

TEMBO’s transfer in was delayed for a long time and I did not want to wait (losing money), so I withdrew £19,999, I have discovered today, that I now have no allowance left for 2025/26 and the £20,000 is back in my bank.

What is really concerning is that this information is not clearly explained to me, of course I did not want to lose my ISA allowance completely for 2025/26.

Has this happened to anyone else?

0 -

Sounds like a bad assumption and a costly error.sdm1985 said:I was with TEMBO and had no idea about flexible and non-flexible cash ISAs, as I assumed that in the current tax year they were flexible, as you could have as many as you liked, but not exceed £20k.

TEMBO’s transfer in was delayed for a long time and I did not want to wait (losing money), so I withdrew £19,999, I have discovered today, that I now have no allowance left for 2025/26 and the £20,000 is back in my bank.

What is really concerning is that this information is not clearly explained to me, of course I did not want to lose my ISA allowance completely for 2025/26.

Has this happened to anyone else?

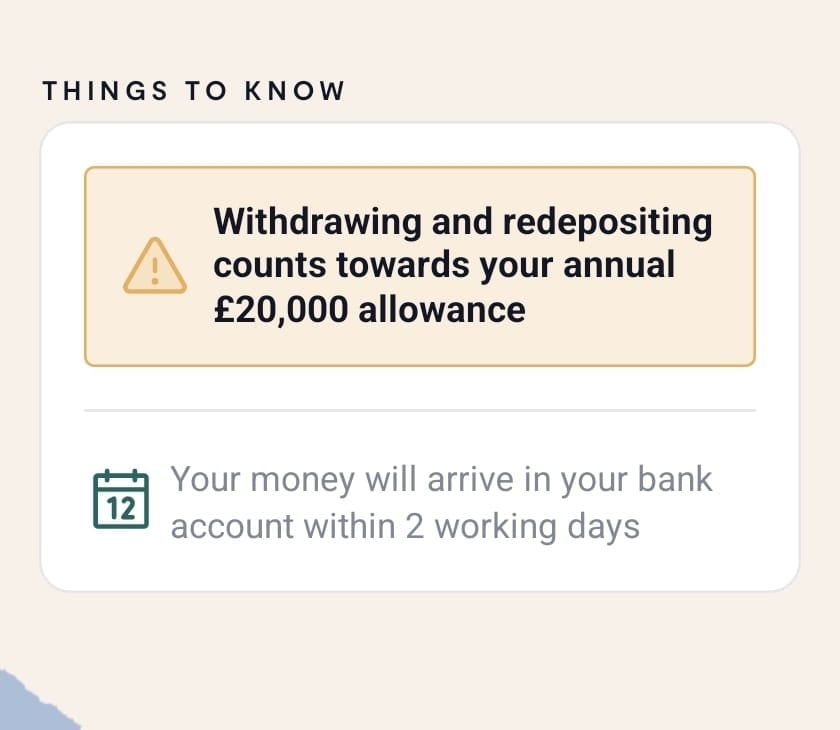

Did you miss the warning?

2 -

sdm1985 said:I was with TEMBO and had no idea about flexible and non-flexible cash ISAs, as I assumed that in the current tax year they were flexible, as you could have as many as you liked, but not exceed £20k.An ISA does not need to be flexible for you to be able to have as many as you like and spread your allowance between them. Flexibility only relates to withdrawing and redepositing into the same ISA.

So instead of transferring in to Tembo, you decided to withdraw from the other ISA thinking you could pay into Tembo without it counting towards your allowance?sdm1985 said:TEMBO’s transfer in was delayed for a long time and I did not want to wait (losing money), so I withdrew £19,999, I have discovered today, that I now have no allowance left for 2025/26 and the £20,000 is back in my bank.

What is really concerning is that this information is not clearly explained to me, of course I did not want to lose my ISA allowance completely for 2025/26.That wouldn't have worked whether or not the Tembo ISA was flexible.It is not completely clear what you did (the above is my best guess), or who you think should have clearly explained the ISA rules to you, but I guarantee if you'd asked here the rules would have been clearly explained to you.For reference, the rules are clearly explained in multiple resources from HMRC to the main MSE site, but to receive a personal explanation, you'd need to ask somewhere like this forum.0 -

To be frank, I think it’s more concerning that you’re investing a large sum of money in a product you clearly don’t understand the basics of… “don’t withdraw from your ISA to initiate a transfer” is like rule number 1.sdm1985 said:

What is really concerning is that this information is not clearly explained to me, of course I did not want to lose my ISA allowance completely for 2025/26.

1 -

Hello, no I did not see this warning when withdrawing from TEMBO.WillPS said:

Sounds like a bad assumption and a costly error.sdm1985 said:I was with TEMBO and had no idea about flexible and non-flexible cash ISAs, as I assumed that in the current tax year they were flexible, as you could have as many as you liked, but not exceed £20k.

TEMBO’s transfer in was delayed for a long time and I did not want to wait (losing money), so I withdrew £19,999, I have discovered today, that I now have no allowance left for 2025/26 and the £20,000 is back in my bank.

What is really concerning is that this information is not clearly explained to me, of course I did not want to lose my ISA allowance completely for 2025/26.

Has this happened to anyone else?

Did you miss the warning? 0

0 -

Hello, no this is not the case.masonic said:sdm1985 said:I was with TEMBO and had no idea about flexible and non-flexible cash ISAs, as I assumed that in the current tax year they were flexible, as you could have as many as you liked, but not exceed £20k.An ISA does not need to be flexible for you to be able to have as many as you like and spread your allowance between them. Flexibility only relates to withdrawing and redepositing into the same ISA.

So instead of transferring in to Tembo, you decided to withdraw from the other ISA thinking you could pay into Tembo without it counting towards your allowance?sdm1985 said:TEMBO’s transfer in was delayed for a long time and I did not want to wait (losing money), so I withdrew £19,999, I have discovered today, that I now have no allowance left for 2025/26 and the £20,000 is back in my bank.

What is really concerning is that this information is not clearly explained to me, of course I did not want to lose my ISA allowance completely for 2025/26.That wouldn't have worked whether or not the Tembo ISA was flexible.It is not completely clear what you did (the above is my best guess), or who you think should have clearly explained the ISA rules to you, but I guarantee if you'd asked here the rules would have been clearly explained to you.For reference, the rules are clearly explained in multiple resources from HMRC to the main MSE site, but to receive a personal explanation, you'd need to ask somewhere like this forum.

I put £20,000 into a cash ISA with TEMBO for 2025/26, from a flexible ISA. I wanted to bring my previous years contributions to TEMBO, but there was a tech glitch with transfers not possible for several weeks. I then withdrew £19,999 and put this into another ISA (flexible).

It was then flagged that I had oversubscribed in 2025/26, despite having no money with Tembo.

Should I speak to HMRC to see if I can repair or void the Tembo ISA for 2025/26?

Thanks all.0 -

With it being the end of the month and with that amount of money available I'd put it into Premium Bonds. Has to be held for one full month before being in any draws. You never know..........0

-

sdm1985 said:

Hello, no this is not the case.masonic said:sdm1985 said:I was with TEMBO and had no idea about flexible and non-flexible cash ISAs, as I assumed that in the current tax year they were flexible, as you could have as many as you liked, but not exceed £20k.An ISA does not need to be flexible for you to be able to have as many as you like and spread your allowance between them. Flexibility only relates to withdrawing and redepositing into the same ISA.

So instead of transferring in to Tembo, you decided to withdraw from the other ISA thinking you could pay into Tembo without it counting towards your allowance?sdm1985 said:TEMBO’s transfer in was delayed for a long time and I did not want to wait (losing money), so I withdrew £19,999, I have discovered today, that I now have no allowance left for 2025/26 and the £20,000 is back in my bank.

What is really concerning is that this information is not clearly explained to me, of course I did not want to lose my ISA allowance completely for 2025/26.That wouldn't have worked whether or not the Tembo ISA was flexible.It is not completely clear what you did (the above is my best guess), or who you think should have clearly explained the ISA rules to you, but I guarantee if you'd asked here the rules would have been clearly explained to you.For reference, the rules are clearly explained in multiple resources from HMRC to the main MSE site, but to receive a personal explanation, you'd need to ask somewhere like this forum.

I put £20,000 into a cash ISA with TEMBO for 2025/26, from a flexible ISA. I wanted to bring my previous years contributions to TEMBO, but there was a tech glitch with transfers not possible for several weeks. I then withdrew £19,999 and put this into another ISA (flexible).

It was then flagged that I had oversubscribed in 2025/26, despite having no money with Tembo.

Should I speak to HMRC to see if I can repair or void the Tembo ISA for 2025/26?

Thanks all.That's not so bad if the original flexible ISA held £20k from 2025/26. In any case, the £20k withdrawn from the flexible ISA can be replaced (into the same ISA only) until the end of this tax year.If you had already subscribed £20k to that original flexible ISA during this tax year, then you busted your annual allowance the moment you paid into Tembo because you'd already subscribed your full allowance to that original ISA (this would be true whether or not the Tembo ISA was flexible). The money you then withdrew from Tembo was composed of invalid ISA subscriptions.The third ISA you paid £19,999 into is (also) invalid, but you are free to return that money to that first flexible ISA where it originally came from.HMRC will deal with the invalid ISA(s) and £39,999 or 59,999 of 2025/26 subscriptions after the end of the tax year, but it's unlikely anything would be done if you've already emptied them.0 -

Thanks for your time and apologies if I am not that clear.masonic said:sdm1985 said:

Hello, no this is not the case.masonic said:sdm1985 said:I was with TEMBO and had no idea about flexible and non-flexible cash ISAs, as I assumed that in the current tax year they were flexible, as you could have as many as you liked, but not exceed £20k.An ISA does not need to be flexible for you to be able to have as many as you like and spread your allowance between them. Flexibility only relates to withdrawing and redepositing into the same ISA.

So instead of transferring in to Tembo, you decided to withdraw from the other ISA thinking you could pay into Tembo without it counting towards your allowance?sdm1985 said:TEMBO’s transfer in was delayed for a long time and I did not want to wait (losing money), so I withdrew £19,999, I have discovered today, that I now have no allowance left for 2025/26 and the £20,000 is back in my bank.

What is really concerning is that this information is not clearly explained to me, of course I did not want to lose my ISA allowance completely for 2025/26.That wouldn't have worked whether or not the Tembo ISA was flexible.It is not completely clear what you did (the above is my best guess), or who you think should have clearly explained the ISA rules to you, but I guarantee if you'd asked here the rules would have been clearly explained to you.For reference, the rules are clearly explained in multiple resources from HMRC to the main MSE site, but to receive a personal explanation, you'd need to ask somewhere like this forum.

I put £20,000 into a cash ISA with TEMBO for 2025/26, from a flexible ISA. I wanted to bring my previous years contributions to TEMBO, but there was a tech glitch with transfers not possible for several weeks. I then withdrew £19,999 and put this into another ISA (flexible).

It was then flagged that I had oversubscribed in 2025/26, despite having no money with Tembo.

Should I speak to HMRC to see if I can repair or void the Tembo ISA for 2025/26?

Thanks all.That's not so bad if the original flexible ISA held £20k from 2025/26. In any case, the £20k withdrawn from the flexible ISA can be replaced (into the same ISA only) until the end of this tax year.If you had already subscribed £20k to that original flexible ISA during this tax year, then you busted your annual allowance the moment you paid into Tembo because you'd already subscribed your full allowance to that original ISA (this would be true whether or not the Tembo ISA was flexible). The money you then withdrew from Tembo was composed of invalid ISA subscriptions.The third ISA you paid £19,999 into is (also) invalid, but you are free to return that money to that first flexible ISA where it originally came from.HMRC will deal with the invalid ISA(s) and £39,999 or 59,999 of 2025/26 subscriptions after the end of the tax year, but it's unlikely anything would be done if you've already emptied them.

The £20,000 was put into TEMBO in 06/04/25 (first day of the new tax year). In had a sum for previous tax years, that I wanted to send to Tembo, but their portfolio transfer service in was not working. I then saw a rate, and moved £19,999 out manually (in 2025/26).

I am not an expert and was unaware of flexible and non flexible ISA and the consequences. I made this decision made on the service provided by Tembo.

I am trying to contact HMRC to see if there is anything I can do, but it is very difficult.

This case cannot be unique and I hope there is a way around this. Yes, my Tembo states that I have ‘used’ my £20,000 allowance for 2025/26, but this does not mean I have invested £40,000 for 2025/26.

Thanks in advance.0 -

If it is a simple case of paying £20k into Tembo and then withdrawing £19,999 from Tembo, while unaware that wouldn't change the fact you have no remaining ISA allowance to use anywhere else, then yes it is a mistake people have been making every tax year for decades. Even flexible ISAs do not permit you to do this (since 2024).HMRC will tell you to do nothing and that they'll be in touch after the tax year is ended and they receive the annual returns from all ISA managers.It is possible they will do nothing if this is the first time you've done something like this.I'm still a little confused about the mention of putting the £20k into Tembo "from a flexible ISA".0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards